Price Adjustment Policies in Procurement Contracting: An Analysis

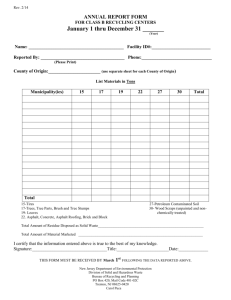

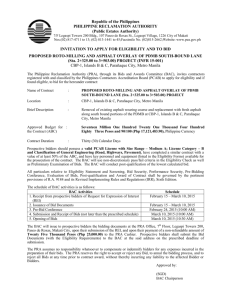

advertisement