As of 3/31/2015

Investment Objective & Strategy

Fund Statistics

Morningstar Equity Style Box

Large

LOVIX Portfolio Date: 3/31/2015

Investment Objective: The Fund seeks to achieve long- Ticker

term capital appreciation and preservation of capital

Equity Style

Investment Manager

Lee Financial Group Hawaii, Inc

while lowering volatility.

21.9 18.4 46.0

Equity Style Value

Manager Name

Terrence K.H. Lee

Investment Strategy: The Fund normally invests

Equity Style Core

ÙÙÙÙ

Morningstar Rating™ Overall

primarily in common stocks of U.S. companies. It

Equity Style Growth

6.2

2.0

5.5

US OE Tactical Allocation

invests in large, medium and/or small capitalization Morningstar Category

securities, primarily with market capitalizations at the

Inception Date

6/10/2011

time of purchase of $2 billion or greater. Under normal

0.0

0.0

0.0

2,500

circumstances, the Fund will allocate a portion of its Minimum Initial Investment ($)

total assets to structured notes. It invests in exchangeNAV ($)

11.85 Value

Blend

Growth

traded funds and mutual funds that invest in domestic

The Morningstar Style Box™ reveals a fund’s investment strategy.

or foreign securities. The Fund is non-diversified.

%

28.1

Mid

20.4

51.5

Small

Fund Assets ($ Million)

2015-03

45.1

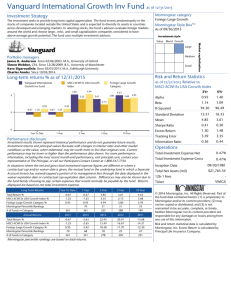

Average Annual Total Return % as of 03/31/2015

18.0

16.1

16.0

14.0

16.1

12.7

12.0

10.8

10.9

10.4

10.0

8.0

9.9

9.0

7.2

6.0

Return

4.0

2.0

0.0

2.0

3.0

1.0

YTD (Not Annualized)

Lee Financial Tactical Fund

1 Year

S&P 500 TR USD

3 Years

S/I

DJ Moderately Aggressive TR USD

For equity funds the ver�cal axis shows the market capitaliza�on of the long stocks

owned and the horizontal axis shows investment style (value, blend, or growth).

For each fund with at least a three-year history, Morningstar calculates

a Morningstar Rating™ based on a Morningstar Risk-Adjusted Return

measure that accounts for variation in a fund's monthly performance

(including the effects of sales charges, loads, and redemption fees),

placing more emphasis on downward variations and rewarding

consistent performance. The top 10% of funds in each category receive

5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars,

the next 22.5% receive 2 stars, and the bottom 10% receive 1 star.

(Each share class is counted as a fraction of one fund within this scale

and rated separately, which may cause slight variations in the

distribution percentages.) The Overall Morningstar Rating™ for a fund

is derived from a weighted average of the performance figures

associated with its three-, five-, and ten-year (if applicable)

Morningstar Rating metrics. Lee Financial Tactical Fund (LOVIX) was

rated against the following number of U.S. domiciled Tactical Allocation

funds over the following time periods: 198 funds in the last three

years. With respect to these Tactical Allocation funds, Lee Financial

Tactical Fund (LOVIX) received a Morningstar Rating of 4 stars for the

3-year period ended March 31, 2015. Past performance is no

guarantee of future results.

Expense Ratio: 1.73% before fee waiver. 1.38% after fee waiver, as stated in the current prospectus dated February 1, 2015. The Investment Manager has voluntarily agreed to

waive .35% of its 1.00% management fees included in the Expense Ratio above. This management fee waiver will be in effect through January 31, 2016.

The Dow Jones Moderately Aggressive Portfolio Index is made up of composite indexes representing the three major asset classes: stocks, bonds and cash. These component

asset class indexes are weighted differently within each relative risk index to achieve the targeted risk level; generally 80% stocks and 20% bonds and cash. The weightings are

rebalanced monthly to maintain these levels. The S&P 500 Index is an unmanaged market capitalization weighted index comprised of 500 widely held common stocks. The S&P

500 Index is generally considered representative of the stock market as a whole. Unmanaged index returns do not reflect any fees, expenses or sales charges. It is not possible to

invest directly in an unmanaged index. Performance quoted represents past performance. Past performance is no guarantee of future results. The LOVIX net performance quoted

reflects fee waivers in effect and would have been lower in their absence. Fund’s yield, share price and investment return fluctuate so that you may receive more or less than your

original investment upon redemption. Performance assumes the reinvestment of all dividends and capital gains distributions. Taxes on distributions or redemptions have not been

deducted. Current performance may be higher or lower than the performance data quoted. Please call us at 800-354-9654 to obtain performance information current to the most

recent month-end.

Source: Morningstar Direct

As of 3/31/2015

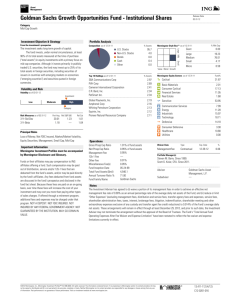

Top 10 Equity Holdings as of 3/31/2015

Equity Sectors (as % of Portfolio Value)

Portfolio

Weighting %

Federated Government Obligs Instl

8.21

Costco Wholesale Corp

5.75

CVS Health Corp

5.63

Goldman Sachs Group Inc

4.92

Google Inc Class A

4.68

Union Pacific Corp

4.47

Apple Inc

4.45

Mylan NV

3.95

SAP SE ADR

3.46

Teva Pharmaceutical Industries Ltd ADR

3.33

Phillips 66

3.31

Portfolio Date: 3/31/2015

Information Technology %

18.73

Consumer Staples %

16.91

Healthcare %

13.22

Financials %

9.35

Energy %

8.42

Consumer Discretionary %

7.99

Industrials %

6.89

Materials %

2.50

A word about risk: Mutual fund investing involves risks. Principal loss is possible. The Lee Financial Tactical Fund’s investments in structured notes may subject the Fund to greater

interest rate, credit and counterparty risks and costs than traditional equity funds. The price of structured notes may be volatile and they may have a limited trading market, making it

difficult to value or sell them. Structured notes are also subject to risks of debt instruments, including interest rate and call risks, but may have a greater risk of loss than a typical debt

security of the same maturity and credit quality. In exchange for the issuer’s guarantee of full or partial payment of principal on maturity, the upside return the Fund could achieve on its

investment may be capped or limited and the issuer’s guarantee is generally available only if the Fund holds the structured note to maturity. The Fund may also invest in options which

may be more volatile and less liquid, increasing the risk of loss when compared to traditional securities. The Fund may also invest in foreign securities which, especially in emerging

markets, involve greater volatility and political, economic, regulatory and currency risks and differences in accounting methods. The Fund may invest in small, mid or large companies.

Investment in smaller companies involves additional risks such as limited liquidity and greater volatility than larger companies. The Fund’s investments in other investment companies,

including exchange traded funds, subjects the Fund to those risks affecting that investment company, including a possible decrease in the value of the underlying securities. The Fund will

also incur brokerage costs when it purchases exchange traded funds and will incur its pro rata share of the underlying investment company’s expenses. Writing call options is a highly

specialized activity which involves greater liquidity, counterparty and equity price risks. This is not a complete list of risks that may affect the Fund. For additional information concerning

the risks applicable to the Fund, please see the Fund’s prospectus.

Lee Financial Securities, Inc./Distributor

Before investing, read the prospectus carefully. Please carefully consider the Lee Financial Tactical Fund’s investment objective, risks, and charges and expenses before

investing. The prospectus contains this and other information about the Fund. Call (808) 988-8088, (800) 354-9654 or visit our website www.LeeHawaii.com for a free

prospectus.

Lee Financial Tactical Fund is a series of Lee Financial Mutual Fund, Inc. Low volatility investing does not guarantee a profit or protect against a loss in a generally declining market. All

data is as of 03/31/2015 unless otherwise indicated. Portfolio holdings are subject to change.

© 2015 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely.

Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Performance information obtained from Morningstar may not be identical to the LOVIX performance information. These differences may be due to differing methodologies for calculating total return or other data

points.

Source: Morningstar Direct