How to Use Demand Systems to Evaluate Risky Projects

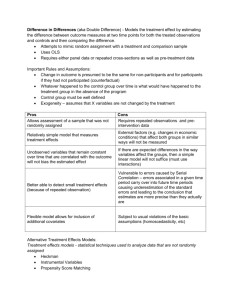

advertisement