Legal Business

Memoranda on legal and business issues and concerns

for multiple industry and business communities

Overview Of Mortgagee’s Remedies Of

Foreclosure And Power Of Sale

1

April 2000

Rajah & Tann

4 Battery Road

#26-01 Bank of China Building

Singapore 049908

Tel: 65 6535 3600

Fax: 65 6538 8598

E-mail: eOASIS@sg.rajahandtann.com

Website: www.rajahandtann.com

Legal Business

Miscellaneous

Overview Of Mortgagee’s Remedies Of Foreclosure And Power

Of Sale

Introduction

A mortgagee of property has four principle remedies available to him in enforcing his mortgage over

the property: foreclosure, sale, possession and the appointment of a receiver. This memorandum will

examine the remedies of foreclosure and sale. It will also, as part of its examination of the power of

sale remedy, look at the remedy of possession, as an ancillary part of the exercise of the power of

sale.

Background

Generally speaking, a mortgage entails a transfer of ownership of the mortgaged property to the

creditor. This transfer of ownership is to provide security to the creditor for moneys which it has lent,

either to the mortgagor or to a third party borrower. The transfer is subject to the condition that the

property will be reconveyed back to the owner of the property when the borrowed moneys have been

returned.

Because the mortgagor of the property retains the right to have ownership of the property returned to

him upon repayment of the borrowed sum, he is said to retain an ‘equity of redemption’ in the

property.

Foreclosure

The Features Of Foreclosure

(a)

Foreclosure as a remedy may only be effected by an order by the court. When a mortgagee

seeks to foreclose on a mortgage, he is essentially asking the court to vest the title of the

mortgaged property in him, free of the mortgagor’s equity of redemption. The vesting is made

in satisfaction of the mortgagee’s right to have the debt repaid to him.

(b)

In other words, upon a foreclosure order being made, two rights are extinguished: the

mortgagee’s right to have the mortgaged property returned to him subject to full repayment of

the debt, and the mortgagor’s right to have the debt repaid.

(c)

As the mortgagor takes the property in satisfaction of the debt, he bears the risk that the

property is worth less than the amount of the debt which remains outstanding. He has no

further recourse to the mortgagor to claim the difference between the value of the property

and the value of the outstanding debt.

(d)

Conversely, if the property is worth more than the outstanding debt, the mortgagee will

receive a windfall, and the mortgagor has no right to the amounts in excess of the outstanding

debt.

© Rajah & Tann, Knowledge Management

April 2000

Page 1

Legal Business

(e)

Miscellaneous

As a foreclosure order, if granted, extinguishes the mortgagor’s equity of redemption,

foreclosure proceedings should not be commenced unless the mortgagor has lost his right to

redeem the property. Accordingly, a mortgagor should only apply for foreclosure after the

legal date for redemption has passed, as then, the mortgagor’s right to redeem has clearly

ceased.

The Procedure For Effecting Foreclosure

(a)

Because of the possibility of a windfall passing to the mortgagee, the court is usually reluctant

to make a foreclosure order without giving the mortgagee every chance to redeem. This

reluctance is reflected in a two stage procedure for effecting foreclosure.

(b)

The court first makes an interim order directing that an account be taken of what is due to the

mortgagee and to give the mortgagor a final opportunity to pay within a stipulated period. This

order is known as a foreclosure nisi.

(c)

If the mortgagor fails to make payment by the stipulated date, the mortgagee applies for an

order which, if granted, operates to vest the mortgagor’s entire estate in the mortgagee. This

order is known as a foreclosure absolute.

(d)

The entire proceedings, from commencing the foreclosure nisi to obtaining the foreclosure

absolute usually takes about 4 to 6 months. As a consequence of this protracted length of

time, foreclosure proceedings tend to be very rare.

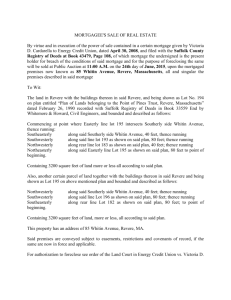

Sale

Features Of The Remedy Of The Power Of Sale

(a)

The mortgagee may instead seek to sell the mortgaged property, and recover his debt from

the moneys received from the sale of the property. An exercise of the power of sale is quicker

and usually requires no order of court.

(b)

Standard mortgage deeds will usually contain a clause giving the mortgagee a right to sell the

mortgaged property upon default by the mortgagor. However, even if the mortgage deed

omits such a clause, the power of sale is implied under section 24 of the Conveyancing and

Law of Property Act.

(c)

The exercise of a power of sale is not the same as an act of foreclosure. In a sale, the

mortgagee is not entitled to retain any proceeds from the sale in excess of the balance debt

due to him. All he is entitled to is to have the outstanding debt (including any interest accruing

on the debt) repaid. Any excess must be forwarded to the mortgagor. Conversely, where the

price received for the property is less than the outstanding debt, the mortgagee is entitled to

claim the unpaid portion of the debt (after the sale) from the mortgagor.

(d)

These differences arise from the fact that the mortgagee is merely exercising a power to

realise his security by selling it, and is not seeking to have the property conveyed in toto into

his name. In a sense, the mortgagor is effectively saying to the mortgagee, “I can’t afford to

© Rajah & Tann, Knowledge Management

April 2000

Page 2

Legal Business

Miscellaneous

repay you. Why don’t you sell the property in order to raise the money which I owe to you,

and use that money to repay yourself.”

The Exercise Of The Power Of Sale

(a)

The mortgagee can only exercise the power of sale under certain specified circumstances.

Where the power of sale is provided for in the mortgage deed, the deed will also usually set

out the circumstances under which the power may be exercised. For example, a mortgage

deed may provide that the power of sale may be exercised upon the expiration of 14 days

after a demand has been made on the mortgagor for the repayment of the moneys secured

by the mortgage. If at the expiration of 14 days no payment is received, the mortgagee can

effect a sale of the property.

(b)

The exercise of a power of sale is quicker and usually requires no court order. In exceptional

cases, the mortgagee may wish to apply to court for a court ordered sale of the property.

Circumstances where the mortgagee may wish to seek a court ordered sale are where there

is a dispute as to the validity of the mortgage or where title to the property is in doubt. One

advantage of a court ordered sale is that the court may order the sale free from the claim, and

this may hopefully fetch a higher price for the property.

(c)

If the mortgagee chooses to apply for a court ordered sale, where the property is sold without

the mortgagee first entering into possession, the process is fairly quick, and the application to

court can be heard within 4 to 6 weeks.

Seeking Vacant Possession Prior To A Sale

(a)

The remedy of possession is usually exercised as a precursor of a sale so that the mortgagee

can given vacant possession to the purchaser of the mortgaged property. This is because it is

hoped that the ability to be able to pass vacant possession on to the purchaser would

increase the value of the mortgaged property.

(b)

Where the mortgagee has a legal mortgage of land not registered under the Land Titles

Register, the legal estate is conveyed to him. This gives him an immediate right to possession

of the property which is not dependent on there being a default by the mortgagor.

(c)

This is in contrast to the situation of a mortgagee who has a registered mortgage of land

registered under the Land Titles Register. Such a mortgagee only has a right to possession of

the mortgaged property once the mortgagor defaults in this payments of the interest, principal

or other money secured by the mortgage. This right arises under section 75 of the Land Titles

Act and before a mortgagee can enter into possession of the mortgaged property, section 75

of the Land Titles Act provides that the mortgagee must give the mortgagor one month’s

notice of its intention to do so. Upon the expiration of the one month notice, if vacant

possession is not peaceably given, then the mortgagee can apply to court for possession.

Upon obtaining the order of court for possession, the mortgagor is given one last chance to

deliver vacant possession or to pay up.

(d)

In the event that no possession is given or the outstanding amounts are not settled, the

mortgagee must apply to court for a writ of possession to be given. Pursuant to this writ of

possession, the court baliff will attend at the premises and take possession of it. The whole

© Rajah & Tann, Knowledge Management

April 2000

Page 3

Legal Business

Miscellaneous

process can take anything from 2 months to almost 4 years. Once possession has been

obtained, a sale can be effected.

Rajah & Tann is one of the largest law firms in Singapore. It is a full service firm and given its alliances, including US premier firm

Weil, Gotshal & Manges, is able to tap into a number of countries.

Rajah & Tann is firmly committed to the provision of high quality legal services. It places strong emphasis on promptness,

accessibility and reliability in dealings with clients. At the same time, the firm strives towards a practical yet creative approach in

dealing with business and commercial problems.

The information contained in this newsletter is correct to the best of our knowledge and belief at the time of writing. Specific

professional advice should be sought before any action is taken. In this regard, you may call the lawyer you normally deal with in

Rajah & Tann or e-mail the Knowledge Management team at eOASIS@sg.rajahandtann.com

© Rajah & Tann Knowledge Management. All rights reserved.

© Rajah & Tann, Knowledge Management

April 2000

Page 4