Indirect Cost Rate Policy - National Forest Foundation

advertisement

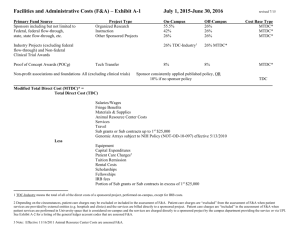

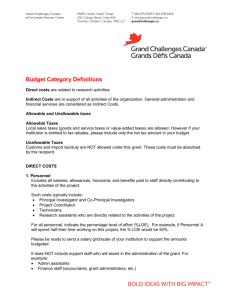

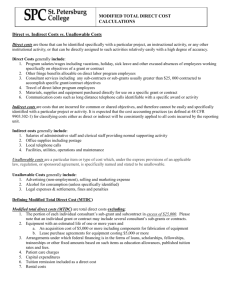

Indirect Cost Rate Policy Grant proposals require a budget that lists direct project costs such as staff time, supplies, and travel. There are also costs associated with the support of the project that are indirectly related to that project such as administrative salaries and office expenses. This policy reflects the indirect expenses that can be recovered through an NFF grant. There are two different ways to determine how to account for these costs. Option 1 addresses organizations that have a federal Negotiated Indirect Rate Agreement (NICRA), and Option 2 accounts for organizations that do not have a NICRA. Option 1: Negotiated Indirect Cost Rate Agreement Odds are, you know it if you have one If your organization directly receives federal funds from a federal agency, then a NICRA can be established by working with the federal agency that provides the most funds (sometimes called the organization’s cognizant agency). This allows organizations to develop an indirect percentage that can be used when receiving federal funds through federal agreements. Organizations with a NICRA tend to be larger entities such as universities and regional or national nonprofits. The NFF accepts indirect rates as a budget line item up to, but not exceeding the federally determined NICRA. Provide the NFF a copy of the current agreement. The NICRA must be current to recover indirect costs. If the organization has ever had a NICRA, but the agreement lapsed, the organization cannot recover indirect costs until a new NICRA is negotiated. Option 2: Modified Total Direct Cost Method For organizations that have never had a NICRA If an organization has never had a NICRA, indirect costs may be calculated up to 10% of the total of the NFF award amount for certain allowable categories. This total is called the Modified Total Direct Cost (MTDC). Allowable and unallowable expenses for calculating the MTDC are described below. Expense Categories for Calculating MTDC Allowable Categories: Direct personnel Applicable fringe Materials Supplies Services Travel Subawards or Subcontracts up to the first $25,000 Excluded Categories: Equipment >$5,000 Capital expenditures Rental costs Tuition, Scholarships, or Fellowships Any portion of subawards or subcontracts beyond the first $25,000 Alcohol Advertising Participant support costs for conferences and trainings, including stipends, travel allowances, or registration fees Morale Boosting Activities Page 1 of 2 Revised 4/17/15 Examples showing how to calculate the Modified Total Direct Cost (MTDC) base and then apply that to the 10% indirect: To calculate the allowable MTDC and indirect charges: list the allowable budget items, including any direct salaries, fringe, materials, supplies, services, travel, and sub-awards or contracts up to the first $25,000. Then multiply the MTDC by 10%, and add that to the Total Direct Charges. Example Budget #1 Example Budget #2 (a) NFF Funds Requested Expense Categories: (a) NFF Funds Requested Expense Categories: Personnel $25,000.00 Personnel $0.00 Fringe Benefits $5,000.00 Fringe Benefits $0.00 Travel $5,000.00 Travel $1,000.00 Equipment $0.00 Equipment $0.00 $2,000.00 Supplies $10,000.00 Supplies Contractual $0.00 Contractual $42,000.00 Other $0.00 $45,000.00 Other $0.00 $45,000.00 Total Direct Charges (TDC) Total Direct Charges (TDC) MTDC: Subtract from TDC Total Direct Charges (TDC) MTDC: Subtract from TDC $45,000.00 Total Direct Charges (TDC) $45,000.00 MTDC $0.00 $45,000.00 Consultant/Subcontractor > $25K MTDC ($17,000.00) $28,000.00 Allowable Indirect Costs at 10% $4,500.00 Allowable Indirect Costs at 10% $2,800.00 Consultant/Subcontractor > $25K Total Grant Request Total Direct Charges (TDC) Total Grant Request $45,000.00 Total Direct Charges (TDC) Allowable Indirect Cost at 10% $4,500.00 Allowable Indirect Cost at 10% $2,800.00 NFF Grant Request $49,500.00 NFF Grant Request $47,800.00 Page 2 of 2 $45,000.00 Revised 4/17/15