AUTOLIV INC. ANNUAL REPORT 1999

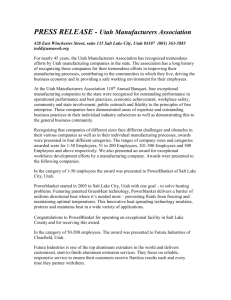

advertisement