LGT Venture Philanthropy Your partner for scaling positive impact

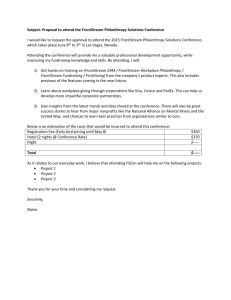

advertisement

LGT Venture Philanthropy Your partner for scaling positive impact Q4 2015 LGT Venture Philanthropy: Summary LGT Venture Philanthropy – Your partner for scaling positive impact Our mission Increase the sustainable quality of life of less advantaged people, contribute to healthy ecosystems and build resilient, inclusive and prosperous communities. Our approach We analyze and support young, strongly growing organizations with high societal impact based on best-in-class venture capital principles. We focus our investments and grants on scalable models and contribute our know-how to make them financially self-sustaining. We offer customized co-investment solutions for a broad range of clients. Our track record 51 portfolio organizations supported 2.8 million less advantaged people reached in 2014 Impact Ventures UK fund launched (USD 55m) 112 ICats Fellows matched with our portfolio organizations to bridge their business know-how needs Mission-related investment suite of LGT supported Our team 30 venture philanthropy and impact investing experts in Latin America, Europe, Africa, India, Southeast Asia and China work together with an engaged board. Our investment themes Education Agriculture Health Energy ICT How can we be a partner? Customize implementation of your impact investment Advise in developing your personal impact investing profile “All human beings should be able to live under dignified conditions and be given a fair chance for personal development in their lives. Wealthy individuals have an economic, political and moral responsibility to champion the cause of disadvantaged persons. In developing countries in particular, the scale of poverty is alarming and the need for help is great. There are limits to the contributions that governments and development agencies can make. This means that helping the disadvantaged in developing countries and assisting social advancement is also a challenge for the private sector. In this respect, it is vital that the invested financial resources generate a high and sustainable social return and do not create any false or unnecessary dependencies nor distort local markets.” H.S.H. Prince Max von und zu Liechtenstein CEO LGT, Member of LGT Venture Philanthropy Foundation Board 2 LGT Venture Philanthropy: Our challenge Over 2 billion people live on less than 2 USD a day – they need solutions that are scalable and sustainable 2.2 billion people live on less than USD 2 a day. 8% of the world’s population owns 80% of the world’s total wealth. The gap is widening. We strive to narrow it. 3 LGT Venture Philanthropy: Our approach We support organizations and enterprises with scalable solutions to social and environmental challenges Applying a venture capital / private equity approach, we provide more than just financing to our portfolio organizations: management know-how and access to relevant networks can be even more important to achieving sustainable growth. “We want to be as efficient and transparent as possible in our impact investing and venture philanthropy efforts. With this objective in mind we have applied many proven principles and processes from the venture capital and consulting industry to our approach.” H.S.H. Prince Max von und zu Liechtenstein Focus on few portfolio organizations Optimization of long-term social & environmental return Continuous controlling of portfolio organizations Young, rapidly growing organizations Approach Long-term engagement Financing combined with management know-how and access to networks Intense local due diligence to build knowledge and relationship Tailored financing: equity, debt and grants 4 LGT Venture Philanthropy: Our active portfolio Our active portfolio creates high social and environmental impact across six world regions and five main thematic areas all values in million USD Total capital committed per region 6% 23% China SEA Global UK Africa India LatAm 20% 22% 29% Total cumulative capital committed to LGT VP since inception 2007 58.4 Total capital committed IVUK Fund (GBP 35.95m ) 54.2 Total capital committed to portfolio organizations since inception 2007 54.4 A - Total capital committed – active portfolio 3% 47% 16% 16% Others Agriculture Energy ICT Education Health 46.8 A.1 - Total capital committed but not yet invested in active portfolio 2.9 A.2 - Total capital invested in active portfolio 43.9 A.2.1 - Total capital invested in organizations in expansion stage 42.8 Grants (incl. iCats program) 7.1 Debt 6.9 Total capital committed per thematic area 11% 7% 112.6 Total capital commited to LGTVP Foundation Convertible Debt 9.9 Equity 18.9 A.2.2 - Total capital invested in organizations in early stage phase 0.6 A.2.3 - Total capital invested from EDP (Employee Donation Program) 0.4 B - Total capital committed - closed engagements 7.7 Breakdow n total capital committed to portfolio organizations by source 54.4 Capital from LGTVP Foundation 40.3 Capital from clients 13.7 Capital from LGT Employees 0.4 % of client commitment of total committed capital Total capital committed per type of funding 25% Total number of organizations supported since 2007 51 Total number of active portfolio organizations 31 Total number of organizations in expansion phase 22% 17% 18% 43% Grant Debt Equity Convertible Debt 21 Total number of organizations in early stage phase 10 Total number of closed engagements 20* Average investment size Average investment size in expansion phase USD 2,200,000 Average investment site in early stage phase USD 115,000 Watchlist Total number of deals on watchlist that require close monitoring % of total portfolio 9 29% 5 LGT Venture Philanthropy: Our active portfolio With engagements across 6 world regions and 5 thematic areas we have gained significant experience in global impact investing Education Regions with activity and networks Health Energy Agriculture ICT LGT Venture Philanthropy: Overview of our active portfolio organizations Active global portfolio by themes and business model Education Health Energy For-profit organizations For-profit organizations For-profit organizations Husk Power Systems (India) M-KOPA Solar (Kenya) One Renewable Energy Enterprise (Philippines) Bridge International Academies (Africa) Enseña Chile (Chile) Lumni (Columbia) New Heaven Partnership (Thailand) Rags2Riches (Phillipines) Tòhe (Vietnam) Varthana (India) Big White Wall (UK) Bive (Colombia) Dr. Consulta (Brazil) MyDentist (India) Unforgettable (UK) Non-profit organizations mothers2mothers (Africa) Non-profit organizations Aangan Trust (India) Educate Girls (India) Additional UK themes Agriculture ICT Housing & Shelter For-profit organizations Non-profit organizations For-profit organizations Institute of Public & Environmental Affairs (China) Homes for Good ACRE (Kenya) Driptech (India, China) Ecolink (Vietnam) Grassroots Innovation Co. (Thailand) Hilltribe Organics (Thailand) Kakoa (Indonesia) Kennemer Foods Int. (Philippines) Mukatri (Colombia) Shangrila Farms (China) Sugruvi (Philippines) Employment & Skills For-profit organizations K10 7 LGT Venture Philanthropy: Case studies from our portfolio (1/3) M-KOPA Solar makes clean energy affordable to low income households ENGAGEMENT OF LGT VENTURE PHILANTHROPY (since 2011) USD 500’000 debt and USD 37’500 equity investment to fund roll-out of M-KOPA’s inaugural commercial product targeting low-income households USD 1m in debt funding from LGT VP clients towards M-KOPA’s working capital requirements. Follow-up USD 8m investment (Series D) funding from LGT VP to facilitate roll out new products and finance entry into new markets across the region. 3 ICats Fellows were matched to work for 11 months, full-time in Nairobi on Engineering, Sales & Marketing, IT Access to LGT VP’s network, the LGT Employee Donation Program and other alternative funding resources, as well as ongoing mentoring support PROBLEM IMPACT Over 63% of Sub-Saharan Africa’s population are rural, lower-end consumers with small inconsistent incomes/revenue streams. These masses can barely afford basic goods and services but nevertheless spend up to 70% of their income on inefficient, low-quality goods M-KOPA aims to reach over 1 million low income households in the upcoming years by providing affordable, fume-free, uninterrupted electricity through M-KOPA home solar systems. For example, about 110 million households across Africa spend USD 160 or more annually on kerosene for lighting despite the poor quality of light provided by kerosene lamps alongside the related health risks of smoke fumes IMPACT REACH 2012 2013 2014 2015e # (TSD) of household members with access to M-KOPA Solar Home System 19.8 271.8 540.4 1120 % of clients living below USD 2 p.d. n/a 66% 81% >50% 1 2 3 3 # of active countries SOLUTIONS IMPACT DEPTH M-KOPA Solar targets low-income consumers, enabling them to purchase productive assets like solar systems through an affordable and convenient pay-per-use system that matches their income and expenditure patterns Increase in disposable income: Households are saving an avg. 347 KSH p.w. on kerosene, paying someone to charge their phones and buying radio batteries. In addition, some households generate income through getting paid by others to charge their mobile phones M-KOPA Solar’s inaugural product, a home solar system, seeks to address the energy needs of low-income households. The home solar system will enable households to charge radios, torches and mobile phones without incurring additional costs. Households also have options to increase additional bulbs in the provided systems Ownership of assets: Low-income clients can afford to buy a solar home systems from savings generated through replacing expensive sources of energy like kerosene Increasing safety: Clients feel safer due to better lighting at night, not using kerosene, having a charged mobile phone and a detachable torch to light way Reducing environmental pollution: The burning of kerosene is a major pollutant that contributes to global warming through the omission of CO2 8 LGT Venture Philanthropy: Case studies from our portfolio (1/3) How LGT Venture Philanthropy contributes to M-KOPA‘s growth Impact (# units sold) Due Diligence 250K Implementation Early phase Expansion 200K 150K 100K 50K M-KOPA’s application to LGT VP Tailored financing* On-site support 2012 2011 LGT VP’s equity and debt investment Permanent on-site support from IM LGT VP Africa Transparency Highlights Client debt co-investments ICats No. 1 & 2: Mairead, Legal & Strategy, Anna-Marie, Product Development Preliminary Review & Investment Memo 2013 Quarterly Report Q3/12 Commercial launch of first solar home system M-KOPA I 2014 One debt tranche fully repaid LGT VP’s debt investment Time 2015 LGT VP is lead investor for equity and debt investment series ICat No. 3: Rasto, Lead Systems Engineer Half-year Report Q2/2013 Annual Report 2013 100K solar units sold Launch M-KOPA III with Safaricom 250K solar units sold * all numbers in USD Impact targets • 1 million units sold by 2018 • 1’450 agent distributors • 5 program countries 9 LGT Venture Philanthropy: Case studies from our portfolio (2/3) Educate Girls increases school attendance and learning outcomes of children ENGAGEMENT OF LGT VENTURE PHILANTHROPY (since 2010) Grant of USD 500’000 for expansion to one additional district of Jalore Client grants of USD 1.3m for recruitments, operational costs and to expand into additional 3 districts 7 ICats Fellows matched to work for 11 months, full-time in Mumbai on marketing/communication, partner mgmt. and growth strategy Access to LGT VP’s network, the LGT Employee Donation Program and other alternative funding resources, as well as ongoing mentoring support IMPACT PROBLEM India has the world’s largest illiterate population - women and girls in rural areas are especially affected Poverty is one cause, but more importantly, cultural and social barriers, bad quality of education and inadequate infrastructure (such as lack of toilets) keep many parents from sending their children - especially girls - to school SOLUTION Educate Girls (EG) works towards increasing the enrollment of girls in schools by identifying out-of-school girls through a door-to-door survey or secondary research. EG then mobilizes communities and makes them aware of the necessity of sending girls to school EG partners with other organizations to create better pedagogy and creative learning methodologies to improve education quality and learning outcomes EG trains public school teachers and appoints para-teachers to enhance quality of teaching and improve retention in schools EG also trains local community members who liaise with the government to seek funds and implement projects to improve school infrastructure By 2018, 4 million out-of-school children, especially girls, will have an opportunity to a better life through EG's initiatives of empowering girls in villages, educating communities on importance of girls education and improving infrastructure and teaching quality in public schools. IMPACT REACH 2010/11 2013/14 2014/15 2015/16e # of children reached 250’450 567’812 1’111’068 941’125 # of girls newly enrolled 14’093 22’915 55’596 58’550 # of schools 2342 6130 8807 7695 # of districts 1 3 6 7 IMPACT DEPTH Quality education: Improved access to quality education strengthens cognitive capacity and the ability to think independently, form own opinions and make the right decisions for girl’s future lives Health improvements: Families with educated girls experience improved health and lower child mortality as shown by research of UN/World Bank Inclusion, equality and tolerance: Families with educated girls benefit from an increased social cohesion, higher gender equality and religious tolerance Poverty reduction: Educated girls and boys are likely to get better jobs and therefore help their families break out of the cycle of extreme poverty 10 LGT Venture Philanthropy: Case studies from our portfolio (2/3) How LGT Venture Philanthropy contributes to Educate Girls’ growth (actual) Impact (#out-of-school girls enrolled) 1M Due Diligence Early phase Implementation Expansion 750K 500K 250K Educate Girl’s application to LGT VP 2012 2011 Tailored financing On-site support Transparency Highlights Client grants from 2012 until 2014 LGT VP grant in three tranches in 2011/12 ICat No. 1: Nadine, PR & Communications 2013 Permanent on-site support by IM LGT VP India ICats No. 2 & 3: Louise & Alexander, Communications 2014 2015 Leveraged additional funding from external sources ICats No. 5 & 6: David ICat No. 4: Kyla, & Camille, Program Marketing & expansion, Fund raising Communications Preliminary Review & Investment Memo Safeena Husain, Founder and Executive Director of EG, wins the Stars Impact Award 2014 and the Skoll Award for Social Entrepreneurship 2015 EG expands to 5000 schools in 3 districts Qatar Foundation as new lead investor – introduced by LGT VP India EG expands to 8252 schools in 6 districts Impact targets • Expand operations to 8 districts by 2016/17 • Reach 11K schools by 2016/17 • Reach 4m children by 2018 11 Time LGT Venture Philanthropy: Case studies from our portfolio (3/3) Dr.consulta provides high quality, low-cost primary and minor secondary healthcare to low-income population ENGAGEMENT OF LGT VENTURE PHILANTHROPY (since 2014) LGT VP invested USD 7.8m in dr.consulta to grow from 1 to 15 clinics by 2016 The investment has been split in three tranches and adheres to fixed milestones: two convertible notes of USD 2.1m (2014) and USD 4.2m (2015), and a Series A investment of USD 3.7m (2016) Grant of USD 200k to pilot patient financing project with 2000 patients 1 ICats Fellow was matched to work for 11 months, full-time with dr.consulta in São Paulo on finance and fundraising Access to LGT VP’s network, the LGT Employee Donation Program and other alternative funding resources, as well as ongoing mentoring support PROBLEM 75% of the Brazilian population (150m) relies purely on the public healthcare system which is inefficiently managed, underfunded, and incapable of providing quality healthcare services, e.g. scheduling a consultation appointment can take 3-6 months Public day clinics are scarce and of very low quality. In Sao Paulo, for example, there are only 16 public specialty care clinics available to serve 15m people (~1 clinic for 1m people), which leads to overcrowded waiting rooms and waiting times that are exceptionally long Without low cost quality healthcare services, the opportunity for poor Brazilians to access quality healthcare services is reduced and the probability to receive illness relieve is diminished SOLUTION Dr.consulta provides high quality, low-cost specialty healthcare and diagnostic services to Brazil’s low to middle income population via a network of clinics that offer 30 specialty care services, diagnostics and laboratory services IMPACT By 2020, dr.consulta aims to provide affordable healthcare to 1 million patients per year through a network of 100 clinics. Patients, with 80% percent being women and children, will have better access to quality healthcare services with a focus on preventive care of most prevalent chronic diseases. IMPACT REACH # of served patients p.a. % of satisfied patients 2013 2014 2015e 2016e 13’269 37’399 137’089 350’000 82% 97% 85% 85% IMPACT DEPTH Better physical health: Individuals experience a better overall health due to 1) modern examination and diagnosis services, b) timely consultations when sick and c) dr.consulta’s focus on preventative healthcare Accessibility of health care: Patients are more likely to visit a doctor when they are sick as 1) dr.consulta guarantees short waiting times and 2) clinics are in close proximity of the peoples’ communities Affordability of quality health care: Patients benefit from low prices in comparison to other private health clinics (avg. 63% cheaper than lower end of benchmark prices according to national insurance plans and medical associations). In addition, dr.consulta offers installment payments of up to 24 months 12 LGT Venture Philanthropy: Case studies from our portfolio (3/3) How LGT Venture Philanthropy contributes to dr.consulta’s growth (actual & expected) Impact (# of served patients) 600K Due Diligence Early phase Implementation Expansion 400K 200K Date of application to LGT VP 2014 2015 2016 Time Tailored financing LGT VP’s 1st debt tranche LGT VP’s 2nd debt tranche LGT VP’s 3rd debt tranche Client grant LGT VP’s 4th debt tranche Launch of Series B to raise USD 30m Use of funding Open 3 new clinics Open 1 new clinic by eoy Open 5 new clinics in 2015 Healthcare financing 15 open clinics in total by eoy Open 20 additional clinics in 2016/17 Transparency Highlights Preliminary Review & Investment Memo Opening of first clinic Impact targets • Vision: reducing the healthcare gap in Brazil by 5% per year with a chain of 400 clinics • Reach 1m low income patients by setting up 50 clinics until 2017 Half-year report Q2/14 Milestones review to trigger 3rd tranche Opening of clinic no. 7 / ICat No. 1: Eliana, Finance Manager 13 LGT Venture Philanthropy: Our engagement spectrum LGT Venture Philanthropy focuses both on philanthropy and impact investing Source: http://impactspace.org/category/impact-investing-101 14 LGT Venture Philanthropy: Our investment process A multi-step investment process focuses on deep analysis to enable LGT VP to select the best portfolio organizations Process Main activities 5 – 10 years Due Diligence 3-6 months Timing Deal sourcing Sourcing of potential deals Information exchange with cooperation partner/ reference calls Stop-go decision partners Tools/ Tracking database Documents Quick-screen checklist 1 week – 3 months Deal screening Preliminary review Screening of organizational information Gathering of basic information Calls or first meeting with senior mgt members of portfolio organization Stop-go decision team/partners Evaluation of business plan/ proposal Intensive discussions with senior mgt team members of portfolio organization Stop-go decision board/client Intensive on-site due diligence Reference calls for each management team member of a portfolio organization KPI and milestones determination Final investment decision board/client Continuous support/meeting (management know-how and networks) Each investment manager covers on average 5 investments, spending min. 0.5 day/week with each organization Exit options: MBO Sell to social strategic buyer Sell to social investor Exit is clarified and agreed on with the portfolio organization upon deal execution (preinvestment) Factsheet (~5 pgs) Capabilities Assessment (light) Preliminary Review Business, risk and capabilities assessment Depth and scale of impact assessment Termsheet Investment Memo (~20 pgs) Contract(s) Monthly reports Quarterly KPI Annual report Post investment monitoring Business, risk and capabilities assessment Depth and scale of Impact assessment Contract(s) (~10 pgs) Deal execution Portfolio controlling & reporting Exit 15 LGT Venture Philanthropy: Our ICats Program Connecting social enterprises in need of professional know-how with experts looking for ways to apply their skills in a meaningful way Situation Young social enterprises need additional know-how to grow their business and scale their impact Professionals are looking for jobs where they can apply their knowledge in a meaningful way Complication Scarce financial resources and missing networks often prevent these enterprises from hiring talents Professionals struggle to find meaningful engagements that require their professional skill set Solution The ICats Program connects social enterprises in need of professional know-how with experts who have the desire to apply their knowledge in a meaningful way Experts stay for 11-14 months on the ground and work for a living stipend with the senior management team of the social enterprise in order to build capacity and train their talents Benefits Social enterprises enhance their management/operational excellence through skill development and the exchange of experiences Professionals use their skills to create positive impact Personal and professional development of ICats Fellows empowers them to take on leading roles in the sustainability sector Track record & future impact Since 2007, 112 professionals joined the ICats Fellowship contributing to the increased quality of life of less advantaged people around the world 16 LGT Venture Philanthropy: Impact Ventures UK With Impact Ventures UK (IVUK) we have an award winning social impact fund scaling purpose in the United Kingdom Key facts IVUK focuses on all UK regions and all UK sectors where social impact can be proven First close at USD 31.6 m (GBP 20.8 m) in 2013, second close at USD 54.7 USD m (GBP 36.0 m) in 2014 Big Society Capital is a cornerstone investor with USD 15.2 m (GBP 10.0 m) LGT VP invested USD 3.0 m (GBP 2.0 m) in the fund; the IVUK team provides management know-how and networks to the selected social enterprises Other investors include Anton Jurgens Fonds and Waltham Forest The IVUK team shares co-investment opportunities, offers regular updates on its portfolio, and provides observations on the social impact market in the UK The IVUK team formed strategic partnerships with The University of Northampton, Wavelength, and GP Bullhound IVUK was recognized with the “Product Innovation Award” by Private Asset Managers in March 2014 Portfolio investments K10: Provides disadvantaged youngsters with an apprenticeship within the construction and non-construction/ corporate sectors in London (Feb 2014) Buddy App: A digital tool to support therapy services in the fields of mental health and well-being (Apr 2014) Homes for Good: Scotland's first lettings agency to specialize in supporting low-income tenants (Aug 2014) Big White Wall: A digital peer network for sufferers of non-acute mental health problems (Aug 2014) Unforgettable: Unforgettable aims to become the ‘go-to’ resource for anyone affected by dementia (Jun 2015) 17 LGT Venture Philanthropy: Our client offering We offer customized options to implement our client’s impact investing/philanthropy engagement efficiently Four main implementation options Support portfolio Selected organizations 1 2 Invest directly into a selected organization from LGT VP’s portfolio You want to invest? 3 You want to donate? Invest into a fund that invests into LGT VP’s portfolio organizations 4 Donate directly to a selected organization from LGT VP’s portfolio Donate to one of LGT VP’s charitable foundations 18 LGT Venture Philanthropy: Our strengths A strong partner for customized impact investing Long-term LGT Venture Philanthropy is a long-term commitment of the Princely Family of Liechtenstein We look for long-term impact, not quick, unsustainable solutions Individual Your personal impact investing/philanthropy preference is at the core of our work We offer customized implementation options and personal reporting for each client Competent Our team and board have combined experience in finance, management consulting and impact investing/philanthropy We are known for the depth of our due diligence and the intensive engagement while investing We build on the experience and proven processes established while working for the Princely Family We can access expert knowledge in HR, accounting, marketing, legal department and asset management at the LGT Group Like-minded The Princely Family has founded LGT Venture Philanthropy to set up efficient and transparent processes and a competent team for their own impact investing/philanthropic engagement Since 2007, the Princely Family and other clients have committed USD 55m through LGT Venture Philanthropy to best-in-class social enterprises Local & Global Our team members are locals; they live and work in six regions across the globe We monitor each engagement locally to ensure efficient use of resources We have a low cost structure through fair local salaries 19 LGT Venture Philanthropy: Our team Our global team is based in six regions and passionate about creating societal impact Board members Countries with local teams and board ■ LGT Venture Philanthropy (LGT VP) is supported administratively by different competence centers within LGT such as legal department, HR, accounting, marketing and asset management. ■ LGT is the largest private wealth & asset management group in Europe that is entirely owned as a family business. The LGT Group Foundation (including LGT VP) is wholly owned by the Prince of Liechtenstein Foundation, and has a strong global presence with around 2148 employees in more than 22 locations in Europe, Asia and the Middle East, with assets under management of USD 131.0 bn (as at Jun 30st, 2015). 20 LGT Venture Philanthropy: Our team Our multinational team with complementary skills and backgrounds is passionate about creating positive impact Senior Management Oliver Karius Partner 2007 (14.5 yrs)1 SAM, Dow Jones Sustainability Index, F&C, Forma Futura, MunichRe LGT Venture Philanthropy Foundation Board Raf Goovaerts Partner 2013 (14 yrs) Dr. Alexander Leeb* Chairman: Plansee, Leder&Schuh Intl., LGT Venture Philanthropy Former Chairman: BCG Asia HSH Prince Max of Liechtenstein* CEO, LGT Group Elliott Donnelley Reynir Indahl Dr. Erik Müller* Stefan Kalmund Founder/ Managing Partner, White Sand Investors Group Partner with Altor Equity Partners Member of Executive Board, First Advisory Group Managing Director of the Kalmund Family Office Investment Management (based in their region) Juan Carlos Moreno Latin America 2009 (11 yrs) Graham Day Latin America 2013 (7 yrs) Client Advisory Helena Hasselmann Samuel Senyimba Africa Latin America 2009 (8.5 yrs) 2015 (10.5 yrs) Winnie Mwangi Africa 2015 Beatrice Gitu Africa 2015 Dr. Katharina Sommerrock 2013 (8 yrs) Alexander Brunner 2014 (12 yrs) Impact, Talent & Operations Inderpreet Chawla India 2010 (11.5 yrs) Rajat Aurora India 2012 (6.5 yrs) En Lee Southeast Asia 2013 (12 yrs) Veselina Kertikova Southeast Asia 2015 (8 yrs) David Soukhasing Southeast Asia 2014 (8 yrs) Crystal Ding China 2010 (8 yrs) Tom Kagerer COO 2010 (10 yrs) Dr. Marc Moser 2014 (4 yrs) Investment Controlling José Carlos Carvalho 2013 (11 yrs) Marketing & Communications Natija Dolic 2009 (7 yrs) Office Management Susie Arnott UK 2014 (15 yrs) 1 Year Shantanu Bhagwat UK 2015 (5 yrs) Chris Hunter UK 2014 (8 yrs) Jennifer Webb UK 2014 (5 yrs) Lucy Inmonger UK 2015 (6 yrs) joined LGT Venture Philanthropy (years of relevant experience prior to joining) * Board member of Impact Ventures S.A., SICAV-SIF Shishir Malhotra UK 2014 (1 yr) Jared Tausz UK 2015 (5 yrs) Faye Forster 2015 Luci Athanassiou 2012 (3.5 yrs) Harriet Simon 2015 (28 yrs) 21 LGT Venture Philanthropy: Our recognitions We have been internationally recognized for our impact investing work, philanthropy offering, and the IVUK fund Most Impactful Funder / Social Enterprise 2015 Together with our portfolio organization Kennemer Foods International we won the Singapore Venture Capital & Private Equity Association (SVCA) Award Best Social Impact Investor 2014 Sustainable Investment Awards by Investment Week Outstanding Philanthropy Offering 2014 Highly Commended, Global Wealth Award by Private Banker International Product Innovation Award 2014 for the Impact Ventures UK fund by Private Asset Managers 22 LGT Venture Philanthropy: Contact information It all starts with a personal conversation. Contact us to arrange a meeting. We are looking forward to meeting you. Natija Dolić Head of Marketing & Communications Phone: +41 44 256 8120 Email: natija.dolic@lgtvp.com Website: www.lgtvp.com Support LGT Venture Philanthropy is funded through substantial contributions from each of the following LGT Group companies: LGT Bank Ltd., LGT Bank (Switzerland) Ltd., LGT Bank (Austria) AG, LGT Bank (Singapore) Ltd., LGT (Middle East) Ltd., and LGT Capital Partners Ltd. 38 Disclaimer This publication is produced by LGT Venture Philanthropy, the Venture Philanthropy and Impact Investing department of LGT Bank (Switzerland) Ltd. (hereafter LGT VP). The contents of this publication have been prepared by our staff and are based on sources of information we consider to be reliable. However, we cannot provide any undertaking or guarantee as to it being correct, complete and up to date. The circumstances and principles to which the information contained in this publication relates may change at any time. Once published, therefore, the information shall not be understood as implying that no change has taken place since publication or that it is still up to date. The information in this publication does not constitute an aid for decision-making in relation to financial, legal, tax or other consulting matters, or should decisions be made on the basis of this information alone. It is recommended that advice be obtained from a qualified expert. We disclaim without qualification all liability for any loss or damage of any kind, whether direct, indirect or consequential, which may be incurred through the use of this publication. Venture philanthropy is an approach to philanthropic giving that uses concepts and techniques from the venture capital industry to build strong social organizations by providing them with both financial (grants and high-risk impact investments) and non-financial support in order to increase their societal impact. Impact investments, as an approach, are high-risk investments made into companies and organizations with the intention to generate social and environmental impact (“Impact Investing”). Impact Investing has the character of a high risk investment and therefore entails the risk of a total loss of an investment. It often also means to engage in emerging markets, i.e. in jurisdictions which may not be politically, financially or organizationally stable. Therefore the influence on an investment can be substantially restricted and not guaranteed. Copyrights Icons: http://www.flaticon.com Graph (page 4): http://impactspace.org 24