asian parents spend less than six years planning for

advertisement

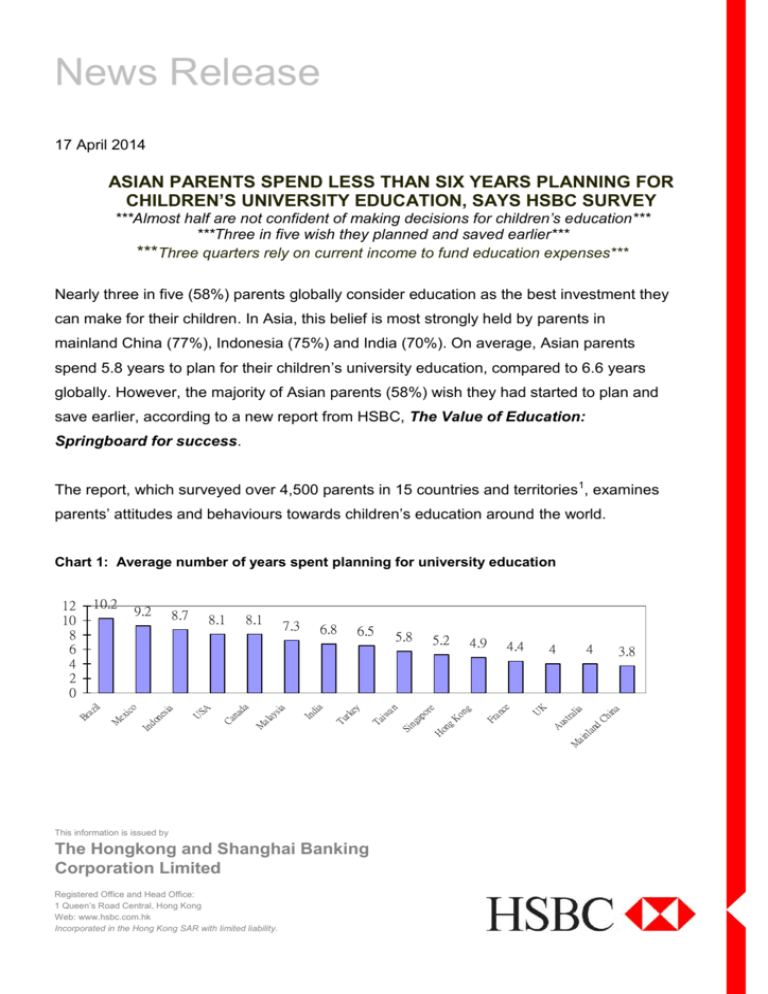

News Release 17 April 2014 ASIAN PARENTS SPEND LESS THAN SIX YEARS PLANNING FOR CHILDREN’S UNIVERSITY EDUCATION, SAYS HSBC SURVEY ***Almost half are not confident of making decisions for children’s education*** ***Three in five wish they planned and saved earlier*** ***Three quarters rely on current income to fund education expenses*** Nearly three in five (58%) parents globally consider education as the best investment they can make for their children. In Asia, this belief is most strongly held by parents in mainland China (77%), Indonesia (75%) and India (70%). On average, Asian parents spend 5.8 years to plan for their children’s university education, compared to 6.6 years globally. However, the majority of Asian parents (58%) wish they had started to plan and save earlier, according to a new report from HSBC, The Value of Education: Springboard for success. The report, which surveyed over 4,500 parents in 15 countries and territories 1, examines parents’ attitudes and behaviours towards children’s education around the world. Chart 1: Average number of years spent planning for university education This information is issued by The Hongkong and Shanghai Banking Corporation Limited Registered Office and Head Office: 1 Queen’s Road Central, Hong Kong Web: www.hsbc.com.hk Incorporated in the Hong Kong SAR with limited liability. 4 us t M ai nl A 3.8 Ch in a ra lia K 4 an d 4.4 U on g 4.9 K H on g ga po re 5.2 Fr an ce 5.8 Si n 6.5 Tu rk ey In d ia 6.8 Ta iw an 7.3 ia SA U 8.1 Ca na da In d 8.1 M al ay s 8.7 on es ia 9.2 M ex ic o 10.2 Br az il 12 10 8 6 4 2 0 High aspirations for children’s education Parents globally have high aspirations for their children’s education. In Asia, nine in 10 (90%) parents want their children to go to university and 61% want them to go on to study at a postgraduate level. Parents in Malaysia (91%), India (83%) and Mainland China (74%) are among the highest proportions of those who hope their children will take postgraduate studies. Over three quarters (78%) would consider sending their children abroad for university, especially Indonesia (92%), Malaysia (88%) and Hong Kong (86%). While Asian parents regard education as the top financial support for their children, around half (47%) find making decisions about education daunting, higher than the global average of 38%. The desire to save earlier is particularly strong among Asian markets such as Malaysia (84%), mainland China (78%), Indonesia (66%), India (58%) and Taiwan (54%), which contrast sharply with France (14%), the UK (27%) and Australia (32%) in the developed world. Vineet Vohra, HSBC’s Regional Head of Wealth Development, Asia-Pacific, said: “HSBC’s new survey validates the high expectations of Asian parents to support their children through tertiary and post-graduate studies. The choices parents need to make around their children’s education can be overwhelming. All these decisions require forward planning to ensure that parents make the right choices for their family and provide the best possible opportunities for their children. Parents must start planning early and ensure that saving for education forms an integral part of their long-term financial plans. “For those who wish to send their children abroad, foreign exchange will play a role in their efforts to save for tuition fees and expenses, with a need to exchange local to foreign currency and make overseas fund transfers. Parents can leverage different FX products and services to accumulate the foreign currency they need over time to cover these costs and in doing so, help reduce the risk of a short-fall induced by any sudden, unfavourable movement in the exchange rate.” Parents expect good education will lead to a successful career While parents generally have different expectations towards education at different stages, having the ability to compete in the workplace stand out as the top requirement for a good university education across the globe. In Asia, India and Indonesia are the exceptions where parents believe income-earning potential (41%) and access to opportunities in life (54%) are most important, respectively. Heavily reliant on current income When it comes to the sources of funding, current income (76%) and savings (60%) are most popular for Asian parents. Less than a third (30%) will draw on investments and specific education plans are relatively less common. Vineet said, “Asian parents tend to take full responsibility for funding their children’s education. However, relying too heavily on current income and savings to fund education expenses could be risky. For parents who have a longer savings horizon, they can consider making regular contributions to fund investments or insurance savings plans to achieve a specific target. Otherwise, bond investments that offer regular returns or some life insurance plans that distribute guaranteed cash bonus will be options for parents whose children are approaching their university years, providing them with liquidity to cover education expenses. Parents should also ensure that saving for children’s education will not affect their other wealth needs and that they have adequate protection to continue funding school fees if something unexpected happens to them. “With the help of a trusted financial advisor, parents can discuss their goals, project total amounts required and map out the most suitable financial solutions in line with their needs, risk appetite, time horizons and financial position. It is important to have an on-going conversation with your financial advisor to keep track of the progress of their financial plan,” he concluded. Chart 2: Asian parents have high aspirations for their children’s education 120% 100% 80% 60% 40% 20% 0% Australia Mainland China India Indonesia Parents want their children to study at university Parents intend to send their children abroad for university Malaysia Hong Kong Singapore Taiwan Parents want their children to take postgraduate studies Key findings: 1. Nearly nine in 10 (89%) parents want their children to go to university. 62% want their child to study to a post graduate level. 2. More than two in five (43%) parents say the ability to compete in the workplace is a key expectation of a good university education 3. More than half (58%) of parents say that paying for a child’s education is the best investment you can make. 4. When presented with different options for supporting their child financially in life, parents would ideally allocate 42$ of their funds to education, much more than for anything else. 5. Just 18% of parents would consider private primary schooling for their child. For secondary school, this rises to 33%. Consideration of private primary and secondary education is strongest in the developing world and in Asia. 6. Of parents who are paying for their child’s education, the vast majority (91%) fund it partially or fully themselves. Most rely on current income (82%), while savings (41%), investments (19%) and specific education plans (13%) are less common sources. 7. More than half (51%) of parents wish they had started to plan and save earlier for their child’s education. This view is particularly strong in Malaysia (84%) and China (78%). 8. Almost two in five (38%) parents say they find making decisions about their children’s education dauniting, with parents in Taiwan (69%) abd Hongkong (60%) feeling particularly daunted. 9. The USA is regarded as offering the highest quality education in the world, with 51% of parents ranking it in their top three countries. This is followed by the UK (38%), Germany (27%), Australia (25%) and Taiwan (75%). 10. In countries where English is not the first language, most parents see foreign language skills as the main benefit of an education abroad. This view is particularly strong in Turkey (82%), Hongkong (77%), Brazil (76%) and Taiwa (75%). Media enquiries: Laine Santana +852 2822 4918 lainesantana@hsbc.com Notes to editors 1/ The Value of Education is a new global consumer research study which explores parents’ attitudes and behaviours towards children’s education. This report, Springboard for success, represents the views of 4592 parents in 15 countries and territories around the world: Brazil, Canada, France, Mexico, Turkey, United Kingdom and United States, as well as 8 in Asia, including Australia, Hong Kong, India, Indonesia, Mainland China, Malaysia, Singapore and Taiwan. The survey was conducted online in December 2013 and January 2014, among parents who have at least one child under the age of 23 currently (or soon to be) in education, and who are solely or partially responsible for making decisions about their child’s education. This independent research study was commissioned by HSBC and carried out by Ipsos MORI. The Value of Education global report is available on www.hsbc.com > Retail Banking and Wealth Management. The Hongkong and Shanghai Banking Corporation Limited The Hongkong and Shanghai Banking Corporation Limited is the founding member of the HSBC Group, which serves around 54 million customers through four global businesses: Retail Banking and Wealth Management, Commercial Banking, Global Banking and Markets, and Global Private Banking. The Group serves customers worldwide from around 6,300 offices in 75 countries and territories in Europe, Hong Kong, Rest of Asia-Pacific, North and Latin America, and the Middle East and North Africa. With assets of US$2,671bn at 31 December 2013, the HSBC Group is one of the world’s largest banking and financial services organisations.