Initiation

China: Internet Software & Services

13 December, 2013

Action

What’s new?

Our view

BUY (Initiation)

► We initiate coverage of Qihoo

► Qihoo has established a leading

TP upside (downside) 43.9%

position in China’s antivirus

43.9% upside.

and app distribution segments

price of US$115, which implies

Close 11 December, 2013

Price

12M Target

Previous Target

NASDAQ

with a BUY rating and a target

US$79.91

US$115.00

N.A.

4,003.8

software, website navigation,

via several popular mobile apps.

►

We believe PC/mobile internet

monetization is on track.

Company profile: Primarily known for its antivirus software, Qihoo is the largest website navigation/mobile assistant

supplier and second largest search engine player in China.

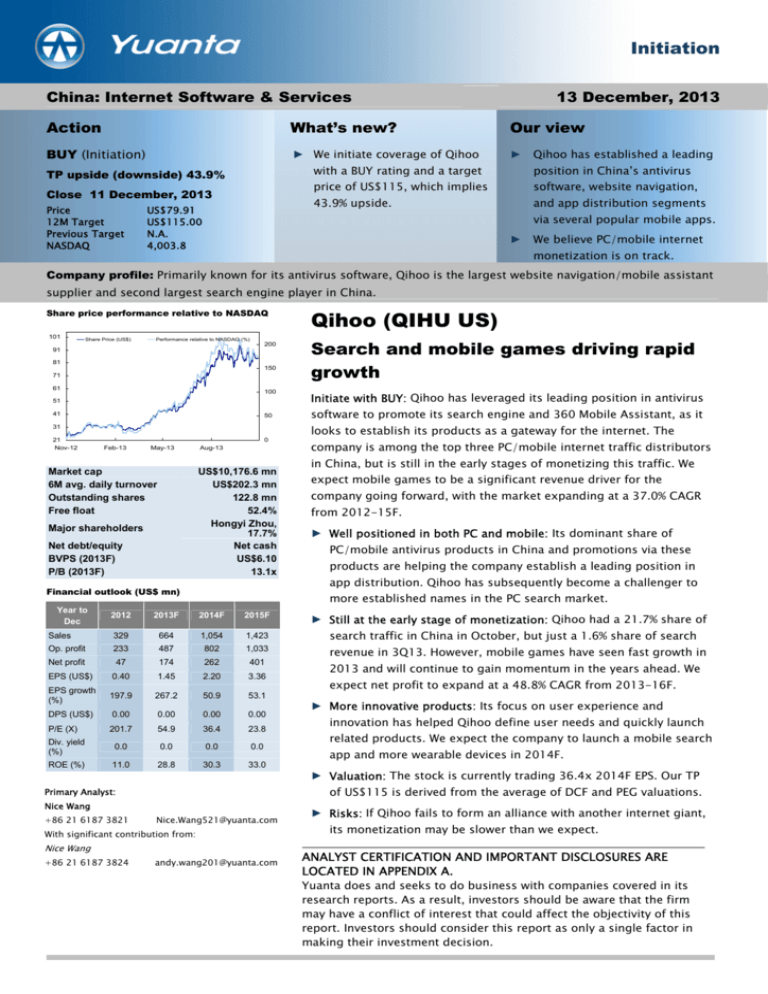

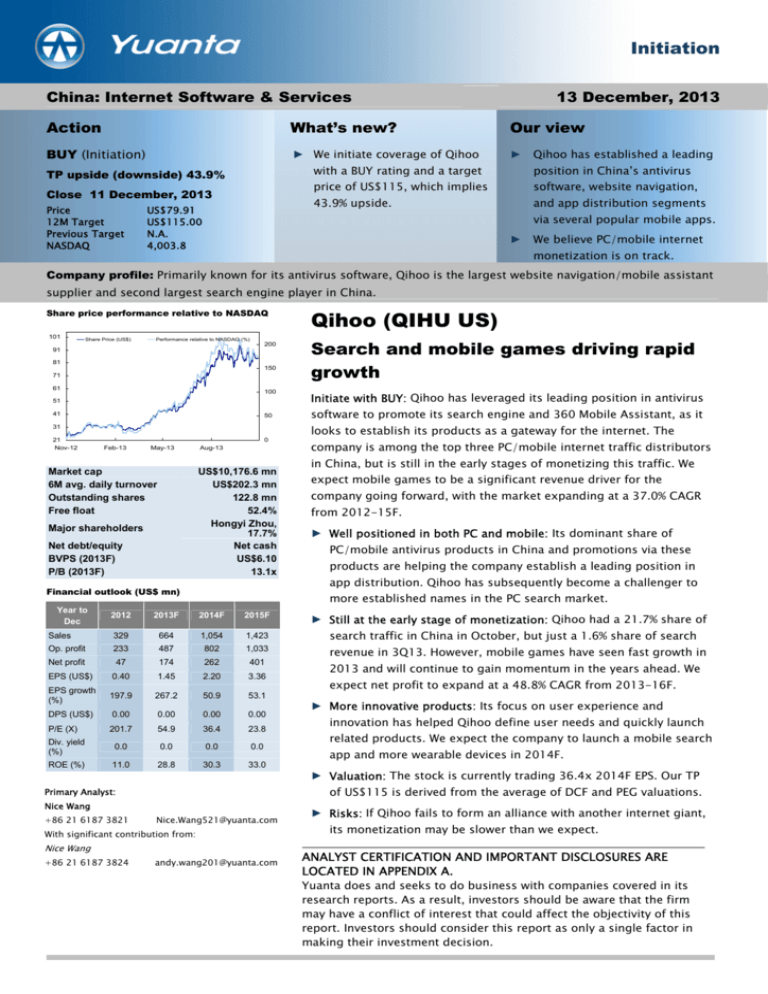

Share price performance relative to NASDAQ

101

Share Price (US$)

Performance relative to NASDAQ (%)

200

91

81

150

71

61

100

51

41

50

31

21

Nov-12

0

Feb-13

May-13

Market cap

6M avg. daily turnover

Outstanding shares

Free float

Aug-13

US$10,176.6 mn

US$202.3 mn

122.8 mn

52.4%

Hongyi Zhou,

17.7%

Net cash

US$6.10

13.1x

Major shareholders

Net debt/equity

BVPS (2013F)

P/B (2013F)

Financial outlook (US$ mn)

Year to

Dec

2013F

2014F

2015F

Sales

329

664

1,054

1,423

Op. profit

233

487

802

1,033

Net profit

47

174

262

401

EPS (US$)

0.40

1.45

2.20

3.36

EPS growth

(%)

197.9

267.2

50.9

53.1

DPS (US$)

0.00

0.00

0.00

0.00

P/E (X)

201.7

54.9

36.4

23.8

Div. yield

(%)

0.0

0.0

0.0

0.0

ROE (%)

11.0

28.8

30.3

33.0

Initiate with BUY: Qihoo has leveraged its leading position in antivirus

software to promote its search engine and 360 Mobile Assistant, as it

looks to establish its products as a gateway for the internet. The

company is among the top three PC/mobile internet traffic distributors

in China, but is still in the early stages of monetizing this traffic. We

expect mobile games to be a significant revenue driver for the

company going forward, with the market expanding at a 37.0% CAGR

from 2012-15F.

► Well positioned in both PC and mobile: Its dominant share of

PC/mobile antivirus products in China and promotions via these

products are helping the company establish a leading position in

app distribution. Qihoo has subsequently become a challenger to

► Still at the early stage of monetization: Qihoo had a 21.7% share of

search traffic in China in October, but just a 1.6% share of search

revenue in 3Q13. However, mobile games have seen fast growth in

2013 and will continue to gain momentum in the years ahead. We

expect net profit to expand at a 48.8% CAGR from 2013-16F.

► More innovative products: Its focus on user experience and

innovation has helped Qihoo define user needs and quickly launch

related products. We expect the company to launch a mobile search

app and more wearable devices in 2014F.

► Valuation: The stock is currently trading 36.4x 2014F EPS. Our TP

of US$115 is derived from the average of DCF and PEG valuations.

Primary Analyst:

Nice Wang

Nice.Wang521@yuanta.com

With significant contribution from:

Nice Wang

+86 21 6187 3824

Search and mobile games driving rapid

growth

more established names in the PC search market.

2012

+86 21 6187 3821

Qihoo (QIHU US)

andy.wang201@yuanta.com

► Risks: If Qihoo fails to form an alliance with another internet giant,

its monetization may be slower than we expect.

ANALYST CERTIFICATION AND IMPORTANT DISCLOSURES ARE

LOCATED IN APPENDIX A.

Yuanta does and seeks to do business with companies covered in its

research reports. As a result, investors should be aware that the firm

may have a conflict of interest that could affect the objectivity of this

report. Investors should consider this report as only a single factor in

making their investment decision.

Investment thesis

Its business model is to

acquire a vast user base via

free popular products and

make money from other

avenues

Quickly reaching internet users

Qihoo has established a number of gateways to the internet, such as its PC/mobile

antivirus products, its search engine, mobile app distribution platform, and internet

browsers. Its business model is to acquire a vast user base via free popular

products and make money from other avenues.

Qihoo is the dominant internet antivirus product supplier in China with 465 mn PC

users and 408 mobile users in 3Q13. It has no powerful competitors in China

thanks to its strategy of giving its products away for free, and new competitors will

not threaten its dominant market position, in our view.

Antivirus products are Qihoo’s key channel to promote its other products, such as

360 Mobile Assistant has more

than 300 mn users, and is the

largest third-party Android app

distribution platform in China

360 Browser, 360 Search, 360 Website Navigation, and 360 Mobile Assistant. Unlike

other software or apps, antivirus products are always running and always monitor

users’ operations, and we view this platform as ideal to promote products to

PC/mobile internet users. Furthermore, Qihoo’s 360 Browsers had a 26.09% market

share in November in China, second only to Internet Explorer, while 360 Mobile

Assistant has more than 300 mn users, and is the largest third-party Android app

distribution platform in China.

The company is also focused on start-ups because of CEO Hongyi Zhou’s angel

investor background, and has invested in some successful companies such as PP

Assistant, which was just acquired by UCweb. Qihoo has good relationships with

lots of venture capital firms, which can help it keep in touch with new internet

development trends.

Figure 1: Qihoo has already well positioned in both PC and mobile internet market

Source: Yuanta Research

Yuanta

China: Internet Software & Services

Qihoo (QIHU US)

13 Dec, 2013

Initiation

Page 2 of 27

Figure 2: Qihoo’s PC user base

PC safe products users

500

Figure 3: Top 10 antivirus products in China

1H12

product penetration

100%

mn

Ranking

Software

Monthly Unique User

Chg %

1

360 Security Guard

369.4

10.7%

2

360 Antivirus

360.8

20.9%

3

QQ Computer Guard

84.1

22.1%

4

Kingsoft Antivirus

82

4.1%

5

360 Safebox

80.8

-9.4%

6

Rising Antivirus

46.3

-4.1%

7

Kingsoft PC Doctor

41.5

-3.7%

8

Rising Personal

Firewall

17

N.A.

9

360 First-aid Kit

10

N.A.

10

Kingsoft Web Shield

9.7

-52.5%

450

400

80%

350

300

60%

250

200

40%

150

100

20%

50

0

0%

1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13

Source: Company Data, Yuanta Research

Source: iResearch (1H12), Yuanta Research

Figure 4: Qihoo’s smartphone user base

Figure 5: 71.7% of smartphone users prefer Qihoo for

450

mobile antivirus products

mn

80%

400

71.7%

70%

350

60%

300

50%

250

36.7%

40%

200

150

30%

100

20%

50

10%

8.3%

7.2%

9.1%

Kingsoft

NQ

Others

0%

0

1Q12

2Q12

3Q12

4Q12

1Q13

2Q13

3Q13

Source: Company Data, Yuanta Research

Qihoo

Tencent

Source: iiMedia, Yuanta Research

Monetization of search and mobile games will accelerate in 2014F

After the company’s channel PC/mobile antivirus products helped its platform

products (search engine and app distribution platforms) establish their positions in

the search engine and app distribution platform markets, Qihoo began to monetize

them in 1Q13.

Qihoo’s search engine contributed sales of US$5/15/27.7 mn in 1Q13/2Q13/3Q13,

accounting for 4.6%/9/9%/14.8% of total revenue. However, monetization of its

search engine is still at an early stage. According to CNZZ, Qihoo had a 21.7% share

of search traffic in November 2013, but accounted for just 1.6% of total search

We expect the company to

account for 30% of search

traffic in 2015 and 5.2% of

search engine revenue

engine revenue in 3Q13 based on iResearch’s estimate, as its keyword system is

not yet mature and it still needs to establish its advertising network. Taking the US

search market as an example, Yahoo and Bing had around of 22% search traffic and

19.4% of search engine revenue in 4Q12, and we expect Qihoo to achieve a similar

share of search traffic and search engine revenue when its technology, keyword

system and sales network mature. Management said their keyword system and

sales network will be improved by 2H14. We expect the company to account for

30% of search traffic in 2015 and 5.2% of search engine revenue.

Yuanta

China: Internet Software & Services

Qihoo (QIHU US)

13 Dec, 2013

Initiation

Page 3 of 27

Figure 6: PC search traffic in China

Baidu

90%

Qihoo

Figure 7: Search revenue market share

Sogou & Soso

Qihoo

others

Sogou & Soso

Google

Baidu

100%

80%

90%

70%

63.6%

80%

60%

70%

50%

60%

40%

80.6%

81.4%

81.4%

4.7%

0.3%

4.6%

0.8%

4.5%

1.6%

1Q13

2Q13

3Q13

50%

21.8%

30%

40%

20%

30%

10%

20%

0%

10%

Aug-12

Nov-12

Feb-13

May-13

Aug-13

Nov-13

0%

Source: CNZZ, Yuanta Research

Source: iResearch, Yuanta Research

Figure 8: Page view market share in US

Figure 9: Search ad market share in the US

%

90

Google

Google

Yahoo!

bing

Others

Bing & Yahoo

100%

80

90%

70

80%

18.0%

18.6%

18.1%

18.5%

19.4%

82.0%

81.4%

81.9%

81.5%

80.6%

4Q11

1Q12

2Q12

3Q12

4Q12

70%

60

60%

50

50%

40

40%

30

30%

20

20%

10

10%

0%

0

-1008-07 09-03

09-11

10-07 11-03

11-11

12-07 13-03

Source: State Counter, Yuanta Research

Source: eMarketer, Yuanta Research

According to iResearch, China’s mobile game market revenue will increase at a

37.0% CAGR from 2012-15F, and we expect the market size of mobile games will

exceed PC based games in 2017 given more potential users and as they are more

attractive to female players. Qihoo has the leading app distribution platform in

China with around 25% market share in September, and is one of the most

important mobile game publishers in China. We expect the company to continue to

be the second largest mobile game distributor in China behind Tencent’s (700 HK;

HOLD-OPF) Weixin, and will continue to benefit from the fast growth of mobile

games in the years to come.

Yuanta

China: Internet Software & Services

Qihoo (QIHU US)

13 Dec, 2013

Initiation

Page 4 of 27

Figure 10: Mobile app distribution platform time spent

Figure 11: Mobile games market size forecast

23

RMB bn

Feature phone

Smartphone

21

Qihoo

25%

Others

34%

19

17

CAGR: 37.0%

15

12.4

13

8.2

11

Baidu

21%

MIUI

3%

Wandoujia

17%

7

5

Source: iResearch (September 2013), Yuanta Research

4.7

9

1.9

6.8

7.6

7.9

6

2012

2013F

2014F

2015F

Source: iResearch, Yuanta Research estimates

Focus on user experience and product innovation

CEO Hongyi Zhou has always been focused on user experience and product

innovation. Qihoo’s business model is to acquire a vast user base via free popular

products, and make money from online advertising clients and cooperation of

mobile game companies. The company pays attention to user experience in order

to be the dominant player in antivirus products. It also develops lots of simple

products/apps to make users’ PC/handset operate smoothly and quickly get

information from users on their PC/mobile internet habits.

Figure 12: Qihoo’s innovative products

Innovative products

Function

Desktop Search Box

Users do not need to open a browser to search, just press the “Ctrl” button twice

then can search information.

360 Keyboard

Qihoo’s customized keyboard to promote its desktop search box.

360 Mobile Safe

Intercept crank calls and junk SMS.

360 Mobile Assistant

Grants smartphone users the right to uninstall pre-installed apps.

Yingshi Daquan

Users can search mobile videos from different video platforms.

Children Guard

Lets parents can monitor their children.

Source: Yuanta Research

Figure 13: Qihoo’s desktop search box

Figure 14: Yingshi Daquan

Source: Yuanta Research

Source: Yuanta Research

Yuanta

China: Internet Software & Services

Qihoo (QIHU US)

13 Dec, 2013

Initiation

Page 5 of 27

Figure 15: Qihoo’s customized keyboard to promote

Figure 16: Qihoo’s wearable products for children

the desktop search box

Source: Yuanta Research

Source: Yuanta Research

Management efficiency

Qihoo has a relatively “flat” management structure, with more than 400 small teams

Qihoo has a relatively “flat”

management structure

reporting to the CEO directly if they have good business ideas. This has helped the

company develop many popular products such as Leidian, Yingshi Daquan, its

desktop search box with a workforce of less than 5,000. Its employees are also well

rewarded, with a positive working environment.

We view the management structure as efficient, which can be seen in examples

such as the 360 Mobile Assistant, which although it launched four years after 91

Wireless, surpassed 91 Wireless to be the number one Android app distribution

platform within two years thanks to the favorable user experience and strong

channel advantage via its 360 Mobile Safe product. Qihoo launched its search

engine in August 2012 and already has a 21.7% share of search traffic in November

2013, thanks to its popular internet browsers.

Yuanta

China: Internet Software & Services

Qihoo (QIHU US)

13 Dec, 2013

Initiation

Page 6 of 27

Valuation

Our 12-month target price of US$115 is derived from the average of our DCF

valuation and our PEG-derived fair value estimates. We believe our valuation

captures both the short-term and long-term earnings potential of the company, as

well as the stock’s relative valuation. Our target price implies 52.4x 2014F P/E.

DCF analysis

Our forward DCF estimate is

US$121.8

We derive a forward DCF estimate of US$121.8. Our valuation is based on the

assumptions of a cost of equity of 14.5%, and a terminal growth rate of 3% for the

period after 2030. Our forward DCF estimate implies a P/E of 55.5x.

Our DCF assumes China’s online advertising market will develop in a similar fashion

to the US market, where paid searches account for the bulk of the online advertising

market. We expect paid searches to be driven by further penetration of search

marketing among Chinese SMEs, and continued increases in the number of Chinese

consumers adopting e-commerce. We assume Qihoo will take some of Baidu’s

share, and China’s mobile game market is still at an early stage and Qihoo will be

the second largest mobile game operators in the coming years.

Relative valuation analysis

For relative valuation analysis, our PEG-derived value estimate is US$107.1, based

on 1.0x PEG, implying a P/E of 48.8x derived from our 2014F EPS estimate. Qihoo’s

Our PEG-derived value

estimate is US$107.1

P/E ratio is much higher than its peers because in our view Qihoo is only at its early

stage of its monetization and is doing well in the search engine and mobile game

markets.

Figure 17: Qihoo’s 12-month forward P/E

250

Figure 18: Qihoo’s PEG ratio

1.6

US$

1.4

200

1.2

1.0

150

0.8

100

0.6

0.4

50

0.2

0

Source: Bloomberg, Yuanta Research

13-10

13-07

13-04

13-01

12-10

12-07

12-04

12-01

11-10

11-07

Source: Bloomberg, Yuanta Research

Yuanta

China: Internet Software & Services

11-04

13-10

13-07

13-04

13-01

12-10

12-07

12-04

12-01

11-10

11-07

11-04

0.0

Qihoo (QIHU US)

13 Dec, 2013

Initiation

Page 7 of 27

Figure 19: EPS CAGR for 2013-15F

Figure 20: P/E vs. EPS CAGR for 2013-15F

120%

4.5

104.7%

Amazon

4.0

100%

3.5

80%

3.0

2.5

Tencent

60%

2.0

40%

1.5

33.1%

25.3%

19.60%

20.1%

20%

12.7%

15.5%

eBay

1.0

13.4%

Facebook

Baidu

Google

NetEase

Qihoo

0.5

0.0

0%

0%

Qihoo

Tencent

Baidu

NetEase

Google

Facebook

eBay

20%

40%

60%

80%

100%

120%

Amazon

Source: Bloomberg, Yuanta Research

Source: Bloomberg, Yuanta Research

Figure 21: Peer valuation comparison table

P/E

Name

Qihoo

Ticker

QIHU US

Rating

Share price

ROE

Mkt Cap (mn)

PEG

2013F

2014F

2013F

2014F

BUY

79.9

10,176

54.9x

36.4x

0.7

24%

30%

700 HK

HOLD-OPF

474.6

882,557

40.8x

35.7x

2.1

33%

28%

Baidu

BIDU US

HOLD-UPF

173.2

59,038

33.2x

25.6x

1.7

35%

30%

Sina

SINA US

Not rated

78.5

5,232

82.3x

38.2x

2.3

4%

9%

NetEase

NTES US

Not rated

69.8

9,116

12.3x

11.0x

0.9

25%

23%

Youku

YOKU US

Not rated

29.6

4,912

-66.9x

149.6x

N.A.

-5%

3%

GOOG US

Not rated

1,077.3

359,909

24.5x

20.6x

1.4

18%

18%

FB US

Not rated

49.4

123,048

59.6x

44.2x

2.0

14%

14%

eBay

EBAY US

Not rated

51.4

66,503

19.3x

16.6x

1.3

15%

15%

Amazon

AMZN US

Not rated

382.2

174,941

155.4x

82.9x

4.2

8%

8%

China's internet peers

Tencent

Global peers

Google

Facebook

Source: Company data, Bloomberg, Yuanta Research

Note: Figure s are denominated in local currency, latest update on December 12, 2013; Qihoo, Baidu and Tencent’s figures are

from our estimates, while other companies’ data are from Bloomberg consensus.

Yuanta

China: Internet Software & Services

Qihoo (QIHU US)

13 Dec, 2013

Initiation

Page 8 of 27

Earnings outlook

Qihoo’s monetization of its traffic is still at an early stage, especially for its search

engine and mobile games. We expect its leading position in PC/mobile antivirus

products will continue, and its search engine market share will grow from 1.6% in

3Q13 to 5.2% in 2015. In terms of app distribution platform, competition with Baidu

will intensify, but we believe Qihoo will maintain its leading edge in the coming

years. However, Tencent’s Weixin will compete in mobile games, and we see Weixin

as more competitive than Qihoo’s 360 Mobile Assistant. Overall, we estimate

revenue of US$664/1,053/1,423 mn in 2013-15F, implying a CAGR of 62.9%, while

we expect net profit of US$174/262/401 mn, implying a CAGR of 104.7%.

Figure 22: Qihoo’s revenue breakdown

Online advertising

1,600,000

IVAS

Others

Figure 23: EPS assumptions

EPS (L)

YoY (R)

250%

US$ k

2.5

YoY (R)

300%

US$

2.3

200%

1,200,000

250%

2.0

1.8

150%

200%

1.5

1.3

800,000

100%

150%

1.0

100%

0.8

400,000

50%

0.5

50%

0.3

0

0%

2011

2012

2013F

2014F

2015F

Source: Company Data, Yuanta Research estimate

Yuanta

China: Internet Software & Services

0.0

0%

2011

2012

2013F

2014F

2015F

Source: Company Data, Yuanta Research estimate

Qihoo (QIHU US)

13 Dec, 2013

Initiation

Page 9 of 27

Revenue breakdown

Rapidly growing internet user base

China’s search market will benefit from a growing internet user base, while

increasing user sophistication and internet content volume should also boost

search demand. According to the CNNIC, total China internet users have grown at a

CAGR of 21.8% over the past five years to 564 mn at the end of 2012. Nevertheless,

the Chinese internet penetration rate of 42.1% at the end of 2012 was still much

lower than the 70% and above in many developed economies.

Figure 24: China’s Internet population and penetration

Internet user(L)

mn

140%

Internet penetration(R)

800

700

60%

120%

50%

100%

600

40%

500

Figure 25: Global Internet penetration rate (2012)

126%

115%

86%

82%

80%

78%

78%

75%

60%

400

30%

38%

40%

300

20%

20%

200

10%

100

0

0%

HongKong South

Korea

2015F

2014F

2013F

2012

2011

2010

2009

2008

2007

2006

2005

0%

Source: CNNIC, Yuanta Research estimates

France

UK

Japan

US

Germany

China

Source: International Telecommunications Union

We see room for further growth in the internet user base in China in the coming

years, driven by rising PC penetration and continued upgrades in broadband

infrastructure. Based on our estimates, internet users will likely grow at a CAGR of

6.6% to 684 mn by the end of 2015 with an internet penetration rate of 49.6%,

which is at the lower end of internet penetration rates for developed economies.

Search engine business

Search user base and search advertising customers will continue to grow

Driven by rising internet users and more internet content, the search user base has

been growing in tandem with China’s internet market. Search remains the second

most popular internet application among all Chinese internet users. The number of

search users increased from 407 mn in 2011 to 470 mn in 1H13, and we expect

this number to rise further to 659.5 mn by the end of 2015. More SMEs will

increase budgets for online advertising, especially for search advertising. According

to CNNIC, 23% of SMEs would have liked to place internet adverts in 2012, while

53.2% prefer search advertising.

Yuanta

China: Internet Software & Services

Qihoo (QIHU US)

13 Dec, 2013

Initiation

Page 10 of 27

Figure 26: China’s internet users and search users

800

mn

Search users (L)

60%

YoY (R)

700

50%

600

40%

500

400

30%

300

20%

200

10%

100

0

0%

2004

2006

2008

2010

2012

2014F

2016F

Source: CNNIC, Yuanta Research estimates

Figure 27: SMEs favor internet adverts most (2012)

Figure 28: SMEs prefer search & IM advertising (2012)

0.5%

Others

3.4%

Others

Handset

Radio

4.1%

4.1%

Online v ideo

16.3%

Forum/BBS

16.4%

Internet ads Union

16.4%

SNS

8.3%

Magazine

10.8%

Outdoor

17.9%

20.2%

Weibo

23.0%

Internet

Display

44.3%

Email

44.5%

50.0%

E-commerce

11.5%

New s paper

51.6%

IM

6.4%

TV

0%

5%

53.2%

Search

10%

15%

20%

25%

Source: CNNIC

0%

10%

20%

30%

40%

50%

60%

Source: CNNIC

Search usage still relatively low

While the search user base is growing rapidly, search usage in China is still

relatively low. According to comScore, China’s monthly average searches per user

was only 66.8 in 2011, much lower than in developed countries and also lower than

some developing countries such as Vietnam and Indonesia. We expect search

demand will continue to grow along with increases in internet content and rising

numbers of internet users going forward.

Yuanta

China: Internet Software & Services

Qihoo (QIHU US)

13 Dec, 2013

Initiation

Page 11 of 27

Figure 29: Monthly average searches per user by area

Figure 30: Monthly average searches per user by

(2011)

country (2011)

160

160

144.7

140

113.4

109.5

120

96.9

89

100

136.9

140

126.2

126.2

125.6 122.7

120

100

80

91.4

85.8

79.2

80

72.1

66.8

60

60

40

40

20

20

0

Worldw ide

Asia

Pacific

Europe

North

America

Latin

America

MidEastAfrica

Source: comScore, Yuanta Research

0

China

Japan

India

Korea

Taiwan Vietnam Indonesia

HK

Singapore

Source: comScore, Yuanta Research

Online marketing will be more popular going forward, due to rising internet users

and marketing demand from SMEs. Since search advertising has higher ROI and

lower fund entry barriers, we expect paid advertising as a proportion of total

internet advertising will increase from 49.8% in 2012 to 56.7% in 2015F. We

estimate paid search revenue will be RMB38.8/50.7/63.4 bn, implying a CAGR of

31.2% over 2012-15F.

Figure 31: China’s online advertising proportion is on

Figure 32: China’s online advertising revenues

the rise

RMB bn

500

450

Online adverts (L)

China adverts (L)

As % of China adverts market (R)

400

350

300

250

Internet adverts market size (L)

YoY (R)

40%

RMB bn

200

90%

35%

180

80%

30%

160

70%

25%

140

20%

60%

120

50%

100

200

15%

150

40%

80

30%

10%

60

50

5%

40

20%

0

0%

20

10%

100

2007

2009

2011

2013F

2015F

0

0%

2006

Source: iResearch, Yuanta Research estimates

Yuanta

China: Internet Software & Services

2008

2010

2012

2014F

Source: iResearch, Yuanta Research estimate

Qihoo (QIHU US)

13 Dec, 2013

Initiation

Page 12 of 27

Figure 33: China’s online advertising breakdown

Others

Paid search revenue (L)

RMB bn

70

100%

73.4%

38.8

38.4%

40

50%

30%

30.6%

11.0

25.0%

20%

10%

0%

0

2010

29.5% 29.7% 33.1%

56.5% 56.7%

49.8% 55.0%

7.0

2009

10%

40.9%

5.0

2008

30%

38.3%

18.9

20

10

40%

28.1

30

40%

50%

0%

2015F

50.5%

60%

48.5%

2014F

60% 61.4% 61.1% 58.7%

20%

50.7

2011

70%

43.0% 36.1% 35.0% 35.3%

80%

70%

58.6%

50

80%

63.4

71.1%

60

90%

YoY (R)

2013F

Display

2012

Paid search

Figure 34: China’s paid search revenue forecast

2008 2009 2010 2011 2012 2013F 2014F 2015F

Source: iResearch, Yuanta Research estimate

Source: iResearch, Yuanta Research estimate

Search engine market share to continue to rise

Qihoo entered the search engine market in August 2012, and accounted for 21.7%

of total China search traffic in November 2013, supported by its popular

browser/navigation site and desktop search box. Baidu (BIDU US; HOLD-UPF)

continues to have advantages over Qihoo, with better technology, a keyword system,

its Baidu Union platform, and greater sales capability. We believe Qihoo will need

around two more years to perfect its search engine, but expect it to take some

market share from Baidu in the years to come.

Qihoo accounted for 1.6% of total paid search revenue in China in 3Q13, with only

Baidu will remain the leader in

the Chinese search market, but

Qihoo may gain market share

12-13% of advertisers willing to place adverts on its searches, according to Adsage.

Similar to the situation in the US, where Google remains the search engine leader

despite Bing taking some market share, we expect Baidu will remain the leader in

the Chinese search market, but Qihoo may gain market share.

Figure 35: Search engine industry chain

Typing URL

Brand

Paid links

Paid links

Favorites

Paid links

Searcher

Browser

Organic results

Organic results

Advertiser

Organic results

Organic results

Navigation Site

Organic results

Channel

App/software/

Desktop

search/toolbar

Source: iResearch, Yuanta Research

Yuanta

China: Internet Software & Services

Qihoo (QIHU US)

13 Dec, 2013

Initiation

Page 13 of 27

Figure 36: PC search traffic in China

Baidu

90%

Qihoo

Figure 37: Search revenue market share

Sogou & Soso

Qihoo

others

Sogou & Soso

Google

Baidu

100%

80%

90%

70%

63.6%

80%

60%

70%

50%

60%

40%

80.6%

81.4%

81.4%

4.7%

0.3%

4.6%

0.8%

4.5%

1.6%

1Q13

2Q13

3Q13

50%

21.8%

30%

40%

20%

30%

10%

20%

0%

10%

Aug-12

Nov-12

Feb-13

May-13

Aug-13

Nov-13

Source: CNZZ, Yuanta Research

0%

Source: iResearch, Yuanta Research

We believe Qihoo’s keyword system, sales network and technology will mature

going forward, and as such expect its search traffic will increase, rising to 30% of

China’s total traffic by 2015F. Given an increased search traffic market share, the

company is likely to attract more online advertisers, and as a result its click through

rate (CTR) and cost per click (CPC) should increase. We estimate search engine

revenue of US$88.3/279.7/536.9 mn in 2013/14/15F.

Figure 38: Search engine business forecast

1Q13

2Q13

3Q13

4Q13F

1Q14F

2Q14F

3Q14F

4Q14F

2013F

2014F

2015F

Search users from PC (mn)

451

470

489

508

527

546

565

584

508

565

659

average monthly search times per user from PC

68.0

68.5

69.0

69.5

70.0

70.6

71.1

71.6

69.5

71.6

72.0

Qihoo's market share (%)

13.5%

15.3%

18.2%

23.0%

24.5%

26.0%

27.0%

28.0%

23.0%

28.0%

30.0%

Qihoo's queries (mn)

10,758

13,609

16,609

21,418

25,822

28,668

31,378

33,918

62,393

119,785

155,822

0.5

0.9

1.1

1.2

1.2

1.2

1.3

1.3

0.9

1.2

1.5

1.00%

1.00%

1.05%

1.05%

1.07%

1.09%

1.11%

1.14%

1.03%

1.10%

1.19%

Paid clicks (mn)

50.0

125.2

192.5

260.7

330.2

385.1

442.9

502.9

628

1,661

2,762.3

Cost per click (US$)

0.10

0.12

0.14

0.16

0.16

0.16

0.17

0.18

0.14

0.17

0.19

Revenue from PC search traffic (US$ k)

5,000

15,000

27,724

40,542

52,893

63,544

75,263

88,035

88,266

279,735

536,899

958%

324%

172%

117%

217%

92%

Average advertisements per query

Click through rate

YoY

Source: Company Data, Yuanta Research estimate

Website navigation business

Qihoo launched its website navigation page at the end of 2009 in order to leverage

its significant traffic and user base. The service surpassed Baidu’s Hao123, the

leader in China’s website navigation segment for ten years, to become the largest

website navigation operator in China from 2011, thanks for its popular browsers

(25.3% market share as of October 2013) and better user experience.

The company provides key outside internet traffic for a lot of major internet players,

such as Taobao, Youku, and Sina. The business model for website navigation is to

charge advertisers a monthly fee to provide paid links for clients, and also guide

users to clients.

Yuanta

China: Internet Software & Services

Qihoo (QIHU US)

13 Dec, 2013

Initiation

Page 14 of 27

Figure 39: Browser market share (October 2013)

Figure 40: Mkt share for website navigation in China

Others

2%

2345

12%

Chrome

5%

Others

11%

Qihoo

38%

Safari

7%

Sogou

Browser

6%

Microsoft

IE

46%

Sogou

17%

360

Browser

25%

Hao123

31%

Source: CNZZ, Yuanta Research

Source: CNNIC(Nov. 2013), Yuanta Research

The website navigation market is already mature, with the competitive landscape

likely to remain stable in the years to come. We expect Qihoo’s website navigation

business will continue to grow, and estimate website navigation revenue of

US$329.8/408.7/415.9 mn in 2013/14/15F, a CAGR of 23.4%.

Figure 41: Website navigation business forecast

1Q13 2Q13 3Q13 4Q13F 1Q14F 2Q14F 3Q14F 4Q14F

Average daily clicks on the 360 Personal-Start-up Page (mn)

Days of this quarter

Total clicks of this quarter (mn)

489

590

681

744

778

796

806

810

90

91

92

92

90

91

92

92

44,010 53,690 62,652 68,450 70,060 72,478 74,122 74,550

ASP per k click

1.33

1.41

1.48

1.50

1.30

1.38

1.45

1.47

Website navigation(US$ k)

58,400 75,600 92,976 102,868 91,109 100,014 107,797 109,796

YoY

28.6% 48.8% 59.2% 53.8% 56.0% 32.3%

15.9%

6.7%

2013F

2014F

2015F

626

798

816

365

365

365

228,802 291,210 298,005

1.44

1.40

1.40

329,845 408,715 415,902

48.9%

23.9%

1.8%

Source: Company Data, Yuanta Research estimates

Gaming business

Qihoo charges users for web and mobile games. We believe the webgame business

Qihoo was the number two

webgame operator in China in

3Q13

has already entered a mature stage, and estimate the market size CAGR will fall to

23% in 2012-15F, down from 63% in 2009-12. Some webgame developers

transformed into mobile game developers in 2013, such as IGG (8002 HK; NR),

Kingsoft (3888 HK; NR). The webgame business model is positive for operators, as

they can retain around 70% of game revenue.

Qihoo was the number two webgame operator in China in 3Q13 with 12% market

share. We believe it will maintain its advantages as competitors enter the mobile

game segment.

Yuanta

China: Internet Software & Services

Qihoo (QIHU US)

13 Dec, 2013

Initiation

Page 15 of 27

Figure 42: Webgame market size

Webgame market size (L)

16

Figure 43: Webgame operation and payment model

YoY (R)

Webgame developers

Around 30% webgame revenue

35%

RMB bn

14

30%

12

25%

10

Revenue sharing

Game content & update

20%

8

Webgame operators

Around 70% webgame revenue

15%

6

10%

4

2

5%

0

0%

Game content & update

Payment

Other player services

2012

2013F

2014F

2015F

Webgame players

Source: iResearch, Yuanta Research

Source: Yuanta Research

Figure 44: Webgame market share in 3Q13

Yaowan Xunlei

4%

7K7K4%

4%

91Wan

5%

Tencent

38%

Baidu

5%

YY

5%

4399

11%

Qihoo

12%

37Wan

12%

Source: Source: iResearch

Figure 45: Top 10 web games in China by daily search

Ranking

Game

Operator

No. of Searches (k)

1

Pindldea

Qihoo/4399 Game/37Wan/51Game/91

88

2

Arcade in Three Kingdoms

Qihoo/4399 Game/Baidu/7K7K/37WAN

/91Wan/51Game

85

3

Tribal Guards Battle

Tencent

80

4

DDtank

Qihoo/4399 Game/Baidu/7K7K/51Game

66

5

Killers of the Three Kingdoms

4399Game/Baidu/Shanda

52

6

Genesis Soul

4399 Game/7K7K

40

7

Blood King Someday

Qihoo/4399 Game/7K7K/91Wan/37Wan

40

8

Qiang Hun

Qihoo/4399 Game/7K7K/91Wan/37Wan

34

9

Ao Jiang

7711/Juu/Zhengwu

33

10

Qi Xiong Zheng Ba

Tencent

32

Source: Baidu Index of Dec 9 2013, Yuanta Research

Yuanta

China: Internet Software & Services

Qihoo (QIHU US)

13 Dec, 2013

Initiation

Page 16 of 27

Mobile game segment to continue to see fast growth

The mobile game market has grown significantly in China since 2013, with an

increasing number of users accessing the internet via mobile devices, such as

We expect time spent on

mobile apps to exceed time

spent on websites on PC by

2Q14F

smartphones and tablets. According to iResearch, a research firm focused on the

internet market, time spent on mobile apps has increased at a fast pace, with

internet users spending 35.3% of their time online using mobile apps as of March

2013. We expect time spent on mobile apps to exceed time spent on websites on

PC by 2Q14F.

Figure 46: China‘s smartphone population to be 500

Figure 47: China’s mobile internet penetration to

mn in 2013F

increase to 40.7% in 2013

mn

800

700

Smartphone population(L)

YoY (R)

710

640

150%

140%

570

600

500

500

400

360

300

80%

160%

120%

500

100%

400

80%

200

40%

80

14%

12%

11%

0

20%

0%

2010

2,011

2012F

2013F

mn

Mobile Internet User(L)

Penetration(R)

37.8%

45%

40.7%

40%

420.0

35%

30%

25%

300

20%

60%

39%

200

100

600

2014F

2015F

2016F

15%

200

10%

100

5%

0

0%

2H06

2H07

2H08

2H09

2H10

2H11

2H12 2H13F

Source: iResearch, Yuanta Research

Source: CNNIC, Yuanta Research estimate

Figure 48: Increasing numbers of people access the

Figure 49: Time spent on mobile applications vs. PC

internet by handset

websites

600

Desktop

Notebook

Handset

Mobile APP

500

100%

400

90%

80%

300

55.7%

70%

64.7% 59.7%

72.7%

60% 78.7%

200

50%

40%

100

30%

20%

0

2H09

1H10

2H10

1H11

2H11

1H12

2H12 1H13F 2H13F

Source: CNNIC, Yuanta Research

35.3% 40.3%

27.3%

10% 21.3%

0%

3Q12

1Q13

PC w ebsite

52.7% 50.2% 47.7%

44.3% 47.3% 49.8%

3Q13F

1Q14F

45.7% 43.7%

52.3% 54.3% 56.3%

3Q14F

Source: iResearch, Yuanta Research

Since more and more users will access internet via mobile devices, we expect

mobile game market size will exceed the client-based game market eventually. Key

trends which benefit the development of mobile games include: 1) the 1.22 bn

mobile users in China as of October 2013, vs only 591 mn internet users in 1H13,

according to CNNIC and MIIT; 2) only 27% of PC game users are female, but there

are 33.8% female mobile users, while 18.8% of female game users would pay for

games, vs. 17.5% of male game users, according to iiMedia; 3) young people prefer

to play online games on their PC, while older people prefer to play mobile games,

but older people have higher payment ability.

Yuanta

China: Internet Software & Services

Qihoo (QIHU US)

13 Dec, 2013

Initiation

Page 17 of 27

Figure 50: PC-end gamers by gender

Figure 51: Mobile gamers by gender

Female, 27%

Female,

33.80%

Male, 66.20%

Male, 73%

Source: Analysys international, Yuanta Research

Source: iiMedia, Yuanta Research

Figure 52: PC-end gamers by age

Figure 53: Mobile gamers by age

>36, 2.0%

>40, 11.5%

31-35, 13.2%

<15, 14.1%

<18, 37.0%

36-40, 7.0%

31-35, 8.6%

16-20, 20.0%

26-30, 18.3%

25-30, 11.5%

21-25, 32.4%

18-24, 24.4%

Source: iResearch, Yuanta Research

Source: iiMedia, Yuanta Research

Based on our channel checks, there are more than 1000 mobile game developers in

China and more than 8000 mobile games will have been launched by the end of

2013, with more developers and mobile games to be added in 2014. According to

iResearch, China’s mobile game market size will be RMB20.3bn by 2015, implying a

2012-15F CAGR of 37.0%.

Figure 54: Mobile game market size

23

RMB bn

Feature phone

Figure 55: Online game market breakdown

Smartphone

Client-based games

90%

19

CAGR: 37.0%

Social games

12%

14%

16%

18%

2012

2013F

2014F

2015F

70%

15

12.4

13

60%

50%

8.2

11

40%

4.7

9

5

Mobile games

80%

17

7

Webgames

100%

21

1.9

30%

6

6.8

7.6

2012

2013F

2014F

7.9

20%

10%

2015F

Source: iResearch, Yuanta Research

Source: iResearch, Yuanta Research

Yuanta

China: Internet Software & Services

0%

Qihoo (QIHU US)

13 Dec, 2013

Initiation

Page 18 of 27

Similar to client-based and webgames, mobile game developers need to cooperate

with publishers/operators with channels to access mobile users. There are three

major channels, pre-installation, app distribution platforms and Weixin; the latter

two are popular mobile game channels. Tencent (700 HK; HOLD-OPF) selects

mobile games to operate in its Weixin and mobile QQ channels, while most mobile

game developers are willing to cooperate with app distribution platforms.

Qihoo has the largest China android app distribution platform, with android devices

accounting for 65.98% of China’s total smartphones in 3Q13. According to

iResearch, Qihoo accounted for 25% of time spent on mobile app distribution

platforms in September 2013.

Figure 56: Competition landscape of app distribution platform

Jan-13

Feb-13

Mar-13

Apr-13

May-13

Jun-13

Jul-13

Aug-13

Sep-13

Qihoo

38.4

39.1

42.7

44.2

46.4

46.7

47.7

48.2

52.8

Baidu

37.5

36.5

39.9

37.4

39.4

41.7

44.0

45.3

41.9

Wandoujia

27.2

28.8

29.2

26.7

29.3

27.1

29.4

29.2

31.1

MIUI

10.0

10.1

11.5

10.3

10.6

10.7

11.8

13.7

13.8

Qihoo

13.9

11.7

16.5

12.1

12.7

12.0

14.0

12.4

12.6

Baidu

8.8

8.8

8.4

8.8

8.5

8.7

10.2

12.0

10.4

Wandoujia

3.7

4.1

4.9

4.9

5.3

4.4

4.3

6.5

8.5

MIUI

1.2

1.0

1.2

1.4

1.4

1.1

2.0

1.5

1.7

Total

38.9

40.8

46.5

46.6

46.4

44.6

47.8

50.1

50.5

Qihoo

35.7%

28.7%

35.5%

26.0%

27.4%

26.9%

29.3%

24.8%

25.0%

Baidu

22.6%

21.6%

18.1%

18.9%

18.3%

19.5%

21.3%

24.0%

20.6%

Wandoujia

9.5%

10.0%

10.5%

10.5%

11.4%

9.9%

9.0%

13.0%

16.8%

MIUI

3.1%

2.5%

2.6%

3.0%

3.0%

2.5%

4.2%

3.0%

3.4%

Mobile app distribution platform monthly unique visitors (mn)

Mobile app distribution platform monthly time spent (mn hours)

Mobile app distribution platform monthly time spent market share

Source: iResearch, Yuanta Research

Since there is a debate whether Qihoo or Baidu is the largest mobile game operator

via app distribution platform, we have checked four popular games launched on

both Qihoo and Baidu’s platform. We found that Qihoo contributed more than 30%

of revenue of the four mobile games total revenue, while Baidu contributes around

20%, which leads us to believe Qihoo still has some advantage over Baidu on mobile

game distribution.

Yuanta

China: Internet Software & Services

Qihoo (QIHU US)

13 Dec, 2013

Initiation

Page 19 of 27

Figure 57: Revenue source of “I am MT”

Others,

30%

Figure 58: Revenue source of “The legend of King”

Qihoo,

30%

Others,

33%

Xiaomi,

10%

UCweb,

8%

Qihoo,

36%

Xiaomi,

7% UCweb,

Baidu,

22%

Baidu,

18%

6%

Source: Game to look (up to June)

Source: Game to look (up to June)

Figure 59: Revenue source of “Fishing Joy”

Figure 60: Revenue source of ”Plants & Zombies”

Qihoo,

30%

Qihoo,

30%

Others,

40%

,

,

UCw eb,

6%

,

Others,

70%

Baidu,

19%

Wandoujia

, 5%

Source: Game to look (up to June)

Source: Game to look (up to Sept)

Qihoo operated more than 500 games (including webgames and mobile games) in

3Q13, increasing by 230 games QoQ, of which we estimate most were mobile

games. The company acquired 590 k paying users in 3Q13, and we expect it to

have 1.07 mn paying users by the end of 2015. We estimate Qihoo’s game business

revenue will be US$197.4/292.3/382.8mn in 2013-15F, and estimate a CAGR of

65.7% for 2012-15F.

Figure 61: Qihoo’s game business forecasts

Paying users of Qihoo's game platform (k)

1Q13

2Q13

3Q13

4Q13F

1Q14F

281

440

560

590

670

2Q14F 3Q14F 4Q14F

2013F

2014F

2015F

710

780

870

590

870

1,066

YoY

102.2% 197.3% 207.7% 147.9% 138.4%

61.4%

39.3%

47.5%

147.9%

47.5%

22.5%

QoQ

18.1%

56.6%

27.3%

5.4%

13.6%

6.0%

9.9%

11.5%

ARPU (US$)

131.0

110.7

96.8

97.8

98.7

93.8

95.7

97.6

477

400

395

YoY

5.2%

-14.2%

-14.1%

-14.5%

-24.6%

-15.3%

-1.2%

-0.2%

-1.6%

-16.0%

-1.2%

QoQ

14.6%

-15.5%

-12.6%

1.0%

1.0%

-5.0%

2.0%

2.0%

Revenue (US$ k)

36,800

48,700

54,200

57,675

66,150

66,594 74,623 84,898

197,375 292,265 382,791

YoY

112.7% 155.0% 164.4% 112.0%

79.8%

36.7%

37.7%

47.2%

134.7%

QoQ

35.3%

14.7%

0.7%

12.1%

13.8%

32.3%

11.3%

6.4%

48.1%

31.0%

Source: Company Data, Yuanta Research estimate note: mobile game ARPU began to decline in 2Q13 because Qihoo just started to

calculate mobile paying users in 2Q13

Yuanta

China: Internet Software & Services

Qihoo (QIHU US)

13 Dec, 2013

Initiation

Page 20 of 27

Company structure

Qihoo was founded in June 2005, and the listed company was incorporated in the

Cayman Islands and operates its onshore entities via wholly-owned subsidiaries

and affiliated entities. The company is based in Beijing, China.

Figure 62: Corporate structure

Qihoo 360 Technology

(Cayman Islands)

100%

100%

100%

360 International

Development Co.

(Hong Kong)

Qihu 360 Software

Co. Limited

(Hong Kong)

100%

Qiji International

Development

(Hong Kong)

100%

Qifei International

Development

(Hong Kong)

100%

Qizhi Software

(Beijing) Co.Ltd

100%

Tianjin Qisi Technology

Co. Ltd.

30%

Qifei Xiangyi

(Beijing) Co.Ltd

70%

Beijing Qichuang Yousheng

Keji Co. Ltd

Beijing Star World

Technology Co.

Ltd. (PRC)

Beijing Qihu Technology

Co. Ltd. (PRC)

Eleven Other VIEs (PRC)

Source: Yuanta Research

Qihoo’s mgmt has around a 39.3% stake in the company, as it offers employees

stock. Venture capitalists hold a 37.1% stake. Some profit taking by venture

capitalists may be the reason that Qihoo’s share price has fluctuated recently.

We believe core management is stable. Hongyi Zhou, Xiangdong Qi and Shu Cao,

have cooperated for many years which should help strengthen Qihoo’s execution.

Figure 63: Qihoo’s shareholding structure

Others

23.6%

Hongyi Zhou

17.7%

Xiangdong Qi

9.5%

Trustbridge

Partners

5.4%

Shu Cao

4.9%

Sequoia Capital

China

5.4%

Neil Nanpeng

Shen

5.4%

Young Vision

Group

8.6%

Global Village

17.7%

Other

management

1.8%

Source: Company data, Yuanta

Yuanta

China: Internet Software & Services

Qihoo (QIHU US)

13 Dec, 2013

Initiation

Page 21 of 27

Figure 64: Executive Directors a brief introduction

Name

Hongyi Zhou

Age

43

Xiangdong Qi 49

Position

Brief-introduction

CEO

Mr. Zhou is a co-founder of Qihoo 360 and has served as chairman and CEO since 2006. Mr. Zhou has over ten years of

managerial and operational experience and China's Internet industry. Prior to founding Qihoo 360, Mr. Zhou was a partner at

IDG Ventures Capital from September of 2005. Mr. Zhou was CEO of Yahoo! China from January 2004 to August 2005. In 1998,

Mr. Zhou founded www.3721.com, a company engaged in internet search and online marketing business in China, and served

as chairman and CEO until www.3721.com was acquired by Yahoo! China in January 2004.

President

Mr. Qi is a co-founder of Qihoo 360 and has served as director and president since inception. prior to founding Qihoo 360, Mr. Qi

served as vice president of Yahoo! China from January 2004 to August 2005, where he was responsible for Yahoo! China's

operations and marketing. From August 2003 to January 2004, Mr. Qi was the general manager of www.3721.com, responsible

for its overall operations and strategic planning. Mr. Qi worked at Xinhua News Agency from 1986 to March 2004.

Shu Cao

Mr. Cao has been the director of Qihoo 360 since 2006 and served as chief engineer since October 2005. Prior to joining Qihoo

360, Mr. Cao served as the chief engineer of Yahoo! China from November 2003 to September 2005 and was responsible for

38 Chief Engineer system operation and maintenance. Mr. Cao has extensive experiences in software engineering, information and technology

infrastructure and system operation. Mr. Cao was the co-founder of www.3721.com and served as its head of operations from

January 1999 to August 2003.

Jue Yao

40

Alex Zuoli Xu

Xiaosong Shi

45

43

Co-CFO

Ms. Jue Yao has been Qihoo 360's co-CFO since 2012 and VP of finance since 2008. Ms. Yao served as financial director from

2006 to 2008. Prior to joining Qihoo in 2006, Ms. Yao held various positions at Sohu.com from 1999 to 2006, including financial

director, where she was responsible for its strategic planning, budgeting and finance of wireless value-added and gaming

business units. From 1996 to 1999, Ms. Yao was a senior auditor at KPMG.

Co-CFO

Mr. Xu has been CFO since February 2011. Mr. Xu has extensive experience in investment research and business

management. Prior to joining Qihoo, Mr. Xu was a managing director at Cowen & Company, LLC, and investment banking

service provider, from August 2010 to February 2011. From March 2010 to August 2010, he served as the CFO of Yeecare

Holdings, a private health care product distributor in China, and from May 2008 to march 201, as the chief strategy office of

China Finance Online Co, Ltd., a Chinese Nasdaq-listed online financial information/service company. Prior to that, Mr. Xu was a

senior VP at Brean Murray, Carret & Co, a research-driven investment and merchant bank. He was part of a top-ranked

research team at Bank of American Securities, LLC from 2003 to 2007, and was an equity research associate at BUS from 2002

to 2003.

VP

Mr. Shi has been our vice president of Technology since 2006. From January 2004 to August 2005, Mr. Shi was the chief

technology officer of Yahoo! China, where he was responsible for technology research and development. From 1999 to 2003,

Mr. Shi was the chief technology officers of www.3721.com, a company engaged in Internet search and online marketing

business in China. From November 1998 to August 1999, Mr. Shi was a project manager at Founder Group, a leading Chinese

information technology company. Mr. Shi received his Ph.D. and Master's degrees in computer science from Xi'an Jiaotong

University in 1998 and 1995, respectively.

Source: Company Data, Yuanta Research

Yuanta

China: Internet Software & Services

Qihoo (QIHU US)

13 Dec, 2013

Initiation

Page 22 of 27

Risks to our recommendation

► Changes in the PC and mobile internet industries happen very fast, there is the

possibility that Qihoo may miss the next big trend.

► Large internet names are eager to form alliances to compete in the mobile

internet era. Qihoo has some strong competitors, and it will be hard for it to

become a first-tier internet player (such as Baidu, Tencent and Alibaba) without

strong partners.

► Qihoo has been affected by lawsuits with other internet players, such as Tencent

and Baidu. There is the possibility Qihoo could lose one of these lawsuits, which

may slow the monetization of its search engine and mobile games.

Yuanta

China: Internet Software & Services

Qihoo (QIHU US)

13 Dec, 2013

Initiation

Page 23 of 27

Balance Sheet

Year as of Dec

(US$ mn)

Cash & ST investment

Profit and Loss

2011

2012

2013F

2014F

Year to Dec

(US$ mn)

2015F

344

383

1,198

1,539

2,021

0

0

0

0

0

17

24

48

76

102

Inventories

Accounts receivable

Others

Sales

Cost of goods sold

Gross profit

2011

2012

2013F

2014F

2015F

168

329

664

1,054

(19)

(33)

(84)

(124)

1,423

(161)

149

296

580

930

1,262

14

29

56

88

118

(18)

(66)

(94)

(128)

(230)

374

435

1,302

1,702

2,241

Operating profit

131

233

487

802

1,033

LT investments

16

101

101

101

101

Interest income

3

7

5

4

4

Net fixed assets

17

126

132

148

174

Interest expense

0

0

0

0

0

Others

4

Current assets

17

27

43

60

76

Other assets

50

254

276

309

351

Total assets

424

690

1,577

2,012

2,592

Accounts payable

6

7

11

18

23

ST borrowings

0

0

0

0

0

Others

Operating expenses

Net interest

Net Invst.Inc/(loss)

Net oth non-op.Inc/(loss)

Pretax income

40

197

224

370

508

Income taxes

47

204

236

388

531

Net profit

Long-term debts

0

0

600

600

600

Others

6

8

14

22

30

6

8

614

622

630

Total liabilities

52

211

850

1,011

1,161

Paid-in capital

179

180

182

182

182

Capital surplus

186

274

348

360

390

Retained earnings

6

24

198

460

861

Capital adjustment

0

0

0

0

0

371

478

728

1,002

1,433

Shareholders' equity

7

5

4

(2)

(1)

0

0

(107)

(174)

(291)

(478)

(534)

Net extraordinaries

Current liabilities

Long-term liabilities

3

(1)

0

(5)

0

0

0

25

58

200

327

502

(11)

(11)

(27)

(66)

(101)

16

47

174

262

401

1,080

EBITDA

136

249

515

839

EPS (US$)

0.13

0.40

1.45

2.20

3.36

EPS (US$) Bonus Adj.

0.13

0.40

1.45

2.20

3.36

Source: Company data, Yuanta

Key Ratios

Source: Company data, Yuanta

Year to Dec

2011

2012

2013F

2014F

2015F

Growth (% YoY)

Cash Flow

Year to Dec

(US$ mn)

Net profit

Depr & amortization

Change in working cap.

Others

Operating cash flow

Capex

Change in LT inv.

Change in other assets

Investment cash flow

Change in share capital

Net change in debt

Other adjustments

2011

2012

2013F

2014F

Sales

191.1

96.0

101.9

58.7

Op profit

211.9

77.1

109.0

64.7

28.8

EBITDA

212.0

83.9

106.4

62.9

28.8

Net profit

2015F

EPS

35.0

83.4

199.6

271.9

50.7

53.1

(63.7)

197.9

267.2

50.9

53.1

16

47

174

262

401

4

17

28

37

47

Profitability (%)

15

135

(19)

93

86

Gross margin

88.7

90.0

87.4

88.2

88.7

Operating margin

78.3

70.8

73.3

76.1

72.6

EBITDA margin

80.8

75.8

77.5

79.6

75.9

Net profit margin

9.3

14.2

26.2

24.9

28.2

47

(81)

74

(6)

12

82

118

257

386

546

(18)

(69)

(28)

(48)

(66)

(1)

1

0

0

0

ROA

5.7

8.3

15.3

14.5

17.4

(16)

(15)

(12)

(12)

(13)

ROE

8.3

11.0

28.8

30.3

33.0

(35)

(84)

(40)

(60)

(79)

Stability

233

0

0

0

0

0

2

600

15

15

Gross debt/equity (%)

0.1

0.0

82.5

59.9

41.9

Net cash (debt)/equity (%)

92.4

80.0

82.2

93.7

99.2

0

0

0

0

0

Int. coverage (X)

N.A.

N.A.

N.A.

N.A.

N.A.

Financing cash flow

233

2

600

15

15

Int. & ST debt cover (X)

55.3

N.A.

N.A.

N.A.

N.A.

Net cash flow

281

36

817

341

482

Cash flow int. cover (X)

N.A.

N.A.

N.A.

N.A.

N.A.

467

Cash flow/int. & ST debt (X)

178.9

N.A.

N.A.

N.A.

N.A.

Free cash flow

47

34

217

326

Source: Company data, Yuanta

Current ratio (X)

8.0

2.1

5.5

4.4

4.2

Quick ratio (X)

8.0

2.1

5.5

4.4

4.2

(343.5)

(382.7)

(598.0)

(938.5)

(1,420.8)

3.16

4.05

6.10

8.40

12.01

P/E

600.9

201.7

54.9

36.4

23.8

P/FCF

197.4

278.5

44.0

29.3

20.4

P/B

25.3

19.7

13.1

9.5

6.7

P/EBITDA

69.1

37.8

18.6

11.4

8.8

P/S

55.9

28.7

14.4

9.0

6.7

Net debt (US$ mn)

BVPS (US$)

Valuation Metrics (x)

Source: Company data, Yuanta

Yuanta

China: Internet Software & Services

Qihoo (QIHU US)

13 Dec, 2013

Initiation

Page 24 of 27

Appendix A: Important Disclosures

Analyst Certification

Each research analyst primarily responsible for the content of this research report, in whole or in part, certifies that with respect to

each security or issuer that the analyst covered in this report: (1) all of the views expressed accurately reflect his or her personal

views about those securities or issuers; and (2) no part of his or her compensation was, is, or will be, directly or indirectly, related

to the specific recommendations or views expressed by that research analyst in the research report.

Qihoo (QIHU US) – Three-year recommendation and target price history

103

103

93

93

83

83

Share Price US$

73

73

63

63

53

53

43

43

33

33

23

23

13

13

Mar-11

No.

Sep-11

Date

Mar-12

Closing Price (A)

Sep-12

Target Price (B)

Adjusted Target Price

(C)

Mar-13

Rating

Sep-13

Analyst

Source: Bloomberg, Yuanta Research

Notes: A = price adjusted for stock & cash dividends; B = unadjusted target price; C = target price adjusted for stock & cash

dividends. Employee bonus dilution is not reflected in A, B or C.

Current distribution of Yuanta ratings

Rating

Buy

HOLD-OPF

HOLD-UPF

Sell

Under Review

Restricted

Total:

# of stocks

144

80

60

12

44

6

346

%

42%

23%

17%

3%

13%

2%

100%

Source: Yuanta Research

Ratings Definitions

BUY: We have a positive outlook on the stock based on our expected absolute or relative return over the investment period. Our

thesis is based on our analysis of the company’s outlook, financial performance, catalysts, valuation and risk profile. We

recommend investors add to their position.

HOLD-Outperform: In our view, the stock’s fundamentals are relatively more attractive than peers at the current price. Our thesis

is based on our analysis of the company’s outlook, financial performance, catalysts, valuation and risk profile.

HOLD-Underperform: In our view, the stock’s fundamentals are relatively less attractive than peers at the current price. Our thesis

is based on our analysis of the company’s outlook, financial performance, catalysts, valuation and risk profile.

SELL: We have a negative outlook on the stock based on our expected absolute or relative return over the investment period. Our

thesis is based on our analysis of the company’s outlook, financial performance, catalysts, valuation and risk profile. We

recommend investors reduce their position.

Under Review: We actively follow the company, although our estimates, rating and target price are under review.

Restricted: The rating and target price have been suspended temporarily to comply with applicable regulations and/or Yuanta

policies.

Note: Yuanta research coverage with a Target Price is based on an investment period of 12 months. Greater China Discovery

Series coverage does not have a formal 12 month Target Price and the recommendation is based on an investment period

specified by the analyst in the report.

Yuanta

China: Internet Software & Services

Qihoo (QIHU US)

13 Dec, 2013

Initiation

Page 25 of 27

Global Disclaimer

© 2013 Yuanta. All rights reserved. The information in this report has been compiled from sources we believe to be reliable, but

we do not hold ourselves responsible for its completeness or accuracy. It is not an offer to sell or solicitation of an offer to buy any

securities. All opinions and estimates included in this report constitute our judgment as of this date and are subject to change

without notice.

This report provides general information only. Neither the information nor any opinion expressed herein constitutes an offer or

invitation to make an offer to buy or sell securities or other investments. This material is prepared for general circulation to clients

and is not intended to provide tailored investment advice and does not take into account the individual financial situation and

objectives of any specific person who may receive this report. Investors should seek financial advice regarding the appropriateness

of investing in any securities, investments or investment strategies discussed or recommended in this report. The information

contained in this report has been compiled from sources believed to be reliable but no representation or warranty, express or

implied, is made as to its accuracy, completeness or correctness. This report is not (and should not be construed as) a solicitation

to act as securities broker or dealer in any jurisdiction by any person or company that is not legally permitted to carry on such

business in that jurisdiction.

Yuanta research is distributed in the United States only to Major U.S. Institutional Investors (as defined in Rule 15a-6 under the

Securities Exchange Act of 1934, as amended and SEC staff interpretations thereof). All transactions by a US person in the

securities mentioned in this report must be effected through a registered broker-dealer under Section 15 of the Securities

Exchange Act of 1934, as amended. Yuanta research is distributed in Taiwan by Yuanta Securities Investment Consulting. Yuanta

research is distributed in Hong Kong by Yuanta Securities (Hong Kong) Co. Limited, which is licensed in Hong Kong by the

Securities and Futures Commission for regulated activities, including Type 4 regulated activity (advising on securities). In Hong

Kong, this research report may not be redistributed, retransmitted or disclosed, in whole or in part or and any form or manner,

without the express written consent of Yuanta Securities (Hong Kong) Co. Limited.

Taiwan persons wishing to obtain further information on any of the securities mentioned in this publication should contact:

Attn: Research

Yuanta Securities Investment Consulting

4F, 225,

Section 3 Nanking East Road, Taipei 104

Taiwan

Hong Kong persons wishing to obtain further information on any of the securities mentioned in this publication should contact:

Attn: Research

Yuanta Securities (Hong Kong) Co. Ltd

23/F, Tower 1, Admiralty Centre

18 Harcourt Road,

Hong Kong

Yuanta

China: Internet Software & Services

Qihoo (QIHU US)

13 Dec, 2013

Initiation

Page 26 of 27

Yuanta Greater China Equities

Research - Taiwan

Vincent Chen

Head of Taiwan Research

+886 2 3518 7903

vincent.chen@yuanta.com

George Chang, CFA

Co-Head of Tech

+886 2 3518 7907

george.chang@yuanta.com

DC Wang

Co-Head of Tech

+886 2 3518 7962

dc.wang@yuanta.com

Bonnie Chang

Head of Non-Tech

+886 2 3518 7925

bonnie.chang@yuanta.com

Jeffrey Cheng

Head of Strategy

+886 2 3518 7902

jeffrey.cheng@yuanta.com

Andrew C Chen

IC Backend, IC Substrate, PCB

and LED

+886 2 3518 7940

andrew.chen@yuanta.com

Dennis Chan

PC Components, Handsets

+886 2 3518 7913

dennis.chan@yuanta.com

Steve Huang, CFA

Semiconductors & Display

+886 2 3518 7905

steve.huang@yuanta.com

Calvin Wei

PC/NB, Passive Components,

IPC

+886 2 3518 7971

calvin.wei@yuanta.com

SzuLiang Liu

PCB, Connectors, Auto

Electronics

+886 2 3518 7963

sl.liu@yuanta.com

Chuanchuan Chen

IC Design

+886 2 3518 7970

chuanchuan.chen@yuanta.com

Felix Hsu

Semiconductor, Solar

+886 2 3518 7946

felix.hsu@yuanta.com

John Chen

TFT

+886 2 3518 7933

john.lw.chen@yuanta.com

Chia-Wen Yeh

Conglomerates and Tourism,

Household Durables

+886 2 3518 7922

chiawen.yeh@yuanta.com

Yvonne Tsai

Petrochem/Textile/Medical

Devices/Shipping

+886 2 3518 7942

yvonne.tsai@yuanta.com

Peggy Shih

Taiwan Financials,

Environmental Eng

+886 2 3518 7901

peggy.shih@yuanta.com

Peggy Lee

Pharmaceuticals

+886 2 3518 7984

peggy.lee@yuanta.com

Leslie Kuo

Autos & Food Staples

+886 2 3518 7961

leslie.kuo@yuanta.com

Huiyi Chen

Property and Building Materials

+886 2 3518 7904

huiyi.chen@yuanta.com

Robbie Tseng

Petrochemicals & Chemicals

+886 2 3518 7945

robbie.tseng@yuanta.com

Maggie Chi

RA - Upstream Tech

+886 2 3518 7969

maggie.chi@yuanta.com

Sunny Chow

RA - Upstream Tech

+886 2 3518 7939

sunny.chow@yuanta.com

Edward Du

RA - Upstream Tech

+886 2 3518 7911

edward.du@yuanta.com

David Huang

RA – Non-tech

+886 2 3518 7948

david.sw.huang@yuanta.com

Ted Lai

RA – Non-tech

+886 2 3518 7909

ted.lai@yuanta.com

Frank Lin

RA – Downstream Tech

+886 2 3518 7915

franky.lin@yuanta.com

Rainy Wang

RA – Upstream Tech

+886 2 3518 7916

rainy.wang@yuanta.com

Sandy Weng

RA – Strategy, Downstream

Tech

+886 2 3518 7956

sandy.weng@yuanta.com

Livia Wu

RA – Strategy, Downstream

Tech

+886 2 3518 7920

livia.wu@yuanta.com

Yingyu Wu

RA – Strategy, Upstream Tech

+886 2 3518 7930

jessie.y.wu @yuanta.com

Kelvin Ng

Renewable Energy

+852 3969 9518

kelvin.kc.ng@yuanta.com

Benson Wan

Oil & Gas/Industrial

+852 3969 9529

benson.cf.wan@yuanta.com

Nice Wang

China Strategy

+86 21 6187 3821

nice.wang521@yuanta.com

Research - Hong Kong/Shanghai

Peter Chu, CFA

Head of HK Research

Consumer Research

+852 3969 9521

peter.kk.chu@yuanta.com

Samuel Kwok, CFA

Autos & Machinery

+852 3969 9527

samuel.kwok@yuanta.com

Sales and Trading

John Chang

Head of Taiwan Equities

+886 2 2175 8898

john.chang@yuanta.com

Juan Tseng

Head of Taiwan Sales

+886 2 2175 8962

juan.tseng@yuanta.com

Duncan Wun

Head of HK Cash Equities

+852 3969 9869

duncan.wun@yuanta.com

Tom Hsu

Head of Taiwan Sales

Trading

+886 2 2175 8800

tom.hsu@yuanta.com

Jenny Lo

Head of HK Sales Trading

+852 3969 9769

jenny.lo@yuanta.com

Kerry Chen - Sales

+886 2 2175 8922

kerrychen@yuanta.com

Philip Kong – Sales

+852 3969 9879

philip.kong@yuanta.com

Jason Lin - Sales

+886 2 2175-8998

jason.lin@yuanta.com

Michael Lin - Sales

+886 2 2175 8977

michael.lin@yuanta.com

Leslie Ling – Sales Trading

+886 2 2175 8855

leslie.ling@yuanta.com

Fiona Tan – Sales

+886 2 2175 8921

fiona.tan@yuanta.com

Kate Jackson – Sales

Trading

+852 3969 9767

kate.jackson@yuanta.com

Derek Tong – Sales Trading

+852 3969 9728

derek.tong@yuanta.com

Joyce Wan – Sales

+852 3969 9876

joyce.wan@yuanta.com

Jason Wang – Sales Trading

+886 2 2175 8888

jason.wang@yuanta.com

Paula Wong – Sales

+852 3969 9832

paula.wong@yuanta.com

Sales of Non-Taiwan Equities

Franker Lin

Head of Foreign Equity

Department