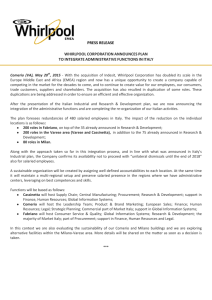

Whirlpool Corporation NYSE: (WHR)

advertisement