Dabur India Limited

advertisement

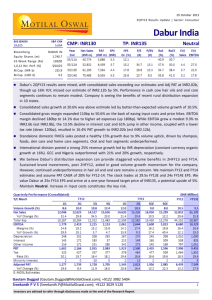

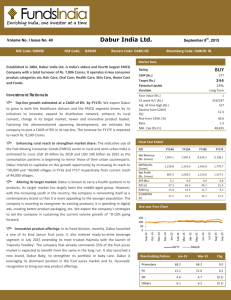

Dabur India Limited India Limited Morgan Stanley – 14th Annual India Summit, Mumbai June 2012 Indian Economy Annual disposable income Annual disposable income (US$ bn) Real GDP Growth Rate – YoY (%) 2,000 1,800 1 600 1,600 1,400 1,200 1,000 800 600 400 200 0 Source: CSO and RBI estimates 2008 2009 2010 2011 2012 Source: Euromonitor WPI Inflation – YoY (%) Overview Indian economy faced some slow down in growth trajectory with Real GDP growth at 7% for FY12 Personal disposable income continued upward trend Though inflation seems to be trending down over the last few months, it continues to remain volatile Source: Office of Economic Adviser 2 FMCG Sector Overview FMCG Industry Size (in Rs. bn) FMCG Industry Urban (in Rs. bn) FMCG Industry Rural (in Rs. bn) Source: AC Nielsen Overview FMCG sector in India continued on a strong growth path with both Urban and Rural India contributing to growth. Rural India contributes to c. one third of FMCG sales in India Growth driven by increasing consumption led by rise in incomes, changing lifestyles and favorable demographics As per a study conducted by Booz & Company, FMCG sector is expected to grow in the range of 12% to 17% upto 2020 and would touch a market size between of Rs. 4,000 to Rs. 6,200 billion by 2020 3 FMCG Industry Growth Drivers Shift from unorganised to organised Rise in per capita category consumption • Evidenced by growth in hair oils • Current level of un‐ organised presence presence is a key driver for future volume growth • Level of per capita increase in consumption in the y future is a key variable for future volume growth • Demonstrated by recent strong growth in branded growth in branded foods Increase in penetration Rural Consumption • Category Category penetration continues to be abysmally low in various categories like instant branded foods, OTC, skin creams, etc. indicating scope for g volume growth through increase in penetration • Driven by a Driven by a combination of increasing incomes (MSPs, NREGS etc.) and higher aspiration levels there is an increased demand for branded products in Rural p India Above drivers aided by favourable demographics and rise in disposable incomes indicate that India’s consumption story is robust 4 Strong Rural Growth Rural India Contributes to a third of the FMCG sector in India Rural consumers’ wallet has expanded driven by factors such higher MSPs (Minimum Support Prices) for agricultural produce, loan waivers and employment guarantee schemes Aspiration p levels continue to trend upwards p with rural consumers preferring branded products Rural growth has clearly caught up and in some periods, even exceeded urban growth FMCG Growth Urban v/s Rural MSPs for Paddy and Wheat (Rs. per quintal) 5 Category Penetration Levels 90% 80% 77% 80% 67% 70% 59% 57% 60% 50% 42% Rural Penetration 37% 40% Urban Penetration 32% 30% 26% 18% 20% 19% 18% 10% 3% 2% 5% 4% 0% Toothpaste Shampoo Hair Oil Skin Cream Mosquito Repellants Instant Noodles Hair Dyes Floor Cleaners Source: Industry data Low penetration levels offer room for growth across consumption categories Rural penetration still lower but catching up with urban penetration levels 6 Per Capita Consumption Skin Care – Per Capita Consumption (in US$) 9 2.7 3 7.7 7.4 8 Shampoo – Per Capita Consumption (in US$) 2.5 2.4 7 2 6 5 4 1.5 3.2 1.0 1.1 1 3 0.8 2 1 0.3 0.5 0.3 0 0 China Indonesia India Malaysia China Thailand Indonesia India Malaysia Thailand Toothpaste – Per Capita Consumption (in US$) 3.5 2.9 3 2.5 20 2.0 2 1.5 1 1.0 0.5 0.4 0.5 0 China Indonesia India Malaysia Thailand Source: MOSL India has very low per capita consumption levels as compared to other emerging economies 7 Dabur Overview Established in 1884 - more than 125 Years of Trust & Excellence Among top 4 FMCG companies in India World’s largest in Ayurveda and natural healthcare Revenue of Rs. 53.2 billion and profits of Rs. 6.4 6 billion b ll in FY2011-12 20 2 Strong brand equity Dabur is a household brand Vatika and Real are Superbrands Hajmola , Real & Dabur ranked among India’s Most Admired Brands 12 Billion Rupee Brands having turnover of over Rs. 1 billion each Wide distribution network covering 3.4 million retailers across the country 17 world class manufacturing plants catering to needs of diverse markets Strong overseas presence with c. 30% contribution to consolidated sales Twelve Billion Rupee Brands Dabur has been ranked as the Most Trusted Leader in the Healthcare category in the Brand Trust Report 2012 Dabur ranked as No. 2 Most Social Brand of India, in the Social Media report launched at Click Asia Summit 2012 “Dabur has recently surpassed the US$ 1 billion mark in revenues” Dabur ranked the No. 2 Indian Green Brand by Green Brands Global Survey 8 Performance At A Glance (5 years) Sales (Rs. billion) Net Sales Net Profit (Rs. billion) 6.5 52.8 5.7 5.0 40.8 28.1 33.9 3.9 3.3 23.6 FY08 FY09 FY10 FY11 FY12 FY08 EBITDA (Rs. billion) FY09 FY10 FY11 FY12 Shareholders Funds (Rs. billion) 9.5 17.2 8.3 13.9 6.7 5.2 44 4.4 8.2 93 9.3 6.2 FY08 FY09 FY10 FY11 FY12 FY08 FY09 FY10 FY11 FY12 9 Global Footprint UK Turkey y Canada U.S. Egypt UAE Nepal B’Desh Nigeria Domestic Mfg. Locations Key markets Manufacturing Facilities Our strategy is to localize manufacturing, manufacturing supply chain and product offerings to suit consumer requirements in each geography 10 Distribution Overview Factory Depot Stockists (Carry & Forward Agents) Insti Stockists Super stockists Modern Trade Stockist Direct Dealer Co‐operatives Wholesalers Retail trade Military / CSD Sub stockists Co‐Op Stores Rural trade Unit Canteens Shoppers & Consumers Insti customers Direct reach 0.7 Mln outlets Direct + Indirect Reach is around 3.4 Mln Retail Outlets 11 Presence in FMCG Categories Category Position Market Share Key Brands Hair Care 3 12% Dabur Amla hair Oil, Vatika hair oil & Vatika Shampoos Oral Care 3 13% Red toothpaste, Babool, Meswak, Red toothpowder Ayurvedic Tonics 1 67% Dabur Chyawanprash Digestives 1 56% Hajmola Fruit Juices 1 52% Real Fruit Juices, Real Activ Honey 1 50% Dabur Honey Gl Glucose 2 25% Dabur Glucose Skin Care (Bleaches) ( ) 1 50% Fem Hair care includes Hair Oils & Shampoos; Oral care includes Toothpastes & Toothpowder; Digestives includes herbal digestives; Market share is based on AC Nielson data and industry estimates 12 Business Structure Dabur India Li it d Limited International Business (30.3%) Domestic Business (69.7%) Consumer Care (56.0%) Foods (10.1%) Retail (0.8%) Others* (2.7%) Dabur International (17.5%) Hobi Group (2.6%) Namaste Labs. LLC (10.3%) Note: % figure in brackets indicate % share in Consolidated Sales for FY12 * Others includes Commodity Exports etc 13 Consumer Care Overview Category‐wise Share of Consumer Care Sales Oral Care 17% Skin Care 6% Home Care 6% Hair Care 30% Health Supplements 21% Digestives 8% OTC & Ethicals 12% Hair Care is the largest category and contributes to 30% of Consumer Care sales Health H lth Supplements S l t contribute t ib t to t 21% off Consumer C C Care sales l Oral Care, comprising toothpastes and toothpowders contributes to 17% of Consumer Care sales Note: Percentage share based on revenue for FY12 14 Consumer Care Categories Hair Oils Key Brands #2 player in Hair Oils Dabur Amla: Largest brand in the portfolio Vatika: Value added coconut oil Shampoo Key Brands #4 player l in i Shampoos Vatika range of shampoos 15 Consumer Care Categories Oral Care Key Brands #3 player in Toothpastes #2 player in Toothpowder Dabur Red: Ayurvedic Toothpaste & Toothpowder Meswak: Premium Babool: Herbal toothpaste for economy herbal toothpaste segment Skin Care Key Brands #2 player in Ski Skin Lightening Gulabari range of rose based skin care products Uveda: Range of Ayurvedic Skin Care Fem range off F Bleaches 16 Consumer Care Categories Health Supplements Key Brands #1 p player y in Ayurvedic Tonics #2 player in Glucose #1 player in branded Honey Dabur Chyawanprash: Largest selling health supplement in the country Dabur Glucose: 2nd largest player in the country Dabur Honey: Largest branded honey in the country Di Digestives ti Key Brands #1 player l in i Herbal Digestives Hajmola: Flagship brand for Herbal Digestives Hajmola tasty digestive candy 17 Consumer Care Categories Home Care Key Brands #1 player in Air Fresheners #1 player in Mosquito Repellant Creams #2 player in Toilet Cleaners Odonil: Air freshner range Odomos: Mosquito repellant skin cream Sanifresh: Toilet cleaner Odonil became one of the Billion Rupee Brands during 2011-12 18 Consumer Care Categories OTC and d Ethicals Ethi l Description Repository of Dabur’s Ayurvedic Healthcare knowledge Range of over 260 products Focusing on multiple therapeutic areas. Distribution coverage of 200,000 chemists, ~12,000 vaidyas & 12,000 Ayurvedic pharmacies Focus on growing the OTC Health-Care portfolio aggressively CHD Structure OTC (64%) ETHICAL (36%) Generics Tonic Branded Products Classicals Branded Ethicals Healthcare Focus OTC Healthcare is Rs.130 billion size industry Expected E t d to t grow att 14-15% 14 15% p.a. as preference for Over-the-Counter products accelerates Dabur to expand its presence by : Consolidating / expanding current portfolio Launching new products in emerging therapeutic areas Look at inorganic opportunities Acquired the energizer brand, Thirty Plus from Ajanta Pharma in May 2011 Range of OTC products 19 Foods Business Foods portfolio comprises Fruit Juices and Culinary range Fruit Juices are under the brands – Real, Activ and Burrst Culinary range is under Hommade brand Foods business has surpassed the Rs. 5 billion mark in sales during FY2011-12 Foods Key Brands #1 player in Fruit Juices Real: Flagship beverages brand Real Activ: Range off 100% pure juice j i 20 Sales & Distribution Initiatives Project SPEED Distribution structure re‐organised during 2011‐12 to build scale and maintain focus on 3 specialized categories : Health care, Home and Personal care, Foods Project j completed p byy October 2011 – Distributor count rationalized to 3,600 as compared to 4,500 prior to project SPEED – Stockist disengagement of 80% of FEM & 16% of CHD network; merged into Consumer Care Exclusive stockists in metros and large cities; common in smaller towns Greater category focus among front end teams Aimed at enhancingg distribution efficiencyy and throughput g p Project DOUBLE Project Double initiated in FY2011‐12 to expand direct coverage in rural markets Pilots in UP and Maharashtra to test the feasibility Project being rolled out to 8 other states having significant rural potential : MP, Bihar, West Bengal, Assam, Karnataka, Rajasthan, Orissa, Punjab Deployment of field resources at local village level : addition of about 1600 2000 feet on street addition of about 1600 ‐2000 feet on street Aimed at increasing rural penetration and driving growth of broader portfolio Population in Mln Rural Urban Total Population 833.1 377.1 1210.2 Popln incr ‘01‐ ’11 90.9 90.5 181.4 Increasing Urbanisation in the last decade, yet Rural population at 69% l i 69% 21 International Business Started as an Exporter Focus on Order fulfillment through India Mfg. 1980’s Set up a franchisee at Dubai in 1989 Demand generation led to setting up of mfg in Dubai & Egypt Acquired & renamed franchisee as Dabur International Ltd Local operations further strengthened Set up new mfg facilities in Nigeria, RAK & Bangladesh Early 90’s 2003 Onwards Highlights Dabur’s overseas business contributes c. 30% to consolidated sales led by CAGR of 37% in last 7 years Focus markets: GCC Egypt Nigeria Turkey Bangladesh Nepal U.S. High level of localization of manufacturing and sales and marketing Leveraging the “Natural” preference among local consumers to increase share in personal g care categories Sustained investments in brand building and marketing Building scalescale c. c 30% of Consol. Sales High Levels of Localization Global Supply chain Today High Growth in IBD* in Rs. million 16,161 18000 16000 14000 12000 8,922 10000 8000 6000 4000 2000 2,258 2,917 1,281 1,807 3,760 4,770 6,025 0 FY04 FY05 FY06 FY07 FY08 FY09 FY10 FY11 FY12 International Sales Breakdown* (FY12) * Including overseas acquisitions 22 Africa and Middle East Potential Real GDP Growth Rates (YoY) in % Source: IMF Africa’s Bulging Base Source: McKinsey on Africa Africa, June 2010 Middle East and Africa have witnessed stable GDP growth rates Total GDP of African economies is around US$ 1 trillion i.e. similar to India Between 2005 and 2015, it is estimated that in Africa, the share of individuals earning above US$1,000 will grow from 39% to 55%. The rapidly emerging African middle class could number as many as 300 million, out of a population p of one billion total p The sheer volumes and the growth in the number of consumers with disposable income creates huge opportunities for consumer products companies 23 Our Strategy Three pronged Growth Strategy Expand Innovate Acquire Our differentiation is the herbal and ayurvedic platform E Expand d Strengthening presence in existing categories and markets as well entering new geographies Maintain dominant share in categories where we are category builders like Health Supplements, Honey etc. etc and expand market shares in other categories Calibrated international expansion – local manufacturing and supply chain to enhance flexibility / reduce response time to change in market demands Innovate Strong focus on innovation. Have rolled out new variants & products which have contributed to around 5-6% of our growth p.a. Renovation of existing products to respond to changing demands (Toothpowder to Toothpaste) Acquire Acquisitions critical for building scale in existing categories & markets Should be synergistic and make a good strategic fit Target opportunities in our focus markets 24 Acquisition of Hobi Group, Turkey A Acquisition i ii off Hobi H bi Group, G T k Turkey f for a totall consideration of US$ 69 Million completed on October 7, 2010 Hobi manufactures and markets hair, skin and body care products under the brands Hobby and New Era Product range of the company complementary l t t our product to d t range is Acquisition provides an entry into another attractive emerging market and a good platform to leverage this across the region 25 Acquisition of Namaste Laboratories Dabur India Limited through its subsidiary Dabur International Limited acquired 100% stake in Namaste Laboratories LLC for $100 million, in an all-cash deal on January 1, 2011 Namasté is a leading ethnic hair care products company, having products for women of colour, l with ith revenues off c. $95 million illi (CY2010) from f US E US, Europe, Middle Middl East E t and d African Af i markets The company markets a portfolio of hair care products under the brand ‘Organic Root Stimulator’ and has a strong presence in ethnic hair care market for women of colour. Acquisition to enable entry into Ethnic Hair Care products market valued at more than US$1.5 billion and tap into significant market opportunity in the fast growing, hugely populated (~1 Bn) yet highly underpenetrated consumer markets of Sub Saharan Africa Dabur would leverage its own network in Africa and Middle East to grow the business aggressively in these markets We have commenced local manufacturing for Namaste at our RAK facility in UAE 26 Recent Performance: Q4 FY2011-12 Revenue (in Rs. Cr.) EBITDA (in Rs. Cr.) PAT (in Rs. Cr.) Consolidated Sales grew by 23.0% during Q4FY12. Sales growth was a combination of volume growth and price increases and marginal translation gains Volume growth was at 12.4% EBITDA increased by 4.2% while EBITDA margin was lower at 17.8% in Q4FY12 v/s 21.1% in Q4FY11 Material costs were at 50.2% of sales vis‐à‐vis 47% in Q4FY11 Adpro during the quarter increased to 13.4% 13 4% as compared to 11.5% in previous year Consolidated PAT reported growth of 16.0% This was despite severe input cost pressure and increase in advertising and promotional costs 27 Market Cap & Shareholding Market Capitalization in Rs. billion 180 174 Shareholding Structure* DIIs, 6.4% Others, 6.4% FIIs, 18.4% Promoters, 68.7% 17 2001 2012 2011 *As on March 31, 2012 Dabur ranked as the organization that offers the best return to investors by the 6th Social & Corporate Governance Awards, presented by the Bombay Stock Exchange 28 Consolidated P&L I R In Rs. crores Q4FY12 Q4FY11 Y Y (%) YoY FY12 FY11 1363.6 1108.2 23.0% 5,283.2 4,077.4 29.6% 9.0 5.9 53.7% 22.2 27.1 ‐17.9% Material Cost 684.9 521.3 31.4% 2,685.2 , 1,937.5 , 38.6% % of Sales 50.2% 47.0% 50.8% 47.5% Employee Costs 95.6 87.3 387.4 308.7 % of Sales 7.0% 7.9% 7.3% 7.6% Ad Pro 182.0 127.4 659.5 534.6 % of Sales 13.4% 11.5% 12.5% 13.1% Other Expenses 185.7 161.0 683.1 522.5 % of Sales % of Sales 13 6% 13.6% 14 5% 14.5% 12 9% 12.9% 12 8% 12.8% 19.0 16.3 16.7% 57.4 32.1 78.6% EBITDA 243.3 233.4 4.2% 947.6 833.4 13.7% % of Sales f 17.8% 21.1% 17.9% 20.4% Interest Exp. and Fin. Charges 5.7 15.9 53.8 30.3 Depreciation + Amortization 29.3 29.1 103.2 95.2 208.3 188.4 10.5% 790.5 707.9 11.7% 37.7 41.4 ‐8.9% 146.4 139.0 5.3% 170.5 147.0 16.0% 644.1 568.9 13.2% 0.0 0.0 ‐0.8 0.3 PAT (After Extra ordinary item & Minority Int) 170.5 147.0 644.9 568.6 % of Sales 12.5% 13.3% 12.2% 13.9% Net Sales Other Operating Income Other Non Operating Income Profit Before Tax (PBT) Tax Expenses PAT(After exceptional Items) Minority Interest ‐ (Profit)/Loss 9.6% 42.9% 15.4% 16.0% Y Y (%) YoY 25.5% 23.4% 30.7% 13.4% 29 Consol. Statement of Assets & Liabilities Particulars (in Rs. crores) ( ) A 1 2 3 4 5 B 1 2 EQUITY AND LIABILITIES Shareholders’ funds (a) Share capital (b) Reserves and surplus ( )M (c) Money received against share warrants i d i t h t Sub‐total ‐ Shareholders' funds Share application money pending allotment Minority interest * Non‐current liabilities (a) Long‐term borrowings (b) Deferred tax liabilities (net) (b) Deferred tax liabilities (net) (c) Other long‐term liabilities (d) Long‐term provisions Sub‐total ‐ Non‐current liabilities Current liabilities (a) Short‐term borrowings (b) Trade payables (b) Trade payables (c) Other current liabilities (d) Short‐term provisions Sub‐total ‐ Current liabilities TOTAL ‐ EQUITY AND LIABILITIES ASSETS Non‐current Non current assets assets (a) Fixed assets (b) Goodwill on consolidation * (c) Non‐current investments (d) Deferred tax assets (net) (e) Long‐term loans and advances (f) Other non‐current assets (f) Other non current assets Sub‐total ‐ Non‐current assets Current assets (a) Current investments (b) Inventories (c) Trade receivables ((d) Cash and cash equivalents ) q (e) Short‐term loans and advances (f) Other current assets Sub‐total ‐ Current assets TOTAL ‐ ASSETS As at ((current year end) ) 31/03/2012 As at ((previous year end) ) 31/03/2011 174 1,543 ‐ 1,717 174 1,217 ‐ 1,391 3 4 727 27 27 ‐ 658 1,412 717 19 19 ‐ 578 1,314 347 859 859 120 164 1,490 4,622 303 661 661 109 141 1,214 3,923 869 799 89 ‐ 433 72 2,262 732 799 2 ‐ 340 101 1,974 393 824 462 448 154 79 2,360 4,622 418 709 355 280 127 60 1,949 3,923 30 Disclaimer Some of the statements made in this presentation contain forward looking information that involve a number of risks and uncertainties. Such statements are based on a number of assumptions, estimates, projections or plans that are inherently subject to significant risks, as well as uncertainties and contingencies that are subject to change. Actual results can differ materially from those anticipated in the Company´s forward‐looking statements as a result of a variety of factors, including those set forth from time to time in the Company´s press releases and reports and those set forth from time to time in the Company´s analyst calls and discussions. We do not assume any obligation to update the forward‐looking statements contained in this presentation. presentation No part of this presentation shall form the basis of or may be relied upon in connection with any contract or commitment. This presentation is being presented solely for your information and is subject to change without notice. 31