Summary - National Association of Insurance Commissioners

advertisement

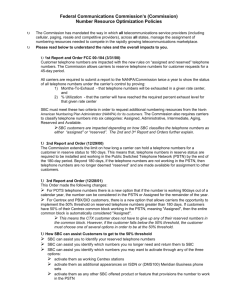

Consumer Information (B) Subgroup Conference Call Summary May 12, 2015 Angela introduced Cameron Ahrens, broker for Johnson County, Kansas, a large employer to provide feedback to the Subgroup. Johnson County is a self-funded employer. BlueCross BlueShield of Kansas is their TPA and provides their stoploss insurance. Mr. Ahrens is the healthcare manager for Johnson County and they have approximately 3,000 employees and approximately 7,000 covered lives. He said he oversees the county’s healthcare fund, made up of employer and employee contributions used to pay all health contractors, which amounts to around about 40 million dollars. He said he is always looking for ways to improve communications with employees. Mr. Ahrens said he did not use the SBC in his communications with employees. He said that he finds the SBC confusing and constricting. He prefers the freedom to design his own employee communications. He said that the claim examples in the SBC are incorrect and need to be revised. He said he was told by his TPA that HHS won’t allow them to change the claim examples. Mr. Ahrens said that he understands the need for some guidelines around communications, but wants the rules to stop at guidelines and allow for differences in format. He said that one area he struggles with is explaining to his employees how copays and deductibles work. He says it is hard to get people to understand that copays apply to the out-of-pocket, not the deductible. Mr. Ahrens explained how his employees learn about and choose their plans. He says the County communicates with employees in person at benefit meetings and they have online resources. He said they also employ staff to answer any questions employees may have. He said that there are a certain number of employees that keep the same plan year after year, but he estimated that around 40% of his employees take advantage of the in-person resources that are available. It is through this in person interaction that he knows some employees are confused by the SBC examples. He said that the County develops a spread sheet that he called a “plan calculator” with all the plan options that allows the employee to calculate their out of pocket and contribution amounts under different scenarios. He said that once they choose a coverage tier they are interested in and they are encouraged to consider the costs under a 3 scenarios: where they utilize services the same way as the previous year, a best case scenario and a worst case scenario. Mr. Ahrens said accurate claim examples were critical and that the examples they provided were a maternity claim example, and emergency room claim, a 3 day inpatient claim, and a routine office visit. He also said that his communications were better in the SBC because he is able to tell each employee exactly how much each plan is going to cost. He thought it might be helpful to have a static claim example in the SBC, but the example needed to show the co-insurance split—the amount the employer (or insurer) pays and the amount the employee pays. Mr. Ahrens thought the definitions in the SBC and in their company communications were helpful. Whitney Griggs, (Georgians for a Healthy Future) is a consumer education specialist who was a navigator during the previous open enrollment. She assisted people in rural Georgia get health insurance, mainly for the first time. The population she assisted had low insurance literacy and often low literacy levels in general. In her experience the SBC and the claim examples helped people compare actual costs and begin to understand how insurance coverage works. She suggested that an illustration, rather than a percentage in the explanation of copay and coinsurance would be helpful for people with low number skills. Ms. Griggs said one problem she observed was with applying the coverage examples to people with cost sharing reductions. Healther Raeburn (CCIIO) explained that the Notice of Proposed Rulemaking addressed this issue and required SBCs to address cost sharing reduction variations. She used the SBC to emphasize the importance of checking with the provider to assure network status because the people she was assisting were able to see the difference in cost. She said the SBC helped people understand the difference between copay and coinsurance, but using round numbers would be easier for people to understand. She said she used simplified numbers to illustrate the cost sharing concepts. After discussion, the Subgroup agreed that hearing from the speakers was helpful, but it was time to move on to the reviewing the SBC form. Brenda Cude (University of Georgia) agreed that it was time to move forward, but wished a simple survey of a significant number of navigators, assistors and application counselors could have been done electronically to give the Subgroup some additional volume of feedback. Ms. Nelson said any additional feedback that is provided to Jennifer Cook (NAIC) will be posted on the consumer information (B) Subgroup webpage. © 2015 National Association of Insurance Commissioners 1 Having no further business, the Consumer Information (B) Subgroup adjourned. © 2015 National Association of Insurance Commissioners 2