RHS Policy and Procedure Manual - RHA Annual Financial Reporting

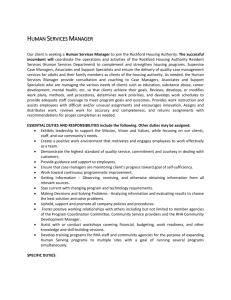

advertisement