ACCT CW 1+9 - CSD: COMPUTERIZED ACCOUNTING I

advertisement

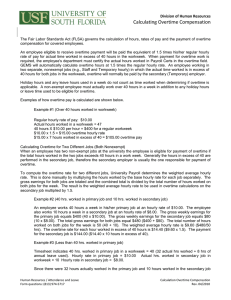

Name: Print a copy and staple to be turned into the instructor. Multiple Choice: Select the best answer for the following questions. Underline or bold the correct answer. 1. Form 941 is used to report A. federal income tax withholding. B. social security tax. C. medicare tax. D. all of the above 2. A W-4 Form contains: I. Martial Status II. Social Security Number III. Age IV. Withholding Allowances A. B. C. D. I and II and III I and III and IV II and III and IV I and II and IV 3. The Fair Labor Standards Act set A. guidelines for employers withholding taxes from employee earnings B. financial security for workers and their families C. minimum wage and overtime rate D. employers compensation insurance 4. The employee earnings record provides A. payroll information for one pay period B. payroll information for a calendar year C. one employee’s earnings for one pay period D. one employee’s earnings for a calendar year 5. Which of the following employees are not normally paid overtime? A. Sales clerk B. Taxi cab driver C. A secretary D. A school teacher 6. The purpose of the workers’ compensation laws is to A. assist unemployed workers B. protect employees from losses that occur because of job-related accidents, disability and death C. aid dependent children D. assist workers that have been injured off the job 7. SUTA taxes are used to A. operate government offices B. operate the unemployment system C. pay out the necessary benefits to jobless workers D. reimburse workers injured on the job 8. The account payroll tax expense is used to record A. employees’ federal income taxes withheld B. health insurance premiums withheld C. employee FICA taxes payable D. employer FICA taxes payable 9. A bi-weekly pay period occurs A. 18 times a year B. 26 times a year C. 24 times a year D. 52 times a year 10. The usual rate for overtime pay is ___________times the regular rate. A. .5 B. 1.25 C. 1.50 D. 1.05 11. The Year-to-date earnings column in the payroll register is A. the employees take home pay total to date B. the employees gross earnings to date C. the employees gross earnings excluding commissions D. the employees net pay including overtime Multiple Choice & Short Answer: Select the best answer(s) for the following questions. (Note: multiple choice may have more than one correct answer—list all that are correct.) 12. An hourly employee is paid bi-weekly and works 44 hours in the first week of the pay period and 37 hours in the second week of the pay period. For how many, if any, overtime hours should the employee be paid? Overtime Hours 13. Select all of the following options that Federal law requires paying overtime. A. Working more than eight hours in a day B. Hourly employees working more than 40 hours in a work week C. Hourly employees working more than 80 hours in a bi-weekly pay period D. Working on Saturday E. Working on holidays Options requiring overtime 14. Jack Trail is paid 14.5 cents for each water valve he packs. For the week ending June 27, Jack packed 4,429 water valves, and worked 44 hours and 49 minutes. What is Jack’s gross pay for the week? Gross Pay 15. Torrie Fisher is paid $77,800 per year as a computer programmer. If she is paid semi-monthly, in which pay period, if any, will she reach the earnings limit for Social Security taxes. Assume that her first pay period for the year is the 15th of January for wages earned January 1-15. Pay period 16. The law that requires employees and employers to pay Medicare tax is A. The Federal Income Contributions Act B. The Federal Unemployment Tax Act C. The Medicare Rights Law D. The Federal Insurance Contributions Act Choice 17. Select the following items that are covered by the Fair Labor Standards Act. A. Employment of minors B. Minimum wage C. Overtime pay D. Maximum wage Choice 18. The payroll register A. records each pay period data B. records data for each year of a company’s life C. details an employee’s annual wages D. details annual payroll tax expenses Choice 19. Form 941 is used to report A. Federal Unemployment Tax B. Federal Income Tax C. FICA Tax D. Federal Income Tax and FICA Tax Choice 20. Rocky Davis worked 42 hours and 18 minutes during the work week. If his regular rate of pay is $15.15 per hour, what is Rocky’s gross pay for the week? Gross Pay