Rivalry among existing firms

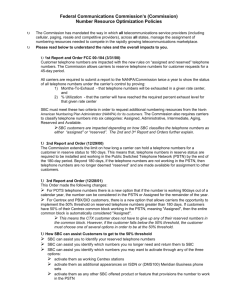

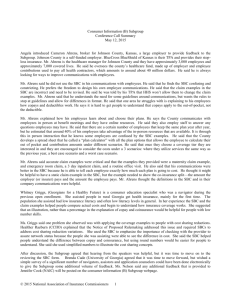

advertisement