Corporate Finance Newsletter

advertisement

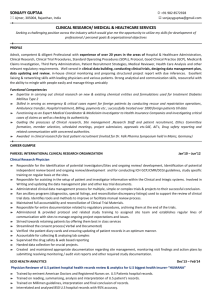

Corporate Finance Newsletter August 2012 ICRA Management Consulting Services Limited Page 1 Disclaimer This report and the analysis herein are based on data and information collected by ICRA Management Consulting Services Limited (IMaCS) from sources believed to be reliable and authentic. While all reasonable care has been taken by IMaCS to ensure that the information and analysis contained herein is not untrue or misleading, neither IMaCS nor its Directors shall be responsible for any losses, direct, indirect, incidental or consequential that any user of this report may incur by acting on the basis of this report or its contents. IMaCS makes no representations or warranties in relation to the accuracy or completeness of the information contained in the report. IMaCS’ analysis in this report is based on information that is currently available and may be liable to change. This report and the analysis herein should not be construed to be a credit rating assigned by ICRA Limited for any securities of any entity. Other than as expressly stated in this report, we express no opinion on any other issue. Our analysis/advice/recommendations should not be construed as legal advice on any issue. Page 2 Table of Contents Transaction activity………………………..…………………………. 4 Domestic M&A transactions………………………..……………... 8 Inbound M&A transactions……………………...……………...... 11 Outbound M&A transactions……………………………………. 14 Private equity transactions ….………………………………….. 17 Venture Capital transactions .……………………………...…… 22 About IMaCS…………………………….……….………..………..…. 25 Page 3 Transaction activity Page 4 Transaction activity in August 2012… (1/3) • The number of Private Equity deals increased from 24 in July to 41 in August • The number of Domestic M&A deals decreased from 20 in July to 10 in August Total value of deals in August was US $ 3.27 billion as compared to US $ 2.23 billion in July and US $ 1.84 billion in June • Total value of Inbound deals increased from US $ 29 million in July to US $ 368 million July 2012 Total number of deals in the month decreased to 89 from 100 deals in July Volume Value (US $ mn) Volume Value (US $ mn) M&A Domestic Inbound Outbound 20 14 15 336.6 29.1 1273.7 10 13 10 72.9 367.9 623.8 Private Equity 24 541.04 41 2187.7 Venture Capital 27 53.31 15 16.2 100 2233.75 89 3268.5 Total Transaction activity break-up 100% • Total value of Private Equity deals increased 80% from US $ 541 million in July to US $ 2.2 billion 60% Average deal size of M&A deals was US $ 62.6 million for 17 disclosed deals. Average deal size of Private Equity deals was US $ 68.4 million for 32 disclosed deals. August 2012 40% 20% 0% 0.5% 16.9% 66.9% 46.1% 11.2% 19.1% 14.6% 11.2% 11.3% 2.2% Value wise Volume wise M&A Domestic M&A Inbound Private Equity Venture Capital M&A Outbound Note: The value given is only for disclosed deals. Page 5 Transaction activity in August 2012… (2/3) Sector wise break-up (Volume) Engineering 10% Education 9% Pharma & Healthcare 11% The number of deals in IT/ITeS sector were highest, followed by e-commerce, Pharma & Healthcare and Engineering sectors • The number of deals in IT/ITeS sector, however decreased to 12 from 19 in July • Eight deals in Education sector, double Others 45% e-commerce 11% compared to July • The number of deals in Engineering sector IT/ITeS 14% increased to 9 from 3 in July Sector wise break-up (Value) IT/ITeS 34% e-commerce 6% Pharma & Healthcare 34% Others 17% Total value of deals in Pharma & Healthcare was US $ 1.1 billion, followed by IT/ITeS and e-commerce sectors • Total value of deals in IT/ITeS sector increased to US $ 1.1 billion from US $ 232 million in July Real Estate 5% • Total value of deals in e-commerce sector Engineering 4% increased to US $ 188 million from US $ 39 million in July Page 6 Transaction activity in August 2012… (3/3) “Deals of the month” Bain Capital’s US $ 1 billion investment in Genpact for 30% stake o Bain Capital bought stake from General Atlantic LLC and Oak Hill Capital Partners LP for $14.76 per outstanding share o In 2011, Genpact’s total revenue was US $ 1.6 billion, with 13.8% of adjusted net income margin Nasper and Tiger Global’s investment in Flipkart o Flipkart Online Services raised US $ 150 million from Nasper and Tiger Global in its fifth round of funding o Flipkart raised US $ 150 million from Accel Partners and Tiger Global Management in January 2012 o The deal will help the company meet its operating losses FashionAndYou’s acqusition of UrbanTouch for US $ 30 million o Urban Touch and FashionAndYou will continue to operate separately but will have cross linkages o The deal will provide exit to existing PE investors of UrbanTouch o The deal signifies that consolidation in e-commerce space is gathering speed Page 7 Domestic M&A transactions Page 8 Domestic M&A transactions in August 2012 … (1/2) Deals (Volume) 20 20 Top 5 sectors (Volume) 16 Sector Volume Value (US $ mn) IT/ITeS 3 34 e-commerce 3 30 Mining 1 8 Gems & Jewellery 1 0.9 Education 1 - 15 10 10 5 0 June July August Deals (Value) 337 350 Top 5 sectors (Value) In US $ Mn 300 250 200 Sector 160 150 73 100 50 Value (US $ mn) Volume IT/ITeS 34 3 e-commerce 30 3 Mining 8 1 0.9 1 - 1 Gems & Jewellery 0 June July August Education Note: The value given is only for disclosed deals. Page 9 Domestic M&A transactions in August 2012 … (2/2) Deal Value (in US $ mn) % stake acquired FashionAndYou 30.0 - e-commerce MangoStreet.com Hushbabies.com - - e-commerce Connectindia Spade Financial Services - - e-commerce Centum Learning Everonn Education Limited - - Education Gem Gold Mining 0.9 12% - - Hospitality Computational Research Laboratories Goenka Diamonds Mahindra Holidays & Resorts India Limited Tata Consultancy Services 34.0 - IT/ITeS SEEinfobiz Private Limited Aurionpro Solutions Limited - - IT/ITeS United Villages Network Pvt Ltd Oxigen Services India Pvt Ltd - 51% IT/ITeS Gujarat NRE Coking Coal (GNCC) Jindal Steel and Power 8.0 2.67% Mining Target Acquirer UrbanTouch Divine Heritage Hotels Private Limited Sector Gems & Jewellery Page 10 Inbound M&A transactions Page 11 Inbound M&A transactions in August 2012 … (1/2) Deals (Volume) 14 15 Top 5 sectors (Volume) 13 10 7 5 0 June July Sector Volume Value (US $ mn) Media & Entertainment 3 - Pharma & Healthcare 2 261 Manufacturing 2 10.9 Engineering 2 0.6 Shipping & Ports 1 38 August Deals (Value) In US $ mn 400 385 Top 5 sectors (Value) 368 300 Sector 200 100 Value (US $ mn) Volume Pharma & Healthcare 261 2 Shipping & Ports 38 1 32.4 1 25 1 10.9 2 Automotives 29 BFSI 0 June July August Manufacturing Note: The value given is only for disclosed deals. Page 12 Inbound M&A transactions in August 2012 … (2/2) Target Honda Siel Cars India MF Global Sify Securities India Acquirer Deal Value (in US $ mn) 32.4 25.0 % stake acquired 3.16% 30% 0.6 4.8% Engineering - - Engineering - 100% IT/ITeS Manufacturing Manufacturing Media & Entertainment Media & Entertainment Media & Entertainment Sector L&T Plastic Machinery Limited Honda Motor Corporation PhillipCapital Group Nippon Magnetic Dressing Company Limited Toshiba Machine e4e inc (India, UK arm) Pole to Win Toto Ltd (India) BP Ergo Resultrix Communicate2 Taproot API manufacturing and R&D facility, Orchid Chemicals And Pharmaceuticals. Mitsui & Co. Ltd HNI Corp Publicis Groupe Aegis Media Dentsu Inc 10.9 - 30% 95% 51% Hospira Inc. 200.0 - Pharma & Healthcare Bilcare Limited (US, UK operations) United Drug Plc. 61.0 - Pharma & Healthcare Pipavav Defence and Offshore Engineering SAAB 38.0 - Shipping & Ports Eco Recycling Limited Auto BFSI Page 13 Outbound M&A transactions Page 14 Outbound M&A transactions in August 2012 … (1/2) Deals (Volume) 15 15 10 Top 5 sectors (Volume) 10 9 5 0 June July Sector Volume Value (US $ mn) Engineering 2 7 Pharma & Healthcare 1 571 Automotives 1 20 Telecom 1 17 Gems & Jewellery 1 4.5 August Deals (Value) 1400 Top 5 sectors (Value) 1,274 In US $ mn 1200 1000 800 624 600 400 200 141 0 June July August Sector Value (US $ mn) Volume Pharma & Healthcare 571 1 Automotives 20 1 Telecom 17 1 Engineering 7 2 4.5 1 Gems & Jewellery Note: The value given is only for disclosed deals. Page 15 Outbound M&A transactions in August 2012 … (2/2) Target Acquirer Deal Value (in US $ mn) % stake acquired Sector Erik Buell Racing Hero MotoCorp Limited 20.0 - Bluebird Aero Systems Piramal Enterprises Ltd 7.0 27.83% Engineering Rotair S.p.a. Elgi Equipments Limited - 100% Engineering SuntyCo Holding Tata Global Beverages Limited - 49% FMCG, Food, Beverage Verite Co. Ltd Gitanjali Gems Limited 4.5 15.3% HCL Infosystems MEA FZCo. HCL Infosystems Limited - 40% IT/ITeS Queensland Coal Tenements Petroleum Oil and Gas Corporation of South Africa Ltd (Gas Block 1, Orange Basin) Legacy Iron (NMDC) 4.3 - Mining Cairn India Limited - 60% Oil & Gas 571.0 34% Pharma & Healthcare 17.0 - Taro Pharma Teligent Telecom Sun Pharmaceutical Industries Limited Altruist Technologies Auto Gems & Jewellery Telecom Page 16 Private Equity transactions Page 17 Private equity transactions in August 2012 … (1/4) Deals (Volume) Top 5 sectors (Volume) 50 40 41 40 30 Sector 24 20 10 0 June July Volume Value (US $ mn) Pharma & Healthcare 6 278.5 IT/ITeS 5 1064 Engineering 5 131.1 e-commerce 4 157.5 Real Estate 3 181.3 August Deals (Value) 2500 Top 5 sectors (Value) 2,188 In US $ mn 2000 Sector 1500 1,150 1000 541 500 0 June July August Value (US $ mn) Volume IT/ITeS 1064 5 Pharma & Healthcare 278.5 6 Real Estate 181.3 3 e-commerce 157.5 4 Travel & Travel Services 137.75 1 Note: The value given is only for disclosed deals. Page 18 Private equity transactions in August 2012 … (2/4) Target Acquirer Deal Value (in US $ mn) % stake acquired - 4.98% Sector Agriculture & Agro Products BFSI Brattle Foods Private Limited GTI Capital Federal Bank ChrysCapital 61.5 MAS Financial Services Limited DEG 12.3 SKS Microfinance Limited Kumaon Investment Holdings 6.0 4.11% Flipkart Online Services Naspers, Tiger Global 150.0 - e-commerce canvera.com Info Edge India Limited 6.5 - e-commerce UrbanLadder.com IndoUS Venture Partners 1.0 - e-commerce Play Games24x7 Pvt Ltd Tiger Global Management - - e-commerce Kids Out Of Home TCS, HDFC - 30% Education Simplilearn Solutions Pvt Ltd. Amber Enterprises (India) Private Limited INOXCVA IndoUS Venture Partners (IUVP) - - Education Reliance Equity Advisors Ltd 12.6 - Electrical & Electronics Standard Chartered PE 45.0 - Engineering Infotech Enterprises Limited Gagil FDI 36.1 10.5% Engineering Consul Consolidated Private Limited Peepul Capital LLC 20.0 - Engineering Cura Healthcare Private Limited Peepul Capital LLC 20.0 - Engineering 10.0 - Engineering 18.0 - FMCG, Food, Beverage Vortex Engineering Unibic Biscuits India Pvt Ltd Peepul Capital BFSI BFSI Page 19 Private equity transactions in August 2012 … (3/4) Target Acquirer Deal Value (in US $ mn) % stake acquired Sector Café Coffee Day TMA Hospitality Services Private Limited Genpact <Buyback, Sequoia> 40.0 - Hospitality SAIF Partners. 7.2 - Hospitality 1000.0 30% IT/ITeS AGS Transact Technologies Limited Actis PE 40.0 - IT/ITeS AbsolutData Fidelity Growth Partners India 20.0 - IT/ITeS 4.0 - IT/ITeS Bain Capital Mettl IndoUS Ventures Webklipper Technologies Private GTI Capital Limited. Craftsman Automation Private Limited Standard Chartered PE - - IT/ITeS 15.5 - Manufacturing BigTree Entertainment Private Limited Accel Partners 18.0 - Media & Entertainment PVR Ltd L Capital Asia 10.4 10% Media & Entertainment SideFX Entertainment Das Star Ventures 1.0 - Media & Entertainment S H Kelkar & Company Pvt Ltd Blackstone Group 35.0 - Others Manipal Hospitals 180.0 - Pharma & Healthcare 54.0 - Pharma & Healthcare Vikram Hospitals Private Limited India Value Fund Advisors (IVFA) Goldman Sachs, New Enterprise Associates Multiples Private Equity 39.5 - Pharma & Healthcare Advinus Therapeutics Takeda 5.0 - Pharma & Healthcare Axiss Dental Pvt Ltd India Equity Partners - - Pharma & Healthcare Nova Medical Centres Private Limited Page 20 Private equity transactions in August 2012 … (4/4) Target Acquirer Deal Value (in US $ mn) % stake acquired Sector Pharma & Healthcare Express Clinics Somerset Indus Capital - - Green Infra Limited Standard Chartered Bank - 26% Power & Energy Hydro Power projects, Dans Group Equis Funds Group Macquarie SBI Infrastructure Fund, SBI Macquarie Infrastructure Trust IL&FS Investment Managers - - Power & Energy 150.0 - Real Estate 21.8 - Real Estate 9.5 49% Real Estate 137.75 - Ashoka Concessions Limited. City Corporation Ltd Lalith Gangadhar Constructions Private <Buy Back> Limited Citigroup Venture Capital Cox & Kings Ltd (UK Arm) International (CVCI) Travel & Travel Services Page 21 Venture Capital transactions Page 22 Venture Capital transactions in August 2012 … (1/2) Deals (Volume) 30 Top 5 sectors (Volume) 27 25 Sector Volume Value (US $ mn) Education 5 4 e-commerce 3 - IT/ITeS 2 - 5 Others 2 - 0 BFSI 1 7.2 20 15 10 15 10 June July August Deals (Value) 60 Top 5 sectors (Value) 53 In US $ mn 50 Sector Value (US $ mn) Volume 7.2 1 Telecom 5 1 Education 4 5 e-commerce - 3 IT/ITeS - 2 40 30 BFSI 16 20 10 6 0 June July August Note: The value given is only for disclosed deals. Page 23 Venture capital transactions in August 2012 … (2/2) Acquirer Deal Value (in US $ mn) % stake acquired Vistaar Financial Services Pvt Ltd Lok Capital, Omidyar, Elevar & SVB 7.2 - BFSI Natural Mantra Freemont Partners - - e-commerce Rock In Fashions Pvt Ltd Partech International - - e-commerce Printbindaas <Angel Investment> - - e-commerce LIQVID SBI Ven Capital 3.0 - Education Mind Edutainment Private Limited Accel Partners 0.5 - Education Classle Knowledge Private Limited Chennai Angels 0.5 - Education BrainNook Imagine K12 - - Education Technium Labs Pvt Ltd Seedfund Mercatus Capital, Hub Media Group India Innovation Fund - - Education - - IT/ITeS - - IT/ITeS <Angel Investment> India Quotient, Blume Ventures, India Venture Partners India Innovation Fund, India Venture Partners JAFCO Asia - - Others - - Others - - Pharma & Healthcare 5.0 - Telecom Target PurpleStream iKen Solutions Pvt Ltd Volano Entertainment Pvt Ltd RedQuanta Consure Medical Bubble Motion Pte Ltd Sector Page 24 About IMaCS Page 25 About IMaCS 40 countries | 600+ clients | 1300+ assignments India based management consulting firm with over 18 years of experience in policy advisory, strategy, operations and transaction advisory A wholly-owned subsidiary of ICRA Limited, one of India’s leading credit rating agencies Offices across India at New Delhi, Noida, Gurgaon, Mumbai, Chennai, Bangalore, Kolkata, Hyderabad, Pune and Ahmedabad and International office in USA Clients include governments, bilateral/multilaterals, industry associations, financial investors and corporates Significant experience across the consulting continuum with assignments spanning; policy advisory, business strategy, operations improvement and transaction advisory services Knowledge repository with continuous tracking of over 100 industries and sector Policy Advisory | Strategy & Operations | Capacity Building | Transaction Advisory Page 26 Contact us IMaCS offices Shaleen Agarwal Principal - Corporate Advisory, IMaCS Noida, India Phone: +91-99581-11350 Email: shaleen.agarwal@imacs.in Rajesh B V DGM and Head – Corporate Advisory, IMaCS Bengaluru, India Phone: +91-98860-21200 Email: rajesh.bv@imacs.in Corporate Office: Noida Logix Park, First Floor, Tower A4 & A5, Sector - 16,Noida - 201 301 Tel: +91-120-4515 800 Fax: +91-120-4515 850 Mumbai 4th Floor, Electric Mansion Appasaheb Marathe Marg, Prabhadevi Mumbai – 400 025 Tel: +91-22-3047 0047 Fax: +91-22-3047 0081 Chennai 5th Floor, Karumuttu Centre, 634, Anna Salai, Nandanam, Chennai - 600035 Tel: +91-44-4596 4300 Fax: +91-11-2434 3663 Bengaluru M-01, Prestige Infantry Court, 130,Infantry Road, Bengaluru – 560 001 Tel: +91 80 4093 4100/ 4123 Fax: +91 80 4093 4111 Kolkata FMC Fortuna, A-10 & 11, 3rd Floor, 243/3A, AJC Bose Road, Kolkata – 700 020 Tel: +91-33-2283 1412 Fax: +91-33-2287 0728 Ahmedabad: 907&908 Sakar II Ellisbridge (Opp. Town Hall) Ahmedabad-380006 Tel: +91 80 4093 4100/2008/4924/5494 Fax:+91 79 26584924 Hyderabad 116, First Floor, Block-III, White House, Kundan Bagh, Begumpet, Hyderabad- 500 016 Pune: 5A, 5th Floor, Symphony S.N. 210, CTS3202, Ranga Hills Road, Shivaji Nagar Pune:411020 Tel:+91 20 25561194/25560195/ 0196 Fax: +91 2025561231 Gurgaon Building No.8 Cybercity Phase II Gurgaon-122002 Tel: +91 124 4545800 Fax:+91 124 4545850 Page 27