dynamic macroeconomics

advertisement

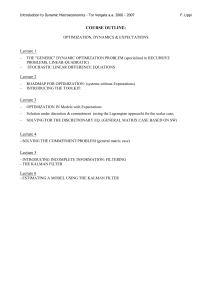

Introduction to Dynamic Macroeconomics - Tor Vergata a.a. 2007 - 2008 Prof. Francesco Lippi Università di Sassari DYNAMIC MACROECONOMICS 1. - Preliminaries Stochastic linear difference equations Analysis of linear systems (variance decomposition; IRFs) Continuous time differential equations 2. - Introduction to Dynamic optimization Statement of general dynamic optimization problem The Lagrangian approach (Euler’s equation method) Dynamic programming (Bellman equation) The linear quadratic case 3. - Partial equilibrium (Single agent problems) Optimal savings Inventory money demand McCall Search model Remarks on structural estimation 4. - Competitive Equilibria Complete markets model (Arrow-Debreu) Decentralized solution (Time-zero and sequential asset trading) The planners problem: Welfare theorems Discussion: Solution methods 5. - More on the Euler equation approach Computation of steady state log linearization Solution (Blanchard Kahn) Pathology: The problem of indeterminacy System analysis on a computer (Using DYNARE or Uhlig’s Toolkit) 6. Strategic problems (when timing matters) - Markov perfect & commitment equilibria - Solving the linear quadratic case (by hand and using GL Toolkit) 7. Taking models to the data - The Kalman filter - Estimating a state space model using the KF Introduction to Dynamic Macroeconomics - Tor Vergata a.a. 2007 - 2008 Prof. Francesco Lippi Università di Sassari Textbooks Ljungqvist L. and T.J. Sargent, Recursive Macroeconomic Theory, 2nd edition, Chapters 2-8 Krueger, Dirk , Macroeconomic Theory, Available on the web. http://www.econphd.net/notes.htm Other useful references Collard, F. and M. Juillard. “Stochastic simulations with DYNARE. A practical guide” (see DYNARE website for many useful tutorials and the code). Hamilton, Time Series Analysis, Chapter 13 on "The Kalman Filter" Gerali, Andrea and Francesco Lippi, Optimal Control and Filtering in Linear Forward-Looking Economies: A Toolkit, downloadable at http://francescolippi.googlepages.com/home (under research/tools) Ireland, P. “A method for taking models to the data”, mimeo 2003, Boston College. Svensson, Lars E.O. and Michael Woodford, Indicator Variables for Optimal Policy, Journal of Monetary Economics, 50:691–720, 2003. Uhlig, H. “A toolkit for analyzing non linear stochastic models easily”, (code and paper available on the web http://www.econphd.net/notes.htm). Some papers with applications (incomplete and strongly biased towards my own work) Abel, A. , J, Eberly, S. Panages, 2007 “Optimal inattention and the stock market”, AER papers and proceedings. Alvarez, Fernando and Francesco Lippi, 2007, “Financial innovation and the transactions demand for cash”, NBER WP 13416. Backus, David Backus David and Mario Crucini, 2000, “Oil prices and the terms of trade”, Journal of International Economics, vol. 50, 185-213. Cukierman, Alex and Francesco Lippi, “Endogenous Monetary Policy with Unobserved Potential Output”, Journal of Economic Dynamics and Control, 2005, Vol. 29:1951-1983. Clarida, Richard, Jordi Galì and Mark Gertler, The Science of Monetary Policy: A New Keynesian Perspective, Journal of Economic Literature, 37:1661–1707, 1999. Ehrmann, Michael and Frank Smets, “Uncertain potential output: implications for monetary policy”, Journal of Economic Dynamics and Control, 27:1611–38, 2003. Fuchs, William and Francesco Lippi, “Monetary Union with Voluntary Participation”, Review of Economic Studies, 2006, Vol. 73: 437-57. Lippi, Francesco and Stefano Neri, “Information variables for monetary policy in an estimated structural model of the euro area”, Journal of Monetary Economics, 2007, Vol. 54 (4): 1256-70. Lippi Francesco and Andrea Nobili, “Oil and the macroeconomy: a structural VAR analysis with sign restrictions”, mimeo. Svensson Lars E.O., “Inflation Forecast Targeting: Implementing and Monitoring Inflation Targets”, European Economic Review, 41:1111–46, 1997.