CREATING A STRATEGIC MARKETING PLAN

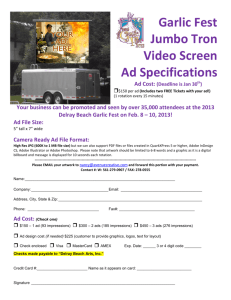

advertisement

CREATING A STRATEGIC MARKETING PLAN CONGRESS AVENUE CORRIDOR Delray Beach, FL March, 2012 CONTENTS y Scope and Objectives – Mission Statement y Current Situation Analysis y Activities to Date and In Process y Initial Focus Areas y Market Observations y SWOT Analysis – Delray Beach and Congress Avenue y Initial Branding Direction y Corridor Maps & Conceptual Plans y Critical Ingredients for Success y Implementation Framework and Phasing y Funding Recommendations y Next Steps SCOPE & OBJECTIVES – MISSION STATEMENT y Create a strategic marketing and branding plan that brings new economic development, jobs, and demand for real estate along Congress Avenue in Delray Beach. y A real estate branding strategy that repositions key underutilized properties along Congress Avenue will transform this Corridor into a catalyst for new private investment. CURRENT SITUATION – CONGRESS CORRIDOR IN DELRAY y The Congress Avenue Corridor in Delray Beach, although right off I‐95, is currently comprised of multiple vacant parcels, vacant offices, and a disjointed mix of uses. y The office real estate segment in the Corridor has not been strong for years because of current aesthetics, a lack of “sense of place”, and lackluster market conditions. y The 550K SF vacant, former Office Depot property (“IWA”) is a major “eyesore” and stands in the way of the Corridor realizing its upside potential. y IWA, the Arbors and Levenger complexes represent about 80% of the Delray office market with vacancy rates of between 60% and 100%. y There are limited services for office users in this corridor, such as restaurants, coffee shops, retail, or other offerings. y The Corridor contains various aesthetically challenged non‐office properties presenting challenges in attracting office users, especially compared to Boca. y New businesses interested in locating in southern Palm Beach County are not currently being brought to the Corridor due to a lack of financial incentives and desirability. ACTIVITIES TO DATE AND IN PROCESS y Market reconnaissance on vacant and available properties in Delray and Boca, including the most recent transactions along Congress. y Meetings with property owners, businesses, brokers, BDB, and other key stakeholders to gain insights and invite them into our strategic marketing process. y Gained market perspectives on supply & demand for commercial, industrial, healthcare, lifestyle, institutional, and residential uses. y Developed a SWOT analysis with recommendations on the best targeted uses for redeveloping Congress Avenue and IWA. y Made general recommendations to City Staff to build an economic development and incentive package to facilitate bringing new deals to Delray Beach. y Formulating a new brand and market identity that will rejuvenate Congress Avenue in Delray Beach. y Working to transform the IWA property into a demand generator for new office users and a new hub of innovation and lifestyle connected uses for the community. INITIAL FOCUS AREAS y Existing Conditions along the Congress Avenue Corridor y What realistic options exist in Delray’s market to transform Congress Ave. Corridor? y How critical is the redevelopment of the IWA site in reinventing the Corridor and bringing new businesses to Delray? y How can aesthetics along Congress be improved to elevate the feel of the area. y Market Observations and Unlocking Future Corridor Potential y What types of retail, office, lifestyle, educational, medical, and other uses would work along the Congress Avenue Corridor between Boca and Atlantic Ave? y What branding strategy for Congress Avenue Corridor in Delray will capture market attention and generate short‐term and permanent demand? y Community Participation and Teaming Success y What processes and tools are critical to building a new market identity for Congress Avenue Corridor in Delray with BDB, Enterprise Florida, and potential users? y Infrastructure and Funding Needs y CRA District, Special Development District, Enterprise Zone, & Foreign Trade Zone Designations. y Economic Development & Incentives to support recruitment, retention, & expansion, and encourage private investment. MARKET OBSERVATIONS – OFFICE POTENTIAL y The south Florida office market is still trying to recover from the last few years of downturn and although trends are turning positive, the pace of recovery will be gradual. y The Boca/Delray Beach office market comprises 12,825,000 SF and currently has a vacancy rate of about 30%, and negative, net absorption of (309,000) SF for 2011. y The Delray Beach office market comprises 1,442,000 SF and has a current direct vacancy rate of 56.6%. The IWA property represents 550K SF or 38 % of the total space. y With an overall vacancy rate for Delray of over 50%, it could take five to ten years to absorb this space if left to market forces. y The Arbor’s new ownership is a great addition to Delray, and should add new energy to the market along Congress Avenue although their 250,000 SF is almost 20% of the Delray market. y There is current demand for office in downtown Delray, but there are no large blocks of space available, so repositioning Congress as a new destination connected to downtown is possible. y Challenges for Congress Avenue include the “white elephant” IWA site, limited appeal of Delray for office users, and the need for more than just Class A office in the future to reach the next level. y The key to capturing new demand along Congress Avenue in Delray is to create a new mix of uses that are branded and presented in a way that will lead to a visible market reaction. MARKET OBSERVATIONS – CONGRESS CORRIDOR y Given the current glut of office space in Boca and Delray, and the projected pace of absorption, relying on the office sector alone to elevate Congress Ave going forward is not justifiable. y Other market segments are necessary to take Congress to the next level, including retail, institutional, healthcare, educational, multi‐family, and restaurants/hospitality. y Green technology, sustainable and solar powered redevelopment can also be strong market differentiators for the Corridor to help “break out” of the current doldrums. y Delray’s connection with Boca at the southern border along Congress can be leveraged to generate more potential demand for both cities from I‐95. y The first steps in the rejuvenation of the Corridor should include repositioning the IWA property into a sustainable mixed‐use development, along with some key commercial parcels along the Boca, Delray border. y In conjunction with the potential new mix of uses coming into the Corridor, the overall aesthetics of Congress Avenue need to elevated. y Given the possibility of budget cuts, current market conditions, and a slow economic recovery, reinventing the Corridor will not be easy, but a strong new strategy and branding will work. SWOT ANALYSIS – CONGRESS AVE. CORRIDOR - DELRAY Strengths Weaknesses •Excellent access to I-95, ports, rail, airports, universities, and hospitals • Vacancy and status of IWA and lack of any market energy or excitement •Real estate prices are generally lower than Boca and Palm Beach • Certain properties diminish the potential uplift of the Corridor • Delray Beach has a track record of success in redevelopment •Lack of nearby food and retail services for office occupancy •MROC zoning is perfect for the uses necessary to redevelop land on Congress and good utilities •Boca leadership and BDB are ready to support a new Congress Ave strategy Opportunities • No competitive package of incentives and/or funding for users •No “sense of place” along Congress Avenue that would help to draw new business Threats • Connecting to downtown Delray’s success in a way that attracts new businesses to Congress • IWA continues to stay dormant and destabilizes the absorption of existing office space • Strategic alliance with Boca for branding and demand uplift based on shared borders • Numerous vacant land parcels available for sale with limited buyers and feasibility for years • Continuing the MedUTech concept north of Boca along Congress into Delray • Boca and Palm Beaches markets have millions of SF of vacant space that competes with Delray • Development of vacant commercial land now available right off I-95 on Congress • Public schools are not well perceived and present challenges for attracting new residents • Working with Delray Medical Center and FAU to attract new healthcare users to Congress Ave • Congress Avenue in Delray is left to market forces and remains “stuck” with no clear vision INITIAL BRANDING DIRECTION y “Delray Innovation Corridor” y y y y y Technology, Research, Education, Aspiration, Talent (“TREAT”) Corporate Headquarters and Regional Offices Tourist and Destination Demand From I‐95 New Food, Lifestyle, Retail & Leisure Uses Solar‐Power & Green Technology Powering the New Mix of Uses INITIAL BRANDING DIRECTION y Reposition the IWA property into the “Delray Innovation Park”. y y y y y y Main Street Entrance with Specialty Retail Uses/Restaurants Corporate/Regional Headquarters Office (Germantown Bldg.?) Technology/Educational Campuses ‐ Adult, STEM, and Children Multi‐Family Units ‐ FAU Med, Young Families & Professionals Park and Open Space for Community Use (Gazebo, Concerts) Model of Sustainability and Innovative Land Uses “DELRAY INNOVATION CORRIDOR” – I-95 TO ATLANTIC “DELRAY INNOVATION CORRIDOR” – I-95 TO LINTON CONCEPTUAL PLANS – “DELRAY INNOVATION PARK” Scenario 1 Scenario 2 CRITICAL INGREDIENTS FOR SUCCESS y The “Delray Innovation Corridor” needs a competitive financial incentive and economic development package for BDB. y Aesthetic improvements, infrastructure, CRA District, FTZ formation, and accelerated entitlements for new users. y IWA owners working with the City on the new strategic marketing and branding plan for redeveloping their property into the “Delray Innovation Park”. y A “green” trolley link and/or transit connection between Congress, the rail stations, and Downtown Delray to shuttle people between the destinations. y Creating a “PR” story and branding/marketing collaterals about the transformation of IWA property into “Delray Innovation Park”. y Partnering with Boca and Boynton along the Congress Avenue corridor to accelerate everyone’s success. IMPLEMENTATION FRAMEWORK & PHASING y Form Public/Private Partnership with City as Lead y Gain control of the IWA site or execute a development agreement with current owners and/or new developers. y Develop and entitle a new master plan for the IWA property under MROC code. y Target Users for Various Economic Units – South to North y y y y Parcels along Boca/Delray border ‐ restaurant/hospitality cluster right off I‐95. Corporate office on 7.99 acres cadi‐corner to IWA. Corporate Headquarters site on IWA property as part of mixed‐uses. Innovation Park at IWA (powered by a solar farm) y Science and technology innovation y Medical & Healthcare y Community college, or University consortium y Multi‐Family Units – Part of IWA Village Plan and geared to FAU Med. y Cultural and Recreational – Open Public Space and Walking Trails. y Landscape Buffers along industrial frontage and other key stretches on Congress. y Build initial momentum by repositioning IWA and southern I‐95 parcels FUNDING RECOMMENDATIONS y Aesthetics and Infrastructure – Public Improvements y Design a landscaping and beautification plan for the Corridor. y Create landscape buffers for industrial and “tired” residential areas. y Transform the Corridor with great aesthetics & lifestyle connectivity. y Types of Non‐Traditional Funding y y y y TIF District, FTZ, Enterprise Zone Designations Solar Farm and other green technologies to generate special tax credits Create a Corporate Headquarters Strategic Fund Pioneer an “Innovation and Technology Company Development Act” for FL y Science and Technology Innovation tax credits y Medical & Healthcare research & development credits y Educational and IT Vocational Degree Programs with Training Credits for Companies y USDA Funding for Agri‐Technology, Logistics, and Innovation Companies y EB‐5 Regional Center Funding – Foreign Direct Investment Capital NEXT STEPS y Refine and polish the conceptual corridor plan and branding collaterals that capture the new mix of uses comprising the “Delray Innovation Corridor”. y Finalize the economic development incentive package and branding refinements to make the “Delray Innovation Corridor” credible. y Present the strategy and new brand to the City Commission, BDB, Chamber of Commerce, and key stakeholders to build excitement and support for the concept. y Fast‐track the process for the IWA property redevelopment to be entitled for new uses and become the “Delray Innovation Park”. y Facilitate new deals in process along the Delray/Boca border up to Linton with local brokers to build immediate momentum and stimulate more demand. y Finalize the market awareness package for BDB including the Economic Development and Financial Incentives Plan for the “Delray Innovation Corridor”. QUALIFICATIONS – DAVID J. WILK, CRE, MAI Mr. Wilk is National Director of Corporate Real Estate and Advisory Services for Sperry Van Ness (“SVN”) and Corporate Valuation Advisors (“CVA”). David creates value in today’s market for corporations, private equity firms, developers/investors, and institutions (universities, hospitals, governmental entities) by focusing on real estate strategies that generate new earnings, cost savings and bottom line impact. Within these types of value propositions, Mr. Wilk also provides valuations and market studies, economic development strategies for municipalities through repositioning key properties, and marketing/branding strategies that optimize challenging real estate assets. Mr. Wilk was formerly National Managing Director of Duff & Phelps Corporate Real Estate Advisory Group from 2008 through 2009 after they acquired Greystone Realty Advisors, a boutique advisory firm he founded in 1997. From 1995 to 1997 Mr. Wilk was Regional Director of Corporate Real Estate Services for Ernst & Young LLP in the Middle Atlantic. From 1993 to 1995, Mr. Wilk was Managing Director of the Real Estate Valuation Group for Arthur Andersen in Philadelphia after Andersen acquired Wilk & Associates, Inc., a real estate consulting company founded in 1987. From 1977 to 1987, Mr. Wilk held senior management positions with Valuation Research Corporation, Arthur D. Little, and was National Director of Valuation Services for Kenneth Leventhal & Co in California. Mr. Wilk is an Adjunct Professor and Co-Founder of the Real Estate program at the University of Delaware Lerner Business School. Courses taught since 1988 include Real Estate Finance (FINC 417), Real Estate Development & Investment (FINC 467), and MBA Real Estate Finance (FINC 854). He earned a Bachelor’s Degree in Finance from the University of Delaware and is completing a sequenced Masters and Doctoral Program in Corporate Real Estate Studies through Johns Hopkins University. Mr. Wilk is a Counselor of Real Estate (CRE) and a Member of the Appraisal Institute (MAI) since 1985. He is a Licensed Real Estate Broker and Certified General Appraiser in the State of Delaware. He has also qualified as an expert witness in numerous State and Federal court jurisdictions on a national level. Mr. Wilk has 35 years of real estate experience on commercial, industrial, residential, agricultural, governmental, and institutional real estate projects including having worked in 48 states in the U.S., Canada, Mexico, Europe, South America, the Caribbean, Asia, and the South Pacific. Fortune 500 clients served have included; Johnson & Johnson, Chevron, GE, Berkshire Hathaway, Agilent Technologies, MBNA America Bank, Hercules (Ashland), DuPont, Comcast, AT&T, Exelon Energy, Bristol Myers Squibb, PNC Financial, Bank of America, AstraZeneca, Sun Company, and J.P. Morgan Chase. Real estate consulting highlights from Mr. Wilk’s career include; Pebble Beach, Aspen Ski Resorts, 20th Century Fox Film Studios, Irvine Ranch, Madison Square Garden, Santa Anita Racetrack, Dover Downs, Elvis Presley Enterprises, Hyatt Regency & Four Seasons Resorts in Hawaii, Chevron’s Huntington Beach Company, Marriott’s Great America Theme Parks, Power Plant in Baltimore, Art Deco Hotels in South Beach, Pennsylvania Convention Center and Philadelphia Marriott Hotel, Comcast Cable Systems, Bikini Atoll in Micronesia (South Pacific) and Fort DeRussy in Waikiki, Hawaii.