Home Depot Report

Ticker: HD

Sector: Consumer Services

Industry: Home Improvement Chains

Recommendation: BUY

Pricing

Closing Price $30.70 (10/15/2010)

52-wk High $37.03 (10/15/2010)

52-wk Low $24.47 (10/15/2010)

Market Data

Market Cap 50.9B

Trading Vol. (3m) 14.9M

Total Assets

Total Liabilities

Valuation

EPS (ttm)

40.9B

21.5B

P/E (ttm)

P/S (ttm)

P/B

1.75

17.73

0.76

2.64

Profitability & Effectiveness

ROA 6.72

ROI (5yr avg)

ROE (5yr avg)

Profit Margin

Oper Margin

12.36

18.36

5.41

9.25

Dividend

Yield (5yr avg)

0.95

2.7%

Analyst: Ali Rife

Email: anrhcd@mail.missouri.edu

RECOMMENDATION: BUY

The home improvement industry was hit hard through the recession starting in 2007. As consumers lost their jobs and economic uncertainty loomed, investment in home remodeling and building was significantly reduced.

Fortunately, this year Home Depot’s revenues have started to go up reflecting an overall positive outlook not only for the company, but for the economy as well. As unemployment begins to decrease and confidence continues to rise, revenue growth will come both domestically and internationally. HD’s strong leadership, advanced strategies, and sound financials ensure that this company has a successful future ahead.

In addition, DCF calculations suggest the stock is currently undervalued.

Therefore, this stock is recommended as a buy for the portfolio.

COMPANY DESCRIPTION

1

The Home Depot was founded in

1978 in Atlanta, Georgia by Bernie

Marcus and Arthur Blank with the fundamental purpose to change consumers’ perspectives about how they could care for and improve their homes.

1 http://corporate.homedepot.com/en_US/Corporate/Pub lic_Relations/Online_Press_Kit/Docs/Corp_Financial_

Overview.pdf

1

Today, it is still headquartered in Atlanta, but has more than 2,200 retail stores in the

United States (including Puerto Rico and the U.S. Virgin Islands and the territory of

Guam), Canada, Mexico and China with over 300,000 employees. The Home Depot, Inc. is the world’s largest home improvement specialty retailer and the fourth largest retailer in the United States with fiscal 2009 retail sales of $66.2 billion.

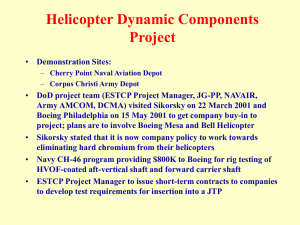

BUSINESS SEGMENTS AND PERFORMANCE

2

The Home Depot stores serve three primary types of customers, Do-It-Yourself,

Do-It-For-Me and Professional Customers. The company operates in these three business segments to provide each client with the proper products and services.

Customers:

Do-It-Yourself ( “D-I-Y”) Customers These customers are typically home owners who purchase products and complete their own projects and installations.

Do-It-For-Me ( “D-I-F-M”) Customers

Professional Customers

These customers are typically home owners who purchase materials themselves and hire third parties to complete the project or installation. HD arranges for the installations of a variety of The Home Depot products through qualified independent contractors.

These customers are professional remodelers, general contractors, repairmen, small business owners, and tradesmen. In many stores, HD offers a variety of programs to these customers including delivery and will-call services, dedicated staff and expanded credit programs.

Products:

A typical Home Depot stores stocks approximately 30,000 to 40,000 products during the year, including both national brand name propriety items. The chart below shows the percentage of Net Sales of each major product group (and related services) for the 2010 fiscal year.

2 http://www.homedepotar.com/2009HD10-K.pdf

2

Services:

The Home Depot offers a variety of installation services. These services target

D-I-F-M customers who select and purchase products and installation of those products from HD. These installation programs include products such as carpeting, flooring, cabinets, countertops, and water heaters. In addition, Home Depot stores provide professional installation of a number of products sold through their in-home sales programs, such as generators and furnaces and central air systems.

Merchandising and Marketing Strategy:

The Home Depot actively made changes to develop their corporate strategy in the following areas in response to the trailing economy:

Inventory Reduction: in 2009 HD reduced their inventory while improving their in-stock rate.

Promotion shift: HD reduced the number of one-time discount promotions and refocused its efforts on offering everyday values.

Enhanced brand focus: continued to introduce innovative and distinctive products, improved strategic alliances and exclusive relationships with selected suppliers to market products under a variety of well-recognized brand names, and added

Martha Stewart Living to their alliances.

REASONS TO BE BULLISH ON HD

3, 4

Renovations > Buying a New House o Despite the economic downturn, consumers are still spending on homemaintenance and improvement projects; sequential sales trends have turned positive for the first time in more than two years.

Strong Dividend o The company has consistently returned value to its shareholders through cash dividends and share buybacks. The firm raised its dividend 5% in early 2010 and intends to use excess cash to repurchase shares

Rapid Deployment Centers (RDC) o New technology tools provide flexibility and visibility into inventory and sales at the store level, driving improved profitability and in-stock levels.

New Merchandizing Strategy o A strategy that establishes a product’s role in a project portfolio. This strategy allows the firm to set appropriate pricing independently, depending on the item’s intent (attracting traffic or capturing profits)

International Exposure o Home Depot has 179 stores in Canada, 80 in Mexico and 9 in China, while its largest competitor, Lowe’s is just entering Mexico this year with two stores and another 10 stores in Canada.

Environmental Conscious

3

4

http://www.homedepotar.com/2009HD10-K.pdf

Home Depot (HD) Morninstar Stock Report

3

o Their commitment impacts all areas of its business, including store construction and maintenance, energy usage, supply chain, product selection, and delivery of product knowledge to its customers. In 2009 alone, HD spent $22 million for energy efficiency-related projects.

Through this initiative HD achieved a 16 percent reduction in kWk per square foot, and their goal is 20 percent by 2015.

Strong Leadership o Chairman and CEO Frank Blake is responsible for turning the company around by trimming HD’s portfolio of business down to focus solely on the traditional orange box Home Depot stores.

REASONS TO BE BEARISH ON HD

5, 6

Negative Economic Conditions o Weak consumer spending, inability of customers to tap home-equity lines of credit, or softer-than-expected economic recovery could delay home improvement projects and hurt Home Depot sales

High Risk in IT Development o Home Depot’s IT and supply-chain transformation projects are filled with inherent risk. A setback could harm profitability.

Mature Domestic Market o A mature domestic store base and slower new store growth may drive increased competitive pricing pressures between Home Depot and Lowe’s, constraining ROIC expansion.

Strong Competitor o Home Depot still has a fair amount of catching up to do to match Lowe’s more attractive store environment and superior customer service.

PERFORMANCE

7,

Chart Set 1

5

6

http://www.homedepotar.com/2009HD10-K.pdf

7

Home Depot (HD) Morninstar Stock Report

Google Finance, Yahoo Finance, Reuters, CNN Money and Morningstar

4

Chart Set 2

In light of a failing economy, Home Depot has continued to focus on their core retail business, investment in associates and stores and improving their customer service.

During the 2009 fiscal year, HD worked primarily to maximize their productivity in their existing store base. Chart Set 1 shows how over the past 4 years Home Depot has seen a slight decrease in revenues as a result of the economic downturn. In the wake of a growing economy in the start of fiscal year 2010, Chart Set 2 shows steady growth in revenues, which reflects a strong future for the company. HD’s is in decent financial health overall with a debt/capital ratio of about 0.39. Their debts maturities are spread out which will hopefully not present any future issues.

Table 1 compares Home Depot to its closest competitor, Lowe’s (LOW), and

Figure 1 compares HD to the overall industry. Home Depot’s two other direct competitors are privately held companies - Menards and True Value Company.

Unfortunately there was not much information available about their finances, but their market share is significantly less than HD and LOW. Home Depot and Lowe’s have very similar businesses especially since HD dramatically shifted its strategy over the past three years to focus solely on the orange box stores. In 2007 HD sold its professional supply business and in 2009 closed its ancillary retail business.

Table 1

HD LOW Industry

Market Cap:

Employees:

Qtrly Rev Growth (yoy):

Revenue (ttm):

Gross Mar gin (ttm):

EBITDA (ttm):

Operating Margin (ttm):

Net Income (ttm):

EPS (ttm):

P/E (ttm):

P/S (ttm):

Dividend

Dividend Yield (5yr avg)

ROA

ROE

ROI

1.75

17.54

0.76

.95

2.7%

6.72

15.06

9.5

51.12B

193,370

1.80%

67.20B

33.86%

6.89B

7.64%

2.91B 1.86B

1.28

16.82

0.63

.44

0.97

5.44

9.67

7.15

30.25B

166,000

3.70%

48.29B

34.81%

5.08B

6.97%

N/A

1.28

17.54

0.76

1.26

2.17

4.92

3.15

30.25B

166,000

2.90%

48.29B

34.81%

5.08B

9.95%

5

Figure 1

STOCK PERFORMANCE COMPARISON

8, 9

HD is considered a large cap core stock by Morningstar (Figure 2). Chart 2 shows a comparison to the S&P 500 and its industry. The specialty retailers industry has outperformed the S&P 500 over the past 8 months. The fall in stock price reflects the ongoing crisis in the US housing market, but many foresee this as rock bottom and have expectations that in the coming months the conditions will get better.

Figure 2

8

9

Home Depot (HD) Moringstar Stock Report

Bigcharts.com

6

Chart 1: HD Stock Price 1 year

Chart 2: HD vs. S&P 500 and Specialty Retailers Industry 1 year

7

Chart 3: Stock Performance vs. Competitor (LOW)

VALUATION

10, 11, 12

For the Discounted Cash Flow calculations, a discount rate of 7.95% was calculated using CAPM as follows:

7.95% = 3% + 0.73 (11% - 3%)

This value was used as a starting point for further calculations. Net income, depreciation, and amortization values were taken from the 2009 10-K and financial statements given in

Morningstar. As shown by the DCF calculations, the intrinsic value is approximately

$41.20 per share, which indicates the stock is likely undervalued at its current $30.70 per share. The sensitivity of the intrinsic value to discount rate and free cash flow are shown below as well in Table 2.

Table 2: Green represents above current selling price, light green represents above 52week low and red represents below current selling price and 52-week low

Discount Rate

FCF

7%

$ 1,500 $29.87

$ 2,000 $39.83

$ 2,499 $49.76

$ 3,000 $59.74

$ 3,500 $69.70

7.95%

$24.68

$32.91

$41.12

$49.37

$57.59

9%

$20.71

$27.62

$34.51

$41.43

$48.33

10%

$17.97

$23.96

$29.94

$35.95

$41.94

11%

$15.88

$21.18

$26.46

$31.77

$37.06

12%

$14.24

$18.99

$23.72

$28.48

$33.23

10

11

12

Home Depot 2009Annual Report: http://www.homedepotar.com/2009HD10-K.pdf

Home Depot (HD) Morningstar Stock Report

Bloomberg

8

CONCLUDING REMARKS

Overall, Home Depot is a member of an industry that has done well during the economic downturn. It appears that the industry will continue to do well during the next period of economic uncertainty as well. Still, the trailing economy and mortgage crisis hit

HD hard and the company has been faced with declining revenues since 2007. Reviewing

Home Depot’s quarterly reports, we can see that their revenues have steadily been going up since the beginning of this year, confirming that the US in slowly coming out of the recession. Still, it is important to note that although the company suffered during the economic downturn, the losses were not exceedingly large and it was able to adapt to the environment with new strategies. Looking into the future, many foresee Home Depot to be a winning investment based on its evolving strategies and good leadership. Chairman and CEO, Frank Blake revamped the company to focus solely on its orange box stores.

Adding advanced IT systems to the stores and creating better ways to manage their inventory, the company has made evident strides to become more efficient and increase productivity.

Over the past 10 years, the stock has performed well compared to its industry and the S&P 500. Home Depot may have smaller growth year-over-year compared to Lowe’s, but it has a strong ROA, ROE and ROI and significantly higher revenue and net income.

The company has also strived to return wealth to shareholders through significant share buyback programs and a consistent dividend. In addition, DCF calculations suggest the stock is undervalued. As a result of the analysis in this report, it is recommended that the fund buy this stock

9