gemm guidebook - UK Debt Management Office

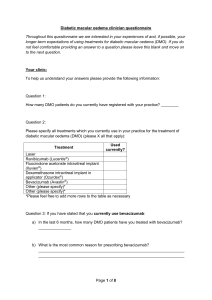

advertisement