Accounting Concepts & Definitions

advertisement

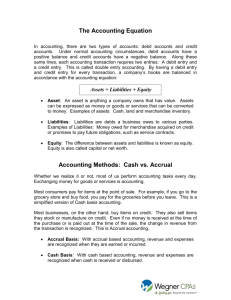

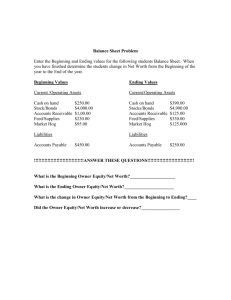

ACCOUNTING CONCEPTS & DEFINITIONS The accounting equation: Assets = liabilities + owner's equity. The financial statement called the balance sheet is based on the "accounting equation." Note that assets are on the left-hand side of the equation, and liabilities and equities are on the right-hand side of the equation. Similarly, some balance sheets are presented so that assets are on the left; liabilities and owner's equity are on the right. Balance sheet: Also called a statement of financial position, a balance sheet is a financial "snapshot" of your resort at a given date in time. It lists your resorts assets, its liabilities, and the difference between the two, which is the equity, or net worth. The balance sheet is a real-life example of the accounting equation because it shows that assets = liabilities + owner's equity. Assets: Things of value held by your resort. Assets are balance sheet accounts. Examples of assets are cash, accounts receivable, and furniture and fixtures. Liabilities: What your resort owes creditors. Liabilities are balance sheet accounts. Examples are accounts payable, payroll taxes payable, and loans payable. Equity: The net worth of the entity. Also called owner's equity or capital. Equity comes from investment in the business by the owners, such as the accumulated reserves. It essentially represents amounts owed to the owners. Equity accounts are balance sheet accounts. Debits: At least one component of every accounting transaction (journal entry) is a debit amount. Debits increase assets and decrease liabilities and equity. For this reason, you will sometimes see debits entered on the left-hand side (the asset side of the accounting equation) of a two-column journal or ledger. Credits: At least one component of every accounting transaction (journal entry) is a credit amount. Credits increase liabilities and equity and decrease assets. For this reason, you will sometimes see credits entered on the right-hand side (the liability and equity side of the accounting equation) of a two-column journal or ledger. Double-entry accounting: In double-entry accounting, every transaction has two journal entries: a debit and a credit. Debits must always equal credits. Because debits equal credits, double-entry accounting prevents some common bookkeeping errors. Errors that do occur are easier to find. Doubleentry accounting is the basis of a true accounting system. There are two basic accounting methods available to most timeshare resorts: cash or accrual. Cash method. Using the cash method of accounting, you record income only when it receives cash from your customers. Your resort records an expense only when it writes the check to the vendor. Most individuals use the cash method for their personal finances because it's simpler and less timeconsuming. However, this method can distort your resort income and expenses, especially if it extends credit to its owners/customers, if it buys on credit from your suppliers, or it keeps an inventory of the products it sell. Accrual method. With the accrual method, your resort record income when the sale occurs, whether it is the delivery of a product or the rendering of a service on your part, regardless of when you get paid. Your resort records an expense when you receive goods or services, even though you may not pay for them until later. The accrual method gives your resort a more accurate picture of its financial situation than the cash method. This is because your resort records income on the books when it is truly earned, and records expenses when they are incurred. Income earned in one period is accurately matched against the expenses that correspond to that period, so your resort gets a better picture of its net profits/loss for each period. Timeshare Resorts should use the accrual method for all businesses, because the accrual method gives a clearer picture of the financial status of your business. Your resort probably needs to keep a record of accounts receivable and accounts payable anyway, so you are already keeping track of all the information needed to do your books on the accrual basis. If your resort is using a computer program, there really isn't much extra effort involved in using the accrual method.