Rivalry among existing firms

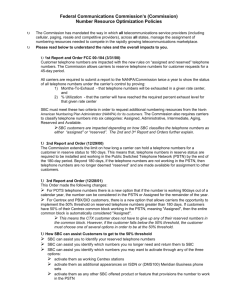

advertisement