abc

Asia Index Futures Fair Value

4 October 2013

Global Research

Asia Index Futures Fair Value

HSCEI – Daily Futures Fair Value Monitor

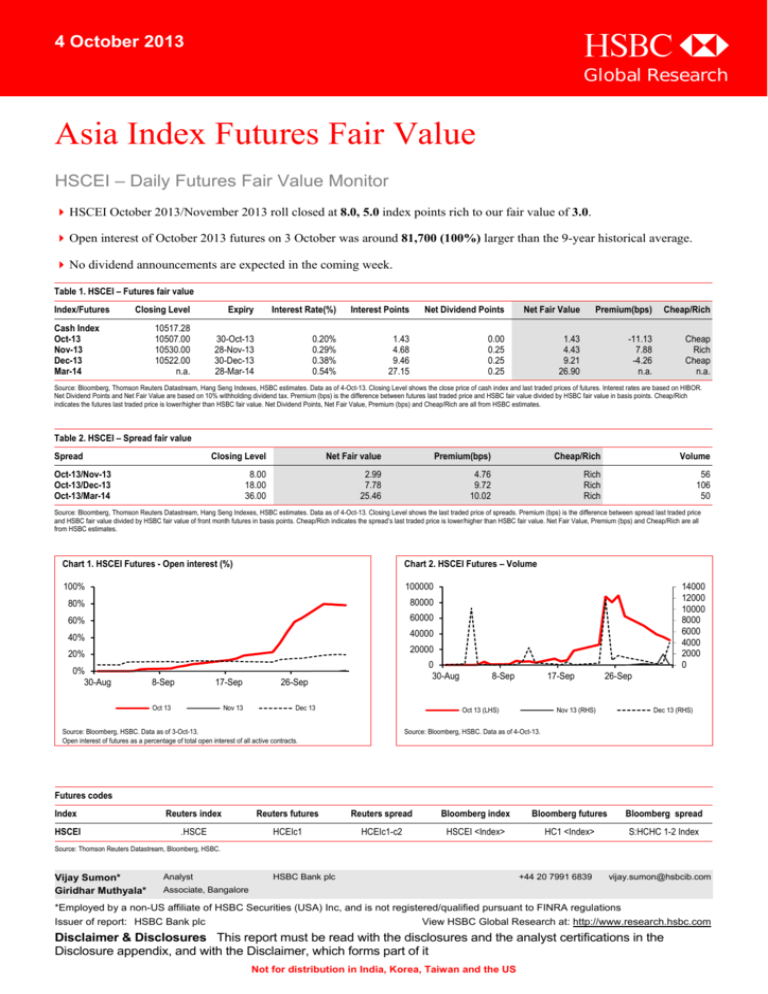

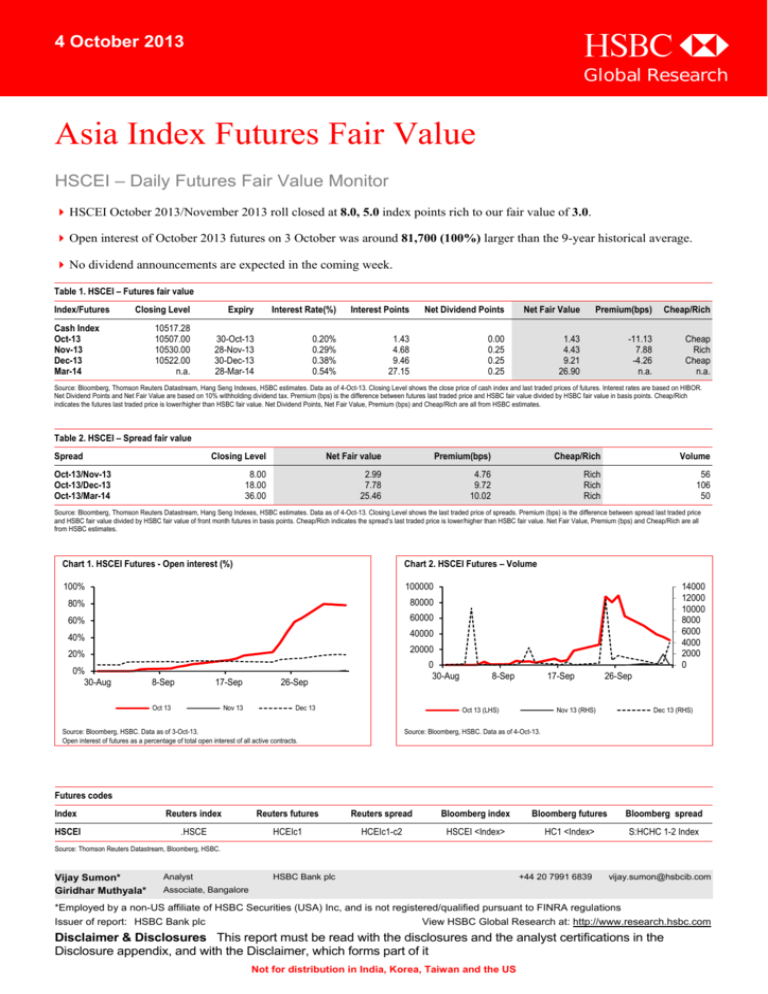

HSCEI October 2013/November 2013 roll closed at 8.0, 5.0 index points rich to our fair value of 3.0.

Open interest of October 2013 futures on 3 October was around 81,700 (100%) larger than the 9-year historical average.

No dividend announcements are expected in the coming week.

Table 1. HSCEI – Futures fair value

Index/Futures

Closing Level

Expiry

Interest Rate(%)

Interest Points

Net Dividend Points

Net Fair Value

Premium(bps)

Cheap/Rich

10517.28

10507.00

10530.00

10522.00

n.a.

30-Oct-13

28-Nov-13

30-Dec-13

28-Mar-14

0.20%

0.29%

0.38%

0.54%

1.43

4.68

9.46

27.15

0.00

0.25

0.25

0.25

1.43

4.43

9.21

26.90

-11.13

7.88

-4.26

n.a.

Cheap

Rich

Cheap

n.a.

Cash Index

Oct-13

Nov-13

Dec-13

Mar-14

Source: Bloomberg, Thomson Reuters Datastream, Hang Seng Indexes, HSBC estimates. Data as of 4-Oct-13. Closing Level shows the close price of cash index and last traded prices of futures. Interest rates are based on HIBOR.

Net Dividend Points and Net Fair Value are based on 10% withholding dividend tax. Premium (bps) is the difference between futures last traded price and HSBC fair value divided by HSBC fair value in basis points. Cheap/Rich

indicates the futures last traded price is lower/higher than HSBC fair value. Net Dividend Points, Net Fair Value, Premium (bps) and Cheap/Rich are all from HSBC estimates.

Table 2. HSCEI – Spread fair value

Spread

Closing Level

Net Fair value

Premium(bps)

Cheap/Rich

Volume

8.00

18.00

36.00

2.99

7.78

25.46

4.76

9.72

10.02

Rich

Rich

Rich

56

106

50

Oct-13/Nov-13

Oct-13/Dec-13

Oct-13/Mar-14

Source: Bloomberg, Thomson Reuters Datastream, Hang Seng Indexes, HSBC estimates. Data as of 4-Oct-13. Closing Level shows the last traded price of spreads. Premium (bps) is the difference between spread last traded price

and HSBC fair value divided by HSBC fair value of front month futures in basis points. Cheap/Rich indicates the spread’s last traded price is lower/higher than HSBC fair value. Net Fair Value, Premium (bps) and Cheap/Rich are all

from HSBC estimates.

Chart 1. HSCEI Futures - Open interest (%)

Chart 2. HSCEI Futures – Volume

100%

100000

80%

80000

60%

60000

40%

40000

20000

20%

0%

30-Aug

14000

12000

10000

8000

6000

4000

2000

0

8-Sep

17-Sep

Oct 13

Nov 13

0

30-Aug

26-Sep

Dec 13

8-Sep

17-Sep

Oct 13 (LHS)

Source: Bloomberg, HSBC. Data as of 3-Oct-13.

Open interest of futures as a percentage of total open interest of all active contracts.

26-Sep

Nov 13 (RHS)

Dec 13 (RHS)

Source: Bloomberg, HSBC. Data as of 4-Oct-13.

Futures codes

Index

Reuters index

Reuters futures

Reuters spread

Bloomberg index

Bloomberg futures

Bloomberg spread

HSCEI

.HSCE

HCEIc1

HCEIc1-c2

HSCEI <Index>

HC1 <Index>

S:HCHC 1-2 Index

Source: Thomson Reuters Datastream, Bloomberg, HSBC.

Vijay Sumon*

Giridhar Muthyala*

Analyst

HSBC Bank plc

+44 20 7991 6839

vijay.sumon@hsbcib.com

Associate, Bangalore

*Employed by a non-US affiliate of HSBC Securities (USA) Inc, and is not registered/qualified pursuant to FINRA regulations

Issuer of report: HSBC Bank plc

View HSBC Global Research at: http://www.research.hsbc.com

Disclaimer & Disclosures This report must be read with the disclosures and the analyst certifications in the

Disclosure appendix, and with the Disclaimer, which forms part of it

Not for distribution in India, Korea, Taiwan and the US

abc

Global Equity Quantitative Research

Asia Index Futures Fair Value

4 October 2013

HSCEI - Monthly dividend schedule

Dividend index points in the next 12 months are based on dividends that have been announced and confirmed by

companies and HSBC estimated regular dividends.

Chart 3. HSCEI – Forecast monthly dividend index points

375

Index points

300

225

150

75

Sep-14

Aug-14

Jul-14

Jun-14

May-14

Apr-14

Mar-14

Feb-14

Jan-14

Dec-13

Nov-13

Oct-13

0

Source: Bloomberg, Thomson Reuters Datastream, Hang Seng Indexes, HSBC estimates. Data as of 4-Oct-13.

Dividend sensitivity analysis of the October 13 / November 13 spread

Dividend risk is minimal for the roll. Sensitivity analysis of the October 2013/November 2013 spread to the estimated

dividends in November and cash index level is provided below. Details of dividend schedule can be found in table 5.

Table 3. HSCEI - Futures spread net fair value vs. cash index

_______________________________________________ Index level ________________________________________________

10200

10300

10400

10500

10600

10700

10800

Dividend sensitivity

100%

3

3

3

3

3

3

3

Source: Bloomberg, Thomson Reuters Datastream, Hang Seng Indexes, HSBC estimates. Data as of 4-Oct-13.

Interest rate sensitivity analysis of the October 13 / November 13 spread

Interest rate change risk is minimal for the roll as HSBC's economists believe Hong Kong policy rates will remain

unchanged over the next three months.

Table 4. HSCEI - Futures spread net fair value

Interest rate

sensitivity

________________________________________________ Index level ________________________________________________

10200

10300

10400

10500

10600

10700

10800

0.20%

0.25%

0.30%

0.35%

0.40%

2

3

3

4

5

2

3

3

4

5

2

3

3

4

5

2

3

3

4

5

2

3

3

4

5

2

3

3

4

5

Source: Bloomberg, Thomson Reuters Datastream, Hang Seng Indexes, HSBC estimates. Data as of 4-Oct-13. Interest rates are based on HIBOR. The interest rate sensitivity analysis is based on interest rate change only in the

November 13 futures, i.e., November 13 rate is varied while October 13 rate remains constant.

Not for distribution in India, Korea, Taiwan and the US

2

2

3

4

4

5

abc

Global Equity Quantitative Research

Asia Index Futures Fair Value

4 October 2013

Dynamics of the HSCEI October 13 / November 13 spread

As of 4 October, the HSCEI October 2013/November 2013 roll closed at 8.0, 5.0 index points rich to our fair value of 3.0.

On average, the roll has been trading 5.2 index points rich to HSBC fair value since inception.

Roll progress is defined as the front month open interest as a percentage of the total open interests in front month and next

month futures.

Chart 4. HSCEI – Oct-13/Nov-13 roll fair value, VWAP & volume

Roll volume (RHS)

Roll VWAP (LHS)

Roll fair value (LHS)

1600

8

1200

6

800

4

400

2

0

0

30-Sep

2-Oct

100%

2000

3-Oct

4-Oct

Source: Bloomberg, Thomson Reuters Datastream, Hang Seng Indexes, HSBC estimates.

Data as of 4-Oct-13. VWAP is Value Weighted Average Price.

Roll progress

Index points

10

Roll volume

12

Chart 5. HSCEI – Oct-13/Nov-13 roll progress

80%

60%

40%

20%

0%

-20

-18

-16

-14

-12

-10

-8

-6

-4

-2

0

Days to expiry

Oct-13/Nov-13 roll

Average -9y

Fastest - 9y

Slowest - 9y

Source: Bloomberg, HSBC. Data as of 3-Oct-13.

Average – 9y, Fastest – 9y and Slowest – 9y are based on Oct/Nov rolls in the last 9 years.

Not for distribution in India, Korea, Taiwan and the US

3

abc

Global Equity Quantitative Research

Asia Index Futures Fair Value

4 October 2013

HSCEI estimated dividend schedule for the next 12 months

Table 5. Dividend estimates for the HSCEI constituents for the next 12 months

Bloomberg

Name

1066 HK

2333 HK

2318 HK

1898 HK

3323 HK

857 HK

914 HK

998 HK

2601 HK

3968 HK

728 HK

1066 HK

2628 HK

2883 HK

3988 HK

753 HK

916 HK

1099 HK

2899 HK

386 HK

1171 HK

358 HK

939 HK

1398 HK

1988 HK

1157 HK

1288 HK

902 HK

1339 HK

6030 HK

1088 HK

1336 HK

3328 HK

489 HK

168 HK

1800 HK

2238 HK

6837 HK

2338 HK

390 HK

1988 HK

2328 HK

386 HK

857 HK

2318 HK

2238 HK

2338 HK

Weigao Group

GreatWall Motor

Ping An

China Coal

CNBM

PetroChina

Anhui Conch

CITIC Bank

CPIC

CM Bank

China Telecom

Weigao Group

China Life

China Oilfield

Bank of China

Air China

China Longyuan

Sinopharm

Zijin Mining

Sinopec Corp

Yanzhou Coal

Jiangxi Copper

CCB

ICBC

Minsheng Banking

Zoomlion

ABC

Huaneng Power

PICC Group

CITIC Sec

China Shenhua

NCI

Bankcomm

Dongfeng Group

Tsingtao Brew

China Comm Cons

GAC Group

Haitong Securities

Weichai Power

China Railway

Minsheng Banking

PICC P & C

Sinopec Corp

PetroChina

Ping An

GAC Group

Weichai Power

Net dividend (HKD)

Ex-dividend date

Price (HKD)

Weight (%)

Index drop

0.03

0.89

0.40

0.14

0.17

0.17

0.36

0.19

0.44

0.64

0.09

0.04

0.36

0.35

0.21

0.07

0.08

0.32

0.06

0.15

0.09

0.31

0.33

0.29

0.19

0.17

0.19

0.46

0.03

0.23

1.01

0.17

0.25

0.19

0.51

0.23

0.07

0.19

0.12

0.07

0.19

0.28

0.09

0.20

0.24

0.15

0.08

19-Nov-13

14-May-14

14-May-14

15-May-14

28-May-14

29-May-14

30-May-14

30-May-14

4-Jun-14

4-Jun-14

4-Jun-14

6-Jun-14

6-Jun-14

6-Jun-14

6-Jun-14

6-Jun-14

6-Jun-14

10-Jun-14

10-Jun-14

10-Jun-14

13-Jun-14

13-Jun-14

13-Jun-14

17-Jun-14

19-Jun-14

20-Jun-14

20-Jun-14

24-Jun-14

25-Jun-14

26-Jun-14

27-Jun-14

27-Jun-14

27-Jun-14

27-Jun-14

2-Jul-14

3-Jul-14

4-Jul-14

9-Jul-14

25-Jul-14

25-Jul-14

2-Sep-14

3-Sep-14

5-Sep-14

5-Sep-14

11-Sep-14

18-Sep-14

18-Sep-14

7.69

44.2

58.95

4.69

7.67

8.61

25.9

4.07

28.75

14.62

4.06

7.69

20.6

20.05

3.61

5.21

8.24

19.96

1.81

6.21

7.65

14.94

6.07

5.51

9.32

7.03

3.64

7.99

3.76

16.32

23.6

22.95

5.81

11.7

59

6.19

8.43

12.2

31

4.17

9.32

10.76

6.21

8.61

58.95

8.43

31

0.55

1.94

5.09

0.82

0.94

7.71

1.36

1.41

2.88

2.85

2.39

0.55

6.51

1.31

10.35

0.45

0.93

0.84

0.46

6.73

0.64

0.84

9.98

10.23

2.06

0.38

3.56

1.09

1.18

0.65

3.41

0.55

2.16

1.35

0.90

1.16

0.79

0.73

0.64

0.71

2.06

1.45

6.73

7.71

5.09

0.79

0.64

0.25

4.09

3.62

2.56

2.18

16.36

1.98

7.06

4.66

13.15

5.56

0.29

12.07

2.41

62.97

0.60

0.96

1.41

1.52

17.33

0.82

1.84

57.48

57.17

4.35

0.96

19.86

6.49

0.90

0.96

15.27

0.42

9.58

2.34

0.82

4.51

0.67

1.22

0.26

1.17

4.36

3.92

10.66

18.75

2.14

1.43

0.18

Source: Bloomberg, Thomson Reuters Datastream, Hang Seng Indexes, HSBC estimates. Data as of 4-Oct-13. # - dividend ex-date confirmed. * - dividend amount confirmed.

Not for distribution in India, Korea, Taiwan and the US

4

#,*

abc

Global Equity Quantitative Research

Asia Index Futures Fair Value

4 October 2013

Appendix – Fair value calculation of index futures

We calculate index futures fair value using the following formula:

Index Futures Fair value = Cash index + Interest carry – Net dividend

For the HSCEI futures, we derive interest rates from Hong Kong Inter-bank Offered Rate (HIBOR), which is provided by the

Hong Kong Association of Banks. We estimate stock dividends according to the historical dividend payout and analyst

consensus estimates from Thomson Reuters Datastream. To calculate dividend index points, we apply 10% withholding tax on

H Shares pursuant to the Enterprise Income Tax Law of the People’s Republic of China effective from 1 January 2008 and its

implementation regulations (“Enterprise Income Tax Law”) and the relevant policies and regulations.

Not for distribution in India, Korea, Taiwan and the US

5

abc

Global Equity Quantitative Research

Asia Index Futures Fair Value

4 October 2013

Disclosure appendix

Analyst Certification

The following analyst(s), economist(s), and/or strategist(s) who is(are) primarily responsible for this report, certifies(y) that the

opinion(s) on the subject security(ies) or issuer(s) and/or any other views or forecasts expressed herein accurately reflect their

personal view(s) and that no part of their compensation was, is or will be directly or indirectly related to the specific

recommendation(s) or views contained in this research report: Vijay Sumon

Basis for financial analysis

The strategies discussed in this report are based purely on the quantitative valuation screens illustrated and use consensus

forecasts. For this reason, they do not necessarily coincide with the ratings of HSBC sector analysts who cover any of the

stocks referred to.

This report is designed for, and should only be utilised by, institutional investors. HSBC believes an investor's decision to buy

or sell a stock should depend on individual circumstances such as the investor's existing holdings and other considerations.

Different securities firms use a variety of ratings terms as well as different rating systems to describe their recommendations.

Investors should carefully read the definitions of the ratings used in each research report. In addition, because research reports

contain more complete information concerning the analysts' views, investors should carefully read the entire research report

and should not infer its contents from the rating. In any case, ratings should not be used or relied on in isolation as investment

advice.

Rating definitions for long-term investment opportunities

Stock ratings

HSBC assigns ratings to its stocks in this sector on the following basis:

For each stock we set a required rate of return calculated from the cost of equity for that stock’s domestic or, as appropriate,

regional market established by our strategy team. The price target for a stock represents the value the analyst expects the stock

to reach over our performance horizon. The performance horizon is 12 months. For a stock to be classified as Overweight, the

potential return, which equals the percentage difference between the current share price and the target price, including the

forecast dividend yield when indicated, must exceed the required return by at least 5 percentage points over the next 12 months

(or 10 percentage points for a stock classified as Volatile*). For a stock to be classified as Underweight, the stock must be

expected to underperform its required return by at least 5 percentage points over the next 12 months (or 10 percentage points

for a stock classified as Volatile*). Stocks between these bands are classified as Neutral.

Our ratings are re-calibrated against these bands at the time of any 'material change' (initiation of coverage, change of volatility

status or change in price target). Notwithstanding this, and although ratings are subject to ongoing management review,

expected returns will be permitted to move outside the bands as a result of normal share price fluctuations without necessarily

triggering a rating change.

*A stock will be classified as volatile if its historical volatility has exceeded 40%, if the stock has been listed for less than 12

months (unless it is in an industry or sector where volatility is low) or if the analyst expects significant volatility. However,

stocks which we do not consider volatile may in fact also behave in such a way. Historical volatility is defined as the past

month's average of the daily 365-day moving average volatilities. In order to avoid misleadingly frequent changes in rating,

however, volatility has to move 2.5 percentage points past the 40% benchmark in either direction for a stock's status to change.

HSBC and its affiliates will from time to time sell to and buy from customers the securities/instruments (including derivatives)

of companies covered in HSBC Research on a principal or agency basis.

Analysts, economists, and strategists are paid in part by reference to the profitability of HSBC which includes investment

banking revenues.

Not for distribution in India, Korea, Taiwan and the US

6

abc

Global Equity Quantitative Research

Asia Index Futures Fair Value

4 October 2013

For disclosures in respect of any company mentioned in this report, please see the most recently published report on that

company available at www.hsbcnet.com/research.

Additional disclosures

1

2

3

This report is dated as at 04 October 2013.

All market data included in this report are dated as at close 04 October 2013, unless otherwise indicated in the report.

HSBC has procedures in place to identify and manage any potential conflicts of interest that arise in connection with its

Research business. HSBC's analysts and its other staff who are involved in the preparation and dissemination of Research

operate and have a management reporting line independent of HSBC's Investment Banking business. Information Barrier

procedures are in place between the Investment Banking and Research businesses to ensure that any confidential and/or

price sensitive information is handled in an appropriate manner.

Not for distribution in India, Korea, Taiwan and the US

7

abc

Global Equity Quantitative Research

Asia Index Futures Fair Value

4 October 2013

Disclaimer

* Legal entities as at 8 August 2012

Issuer of report

‘UAE’ HSBC Bank Middle East Limited, Dubai; ‘HK’ The Hongkong and Shanghai Banking Corporation

HSBC Bank plc

Limited, Hong Kong; ‘TW’ HSBC Securities (Taiwan) Corporation Limited; 'CA' HSBC Bank Canada, Toronto;

8 Canada Square

HSBC Bank, Paris Branch; HSBC France; ‘DE’ HSBC Trinkaus & Burkhardt AG, Düsseldorf; 000 HSBC Bank

London, E14 5HQ, United Kingdom

(RR), Moscow; ‘IN’ HSBC Securities and Capital Markets (India) Private Limited, Mumbai; ‘JP’ HSBC

Securities (Japan) Limited, Tokyo; ‘EG’ HSBC Securities Egypt SAE, Cairo; ‘CN’ HSBC Investment Bank Asia

Telephone: +44 20 7991 8888

Limited, Beijing Representative Office; The Hongkong and Shanghai Banking Corporation Limited, Singapore

Fax: +44 20 7992 4880

Branch; The Hongkong and Shanghai Banking Corporation Limited, Seoul Securities Branch; The Hongkong

Website: www.research.hsbc.com

and Shanghai Banking Corporation Limited, Seoul Branch; HSBC Securities (South Africa) (Pty) Ltd,

Johannesburg; HSBC Bank plc, London, Madrid, Milan, Stockholm, Tel Aviv; ‘US’ HSBC Securities (USA) Inc,

New York; HSBC Yatirim Menkul Degerler AS, Istanbul; HSBC México, SA, Institución de Banca Múltiple,

Grupo Financiero HSBC; HSBC Bank Brasil SA – Banco Múltiplo; HSBC Bank Australia Limited; HSBC Bank

Argentina SA; HSBC Saudi Arabia Limited; The Hongkong and Shanghai Banking Corporation Limited, New

Zealand Branch incorporated in Hong Kong SAR

In the UK this document has been issued and approved by HSBC Bank plc (“HSBC”) for the information of its Clients (as defined in the Rules of FCA) and

those of its affiliates only. It is not intended for Retail Clients in the UK. If this research is received by a customer of an affiliate of HSBC, its provision to the

recipient is subject to the terms of business in place between the recipient and such affiliate.

HSBC Securities (USA) Inc. accepts responsibility for the content of this research report prepared by its non-US foreign affiliate. All U.S. persons receiving

and/or accessing this report and wishing to effect transactions in any security discussed herein should do so with HSBC Securities (USA) Inc. in the United

States and not with its non-US foreign affiliate, the issuer of this report.

In Singapore, this publication is distributed by The Hongkong and Shanghai Banking Corporation Limited, Singapore Branch for the general information of

institutional investors or other persons specified in Sections 274 and 304 of the Securities and Futures Act (Chapter 289) (“SFA”) and accredited investors and

other persons in accordance with the conditions specified in Sections 275 and 305 of the SFA. This publication is not a prospectus as defined in the SFA. It may

not be further distributed in whole or in part for any purpose. In Korea, this publication is distributed by The Hongkong and Shanghai Banking Corporation

Limited, Seoul Securities Branch ("HBAP SLS") for the general information of professional investors specified in Article 9 of the Financial Investment

Services and Capital Markets Act (“FSCMA”). This publication is not a prospectus as defined in the FSCMA. It may not be further distributed in whole or in

part for any purpose. HBAP SLS is regulated by the Financial Services Commission and the Financial Supervisory Service of Korea. The Hongkong and

Shanghai Banking Corporation Limited Singapore Branch is regulated by the Monetary Authority of Singapore. Recipients in Singapore should contact a

"Hongkong and Shanghai Banking Corporation Limited, Singapore Branch" representative in respect of any matters arising from, or in connection with this

report. In Australia, this publication has been distributed by The Hongkong and Shanghai Banking Corporation Limited (ABN 65 117 925 970, AFSL 301737)

for the general information of its “wholesale” customers (as defined in the Corporations Act 2001). Where distributed to retail customers, this research is

distributed by HSBC Bank Australia Limited (AFSL No. 232595). These respective entities make no representations that the products or services mentioned in

this document are available to persons in Australia or are necessarily suitable for any particular person or appropriate in accordance with local law. No

consideration has been given to the particular investment objectives, financial situation or particular needs of any recipient. This publication is distributed in

New Zealand by The Hongkong and Shanghai Banking Corporation Limited, New Zealand Branch incorporated in Hong Kong SAR.

This publication has been distributed in Japan by HSBC Securities (Japan) Limited. It may not be further distributed, in whole or in part, for any purpose. In

Hong Kong, this document has been distributed by The Hongkong and Shanghai Banking Corporation Limited in the conduct of its Hong Kong regulated

business for the information of its institutional and professional customers; it is not intended for and should not be distributed to retail customers in Hong Kong.

The Hongkong and Shanghai Banking Corporation Limited makes no representations that the products or services mentioned in this document are available to

persons in Hong Kong or are necessarily suitable for any particular person or appropriate in accordance with local law. All inquiries by such recipients must be

directed to The Hongkong and Shanghai Banking Corporation Limited. This document is not and should not be construed as an offer to sell or the solicitation of

an offer to purchase or subscribe for any investment. HSBC has based this document on information obtained from sources it believes to be reliable but which it

has not independently verified; HSBC makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or

completeness. HSBC is under no duty to update the information contained herein. The opinions contained within the report are based upon publicly available

information at the time of publication and are subject to change without notice.

Nothing herein excludes or restricts any duty or liability to a customer which HSBC has under the Financial Services and Markets Act 2000 or under the Rules

of FCA and PRA. A recipient who chooses to deal with any person who is not a representative of HSBC in the UK will not enjoy the protections afforded by

the UK regulatory regime. Past performance is not necessarily a guide to future performance. The value of any investment or income may go down as well as

up and you may not get back the full amount invested. Where an investment is denominated in a currency other than the local currency of the recipient of the

research report, changes in the exchange rates may have an adverse effect on the value, price or income of that investment. In case of investments for which

there is no recognised market it may be difficult for investors to sell their investments or to obtain reliable information about its value or the extent of the risk to

which it is exposed.

HSBC Bank plc is registered in England No 14259, is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and

the Prudential Regulation Authority and is a member of the London Stock Exchange.

In Canada, this document has been distributed by HSBC Bank Canada and/or its affiliates. Where this document contains market updates/overviews, or similar

materials (collectively deemed “Commentary” in Canada although other affiliate jurisdictions may term “Commentary” as either “macro-research” or

“research”), the Commentary is not an offer to sell, or a solicitation of an offer to sell or subscribe for, any financial product or instrument (including, without

limitation, any currencies, securities, commodities or other financial instruments).

© Copyright 2013, HSBC Bank plc, ALL RIGHTS RESERVED. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on

any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of HSBC Bank plc. MICA (P)

118/04/2013, MICA (P) 068/04/2013 and MICA (P) 110/01/2013

Not for distribution in India, Korea, Taiwan and the US

8