Simulations of operating exposure to risks

advertisement

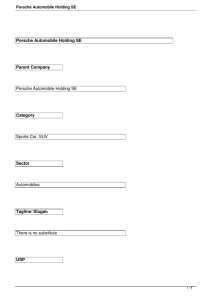

Simulations of operating exposure to risks Richard Friberg, Stockholm School of Economics and CEPR Cristian Huse, Stockholm School of Economics Abstract In this paper we develop methods to measure the exposure to exchange rates, and other macroeconomic risks, of nonfinancial firms. We further explore how various financial and operational strategies can be used to modify the risk profile. We apply the method using data from the US car market 1995-2008 and focus on the exposure facing Porsche, who produces exclusively in Europe but has 30-40 percent of its sales in the US. To generate counterfactual distributions of cash flows we combine two elements: a demand system using a randomcoefficients logit model and counterfactual shocks to a set of macroeconomic variables. We generate these counterfactual shocks using GARCH processes to model the time series properties and copula methods to model their interdependence. Using the counterfactual values of the macroeconomic variables in the demand system generates the counterfactual profits that we use to compare the various strategies. Our results point to that having more production in the US decreases lower tail risk while only being associated with a moderate downward shift in the upper tail of the profit distribution. Abstracting from fixed costs and domestic profits it pays off for Porsche to shift production to foreign markets, as the distribution of profits becomes less dispersed, exhibiting higher expected returns and smaller variance. JEL: F23, G32, L16, L62 Keywords: Exchange rate exposure, macroeconomic exposure, operational hedging, demand for cars. Note: Preliminary and incomplete (in particular the way simulations reported – demand specification is final). Introduction The cash flows of many nonfinancial firms are potentially exposed to exchange rates and other macroeconomic shocks. The aim of this paper is twofold: First we want to develop a tool to generate counterfactual distributions of cash flows that can be used to quantify risks We are grateful to the Swedish Research Council (VR) and Jan Wallanders and Tom Hedelius Stiftelse for financial support. Email: nerf@hhs.se. Correspondence address: Stockholm School of Economics, Dept of Economics, Box 6501, SE-113 83 Stockholm, Sweden. Email: Cristian.huse@sse.edu. Correspondence address: Stockholm School of Economics, Dept of Finance, Box 6501, SE-113 83 Stockholm, Sweden. for nonfinancial firms. Second, we want to apply this tool to compare various operational and financial strategies of dealing with risk. 1 To anchor our analysis we focus on the German manufacturer of luxury cars Porsche, using monthly data from the relevant segments of the US automobile market 19952008. Porsche is an attractive firm to highlight issues of exposure to macroeconomic shocks, and in particular foreign exchange risks, since it produces exclusively in Euroland (Germany and Finland) but has 30-40 percent of its sales in North America. Indeed, Porsche is enough of a school book case on exchange rate exposure that it is featured as mini cases in two of the leading text books in international finance (Eiteman, Stonehill and Moffett (2007, p 322) and Eun and Resnick (2007, p 236) and a popular business school case: Porsche exposed (Moffet and Petitt (2004).2 In the present papers we want to move beyond the type of qualitative discussions carried on in the textbooks and examine the quantitative implications of different strategies. Let us briefly relate our first aim, to quantify risks, to the previous literature. The seminal article on measuring exposure is Adler and Dumas (1983) who show that a linear regression of firm value on exchange rate can be used to gain a measure of the sensitivity of firm value to exchange rate changes. Stultz and Williamson (1997), Miller (1998) and Oxelheim and Wihlborg (2006) discuss the extension of this measurement to a more than one risk factor. Given a large number of observations on firm value (or cash flows) we can relate these to different values exchange rates and demand factors. The question becomes, how do we generate these values? One strategy has been to relate historical stock market valuation to changes in exchange rates and (to a lesser extent) other variables - see Dominguez and Tesar (2006) for a recent ambitious contribution on exchange rate exposure, or Jorion (1990) for a seminal study of the exposure of US firms. This strand of literature has concluded that exporters tend to be positively affected by a depreciation of the exchange rate, but that coefficients tend to be unstable. For a firm's own purposes the application is clearly hampered by that any hedging programs will affect the impact of an exchange rate change, the stock market may have imperfect knowledge of firm's operations and it is difficult to adopt to different scenarios -- such as what would our exposure be if we opened up a second production facility? We instead follow Friberg and Ganslandt (2007) and apply simulation tools developed within industrial organization. While Friberg and Ganslandt (2007) used a rather simple nested logit specification for demand and assumed that shocks followed a bivariate normal process the present paper extends their methodology in several ways. First, following Berry, Levinsohn and Pakes (1995, BLP hereafter) we model demand using a 1 Contrary to what we would expect from a frictionless Modiglini-Miller world there is much evidence that firms use financial instruments to manage exposures. for instance 50 percent of respondents in Bodnar, Hayt and Marston (1998) report using derivatives. Some main reasons for doing so may be to smooth tax payments, avoid bankruptcy or to ensure sufficient cash flow to finance investments also in tough times (see Froot, Stein and Scharfstein (1993) for a formalization of this last mechanism or Tufano (1996), Jin and Jorion (2006) Adam and Fernando (2006) for empirical evidence that hedging by firms adds value). 2 More generally the auto industry has been one of the leading examples of exchange rate exposure in both teaching and research (see the cases on General Motors in Desai (2007) or Williamson's (2001) study of exchange rate exposure in the automobile industry). random-coefficients logit model. We focus on three sources of risk: the exchange rates between the US dollar and yen and euro and a commonly used measure of macroeconomic conditions: consumer confidence. The latter has been shown to be useful in capturing business cycle effects, see for instance Ludvigson (2004). To generate counterfactual distributions for these variables we model the univariate processes that govern these variables using GARCH estimates based on data from 1977 onward. We use a t-copula to model dependence between these variables. The set of counterfactual observations thus generated therefore reflect both time series dependence via GARCH methods and dependence between variables using copula methods. These counterfactual values of macro variables are then fed into the demand system and used to generate counterfactual profits. Our second aim is to compare risk profiles under various financial and operational "hedging" strategies. Brealey and Kaplanis (1995) compare a number of financial hedging strategies in a mean variance setting. Based on their calculations they argue that several common hedging strategies, such as hedging short term expected cash flow leave the firm exposed to exchange rate risk - they argue that the use of short term hedges can be seen as a way to protect profits during the period before production patterns can adjust. Indeed, industry wisdom and text books embrace the idea that operational hedges in the form of producing in several locations or adopting flexible production techniques can be ways setting yourself up to limit the downside and benefit from the upside of variability. The complex nature of the problem has forced researchers that attempt to model operational hedging to quite stylized settings - demand is typically exogenous and fixed allowing models to focus on production decisions. Mello, Parson and Triantis (1995) examine hedging and production decisions of a firm that can produce a fixed output in any of two locations -- the price of the output is fixed but the attractiveness of producing in the different locations varies with the exchange rate. They show how the value of the real option to produce in different locations increases with the volatility of the exchange rate. Much of the literature is in the operations management tradition (see for instance Dasu and Li (1997), Chowdry and Howe (1999), Kamrad and Siddique (2004) or Kazaz, Dada and Moskovitz (2005)). There is little empirical work examining operational hedging: Allayannis, Ihrig and Weston (2001) relate firm value (market-to-book ratio) to measures of geographic dispersion of activity of these firms for 265 US multinationals over 1996-1998. Interpreting the measures of geographic dispersion as operational hedging they find no evidence that operational hedging by itself raises firm value. Géczy, Minton and Schrand (2006) find that both financial and operational hedging (gas storage, cash holding, diversification) lower the variability of stock returns for firms in the natural gas industry. At the practical level the real options we explore have been the focus of much attention in the auto industry. While Porsche produces only in Europe, BMW produces a number of models in its South Carolina plant.3 Mercedes also produces its SUVs and CUVs in the US (more precisely, its M-class, R-class and GL-class models), while Asian carmakers 3 More precisely, BMW produces the CUVs X3, X5 and X6 in South Carolina. While the first generation of its Z4 roadster was also produced there (2003-2008), the second generation production was transferred to Dingolfing, Germany, in 2008. produce most of their cars in North America, mostly in the US, but also Canada and Mexico.4 Interestingly, German carmaker Volkswagen is building a plant planned to start operating in 2011 in Alabama, from where it will produce a new platform destined to compete in the US market for sedans priced in the range USD 20,000-25,000. A frequently given motivation for producing in the US is to manage risk.5 The auto industry has indeed been the testing ground for the class of models used in Industrial Organization. Our demand estimations build closely on Berry, Levinsohn and Pakes (1995) who estimate a demand system for the US automobile market. Related work on US car markets is found in Goldberg (1995) who simulates exchange rate pass-through, Berry, Kortum and Pakes (1996) who show how rising gas prices and environmental regulation raise production costs, Goldberg's (1998) study of the effect of average fuel efficiency standards. Train and Winston (2007) show that the declining share of US manufacturers can be largely explained by observable product characteristics, Berry, Levinsohn and Pakes (1999) examine the impact of Japanese voluntary export restrictions and Petrin (2002) simulates the welfare effects of the introduction of the minivan. A difference between the previous work in this tradition and ours is that we have a focus on risk and also include 2 The Data We now turn to our empirical application. From Wards we have a panel of monthly sales data (Jan/1990-Jan/2008) for the US by model line (BMW 3 series, Porsche 911 etc). In our regression analysis we aggregate these data to model year and set July 2006 as the last data in the sample, leaving the last observations as comparison for out of sample predictions. For the model years from 1996 onwards we in addition have the suggested retail price as well as large set of product characteristics and this is the main data set. 6 Product characteristics are available at a more disaggregated level than sales and we use the baseline model, the one selling for the lowest price in the main analysis. Additional financial and macro data come from Datastream. For a full description of the data see the Appendix. We have data for all products in the luxury, sport, 4 For instance, Honda produces its models Accord, Civic, Civic Hybrid, FCX Clarity, Insight, CR-V, Crosstour, Pilot, Element, Ridgeline, among others in the US, while producing its models S2000, Acura TSX and Acura RL in Japan. Toyota produces its models Camry, Tacoma, Tundra, Sequoia, Sienna, Highlander, Avalon, Camry Solara and Venza in the US, its Corolla, Matrix, Lexus RX and RAV4 in Canada, and its Scion and Lexus in Japan. Hyundai produces its Sonata sedan and Santa Fe in the US. 5 The New York Times for instance reported that “The disparity in exchange rates can upset the economics of the industry, particularly for the global players. That is why auto executives talk a lot about „natural‟ hedging – ways to offset the risks of an unfavorable exchange rate without resorting to exotic financial instruments. The simplest way is to build assembly plants in the United States, as BMW and Mercedes-Benz have done.”(Jan 17, 2004: As exchange rates swing, car makers try to duck). 6 According to Wards over these years the new model year production starts between June and August and the next model year vehicles are available in showrooms between July and September. In the data set August is the month in which the new prices take effect. According to Wards the recommended prices are not changed during the year. We use the recommended dealer price as our measure of price -- a simplification that we share with previous work examining the car market at this level. In practice dealers buy from the manufacturer and rebates on the car are given, either in the form of lower prices, discounted financing or buy-in's of the customers' old car: see Busse, Silva-Risso and Zettelmayer (2006) for an analysis of pricing at a sample of Californian retailers. SUV and CUV segments. In Table 1 below we show some descriptive statistics for our set of cars together with the macroeconomic variables that we consider. We examine the upper segments of the car market and the mean price is above 36 000 dollars. The lowest price is for a Pontiac G5 in the "small specialty" segment and the highest is for a Porsche Carrera GT in the luxury sports segment.7 Table 1. Descriptive statistics, some key variables US car market August 1995-Jan 2008. variable mean sd Cv min median Max Price 36443.87 25034.69 0.69 12230.83 31728.22 410013.97 Quantity 3238.71 4539.82 1.40 1.00 1674.00 51021.00 (if>0) USD/EUR 1.16 0.16 0.14 0.85 1.19 1.48 USD/JPY*100 0.87 0.06 0.07 0.69 0.86 1.07 Consumer 127.56 33.80 0.26 59.70 125.10 186.80 confidence All data are monthly, price and Quantity from Wards, other variables from Datastream. Price and quantity are across models. Exchange rates are nominal, other variables are in real US dollars (base year 2000). The largest selling name plate in the data is the Ford Explorer. Over the period there is considerable variation in the price of gas, disposable incomes and interest rates -- all factors with the potential to affect the demand for new automobiles. The exchange rates also vary considerably over the period -- in particular the usd/euro rate. 2.1 Exposure for Porsche -- A First Look During the time period that we focus on, 1996-2008 Porsche was a small but highly profitable manufacturer.8 For 2004-2006 Porsche's return on assets was on average 9.3 percent compared to 2.8 for a group of 14 peer car manufacturers and its EBITDA (operating margin before interest, taxes, depreciation and amortization) was 27.8 percent compared to 10.3 for the same peer group.9 At the start of the period Porsche had assembly only in Germany. In 1997 it started production (under an agreement with Finnish producer Valmet) of its Boxster in Finland, where since 2005 also the Cayman model is produced. Sales are concentrated to Germany and the US. On average, over 2005-2008, 35 percent of its sales are in Germany, 23 percent in the rest of Europe, 31 percent in North America and some 10 percent in the rest of 7 We follow Ward's classification of segments, arguably the Carrera GT is closer to cars like Ferrari or Lamborghini that are not in the data set. Since it is produced by Porsche, which is our focus, we retain it in the data. The second highest price is for the Ford GT, retailing for an average of 128 000 dollars. 8 Before the start of the study period Porsche's fate covaried with the dollar. In the top year of 1986 Porsche sold some 50 000 vehicles, out of which more than 60 percent were in North America. In 1992 a weakening dollar contributed to difficulties for Porsche -- sales in North America had dropped from 30 000 to 4 000 cars and Porsche was having major financial difficulties. It embarked on a major program to become more efficient and dropped the 928 and 968 models.In principle we could study the exposure for Porsche over a longer time period -- supplementing our data with the data set used by Berry, Levinsohn and Pakes (1995) for instance which covers the 1970-1990 period. We choose to focus on a more finely defined time period however. 9 Source: Infinancials. the world. Porsche's main product over the period is the iconic 911 -- a name plate that was introduced in 1963 and still accounts for roughly half of US revenue during the period. At the start of the period Porsche sold the 911 and the small roadster Boxster. During the 10 years of study the Porsche also introduced the sports car Cayman and the Cayenne, perhaps best described as a sporty SUV. In addition it introduced the Carrera GT in 2004 -- this was a top of the line sports car retailing for almost 400 000 dollars and selling only a handful of cars in the US (some 1 500 worldwide). Table 2. Price, quantity and revenue share, Porsche U.S. 1997 and 2007 Price Share of revenue 1997 0.55 0.15 0.45 0.15 2007 1997 2007 2007 60 792.66 498.08 1041.08 0.48 (726.83) 197.24 174.82 0.07 Boxster 38 533.72 582.42 301.83 0.09 (460.70) 168.26 88.05 0.02 Cayenne 35726.43 1045.58 028 (427.14) 272.57 0.07 Cayman 41689.84 502.25 0.16 498.44 103.97 0.02 Carrera GT 367936.98 0.33 0.01 4398.98 0.78 0.00 The table shows means and standard deviations across months for a given calendar year. Prices are in real 2000 dollars. 911 1997 69211.21 335.08 44164.70 392.06 Quantity Given that Porsche produces in euroland and sells in the US its cash flows are potentially exposed to changes in the dollar/euro real exchange rate. In Figure 1 we graph monthly cash flows in euros (1000‟s) stemming from US sales (using EBITDA margins to calculate marginal costs) over the period for which we have prices. The pattern is consistent with a depreciation of the euro (lower values of the usd/euro rate) being associated with higher cash flows. 1.6 400 1.2 usdeur_real 1.4 300 1 .8 0 Cash_flow 200 100 1995m7 1998m1 2000m7 2003m1 2005m7 2008m1 date Cash_flow usdeur_real Figure 1. Cash flows of Porsche from US sales and dollar/euro exchange rate. However we note that over the period 1995-2002 the euro (german marks for the pre-euro period) had a trendwise depreciaton against the dollar and the cash flows had trendwise increase. The appreciation of the euro in 2003 appears not to have been reflected in a stand out fall in cash flows, a partial explanation for this is the introduction of the Cayenne. Typical work in the literature on exchange rate exposure would use the data represented in the figure above and regress cash flows (or changes in the stock market valuation) on the USD:EUR exchange rate along with some demand shifters thought to influence demand (see for instance Williamson (2001). We have experimented with such regressions. Effects broadly correspond to intuition. However, standard errors are large, parameter estimates are in several cases not stable across specifications and we have not taken account of changing product attributes nor that prices should be endogenous. Such problems are commonly faced in estimating demand for differentiated products (see for instance Whinston (2007) for an accessible discussion of such problems) and are the motivation for our demand system estimation in the following Section. 3 The Empirical Model 3.1 Demand Model Specification We follow Berry, Levinsohn and Pakes who estimate random-coefficients logit model for automobiles in the US market. We do not develop every detail of the model in this section, but rather refer authors to previous treatments including, in particular, BLP as well as Berry (1994) and Nevo (2000). Define the conditional indirect utility of individual i when consuming product j from market m as: K u ijm x jm k ik jm ijm , i 1, . . . , I; j 1, . . . , J; m 1, . . . , M k1 where xjmk are observed product characteristics such as size, HP/weight, brand, country of production, ξjm represent unobserved (by the econometrician) product characteristics, assumed observed by all consumers. Following the literature, we decompose the individual coefficients ik k k v ki where βk is common across individuals, vki is an individual-specific random determinant of the taste for characteristic k, which we assume to be Normally distributed v 1i , . . . , v Ki N0, and σk measures the impact of v on characteristic k. Finally, εijmt is an individual and option-specific idiosynchratic component of preferences, assumed to be a mean zero Type I Extreme Value random variable independent from both the consumer attributes and the product characteristics. The specification of the demand system is completed with the introduction of an outside good with conditional indirect utility , since u i0 0m 0 v i i0 some consumers decide not to buy any car. This demand specification abstracts from explicitly modeling intertemporal substitution (see, for example, Nevo and Hendel (2006) and Gowrisankaran and Rysman (2007) for an alternative approach). This clearly represents a pragmatic modeling approximation to actual consumer choice behaviour in the industry in light of the lack of information of transactions at the consumer level and given that the focus of our paper lays not directly in the dynamics on the demand side. Identification Strategy Following the literature we treat price as endogenous in our demand specification. To estimate our model, besides the exogenous characteristics, we a set BLP instruments (following BLP, 1995), a set of polynomial basis functions of exogenous variables exploiting the three-way panel structure of the data, consisting of the number of firms operating in the market, the number of other products of the same firm and the sum of characteristics of products produced by rival firms. Following the literature of merger simulation, we back out marginal costs from the first-order condition faced by the firms under the maintained assumption of Bertrand-Nash conduct. These USD-denominated marginal costs are assumed fixed in our analysis - we abstract from any efficiency gains (or losses) from relocating production and allow marginal costs to change only due to exchange rate fluctuations, as emphasized below. 3.2 Simulation Modelling Exchange Rate and Market Exposure We now proceed to the simulations of exposures. The simulation combines for a number of alternative scenarios the marginal costs obtained from the first-order conditions of the firms under the Bertrand-Nash assumption and the risk to which carmakers are assumed to be exposed: the USD/EUR and USD/JPY exchange rates, plus a consumer confidence index. The marginal costs we back-out are USD-denominated and allowed to change only due to exchange rate fluctuations. In so doing we abstract from any efficiencies and assume marginal costs are exposed only to exchange rate risk, while demand is only exposed to economic risk captured by consumer confidence. We model the impact of consumer confidence to vary across market segments, reflecting anecdotal evidence in the industry that market segments react differently to the underlying economic conditions. In short, we generate a large number of counterfactual draws on the exchange rates and on consumer confidence. We then calculate counterfactual profits under each set of exchange rates and consumer confidence so generated. Whether real exchange rates follow a random walk or are mean reverting is the focus of an exhaustive literature (see for instance Rogoff (1996) or Taylor and Taylor (2004) for overviews). Our reading of this literature is that real exchange rates are indeed mean reverting but that the pace is slow. Half lives of deviations to purchasing power parity are often measured in years. A closely related set of papers examine the forecasting ability of various macro models for the exchange rate. The igniting spark to this literature was Meese and Rogoff's (1983) finding that a random walk beat all the proposed models. While some of the ensuing studies point to some predictive power of macro based models (for instance Mark (1995)), other studies point to very weak predictive power (Faust et al (2003), Cheung et al (2005) Sarno and Valente (2009). Another literature has focused on modeling exchange rate behavior over shorter horizons using autoregressive processes. A frequent finding is that a GARCH (1,1) model performs well (see for instance Hansen and Lunde (2005) or Rapach and Strauss (2008)). Patton (2006) also uses GARCH(1,1) processes to model the daily exchange rates of the US dollar against the Yen and the euro (DEM). The interrelation between these variables is of potential interest for our purposes. For instance shocks to U.S. monetary policy are likely to affect the exchange rate both against the euro and the yen. A complication when generating counterfactual shocks to the variables if interest is that the multivariate distributions that are available to us may not provide a good description of the data. In recent years copula methods have been extensively used in for instance finance to model the interdependencies (see for instance Patton (2009)). In particular they have attractive properties when tail dependency is of interest. We therefore fit a Student's t-copula to the standardized residuals that we estimate by the GARCH(1,1). 10 Based on the estimated copula we then generate 1000 random shocks for each future period in the forecast horizon where the shocks in each period follow the copula relation. To model the joint behaviour of a set of random variables copula methods take a two step approach. In a first step the univariate processes governing each of the variables is modelled. In a second step the dependence between these variables is modelled. The core result is due to Sklar (1959). He noted that any vector of random variables can be transformed into a vector of random variables with uniform margins. We simulate the joint distribution of the exchange rates and consumer confidence index conditional on the last period of observations for a large enough number of times to approximate the true joint distribution of these variables at various forecast horizons and use these variables to simulate the profit distribution of carmakers under alternative scenarios. Simulation Scenarios Our baseline model allows exchange rates to affect marginal costs and consumer confidence to affect demand. At longer horizons we should allow prices to adjust. There are several ways one could introduce price adjustments here. First, given marginal costs in USD and the (unchanged) ownership structure, one can calculate the corresponding new equilibrium by iterated best response. Despite its elegance, this has a number of drawbacks. One is that, for each given scenario and horizon, we compute 1000 simulated draws of the exchange rates and consumer confidence index and calculate about ten strategies. Another is that the number of products is about 150, potentially requiring a large number of iterations, even with a clearly dominant diagonal in the elasticit matrix. Finally, and frequently observed in our exercise, in the case of extreme movements in the exchange rates, the iterations fail to converge, especially at longer horizons, when the exchange rate and consumer confidence distributions have fatter tails. Second, one could use actual list prices from the years ahead. Although we have list prices for model-year 2007 (12 months ahead), this would require data up to model-year 2011. And clearly this limits the use of the model for predictive purposes. Third, our chosen alternative is to estimate a hedonic price regression. Albeit with small changes, our specification is similar to the demand specification: instead of modelyear fixed effects we introduce a time trend, so that it becomes easier to extrapolate for future time periods. As for demand, we have interactions of consumer confidence and market segments, country and brand fixed-effects, which tend to reflect quite closely what one would expect in terms of brand reputation.11 10 Starting from a general ARMA-GARCH framework (thus simultaneously modelling mean and variance) our final specification after analysing parameter significance and the Schwarz and Hanna-Quinn information criteria is a GARCH(1,1), with the mean being modelled as a constant for the individual series. 11 These also tend to match ratings by companies such as J. D. Power - see, for instance, http://www.jdpower.com/autos/ratings/quality-ratings-by-brand/sortcolumn-0/ascending/page-1#page-anchor, Porsche counterfactuals As of 2006, Porsche produces its models Boxster, Cayenne and 911 in Euroland. In turn, BMW produces its SUVs/CUVs X3 and X5 and its roadster Z4 in the US, while producing its luxury cars (the 3, 5, 6 and 7 series) in Euroland. (Subsequently, it shifted the production of the Z4 to Europe.) We study the eight production strategies Porsche could follow when choosing where to produce each of the three models between the EU and the US: producing only in Euroland, producing only in the US, producing one of the models in the EU, producing two of the models in the US. This obviously abstracts from new product introduction, which is outside the scope of the paper. For a given horizon and counterfactual experiment, we change the production location of the model(s) considered, thus subjecting them or not to exchange risk as applicable. We then subject the system to the exchange rate and consumer confidence shocks on marginal costs and demand, respectively. We allow price adjustment following the hedonic model for prices and recompute market shares before computing firm profits. 4. Results 4.1 Demand and Cost Estimation Demand Estimates Table 3 reports estimates of two RC logit specifications for the US car market. Both use characteristics such as price, engine power (HP), size and whether non-manual transmission is included in the baseline model, as well as a random coefficient for price. Both also include time (model-year), country of origin, and brand fixed-effects. The stance in which Specifications I and II differ is in the treatment of consumer confidence and market segment variables.12 While Specification I uses separate fixed-effects for consumer confidence and market segments, Specification II uses interactions of these terms, thus allowing differential responses in market shares according to the market segment a model belongs to, according to economic outlook consumers expect to prevail.13 Both specifications have significant http://www.jdpower.com/autos/ratings/sales-satisfaction/luxury, satisfaction/mass-market http://www.jdpower.com/autos/ratings/sales- 12 The car industry is characterized by a number of market niches and highly heterogeneous products. See, for instance, Goldberg (1995) for estimates of a nested logit model incorporating market segment information. 13 Following the definition used by WARDS, we adopt 16 market segments: Upper Luxury, Middle Luxury, Lower Luxury, Luxury Sport, Luxury Specialty, Small Specialty, Large Luxury CUV, Middle Luxury CUV, Large CUV, Middle CUV, Small CUV, Large Luxury SUV, Middle Luxury SUV, Large SUV, Middle SUV, Small SUV. Goldberg (1995) uses nine market segments in her study of the US market, namely Subcompacts, Compacts, Internediate, Standard, Luxury, Sports, Pick-ups, Vans and Other, besides an indicator of whether the car's origin is domestic or foreign. The segments with the lowest price elasticities are Sports (both foreign and domestic cars), followed by Luxury (domestic), whereas the ones with the highest price elasticities are coefficients for the mean and dispersion price coefficients, whereas the remaining characteristics are usually not significant. In fact, most of the explanatory power for market shares tends to come from brand and market segment fixed-effects. Intermediate (foreign-made), followed by Standard (domestic) and Vans (foreign). Our market segments reflect a much more segmented market, thanks partly to the development of relatively new market niches such as Luxury SUVs and CUVs (cross-utility vehicles) in the last 15 years or so. Table 3. Demand estimates, US car market 1995-2006. Random-coefficients logit model. I II -0,030 [-3.078] 0,003 [0.415] 0,082 [1.725] 0,000 [-0.132] 0,012 [5.150] -0,043 [-4.628] 0,006 [0.672] 0,116 [1.904] 0,000 [-0.642] 0,017 [5.355] - MACRO x Large CUV 0,021 [1.860] - MACRO x Large Luxury CUV - MACRO x Large Luxury SUV - MACRO x Large SUV - MACRO x Lower Luxury - MACRO x Luxury Specialty - MACRO x Luxury Sport - MACRO x Middle CUV - MACRO x Middle Luxury - MACRO x Middle Luxury CUV - MACRO x Middle Luxury SUV - MACRO x Middle SUV - MACRO x Small CUV - MACRO x Small Specialty - MACRO x Small SUV - MACRO x Upper Luxury - Characteristics Price HP Size Transmission Sigma price Confidence Measures MACRO 0,039 [3.792] 0,043 [4.249] 0,050 [2.777] 0,038 [3.376] 0,035 [3.845] 0,035 [2.741] 0,038 [2.300] 0,030 [3.276] 0,045 [3.708] 0,040 [3.849] 0,040 [3.284] 0,035 [3.405] 0,021 [2.594] 0,017 [1.661] 0,012 [1.195] 0,049 [2.795] Fixed-effects Time Country Brand Segment Yes Yes Yes Yes Yes No Yes No Elasticities Elastic demands Min Mean Max 100% -5,4 -4,8 -1,4 100% -7,0 -6,0 -2,4 The (own) price elasticities (equivalently, markups) of the models in Specification II are in the range 4.2-7.6 with an average elasticity 6.4, thus in line with previous studies of the car industry, notably Petrin (2002) RC logit estimates using micro data (See, for instance, column 6 of his Table 9). For the sake of comparison, our elasticities seem to be somewhat higher than those of Goldberg (1995), BLP (1995) and Goldberg and Verboven (2001). Goldberg's average price elasticities, reported in her Table II, are in the range 1.1-6.2 across specifications and market segments. BLP's price elasticities reported in their Table V are in the range 3-6.5, while Goldberg and Verboven's ones, reported in their Table 6, are in the range 3-6. These results are consistent with the RC logit markup estimates (without microdata) reported in Petrin (2002)'s Table 9, whose 10th and 90th percentiles are 0.28 and 0.63, with an average markup of 0.4 , compared to, respectively, 0.11, 0.25 and 0.17 for his RC logit with microdata. (Equivalently, the 10th and 90th percentile of Petrin's elasticities are 4 and 8.9 in his specification using microdata). Interestingly, the estimates for Specification II suggest an intuitive "pecking order" effect of the interaction terms. For instance, demand for the "Upper Luxury" segment tends to be more sensitive to consumer confidence than that of the "Middle Luxury" one, which in turn is more sensitive than that of the "Lower Luxury" segment.14 Similarly, the "Large Luxury SUV" segment is more sensitive to consumer confidence than the "Middle Luxury SUV" segment, the "Large CUV" segment is more sensitive to the "Middle CUV" and "Small CUV" segments etc. We interpret these results as evidence that, conditional on buying a car, consumers tend to purchase models from high-end segments the more confident they are about the economic outlook. 14 This amounts to saying that a positive economic outlook results on a larger impact on the market shares of, say, an Audi A8 (or BMW 7 series) than on those of an Audi A6 (respectively, BMW 5 series), which in turn are more sensitive to consumer confidence than those of an Audi A4 (BMW 3 series). Table 4. Implied elasticities and price cost margins for selected models using demand estimates from Table 3. Brand Audi Audi Audi Audi Audi BMW BMW BMW BMW BMW BMW BMW Porsche Market Segment Lower Luxury Lower Luxury Middle Luxury Upper Luxury Middle Luxury Lower Luxury Middle Luxury Luxury Specialty Upper Luxury Middle Luxury CUV Middle Luxury CUV Luxury Sport Luxury Sport Porsche Porsche Model AUDI A3 AUDI A4 AUDI A6 AUDI A8 AUDI S4 BMW 3 BMW 5 BMW 6 BMW 7 BMW X3 BMW X5 BMW Z4 BOXSTER PCM 0,205 0,196 0,190 0,247 0,192 0,192 0,189 0,263 0,263 0,186 0,189 0,186 0,190 Elasticity -6,635 -6,867 -6,196 -4,125 -5,945 -6,929 -6,306 -3,903 -3,884 -6,863 -6,339 -7,006 -6,093 PCM 0,151 0,146 0,161 0,242 0,168 0,144 0,159 0,256 0,257 0,146 0,158 0,143 0,164 Middle Luxury CUV CAYENNE -5,329 0,188 -6,392 0,156 Luxury Sport 0,260 -3,935 0,254 911 Elasticity -4,890 -5,094 -5,273 -4,051 -5,204 -5,214 -5,280 -3,798 -3,799 -5,386 -5,302 -5,377 -5,251 -3,843 Price Hedonics As explained above we use hedonic regressions to generate counterfactual prices. This specification uses largely the same set of explanatory variables as our demand estimations do. Table 5. Hedonic regressions for price. Constant Trend hp_base size_base transmis_base MACRO*largecuv MACRO*largeluxurycuv MACRO*largeluxurysuv MACRO*largesuv MACRO*lowerluxury MACRO*luxuryspecialty MACRO*luxurysport MACRO*middlecuv MACRO*middleluxury MACRO*middleluxurycuv MACRO*middleluxurysu MACRO*middlesuv MACRO*smallcuv Coefficient 18067,973 -8,958 1,548 -11,468 -0,008 -0,452 -0,817 0,830 -0,066 -0,525 0,004 0,473 -0,272 -0,110 -0,460 -0,076 -0,165 -0,439 Std. error 88,786 0,045 0,013 0,203 0,000 0,005 0,006 0,004 0,005 0,003 0,005 0,008 0,005 0,003 0,004 0,004 0,005 0,006 t-statistic 203,500 -200,801 123,018 -56,604 -80,252 -88,250 -144,213 211,802 -13,519 -195,658 0,721 58,626 -50,434 -37,732 -106,182 -21,299 -36,022 -76,040 MACRO*smallspecialty MACRO*smallsuv MACRO*upperluxury Country f.e. Brand f.e. R-squared = -0,074 -0,108 0,636 Yes Yes 0,913 0,007 0,008 0,006 -10,242 -14,312 101,637 6. Simulation Results Note: this section is quite preliminary. When prices are allowed to adjust according to the hedonic model, Porsche's profits are decreasing in the USD/EUR exchange rate. 15 Rather than focusing on one of the shocks let us instead examine two distributions of the exchange rate. In generating these counterfactuals we use data up to July 2006 only so counterfactual for 2007 is one year out and for 2009 3 years out. We take counterfactual values for July of the respective year and use these values to generate counterfactual profits for the whole year. As seen the distribution for 2007 is centered between 300 and 400 million euro in profits generated from US sales by Porsche. There is considerable dispersion however even thought the lower tail is well above 0. Looking three years out the mode of the distribution is similar but the spread is now wider, a substantial fraction of realizations are associated with negative cash flows at the same time as the upside potential is better. Counterfactual distribution of profits 2009, all production in the EU .0015 0 0 .0005 .001 Density .001 .002 Density .003 .002 .004 .0025 Counterfactual distribution of profits 2007, all production in the EU 0 200 400 600 Euprod_Jul2007 kernel = epanechnikov, bandwidth = 20.8632 800 -500 0 500 1000 Euprod_Jul2009 1500 kernel = epanechnikov, bandwidth = 40.8914 Figure 2. Counterfactual distribution of profits for Porsche using data up till July 2006. 15 All profit figures reported are in July 2007 home currencies. In particular, Porsche's figures are reported in July 2007 EUR. Different production strategies 0 200 400 600 800 Given the three models produced by Porsche and the choice of producing each of them in Euroland or in the US, we can consider 8 alternative scenarios as to where to produce models. We can also consider the option of being able to shift production between locations. In Figure 3 we present the distribution of profits for three of these alternatives; Producing all three models only in Euroland, producing Cayenne in the US and 911 and Boxster in Euroland and finally producing 911 in the US and the other models in Euroland. As seen, producing Cayenne in US, as opposed to having all production in Euroland raises median profits as well as shortens the lower tail. Some of the upward profit potential is sacrificed but risk-return calculations are likely to point to that such a move would be motivated. Euprod_Jul2007 911US_Jul2007 CayenneUS_Jul2007 Figure 3. Counterfactual profits 2007 under different scenarios of production location. 2,000 1,500 1,000 0 500 Euprod_Jul2009 911US_Jul2009 CayenneUS_Jul2009 Figure 3. Counterfactual profits 2009 under different scenarios of production location. Conclusion We examine firm exposure to both exchange rates (via costs) and market risk (via demand) by focusing on the auto industry. To our knowledge, this is the first paper to structurally estimate firm profits allowing for operating risk. We jointly simulate exchange rates and consumer confidence indices using GARCH models for the univariate time series and a copula function to model their joint behaviour. We consider a number of counterfactual experiments for Porsche, with and without price adjustments, as well as different horizons. If we abstract from fixed costs and domestic profits, the intuition of our results is straightforward: even in the short-run, it pays off to shift production to foreign markets, as the distribution of profits become less dispersed, exhibiting higher expected returns and smaller variance. If we were to consider fixed costs of relocating production and the profits in home markets, the first moments of our estimates would obviously be downweighted, but the second moments would be less affected. References Adam and Fernando (2006) Adler and Dumas (1983) Allayannis, Ihrig and Weston (2001) Berk, J. and P. DeMarzo (2007), "Corporate Finance", Pearson. Berry, S. (1994) "Estimating discrete choice models of product differentiation" RAND Journal of Economics, 25, 2, 242-262. Berry, Kortum and Pakes (1996) Berry, S., J. Levinsohn and A. Pakes (1995) "Automobile prices in Market Equilibrium" Econometrica 63, 841-890 Berry, S., J. Levinsohn and A. Pakes (2004) "Differentiated Product demand systems from a combination of micro and macro data: The new car market", Journal of Political Economy 112, 68-105. Bodnar, Hayt and Marston (1998) Brealey and Kaplanis (1995) Bresnahan, T. (1987) "Competition and Collusion in the American Automobile Market: The 1955 Price War", Journal of Industrial Economics, 35(4), 457-482. Bresnahan, T., S. Stern and M. Trajtenberg (1997) "Market segmentation and the sources of rents from innovation: Personal computers in the late 1980s" RAND Journal of Economics 28, 0, S17-S44. Busse, Silva-Risso and Zettelmayer (2006) Cardell, N. and Dunbar, F. (1980) "Measuring the Societal Impacts of Automobile Downsizing." Transportation Research, 14A, (5-6) pages 423-434. Chowdry and Howe (1999) Dasu and Li (1997) Deaton, A. and J. Muellbauer (1980) "An Almost Ideal Demand System" American Economic Review, 70, 312-326 Desai (2007) Dominguez and Tesar (2006) Eiteman, Stonehill and Moffett (2007, p 322) Eun and Resnick (2007, p 236) Farris, Paul and Kang, Eric, (2008) Product Line Strategy at Porsche: The Effect of New Models on the Porsche Brand and the 911. , Vol. , pp. 1-24, . Available at SSRN: http://ssrn.com/abstract=910111. Friberg and Ganslandt (2007), Exchange rates and cash flows in differentiated product industries: A simulation approach, Journal of Finance Friedman J. (1971), "A non-cooperative equilibrium for supergames." Review of Economic Studies, Vol. 38., pages 1-12. Froot, Stein and Scharfstein (1993) Géczy, Minton and Schrand (2006) Goldberg (1995) Goldberg's (1998) GOLDBERG & VERBOVEN Gorman, T. (1970) "Two Stage Budgeting", mimeo University of North Carolina reprinted in C. Blackorby and A. F. Shorrocks (eds) Separability and Aggregation Volume I: The Collected Works of Terrance Gorman, Oxford: Oxford University Press. Gowrisankaran, G. and M. Rysman (2007), "Dynamics of Consumer Demand for New Durable Goods", forthcoming in Econometrica. Hausman, J., G. Leonard and D. Zona (1994) "Competitive Analysis with Differentiated Products" Annales d'Economie et de Statistique, 34, 159-180 Hausman, J. (1997) "Valuation of New Goods under perfect and imperfect competition" Chapter 5 in Timothy Bresnahan and Robert Gordon (eds) The Economics of New Goods, Chicago: University of Chicago Press Hendel, I. (1999) "Estimating Multiple discrete choice models: an application to computerization returns" Review of Economic Studies, 66(2), 227, 423-446. Hendel, I., and A. Nevo (2006), "Measuring the Implications of Sales and Consumer Inventory Behaviour", Econometrica, November, 74(6), 1637-73. Ivaldi, M. and S. Lörincz (2008), "Implementation Relevant Market Tests in Antitrust Policy: Applications to Computer Servers", Review of Law and Economics. Jin and Jorion (2006) Jorion (1990) Kamrad and Siddique (2004) Kazaz, Dada and Moskovitz (2005) Mello, Parson and Triantis (1995) Miller (1998) Minton, Bernadette, "The Use of Multiple Risk Management Strategies: Evidence from the Natural Gas Industry", with Christopher Géczy and Catherine Schrand, Journal of Risk, 2006. Moffett, Michael H.; Petitt, Barbara S., (2004) Porsche Exposed, Source: Thunderbird School of Global Management Nevo, A. (2002) "Measuring Market Power in the Ready to Eat Cereal Industry" Econometrica, 69, 307-342 Nevo A. (2000) "A Practitioners Guide to Estimation of Random Coefficient Logit Models of Demand" Journal of Economics and Management Strategy Vol 9, No. 4, pages 513--548. Oxelheim and Wihlborg (2006) Petrin, A (2002) "Quantifying the benefits of new products: The case of the Minivan", Journal of Political Economy, 11, 705-729 Pinkse, J., Slade, M. and Brett, C. (2002) "Spatial Price Competition: A Semi-parametric approach" Econometrica, 70: 1111-1155 Ramey and Vine (2006) Stone, R. (1954) "Linear expenditure Systems and demand analysis: an application to the pattern of British Demand" Economic Journal, 64, 511-27. Stultz, René M. and Rohan Williamson "Identifying and Quantifying Exposures," with, in Financial Risk and the Corporate Treasury: New Developments in Strategy and Control," Robert Jameson, ed., Risk Publications, London, 1997, 33-51, available at http://www.cob.ohio-state.edu/fin/journal/dice/papers/1996/96-14.pdf Train and Winston (2007) Tufano (1996) VERBOVEN Werden, G. and L. Froeb (1994) "The Effects of Mergers in Differentiated Products Industries: Structural Merger Policy and the Logit Model" Journal of Law, Economics, & Organization, 10 (1994) pp. 407-426. Whinston (2007) White (1980) "A heteroskedastic-consistent covariance matrix estimator and a direct test for heteroskedacity" Econometrica, 48, 817-838. Williamson's (2001)