here

advertisement

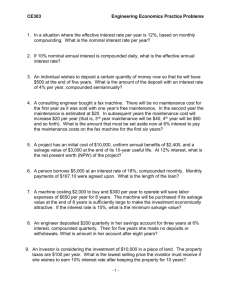

Version A Name_Key_____________________________ ME 353 ENGINEERING ECONOMICS Final Exam – Sample Scoring gives priority to the correct formulas. Numerical answers without the correct formulas for justification receive no credit. Decisions without numerical justification receive no credit. Interest tables and factor formulas are at the end of the exam. 1. (10 Points) A luxury apartment building project requires an investment of $1,250,000. The building has 50 units. We expect the maintenance cost for the apartment building to be $150,000 in the first year, $200,000 in the second year, and will continue to increase by $50,000 per year in subsequent years. The cost to hire a manager for the building is estimated to be $50,000 per year. After five years of operation the apartment building can be sold for $750,000. What is the annual rent per apartment unit that will provide a return on investment of 15%? Assume the building will remain fully occupied during the five years. The Annual Rent for the whole building is the amount that makes the NAW = 0. NAW = -1250(A/P, .15, 5) - 150 – 50(A/G, .15, 5) – 50 + A + 750(A/F, .15, 5) = 0 A = 1250(A/P, .15, 5) + 200 + 50(A/G, .15, 5) – 750(A/F, .15, 5) A = $547.8 thousand per year A = $10,956 per apartment per year Monthly rent is $913. 2. (10 Points) We use the cost of data of problem 1, but now we assume that each apartment unit rents for $1000 per month. In this problem you are to include the effect of taxes. The tax rate on net income per year is 30%. The building is depreciated with the straight-line method using a tax life of 25 years and a tax salvage of zero. Tax on capital gains is 30%. The after tax minimum acceptable rate of return is 12%. We repeat the other data from problem 1. The building project requires an investment of $1,250,000. The building has 50 units. We expect the maintenance cost for the apartment building to be $150,000 in the first year, $200,000 in the second year, and will continue to increase by $50,000 per year in subsequent years. The cost to hire a manager for the building is estimated to be $50,000 per year. After five years of operation the apartment building can be sold for $750,000. Show the after-tax cash flows in the table below. Also, write the formula for the after-tax net present worth of this project. Use as few terms as possible and show time value of money factors with the appropriate interest rates. You do not have to evaluate the formula. Year After Tax Cash Flow 0 -1250 1 -295 2 -260 1 Version A Name_Key_____________________________ 3 -225 4 -190 5 -980 Year 0 1 2 3 4 5 5 - salvage BTCF ($1,250) 400 350 300 250 200 750 Depr 0 50 50 50 50 50 $1,000.00 TI 350 300 250 200 150 -250 Tax 0 105 90 75 60 45 -75 ATCF ($1,250) $295.00 $260.00 $225.00 $190.00 $155.00 $825.00 NPW = -1250 + 295(P/A, .12, 5) - 35(P/G, .12, 5) + 980(P/F, .12, 5) 3. (10 Points) We use the cost of data of problem 1, but now we consider inflation. Do not consider taxes. We first repeat the other data from problem 1. These estimates of future values are estimated with today’s prices, however actual cash flows escalate in the manner described in the next paragraph. The building project requires an investment of $1,250,000. The building has 50 units. We expect the maintenance cost for the apartment building to be $150,000 in the first year, $200,000 in the second year, and will continue to increase by $50,000 per year in subsequent years. The cost to hire a manager for the building is estimated to be $50,000 per year. After five years of operation the apartment building can be sold for $750,000. We assume that each apartment unit rents for $1000 per month. This rent amount is guaranteed to the renters and is not affected by inflation during the five-year period. The maintenance and management costs are expected to escalate in the future at the same rate as general inflation. The resale value of the building will escalate at a 20% rate. The general inflation rate is expected to be 6% per year. The after minimum acceptable rate of return is 18%. This is the market rate of return. Show the cash flows to be used for an analysis in the table below. Indicate whether the cash flows are in real or actual dollars. Also, write the formula for the net present worth of this project. Use as few terms as possible and show time value of money factors with the appropriate interest rates. You do not have to evaluate the formula. Kind of dollars in the cash flow: ___Actual______________ Year Cash Flow 0 -1250 1 388 2 Version A Name_Key_____________________________ 2 319 3 243 4 158 5 1931 Year 0 1 2 3 4 5 5 Rent 0 600 600 600 600 600 Maint/Man Capital -1250 200 0 250 0 300 0 350 0 400 0 750 total 5 Actual -1250 388 319 243 158 65 1866 1931 Real -1250 366 284 204 125 48 1395 1443 ic = 0.18 Compute ir = (0.18 – 0.06)/(1 + 0.06) = 11.32 % NPW = -1250 + 600(P/A, ic, 5) – 200(P/A, ir, 5) – 50((P/G, ir, 5) + 750(1 + .2)5(P/F, ic, 5) or use the cash flow computed in the table. If actual cash flows are used, compute NPW with ic. If real dollars are used, compute NPW with ir. 4. (12 Points) You are considering purchasing a bond with a face value of $1000. The company issuing the bond will pay you an annual interest payment of 10% of the face value. The next interest payment will occur one year from now. The bond matures in 9 years at which time you will receive the face value of the bond. a. What is the most that you should pay for the bond if your minimum acceptable rate of return (MARR) is 15%? The cash flow is -P, the cost of the bond, + 1000 per uear as the interest payments, and +1000 at the end of nine years. The appropriate purchase cost is the value of P that makes the present worth equal to zero. P = 100(P/A, .15, 9) + 1000(P/F, .15, 9) P = 100(P/A, .15, 9) + 1000(P/F, .15, 9) = 100*4.772 + 1000*0.2843 = 477.2 + 284.3 = $761.5 b. Will the purchase price change up or down if the MARR decreases? Explain your answer. The purchase price will increase as the MARR decreases. This occurs because the present worth of the benefits received in the future increase in value as the interest rate decreases. 3 Version A Name_Key_____________________________ c. In addition to the information above, you expect an inflation rate of 7%. The payments from the bond are fixed and are not affected by inflation. You require a real rate of return of 15%. Write a formula with which he can compute the purchase price of the bond in this case. Show numerical interest rates in your formula. The cash flow is in actual dollars. To evaluate P we must use u the interest rate adjusted for inflation. u = 0.15 + 0.07 + 0.15*0.07 = 0.15 + 0.07 + 0.011 = 0.231 P = 100(P/A, 0.231, 9) + 1000(P/F, 0.231, 9) 5. (12 Points) A company is considering producing a new product. The manufacturing process can either be based on manual operations or robotic machines. The manual option costs nothing to install, has operating cost of $300,000 per year and will last indefinitely. The robotic option costs $1,000,000 to install, has no annual operating cost, but will last only 3 years. The manual option has no salvage value, but the robotic option has a salvage value of $500,000 when you sell it after 3 years. Both methods produce the product equally well. Neglect inflation for this problem. Do an after tax analysis to help the company make the right choice. The robotic option is depreciated with the ACRS method using the 3-year class. Depreciation percentages are shown below. The tax rate is 40%. The company’s after tax MARR is 15% per year. Year 1 2 3 4 Percent 33.33% 44.45% 14.81% 7.41% Find the after tax cash flows for the two alternatives. Find the NPW and then find the NAW. Compare. For the Manual process: Operating cost = 300, After tax operating cost is 300*.6 = 180/year. Construct a table for the Robotic operation. Year 0 1 2 3 3 - salvage BTCF -$1,000 0 0 0 500 Depr 0 $333.30 $444.50 $148.10 $74.10 TI -333.3 -444.5 -148.1 425.9 Tax 0 -133.32 -177.8 -59.24 170.36 total 3 ATCF -$1,000 $133.32 $177.80 $59.24 $329.64 $388.88 NPW = -1000 + 133(P/F, .15, 1) + 178(P/F,.15, 2) + 389(P/F, .15, 3) = 494 NAW = 493(A/P, .15, 3) = 216 4 Version A Name_Key_____________________________ Choose the manual process 6. (10 Points) You have three options to perform some function. The required investment and annual costs are shown below. Use a rate of return analysis to select the best. All three options have 0 salvage. Your MARR is 20%. Compute rates to nearest interest rates given in the tables at the end of the test. Option Investment Annual Cost Life A 250 50 5 B 300 55 10 C 215 60 5 Use C as the defender. Challenger is A. Compute ROR A - C NAWA - NAWC = -35(A/P, i, 5) + 10 = 0. (A/P, i, 5) = 10/35 = 0.286 Looking in the 5-year table we find A/P to between 12% and 15%. Reject A - C: Use B as the challenger. NAWB – NAWC = -300(A/P, i, 10) -55 – [215(A/P, i. 5) – 60] -300(A/P, i, 10) + 215(A/P, i, 5) + 5 = 0. Trial and error yields 26% (between 25% and 30%%). Accept B. 7. (12 Points) A chemical plant stores raw materials, finished goods and intermediate products in tanks. The materials are pumped to and from the various processing operations through pipes. There are several pumps in the system. The original investment in the pumps was $500,000 when they were purchased 3 years ago. Unfortunately, there must be a design problem because the pumps are leaking. Last year $180,000 was spent to replace seals and to clean up leaked materials at the pumps. The plant management is tired of the expense of pump repair and is considering two alternatives. The first alternative is to extensively rebuild the pumps. Management likes this idea because the original cost of the pumps will not have been entirely wasted. The renovation cost for the pumps will be $200,000. If this is done the maintenance cost will be reduced to $60,000 next year. If the renovated pumps are kept for a second year, the maintenance cost will increase to $120,000. For the third year, the maintenance cost will be back to $180,000. The renovated pumps will last no more than 3 years. The scrap value of the pumps is $100,000 if they are removed now or at any time in the future. The second alternative is to replace the pumps with an advanced design with gas seals. The cost to purchase and install the gas seal pumps and the gas distribution system that they require is $600,000. The annual cost of maintaining the gas system is $40,000. Its salvage value is zero. The economic life of the new pump system is five years. 5 Version A Name_Key_____________________________ Using a 15% MARR make the most economic decision for the plant. Should the pumps be renovated or replaced? Justify your conclusion. Find the NAC of the new system, the challenger. NAC = 600(A/P, .15, 5) + 40 = 218 Find the NAC of the renovated system, the defender. The investment in the defender is 100 (the scrap value) + 200 (the renovation cost) = 300 NAC(1) = 300(A/P, .15, 1) +60 - 100 = 305 NPC(2) = 300 +60(P/F, .15, 1) + 120(P/F, .15, 2) - 100(P/F, .15, 2) = 367 NAC(2) = 367(A/P, .15, 2) = 225 NPC(3) = 300 +60(P/F, .15, 3) + 60(P/G, .15, 3) - 100(P/F, .15, 3) = 495.5 NAC(3) = 495.5 (A/P, .15, 3) = 217 Defender wins. Keep it for another year. 8. (12 Points) You own a site at which there is the possibility of discovering oil. Your options are: q a1: drill for oil yourself, q a2: lease the site to someone else to drill, q a3: lease the site, but maintain an interest in the results. There are four possible outcomes regarding the success of the well. q q1: 600,000 barrel well, q q2: 400,000 barrel well, q q3: 100,000 barrel well, q q4: dry hole. Your net present worth of the profit depends on which development option you choose and the results of the drilling. NPW Profit Well success q1 q2 q3 q4 a1 800 400 -50 -100 Option a2 60 60 60 60 a3 300 100 0 0 Based on information about the site we make estimates of probabilities of the four results P(q1) = 0.1, P(q2) = 0.15, P(q3) = 0.25, P(q4) = 0.5. a. Compute the expected value of the three drilling options. In order to maximize your expected value, which option should you choose? E(Profit|a1) = 77.5, E(Profit|a2) = 60, E(Profit|a3) = 45. The best decision is to drill the well yourself. 6 Version A b. Name_Key_____________________________ Compute the standard deviations of the option that you chose in part a and the option with the second highest expected value? Comment on what role the standard deviation might play in your decision process. Option a1 a2 a3 Var. 87619 0 8475 Std. Dev. 296 0 92 Only two of these need be computed. The standard deviation is much higher for the drill-it-yourself option. This might cause you to choose the leasing option which has 0 standard deviation. 9. (12 Points) The questions in this problem use the cash flow shown at the right. When formulas are requested in the question, use as few factors as possible. 300 0 1 600 2 900 3 1200 4 5 -1200 a. What is the NAW of the cash flow for a 4-year study period when the MARR is 0%? Sum up the cash flows and divide by 4. sum = 1800. A = 1800/4 = 450. b. Write the formula for the NAW. Use i as the interest rate in the formula. NAW = -1200(A/P, i, 4) + 300 + 300(A/G, i, 4) c. We compute the NAW of the cash flow using i = 30% to be $99.53. Now we want to analyze the cash flow with inflation. Say the general inflation rate is 10% and the cash flow above is expressed in real dollars. The value of ir = 30%. Write the formula for the NPW expressed in actual dollars. Use a numerical interest rate in your formula. NPW = 99.53(P/A, .3, 4) 7 Version A rate in your formula. d. The $1200 value at time 0 is an investment. We depreciate the investment using the SYD method with a tax life of 4 years and a tax salvage of 0. Write the formula for the NAW of the after tax cash flows. The tax rate is 50%. Use i as the after-tax MARR. Name_Key_____________________________ D1 = (4/10)1200 = 480 AT1 = 300 – (300-480).5 = 390 D2 = (3/10)1200 = 360 AT2 = 600 – (600 – 360).5 = 480 The gradient is 90. NAW = -1200(A/P, i, 4) + 390 + 90(A/G, i, 4) 8 Version A Name_Key_____________________________ Compound Interest Factors Single Payment Compound Amount Factor Single Payment Present Worth Factor Uniform Series Compound Amount Factor Uniform Series Sinking Fund Factor Uniform Series Present Worth Factor (F/P, i, n) = (1 + i)n 1 1 = (F/P,!i,!n)! n (1!+!i) (1!+!i)n!–!1 (F/A, i, n) = i i 1 (A/F, i, n) = = (1!+!i)n!–!1 (F/A,!i,!n)! (P/F, i, n) = (1!+!i)n!–!1 i(1!+!i)n i(1!+!i)n 1 (A/P, i, n) = = (P/A,!i,!n)! (1!+!i)n!–!1 (P/A, i, n) = Uniform Series Capital Recovery Factor Arithmetic Gradient Present Worth Factor (1!+!i)n!–!in !!–!1 i2(1!+!i)n (1!+!i)n!–!in !!–!1 (A/G, i, n) = i(1!+!i)n!–!i (P/G, i, n) = Arithmetic Gradient Uniform Series Factor Factor Table for 10 and 5 periods at various interest rates Interest Periods F/P 10 P/F A/F A/P F/A P/A A/G P/G 10 Interest 0.00% 1.000 1.0000 0.1000 0.1000 10.000 10.000 4.500 45.000 0 . 0 0 % 0.25% 1.025 0.9753 0.0989 0.1014 10.113 9.864 4.479 44.184 0 . 2 5 % 0.50% 1.051 0.9513 0.0978 0.1028 10.228 9.730 4.459 43.386 0 . 5 0 % 0.75% 1.078 0.9280 0.0967 0.1042 10.344 9.600 4.438 42.606 0 . 7 5 % 1% 1.105 0.9053 0.0956 0.1056 10.462 9.471 4.418 41.843 1% 2% 1.219 0.8203 0.0913 0.1113 10.950 8.983 4.337 38.955 2% 3% 1.344 0.7441 0.0872 0.1172 11.464 8.530 4.256 36.309 3% 4% 1.480 0.6756 0.0833 0.1233 12.006 8.111 4.177 33.881 4% 5% 1.629 0.6139 0.0795 0.1295 12.578 7.722 4.099 31.652 5% 6% 1.791 0.5584 0.0759 0.1359 13.181 7.360 4.022 29.602 6% 7% 1.967 0.5083 0.0724 0.1424 13.816 7.024 3.946 27.716 7% 8% 2.159 0.4632 0.0690 0.1490 14.487 6.710 3.871 25.977 8% 9% 2.367 0.4224 0.0658 0.1558 15.193 6.418 3.798 24.373 9% 10% 2.594 0.3855 0.0627 0.1627 15.937 6.145 3.725 22.891 10% 12% 3.106 0.3220 0.0570 0.1770 17.549 5.650 3.585 20.254 12% 15% 4.046 0.2472 0.0493 0.1993 20.304 5.019 3.383 16.979 15% 18% 5.234 0.1911 0.0425 0.2225 23.521 4.494 3.194 14.352 18% 20% 6.192 0.1615 0.0385 0.2385 25.959 4.192 3.074 12.887 20% 25% 9.313 0.1074 0.0301 0.2801 33.253 3.571 2.797 9.987 25% 30% 13.786 0.0725 0.0235 0.3235 42.619 3.092 2.551 7.887 30% 35% 20.107 0.0497 0.0183 0.3683 54.590 2.715 2.334 6.336 35% 40% 28.925 0.0346 0.0143 0.4143 69.814 2.414 2.142 5.170 40% 45% 41.085 0.0243 0.0112 0.4612 89.077 2.168 1.973 4.277 45% 9 Version A 50% Interest Name_Key_____________________________ 57.665 Periods F/P 0.0173 0.0088 0.5088 113.330 P/F A/F A/P 1.965 1.824 3.584 5 F/A P/A A/G 50% 5 Interest P/G 0.00% 1.000 1.0000 0.2000 0.2000 5.000 5.000 2.000 10.000 0 . 0 0 % 0.25% 1.013 0.9876 0.1990 0.2015 5.025 4.963 1.995 9.901 0 . 2 5 % 0.50% 1.025 0.9754 0.1980 0.2030 5.050 4.926 1.990 9.803 0 . 5 0 % 0.75% 1.038 0.9633 0.1970 0.2045 5.076 4.889 1.985 9.706 0 . 7 5 % 1% 1.051 0.9515 0.1960 0.2060 5.101 4.853 1.980 9.610 1% 2% 1.104 0.9057 0.1922 0.2122 5.204 4.713 1.960 9.240 2% 3% 1.159 0.8626 0.1884 0.2184 5.309 4.580 1.941 8.889 3% 4% 1.217 0.8219 0.1846 0.2246 5.416 4.452 1.922 8.555 4% 5% 1.276 0.7835 0.1810 0.2310 5.526 4.329 1.903 8.237 5% 6% 1.338 0.7473 0.1774 0.2374 5.637 4.212 1.884 7.935 6% 7% 1.403 0.7130 0.1739 0.2439 5.751 4.100 1.865 7.647 7% 8% 1.469 0.6806 0.1705 0.2505 5.867 3.993 1.846 7.372 8% 9% 1.539 0.6499 0.1671 0.2571 5.985 3.890 1.828 7.111 9% 10% 1.611 0.6209 0.1638 0.2638 6.105 3.791 1.810 6.862 10% 12% 1.762 0.5674 0.1574 0.2774 6.353 3.605 1.775 6.397 12% 15% 2.011 0.4972 0.1483 0.2983 6.742 3.352 1.723 5.775 15% 18% 2.288 0.4371 0.1398 0.3198 7.154 3.127 1.673 5.231 18% 20% 2.488 0.4019 0.1344 0.3344 7.442 2.991 1.641 4.906 20% 25% 3.052 0.3277 0.1218 0.3718 8.207 2.689 1.563 4.204 25% 30% 3.713 0.2693 0.1106 0.4106 9.043 2.436 1.490 3.630 30% 35% 4.484 0.2230 0.1005 0.4505 9.954 2.220 1.422 3.157 35% 40% 5.378 0.1859 0.0914 0.4914 10.946 2.035 1.358 2.764 40% 45% 6.410 0.1560 0.0832 0.5332 12.022 1.876 1.298 2.434 45% 50% 7.594 0.1317 0.0758 0.5758 13.188 1.737 1.242 2.156 50% 10 Version A Name_Key_____________________________ Factor Table for an interest rate of 15%. Interest n Rate F/P 15% P/F A/F A/P F/A P/A A/G P/G 15% n 1 1.150 0.8696 1.0000 1.1500 1.000 0.870 0.000 0.000 1 2 1.323 0.7561 0.4651 0.6151 2.150 1.626 0.465 0.756 2 3 1.521 0.6575 0.2880 0.4380 3.473 2.283 0.907 2.071 3 4 1.749 0.5718 0.2003 0.3503 4.993 2.855 1.326 3.786 4 5 2.011 0.4972 0.1483 0.2983 6.742 3.352 1.723 5.775 5 6 2.313 0.4323 0.1142 0.2642 8.754 3.784 2.097 7.937 6 7 2.660 0.3759 0.0904 0.2404 11.067 4.160 2.450 10.192 7 8 3.059 0.3269 0.0729 0.2229 13.727 4.487 2.781 12.481 8 9 3.518 0.2843 0.0596 0.2096 16.786 4.772 3.092 14.755 9 10 4.046 0.2472 0.0493 0.1993 20.304 5.019 3.383 16.979 10 11 4.652 0.2149 0.0411 0.1911 24.349 5.234 3.655 19.129 11 12 5.350 0.1869 0.0345 0.1845 29.002 5.421 3.908 21.185 12 13 6.153 0.1625 0.0291 0.1791 34.352 5.583 4.144 23.135 13 14 7.076 0.1413 0.0247 0.1747 40.505 5.724 4.362 24.972 14 15 8.137 0.1229 0.0210 0.1710 47.580 5.847 4.565 26.693 15 16 9.358 0.1069 0.0179 0.1679 55.717 5.954 4.752 28.296 16 17 10.761 0.0929 0.0154 0.1654 65.075 6.047 4.925 29.783 17 18 12.375 0.0808 0.0132 0.1632 75.836 6.128 5.084 31.156 18 19 14.232 0.0703 0.0113 0.1613 88.212 6.198 5.231 32.421 19 20 16.367 0.0611 0.0098 0.1598 102.444 6.259 5.365 33.582 20 21 18.822 0.0531 0.0084 0.1584 118.810 6.312 5.488 34.645 21 22 21.645 0.0462 0.0073 0.1573 137.632 6.359 5.601 35.615 22 23 24.891 0.0402 0.0063 0.1563 159.276 6.399 5.704 36.499 23 24 28.625 0.0349 0.0054 0.1554 184.168 6.434 5.798 37.302 24 25 32.919 0.0304 0.0047 0.1547 212.793 6.464 5.883 38.031 25 26 37.857 0.0264 0.0041 0.1541 245.712 6.491 5.961 38.692 26 27 43.535 0.0230 0.0035 0.1535 283.569 6.514 6.032 39.289 27 28 50.066 0.0200 0.0031 0.1531 327.104 6.534 6.096 39.828 28 29 57.575 0.0174 0.0027 0.1527 377.170 6.551 6.154 40.315 29 30 66.212 0.0151 0.0023 0.1523 434.745 6.566 6.207 40.753 30 31 76.144 0.0131 0.0020 0.1520 500.957 6.579 6.254 41.147 31 32 87.565 0.0114 0.0017 0.1517 577.100 6.591 6.297 41.501 32 33 100.700 0.0099 0.0015 0.1515 664.666 6.600 6.336 41.818 33 34 115.805 0.0086 0.0013 0.1513 765.365 6.609 6.371 42.103 34 35 133.176 0.0075 0.0011 0.1511 881.170 6.617 6.402 42.359 35 36 153.152 0.0065 0.0010 0.1510 1014.35 6.623 6.430 42.587 36 40 267.864 0.0037 0.0006 0.1506 1779.09 6.642 6.517 43.283 40 48 819.401 0.0012 0.0002 0.1502 5456.00 6.659 6.608 44.00 48 50 1083.7 0.0009 0.0001 0.1501 7217.72 6.661 6.620 44.10 50 inf. inf. 0.0000 0.0000 0.1500 6.6667 6.667 44.44 inf. inf. 11