ASPE at a Glance - Section 3461: Employee Future Benefits

advertisement

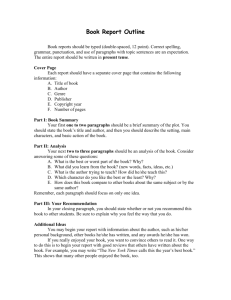

ASPE AT A GLANCE Section 3461: Employee Future Benefits March 2012 Section 3461 – Employee Future Benefits Effective Date Periods beginning on or after 1 January 1, 2011 SCOPE All employee future benefits except benefits provided by an entity to employees during their active employment. DEFINITION Employee benefits are all forms of consideration given by an entity in exchange for services rendered or for the termination of employment. EMPLOYEE FUTURE BENEFITS Employee benefits payable after the completion of employment or for the termination of employment such as pension income, health care benefits, life insurance, and other miscellaneous benefits provided to employees after retirement; post-employment benefits, such as long- and short-term disability income benefits (including workers' compensation), severance benefits, salary continuation, supplemental unemployment benefits, job training and counselling, and continuation of benefits such as health care benefits and life insurance; compensated absences for which it is expected employees will be paid, such as parental leaves, accumulating sick days that vest or are paid without an illness-related absence, and sabbaticals that provide compensated, unrestricted time off for past service; and termination benefits. DEFINED CONTRIBUTION • A benefit plan that specifies how an entity's contributions to the plan are determined rather than the benefits to be received by an employee or the method of determining those benefits. • Recognize a cost for the period comprising: • current service cost; • the interest cost; • amortization of past service costs; • reduction in interest income on any unallocated plan surplus. MULTI-EMPLOYER • These are defined benefit plans in which two or more unrelated entities contribute, usually pursuant to one or more collective bargaining agreements. • An entity may apply defined contribution accounting when sufficient information is not available to apply the accounting requirements for defined benefit plans. DEFINED BENEFIT PLANS A benefit plan that is not a defined contribution plan. An entity shall make an accounting policy choice to account for all of its defined benefit plans using either: the immediate recognition approach (paragraphs 3461.027-.040) or the deferral and amortization approach (paragraphs 3461.041-.139); APPROACH 1 OF 2: IMMEDIATE RECOGNITION APPROACH • Recognize: • the accrued benefit obligation net of the fair value of any plan assets, adjusted for any valuation allowance, in the balance sheet at the end of the year; and • the cost of the plan for the year. Balance Sheet • Recognize the accrued benefit obligation net of the fair value of any plan assets (a market value or approximation of market value), adjusted for any valuation allowance. • The accrued benefit obligation is based on the most recent actuarial valuation report prepared for funding purposes (but not one prepared for solvency or wind-up purposes). • If no funding valuation report is available then determine the accrued benefit obligation using the discount rate in accordance with paragraph 3461.063 and management's best estimates for each actuarial assumption other than the discount rate in accordance with paragraphs 3461.060-.062. • The actuarial valuation of the accrued benefit obligation shall be determined at least every three years but may occur more frequently. In the years between valuations, the entity uses a roll-forward technique to estimate the accrued benefit obligation. • A plan surplus is recognized only to the extent it is expected to be recoverable by the entity. The entity recognizes a valuation allowance for any excess of the plan surplus over the amount expected to be recoverable by the entity. Statement of Operations • The cost of a plan for a year comprise: • changes in the accrued benefit obligation other than those resulting from benefit payments to plan members and net of any employee contributions; • actual return on plan assets; and • changes in valuation allowance. • The actual return on plan assets equals the fair value of plan assets at the beginning of the year, reduced for any benefit payments and increased by any contributions minus the fair value of plan assets at the end of the year. OTHER BENEFITS • Recognize a liability and a cost for: • employee future benefits, other than post-employment benefits and compensated absences that do not vest or accumulate, in the period in which employees render services to the entity in return for the benefits. • post-employment benefits and compensated absences that do not vest or accumulate when the event that obligates the entity occurs. APPROACH 2 OF 2: DEFERRAL AND AMORTIZATION APPROACH Balance Sheet • • • • • • Statement of Operations Accounting by an entity for a defined benefit plan using the deferral and amortization approach includes the following steps: a) making estimates (actuarial assumptions) about demographic variables (such as employee turnover and mortality) and financial variables (such as future increases in salaries and medical costs) that will affect the cost of employee future benefits (see paragraphs 3461.060-.078); b) determining the obligation for employee future benefits using actuarial techniques to make a reliable estimate of the present value of employees' future benefits; c) attributing the cost of benefits to employee service periods in order to determine the accrued benefit obligation and the current service cost (see paragraphs 3461.047-.056); d) determining the interest cost on the accrued benefit obligation (see paragraphs 3461.063-.068 and 3461.088); e) determining the fair value of any plan assets (see paragraphs 3461.079-.081); f) determining the expected return on plan assets (see paragraphs 3461.089-.091); g) determining past service costs to be recognized (see paragraphs 3461.092-.099); h) determining the total amount of actuarial gains and losses and the amount to be recognized (see paragraphs 3461.100-.105); i) determining a valuation allowance on an accrued benefit asset and recognizing any expected benefit over the expected future benefit (see paragraphs 3461.113-.121); and j) determining a gain or loss when a plan has been curtailed or settled, (see paragraphs 3461.122-.139). Accrued Benefit Obligation is determined using the projected benefit method prorated on services or the accumulated benefit method. Attribution • The attribution period begins on an employee's date of hire unless the plan's benefit formula grants credit for service only from a date after the date of hire. If the credited service period is insignificant relative to the total service period, the obligation for employee future benefits shall be attributed from the date of hire. The attribution period shall end on the full eligibility date. • To each year of service in the attribution period based on the plan's benefit formula, except when the plan does not state or imply a benefit formula or when an employee's service in later years will lead to a significantly higher level of benefit than in earlier years, in which case a straight line basis during the attribution period is used. The plan assets and the accrued benefit obligation shall be measured as of the date of the annual financial statements, except that they may be measured as of a date not more than three months prior to that date provided the entity adopts this practice consistently from year to year. The discount rate used to determine the accrued benefit obligation shall be an interest rate determined by reference to: a) market interest rates at the measurement date on high-quality debt instruments with cash flows that match the timing and amount of expected benefit payments; or b) the interest rate inherent in the amount at which the accrued benefit obligation could be settled. Actuarial assumptions about medical costs reflect expected future changes in the cost of medical services resulting from general price-level inflation, specific changes in the prices of medical services, and changes in medical practices and technology. • Recognize a cost for the period comprising: • Current service cost, reduced to reflect employee contributions (paragraph 3461.084) • Interest cost on accrued benefit obligation (paragraph 3461.088), • Expected return on plan assets, based on the expected long-term rate of return on plan assets and the fair value, or a market-related value, of plan assets. (paragraph 3461.089), • Amortization of past service costs arising from plan initiation or amendment (paragraph 3461.092) • Amortization of net actuarial gain (loss) (paragraph 3461.100); • Amount for temporary deviation from plan (paragraph 3461.106) • Increase or decrease in valuation allowance against carrying amount of an accrued benefit asset (paragraph 3461.113) • Gain or loss on a settlement or curtailment (paragraphs 3461.123-.124 and .133-.134) and • Termination benefit expense (paragraphs 3461.140-.142) • Past service costs are recognized on a straight line basis up to the full eligibility date of each employee active at the date of the plan initiation or amendment. However, when all, or almost all, of the employees are no longer active, an entity amortizes past service costs on a straight-line basis over the average remaining life expectancy of the former employees. • Actuarial gains and losses are recognized either immediately or using the ‘corridor method’, where the unamortized net actuarial gain or loss exceeds 10 percent of the greater of: a) the accrued benefit obligation at the beginning of the year; and b) the fair value, or market-related value, of plan assets at the beginning of the year. • Voluntary termination benefits are recognized when employees accept the termination offer and the amount of the special termination benefits can be reasonably estimated. • Involuntary termination benefits are recognized in the period in which: a) management approves and commits the entity to a plan of termination and establishes the benefits that employees will receive upon their termination; b) the benefit arrangement is communicated to employees in sufficient detail to enable them to determine the type and amount of benefits they will receive; c) the plan of termination specifically identifies the target level of reduction in the number of employees, the job classifications or functions and their locations; and d) the period of time to complete the plan of termination indicates that significant changes to the plan of termination are not likely. • Contractual termination benefits are recognized when it is probable that employees will be entitled to benefits and the amount can be reasonably estimated. DISCLOSURE IS REQUIRED FOR ALL EMPLOYEE FUTURE BENEFITS National Office 36 Toronto Street Suite 600 Toronto ON M5C 2C5 800 805 9544 www.bdo.ca This publication has been carefully prepared, but it has been written in general terms and should be seen as broad guidance only. The publication cannot be relied upon to cover specific situations and you should not act, or refrain from acting, upon the information contained therein without obtaining specific professional advice. Please contact BDO Canada LLP to discuss these matters in the context of your particular circumstances. BDO Canada LLP, its partners, employees and agents do not accept or assume any liability or duty of care for any loss arising from any action taken or not taken by anyone in reliance on the information in this publication or for any decision based on it. BDO Canada LLP, a Canadian limited liability partnership, is a member of BDO International Limited, a UK company limited by guarantee, and forms part of the international BDO network of independent member firms. BDO is the brand name for the BDO network and for each of the BDO Member Firms.