MASTER LANGUES APPLIQUEES TERMINOLOGY MARCH 2009

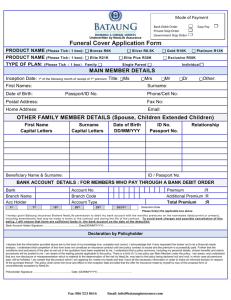

advertisement

MASTER LANGUES APPLIQUEES TERMINOLOGY MARCH 2009 Applying componential analysis to life insurance Whole Life Insurance Whole life insurance offers the policyholder a cash value account and tax-deferred cash accumulation and pays a death benefit directly to the named beneficiary. The policy is in effect during the lifetime of the insured and provides permanent security for all your dependents while building a cash value account. On of the benefits of a whole life policy is that it provides a savings component (cash value), which is tax-deferred. The policyholder can borrow from or cash in the policy during the policyholders lifetime. The policy has a fixed premium, which does not increase during the policyholder's lifetime, as long as the planned premium amount is paid. The premium is invested for the insured for a long-term basis. A whole life insurance policy does not allow for any premium flexibility. The policyholder cannot invest into separate accounts, such as money markets, stocks and bond funds. The policy cannot terminate unless the policy holder dies and the beneficiaries are paid benefits, the policy reaches the age of 100 or the policy cancels for nonpayment of premium and the cash value of the policy is returned to the insured. There are several different types of whole policies. They are as follows: • • • • Single premium whole life policy is when the policyholder pays whole life premium in one lump sum. The only benefit to this policy is tax advantages. The regular life policy grows in response to the interest rate and the growth is then tax deferred. If a client wants to shelter some money and would want death benefits, the single premium would be an excellent choice. Continuous premium life (aka straight life) policy is the most common whole life policies. This policy accumulates in cash value and provides lifetime protection with level premium payments up to the age of 100. This policy offer the lowest regular premium cost among the permanent policies. Limited-Pay policies are paid over a limited period of time. Each type of plan is named after the terms of the payment period (i.e., "20-Pay Life," or "Life Paid-up at 65"). The payment amounts are determined according to length of the payment period. In addition, the insurer must pay the full, insured amount to the beneficiary in the event that the policyholder dies, even if the insured has only made one payment to the policy. Current Assumption Whole Life (aka Interest Sensitive Whole Life) premium payments fluctuate according to the current interest rates. The premiums are adjusted upon renewal of the policy. Comment The four sorts of whole of life insurance (called whole life, the standard American term) share all the features already noted for whole of life insurance in the original matrix analysis. Artificial intelligence calls this inheritance, which simply means that the narrower concepts all have the same features as the broader concepts, with some extra criteria. These can easily be added to the matrix. The distinguishing feature of the differing sorts of whole life insurance is the payment of the premium. This is paid either in one lump sum at the beginning, or over the whole life in annuities or over a shortened, specified period. The premium rate is constant for continuous and limited whole life insurance (and not relevant for single premium), but variable with current. These features can be broken up as shown in the table overleaf: WHOLE OF LIFE INSURANCE whole of life premium paid premiums insurance once paid over whole of life Single + + Continuous + + premium limited pay + Current + assumption premiums paid over a set period + premium rate constant + + - The components are generally represented as discrete entities, present or absent. It may be more economical in presentation to indicate different values for each feature, as below: Single Continuous Whole of life insurance + + Limited + Current + Premiums paid Once over whole period over set period over whole period ? Premium rate Lump sum Constant Constant Variable Definitions single premium whole life insurance : whole of life insurance for which the premium is paid in one lump sum continuous premium whole life insurance : whole of life insurance for which the premium is paid over the whole period (or until the age of 100) limited pay insurance : whole of life insurance for which the premiums are paid over a period defined in the policy current assumption insurance : whole of life insurance for which the rate of the premium is indexed to interest rates Term Life Insurance Term life insurance is the most simplified of the life insurance types. The basic concept for term life is that the policyholder pays a premium for a specified amount of coverage for a limited period of time (aka "term"). If the insured should happen to die before the end of the term, the beneficiary would be paid the face value of the policy. If the insured does not die before the policy period expires, no benefit is paid out. A term life insurance policy has no cash value and the coverage period is very specific. The premium is intended to cover only the cost of the insurance itself and usually for fairly short period of time. The premiums are based mainly on the age of the policyholder and with the increase of age there is the more likelihood of death. The most common of the term policies is the one-year policy written with level benefits. These policies renew annually until a certain age (average 65-70) and the premiums fluctuate according to gender and by specific underwriting guidelines. Some medical testing (i.e., blood, urine, saliva, etc.) maybe required at a certain age or under certain medical conditions. Premiums apt to be more expensive at older ages and most insurance companies offer policies with increments of 5, 10, 15, 20, or 30-year guarantees, with premium levels based on the insured's age at the time the policy was purchased, and on the length of the guaranteed premium level. There are several different types of term policies. They are as follows: • • • • • Level Term is a death benefit contract, which remains level throughout the policy term. The premium can increase at confirmed intervals over the years or it may remain the same, but the death benefit will remain the same. This type of term insurance is sold in yearly terms of one, five, ten, twenty, or until the age of 65. Decreasing Term is a death benefit contract, in which levels decrease over time, but premium remains the same throughout the policy period. The most common use for this type of policy is to cover a mortgage. As the mortgage amount decreases of over time, so does the amount of insurance needed. A term life policy is used cover the policyholders financial obligations. Increasing Term is a death benefit contract, in which levels and premium increase over time. This coverage is usually written as a rider to a policy and written for the purpose of providing the policyholder with increasing death benefits until the policy terminates. One reason for obtaining this type of coverage could be that the insured needs his/or hers benefits increased while their children are attending college. Renewable Term is a death benefit, which provides levels throughout the policy period. In addition, this coverage provides for automatic renewal without having to provide proof of insurability. The premium is adjusted according to the age of the policyholder upon renewal of the policy. If the insured experiences ill health/terminal conditions, the insurance company cannot non-renew or cancel the policy. The maximum number of times a policy can be renewed is specified by the insurer. Convertible Term is a death benefit, which provides levels throughout the policy period. In addition, this coverage provides the option to change the policy to a permanent (whole life) policy without having to prove evidence of insurability. An additional premium is required for this special feature. If the insured experiences poor health/terminal conditions, the insurance company cannot non-renew or cancel the policy. The first difficulty in preparing the matrix for this analysis is clear identification of the criteria, and the ambiguity of tertiary terminology is a major hindrance here. The most ambiguous word is level: as an adjective it is used for fixed rates (i.e. neither rising nor falling); as a noun, it can represent either level of premium or, more commonly, level of cover. From the context provided, the latter meaning is the one relevant here. The next point to be dealt with is the grouping of criteria under the concepts of premium and death benefit. These should be linked, as we have indicated in the table below. Again, a table could be made where the indications are supplied directly under the general heading. TERM INSURANCE Term Death benefit = payout Insur Ance Falling Rising fixed Level + + Decreas ing Increas ing Renew able Convert ible Premium fixed falling rising - + - - + + - + - + + + - - + - + + Re New el - Change to whole of life + Evidence of insur ability + - Definitions level term insurance : term insurance providing level death cover over time and requiring payment of level or rising premiums decreasing term insurance : term insurance providing decreasing death cover over time and requiring the payment of level premiums increasing term insurance : term insurance providing rising death cover over time and requiring the payment of rising premiums renewable term insurance : term insurance which can be renewed automatically without proof of insurability convertible term insurance : term insurance which can be changed into a whole of life policy without proof of insurability