accounting in the arrangement. ASU 2009

accounting in the arrangement. ASU 2009-14 excludes tangible products containing software components and nonsoftware components that function together to deliver the product’s essential functionality from the scope of Subtopic

985-605, “Revenue Recognition.” ASU 2009-13 and ASU 2009-14 are effective for fiscal periods beginning on or after

June 15, 2010, which for us is the first quarter of fiscal 2011. We are currently evaluating the impact that ASU 2009-13 and ASU 2009-14 will have on our consolidated financial statements.

Item 7A.

Quantitative and Qualitative Disclosures About Market Risk

Disclosure About Foreign Currency Risk

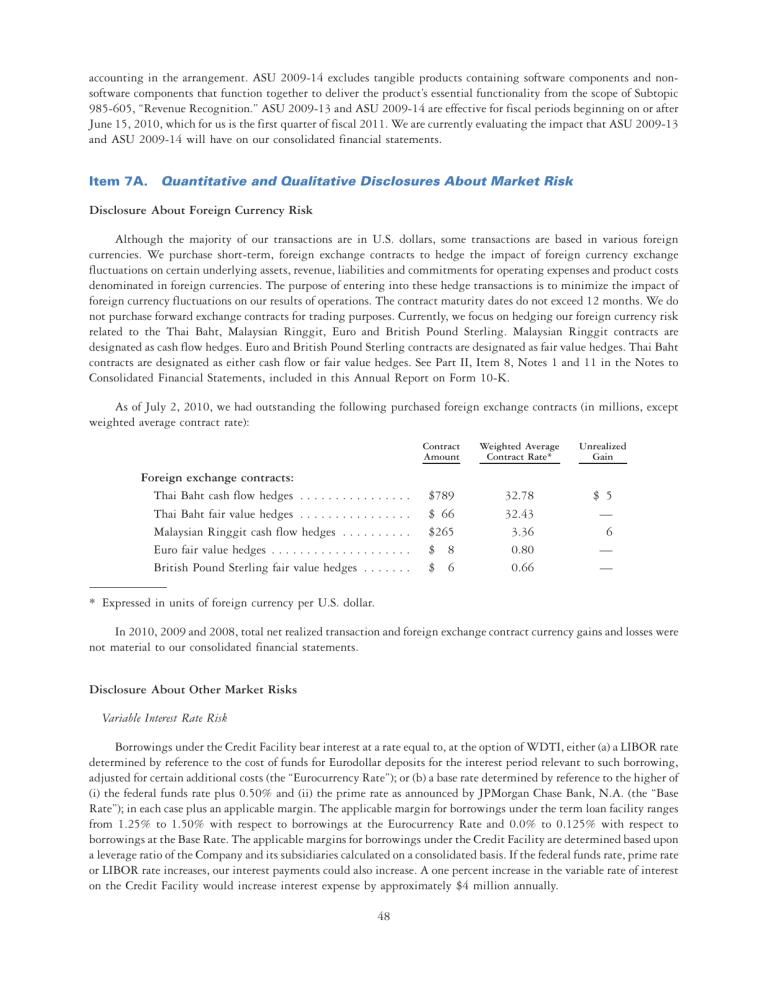

Although the majority of our transactions are in U.S. dollars, some transactions are based in various foreign currencies. We purchase short-term, foreign exchange contracts to hedge the impact of foreign currency exchange fluctuations on certain underlying assets, revenue, liabilities and commitments for operating expenses and product costs denominated in foreign currencies. The purpose of entering into these hedge transactions is to minimize the impact of foreign currency fluctuations on our results of operations. The contract maturity dates do not exceed 12 months. We do not purchase forward exchange contracts for trading purposes. Currently, we focus on hedging our foreign currency risk related to the Thai Baht, Malaysian Ringgit, Euro and British Pound Sterling. Malaysian Ringgit contracts are designated as cash flow hedges. Euro and British Pound Sterling contracts are designated as fair value hedges. Thai Baht contracts are designated as either cash flow or fair value hedges. See Part II, Item 8, Notes 1 and 11 in the Notes to

Consolidated Financial Statements, included in this Annual Report on Form 10-K.

As of July 2, 2010, we had outstanding the following purchased foreign exchange contracts (in millions, except weighted average contract rate):

Contract

Amount

Foreign exchange contracts:

Thai Baht cash flow hedges . . . . . . . . . . . . . . . .

$789

Thai Baht fair value hedges . . . . . . . . . . . . . . . .

$ 66

Malaysian Ringgit cash flow hedges . . . . . . . . . .

$265

Euro fair value hedges . . . . . . . . . . . . . . . . . . . .

$ 8

British Pound Sterling fair value hedges . . . . . . .

$ 6

Weighted Average

Contract Rate*

32.78

32.43

3.36

0.80

0.66

Unrealized

Gain

$ 5

—

6

—

—

* Expressed in units of foreign currency per U.S. dollar.

In 2010, 2009 and 2008, total net realized transaction and foreign exchange contract currency gains and losses were not material to our consolidated financial statements.

Disclosure About Other Market Risks

Variable Interest Rate Risk

Borrowings under the Credit Facility bear interest at a rate equal to, at the option of WDTI, either (a) a LIBOR rate determined by reference to the cost of funds for Eurodollar deposits for the interest period relevant to such borrowing, adjusted for certain additional costs (the “Eurocurrency Rate”); or (b) a base rate determined by reference to the higher of

(i) the federal funds rate plus 0.50% and (ii) the prime rate as announced by JPMorgan Chase Bank, N.A. (the “Base

Rate”); in each case plus an applicable margin. The applicable margin for borrowings under the term loan facility ranges from 1.25% to 1.50% with respect to borrowings at the Eurocurrency Rate and 0.0% to 0.125% with respect to borrowings at the Base Rate. The applicable margins for borrowings under the Credit Facility are determined based upon a leverage ratio of the Company and its subsidiaries calculated on a consolidated basis. If the federal funds rate, prime rate or LIBOR rate increases, our interest payments could also increase. A one percent increase in the variable rate of interest on the Credit Facility would increase interest expense by approximately $4 million annually.

48