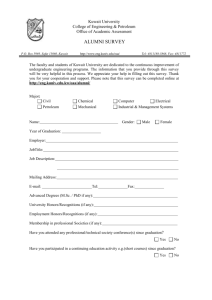

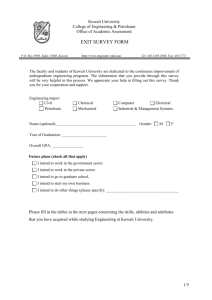

Kuwait's - United Nations Economic and Social Commission for

advertisement