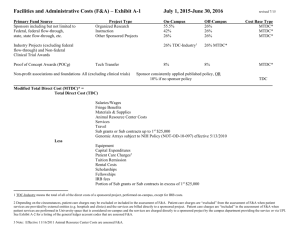

Direct and Indirect Costs Defined, Including Cost Calculation

advertisement

MODIFIED TOTAL DIRECT COST CALCULATIONS Direct vs. Indirect Costs vs. Unallowable Costs Direct costs are those that can be identified specifically with a particular project, an instructional activity, or any other institutional activity, or that can be directly assigned to such activities relatively easily with a high degree of accuracy. Direct Costs generally include: 1. Program salaries/wages including vacations, holiday, sick leave and other excused absences of employees working specifically on objectives of a grant or contract 2. Other fringe benefits allocable on direct labor program employees 3. Consultant services including any sub-contracts or sub-grants usually greater than $25, 000 contracted to accomplish specific grant/contract objectives 4. Travel of direct labor program employees 5. Materials, supplies and equipment purchased directly for use on a specific grant or contract 6. Communication costs such as long distance telephone calls identifiable with a specific award or activity Indirect costs are costs that are incurred for common or shared objectives, and therefore cannot be easily and specifically identified with a particular project or activity. It is expected that the cost accounting practices (as defined at 48 CFR 9903.302-1) for classifying costs either as direct or indirect will be consistently applied to all costs incurred by the reporting unit. Indirect costs generally include: 1. Salaries of administrative staff and clerical staff providing normal supporting activity 2. Office supplies including postage 3. Local telephone calls 4. Facilities, utilities, operations and maintenance Unallowable costs are a particular item or type of cost which, under the express provisions of an applicable law, regulation, or sponsored agreement, is specifically named and stated to be unallowable. Unallowable Costs generally include: 1. Advertising (non-employment), selling and marketing expense 2. Alcohol for consumption (unless specifically identified) 3. Legal expenses & settlements, fines and penalties Defining Modified Total Direct Cost (MTDC) Modified total direct costs (MTDC) are total direct costs excluding: 1. The portion of each individual consultant’s sub-grant and subcontract in excess of $25,000. Please note that an individual grant or contract may include several consultant’s sub-grants or contracts. 2. Equipment with an estimated life of one or more years and a. An acquisition cost of $5,000 or more including components for fabrication of equipment b. Lease purchase agreements for equipment costing $5,000 or more 3. Arrangements under which federal financing is in the forms of loans, scholarships, fellowships, traineeships or other fixed amounts based on such items as education allowances, published tuition rates and fees. 4. Patient care charges 5. Capital expenditures 6. Tuition remission included as a direct cost 7. Rental costs MODIFIED TOTAL DIRECT COST CALCULATIONS Calculating Modified Total Direct Cost (MDTC) base When using an F&A (Facilities & Administrative) indirect cost rate, the rate is applied to a Modified Total Direct Cost (MDTC) base. The F&A rate for SPC is 33% beginning 7/01/2012 through 6/30/2016. Generally, the full F&A rate is applied to the MTDC based, unless specific sponsor guidelines state otherwise. Always review the program guidelines as many sponsors indicate what cost, including F&A is and is not allowable. Example: Indirect costs based on Modified Total Direct Costs: Budget #1: Budget contains no items requiring cost modification. Budget Salary Fringe Benefits Equipment Materials and Supplies Travel Publication Costs Consultant/Subcontract 1 Tuition Remission Total Direct Costs Year 1 24,596 5,942 0 3,462 3,000 0 0 0 37,000 Year 2 25,334 6,374 0 4,202 3,090 1,000 0 0 40,000 Year 3 26,094 6,826 0 4,867 3,183 1,030 0 0 42,000 To find Modified Total Direct Costs (MTDC): Total Directs Less: Equipment Tuition Remission Consultant/Subcontract > $25k MTDC Year 1 37,000 Year 2 40,000 Year 3 42,000 0 0 0 0 0 0 0 37,000 0 40,000 42,000 **Note that MTDC = Total direct costs because no dollars are requested for equipment, tuition remission, or consultant/subcontracts exceeding $25,000 To find indirect costs, multiply the MTDC amount by the indirect cost rate: MTDC Indirect Costs 33.0% Year 1 37,000 12,210 Year 2 40,000 13,200 Year 3 42,000 13,860 MODIFIED TOTAL DIRECT COST CALCULATIONS Example Budget #2: Budget contains items requiring cost modification. Budget Salary Fringe Benefits Equipment Materials and Supplies Travel Publication Costs Consultant/Subcontract 1 Tuition Remission Total Direct Costs Year 1 24,596 5,942 9,000 3,462 3,000 0 10,000 8,000 64,000 Year 2 25,334 6,374 0 4,202 3,090 1,000 11,000 8,000 59,000 Year 3 26,094 6,826 0 4,867 3,183 1,030 9,000 8,000 59,000 Modified Total Direct Cost (MTDC) Calculation: *Note that funding is now requested for our excluded categories, Equipment, Consultant/Subcontracts, and Tuition Remission. Total Directs Less: Equipment Tuition Remission Consultant/Subcontract > $25k MTDC Year 1 64,000 Year 2 59,000 Year 3 59,000 9,000 8,000 0 8,000 0 8,000 0 47,000 0 51,000 5,000 46,000 Consultants/Subcontract detail: Year 1 - $10,000 requested is less than $25,000 Year 2 – Running total is $10k + $11k = $21,000. Still less than $25,000 Year 3 – Total is $10k + $11k + $9k = $30,000. We’re now $5,000 over the $25,000 threshold, so that $5,000 is subtracted to get the MTDC total. Now we multiply MTDC by the indirect cost rate: MTDC Indirect Costs 33.0% Year 1 47,000 Year 2 51,000 Year 3 46,000 15,510 16,890 15,180