(Microsoft PowerPoint - 12. Pr\344sentation PK_e.pptx

advertisement

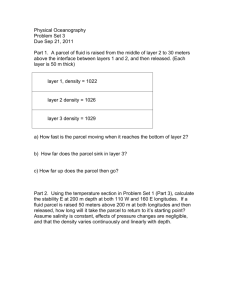

PRESS CONFERENCE FRANKFURT AM MAIN, APRIL 2, 2014 OUR NEXT HORIZON: ACCELERATING ORGANIC GROWTH Accelerating organic expansion Inorganic expansion Unlocking our potential Create the base 1990–1997 PRESS CONFERENCE | APRIL 2, 2014 1998–2008 2009–2015 2014–2020 PAGE 2 RECAP ON MAJOR FUNDAMENTAL STRATEGIC CHOICES Defend and expand position in Germany Stabilized MAIL EBIT above EUR 1bn Long-haul international trade EXPRESS: Focus on Time Definite International strategy Logistics outsourcing Offset of mail revenue decline through parcel growth FORWARDING: Exploit global market share and growth SUPPLY CHAIN: Take advantage of global outsourcing trend Increase margin through contract lifecycle discipline PRESS CONFERENCE | APRIL 2, 2014 PAGE 3 STRONG PROGRESS ALONG ALL DIMENSIONS Customer Satisfaction (Example: DHL Express) 68 (Scale 0-100) 79 GoGreen 2009 2012 C 2 efficiency: +18% (2013) Provider of Choice (cp. to base year 2007) Investment of Choice Business Performance Reported EBIT ‒ EUR bn ‒ 0.2 2009 1.8 2.4 2.7 2.861 2010 2011 2012 2013 PRESS CONFERENCE | APRIL 2, 2014 Employer of Choice Results of group-wide Employee Opinion Survey Active Leadership Employee Engagement (Scale 0-100) (Scale 0-100) 72 70 60 58 2009 2013 2009 2013 PAGE 4 STRUCTURAL MARKET TRENDS Our markets are affected by four major actionable global trends Continued global trade Acceleration of growth but shift in pattern eCommerce and more demand for last-mile solutions Growth in long-haul trade More “fine distribution“ and transport slowing and direct shipping, also in B2B down Importance of emerging markets still increasing PRESS CONFERENCE | APRIL 2, 2014 Multi-channel delivery for B2C Accelerating impact of Increasing demands for process technology and responsible business automation Automation drives efficiencies Importance of data leads to new ways of running businesses Increasing importance of social and ethical behavior Growing need for greener solutions PAGE 5 NEW STRATEGIC PLAN BUILDS ON SUCCESSFUL BASE Our DPDHL Corporate Framework remains valid Our Strategic Plan Vision Die Post für Deutschland, The Logistics Company for the World Mission Excellence. Simply delivered. Purpose We connect people, improving their lives. Guiding Principles Goals PRESS CONFERENCE | APRIL 2, 2014 Respect & Results STRATEGY 2020 Focus. Connect. Grow. 3 Bottom Lines & Living Responsibility PAGE 6 OUR STRATEGY 2020. Focus. We focus on what has made us successful… 1 Logistics as our core Committed to the needs 2 of our stakeholders & our planet A family of divisions 3 … to further expand margins. PRESS CONFERENCE | APRIL 2, 2014 Connect. We connect across the organization… 1 A global team Certified specialists 2 for everything we do Connected approach in operations, commercial, 3 green solutions and shared services … to achieve quality leader… to achieve quality leadership and service excellence. Grow. We expand in new segments… Leader in eCommerce 1 related logistics Accelerate footprint shift towards 2 emerging markets Tap new market opportunities for 3 organic expansion … to achieve sustainable above-market growth. PAGE 7 We focus on what has made us successful to further expand margins. PRESS CONFERENCE | APRIL 2, 2014 PAGE 8 We focus on what has made us successful… The rationale behind FOCUS. 1 Logistics as our core Logistics continues to be an attractive industry offering high growth and returns. 2 Committed to the needs of our stakeholders & our planet Our focus on success criteria which are relevant for our stakeholders has proven effective and will remain so in the future. 3 A family of divisions We want each division to be excellent in its focus areas. … to further expand margins. PRESS CONFERENCE | APRIL 2, 2014 PAGE 9 LOGISTICS MARKETS OFFER ATTRACTIVE GROWTH Plenty of room to grow within logistics market1) Market share DPDHL in total logistics market2) 4% Share of market with significant DPDHL presence3) 19% Attractive growth in key addressable market segments within logistics Estimated Market CAGR 2011‒2020 +5-7% Parcel Germany +8% Parcel Domestic International +5-6% International Express +2-3% +4-5% Air Freight Forwarding Ocean Freight Forwarding +5-6% Contract Logistics 1) 2011 data; 2) i.e. Global SameDay/ Courier, Parcel, Express, AFR, OFR, Ind. Proj., LTL, FTL and Cont. Logistics; 3) i.e. >5% market share (in value) in respective market PRESS CONFERENCE | APRIL 2, 2014 PAGE 10 WE REMAIN COMMITTED TO OUR LETTER BUSINESS IN GERMANY “The Post for Germany” 1 Deutsche Post business and brand remain a key pillar for the Group. 2 Over the last years, substantial investments in physical infrastructure and digital services have been made. 3 The efforts of the past years are paying off, and we remain committed. “MAIL” Division is ready for new opportunities in eCommerce & Parcel. “MAIL” Division becomes “Post - eCommerce - Parcel” Division (PeP). PRESS CONFERENCE | APRIL 2, 2014 PAGE 11 COMMITTED TO THE NEEDS OF OUR STAKEHOLDERS Customer Satisfaction (Scale from 0-100) 70‒78 70‒79 2010 2013 Min. 80 Consistently >80 group-wide 2015 2020 C 2 efficiency improvement: Provider of of Choice Provider Choice Investment of Choice EBIT (in EUR bn) 0.23 2.86 3.35‒3.55 2009 2013 2015 PRESS CONFERENCE | APRIL 2, 2014 GoGreen +30% (by 2020) Employer of Choice >8% CAGR 2020 Employee Engagement & Active Leadership (% favorable votes) Consistently 58‒61 70‒72 min. 80 >80 2009 2013 2015 2020 PAGE 12 A FAMILY OF DIVISIONS One global team Lean Corporate Center A team: Professional, diverse, and in tune with market needs Focus on governance/ ownership tasks Stand alone divisions Connected by a common management approach Customer Solutions & Innovation Selective Group-wide shared functions and services PRESS CONFERENCE | APRIL 2, 2014 Joint key account management and focused shared service unit PAGE 13 We connect across the organization to achieve quality leadership and service excellence. PRESS CONFERENCE | APRIL 2, 2014 PAGE 14 We connect across the organization … The rationale behind CONNECT. 1 A global team A highly professional and diverse management group is essential in order to meet the rising bar. 2 Certified specialists for everything we do Best-in-class team to achieve quality leadership and improve leadership. 3 Connected approach in operations, commercial, green solutions and shared services An approach leveraging our global platform to create value as a Group (i.e. support and connections but no integration). … to achieve quality leadership and service excellence. PRESS CONFERENCE | APRIL 2, 2014 PAGE 15 PROVEN CIS PROGRAM EXTENDED GROUP-WIDE Facts & Figures DHL CIS Program Integrating continuous process optimization Pioneer DHL Express Certified Specialist Trainings Targets Group implementation 100,000 Certified International Specialists since Dec. 2011 „The First Choice Way“ becomes part of „Certified“ Target state is >80% of all staff trained until 2020 Delivered in >40 languages by 1,800 DHL Express employees that are trained as facilitators Combination of: Executives 100% Modular platform for each country and function - Class room sessions Managers >90% - On the job training Supervisors & Staff >80% - Specialized application PRESS CONFERENCE | APRIL 2, 2014 PAGE 16 LEVERAGE PRE-EMINENT INTERNAL SKILLS Sorting Capability building and stronger leverage across Group Obertshausen Parcel site as pilot to enhance expertise PRESS CONFERENCE | APRIL 2, 2014 Automation/ Robotics Automation agenda with crossdivisional Operations Board to review divisional activities Data Analytics Pilots to solve divisional business issues and mine DPDHL data Divisions to drive pilots and applications PAGE 17 LEVERAGE EXCELLENCE IN GREEN LOGISTICS SOLUTIONS Target 2020 C 2 efficiency: +30% Focus today: 1 GoGreen Efficiency Success examples • First efficiency target, carbon accounting and controlling in industry • Role modeling in alternative fleet • Climate-neutral shipping • Driving industry standards PRESS CONFERENCE | APRIL 2, 2014 Next development level: 2 GoGreen 2.0 – GoGreen Solutions Make a difference with customers Action areas • Commercialize green products and services • Focus on optimizing customer supply chains • Help customers achieve CO2 and efficiency aspirations PAGE 18 We expand in new segments to achieve sustainable above-market growth. PRESS CONFERENCE | APRIL 2, 2014 PAGE 19 We expand in new segments… The rationale behind GROW. 1 Leader in eCommerce related logistics We want to create value by utilizing our existing capabilities to build new businesses and grow organically. 2 Accelerate footprint shift towards emerging markets We want to continue being a leader in fast growing markets. 3 Tap new market opportunities for organic expansion We want to serve changing customer needs and tap new sources of growth. … to achieve sustainable abovemarket growth. PRESS CONFERENCE | APRIL 2, 2014 PAGE 20 EMERGING MARKETS CONTINUE TO GROW STRONGER Macro trends continue to support high growth in emerging markets • Demographics, e.g. India and China to provide >50% of increase in global workforce with college education by 2030 Growth differential expected to continue GDP, real, CAGR 2011-2020e 2.0 • Continuing urbanization, e.g. in China expected to reach 70% by 2030 • Growing consumer base, e.g. global middle class set to grow 2.6 fold by 2030 with 90% coming from Asia Pacific PRESS CONFERENCE | APRIL 2, 2014 5.4 ‒ in % ‒ Mature Markets • • • • • USA UK Japan Western Europe … Emerging Markets • • • • • China India Brazil South East Asia … PAGE 21 OUR AMBITION FOR THE EMERGING MARKETS Group revenue footprint 78% 70% 22% 30% Today 2013 Mature Markets PRESS CONFERENCE | APRIL 2, 2014 30% emerging market footprint is ambitious but realistic Target 2020 target Emerging Markets PAGE 22 LEADER IN eCOMMERCE-RELATED LOGISTICS eCommerce trend is a structural growth trend for logistics businesses • Domestic Parcel business driving strong eCommerce growth in Germany • International domestic and cross-border parcel activities already in DHL portfolio Opportunity to expand eCommerce and parcel activities internationally MAIL Division becomes “Post - eCommerce - Parcel” (PeP) Leveraging its two strong brands PRESS CONFERENCE | APRIL 2, 2014 PAGE 23 The Post for Germany and the global eCommerce enabler PRESS CONFERENCE | APRIL 2, 2014 PAGE 24 KEY BUILDING BLOCKS OF PeP BUSINESS STRATEGY Our guiding principles: Internationalization We offer innovative services based on our our core competencies We are the trusted communications and targetoriented advertising provider – online & offline Digital Defend physical mail Enter into the digital world Restructure international business Diversification Develop eCommerce to drive parcel Physical mail PRESS CONFERENCE | APRIL 2, 2014 Parcel / e-Commerce We are the leading parcel and eCommerce service provider Diversify based on core competences PAGE 25 OVERALL UNCHANGED VOLUME TRENDS IN GERMANY Volume Development • in bn items 7.96 7.82 Mail Communication • 2009 2013 • • 10.90 9.75 Dialogue Marketing 2009 PRESS CONFERENCE | APRIL 2, 2014 2013 Overall volumes in Mail Germany declined at an average rate of only 1.8% through Strategy 2015 Mail Communication benefitted from discontinuation of product „Infobrief“ in 2013 Dialogue Marketing volumes continue to be under pressure Parcel Germany continues to show strong development. Market growth rates should come down slightly (expected CAGR ~ 6%) in bn items 1.026 Parcel Germany 0.761 2009 Mail Germany 2013 21.16 19.65 2009 2013 PAGE 26 PeP: PERFORMANCE & HIGHLIGHTS STRATEGY 2015 PeP Strategy 2015: We‘ve put down solid roots for future growth Investment of Choice 2009 2010 2011 2012 2013 2014 2015 Estimate EBIT EUR bn Employer of Choice Provider of Choice 1.4 1.1 1.1 1.21) 1.2 ~1.2 ≥ 1.1 Customer Satisfaction 93% 93% 95% 96% 95% 95% ≥ 95% Employee Satisfaction 66% 74% 76% 77% 76% 80% ≥ 90% 1)excluding VAT impact EUR 151m PRESS CONFERENCE | APRIL 2, 2014 PAGE 27 STRATEGIC EVOLUTION OF PeP DIVISION › 2007 › 2014 Restructuring Stabilization of the traditional letter mail business and build-up of domestic parcel operations „Defend Germany“ Domestic mail volume development stabilized - e-substitution remains the key challenge long-term E-Post established in the market for digital communication Strategic realignment of Global Mail completed Successful build-up of “DHL Paket” as innovation and market leader in Germany Appointment of PeP Division as global lead division for eCommerce logistics services! PRESS CONFERENCE | APRIL 2, 2014 › 2020 Growth Internationalization of the successful German “Parcel Strategy” Transfer of domestic parcel business in Poland, BeNeLux, Czech Republic and India to PeP Expansion and entries into additional domestic parcel markets in APAC/ Americas Stabilisation of classic letter mail operations remains a key challenge Expansion of digital services Increase profitability in Mail Communication Vision: Global No. 1 eCommerce service provider PAGE 28 eCOMMERCE ACCELERATION: OPPORTUNITY & THREAT Opportunity Threat Parcel domestic market revenue 2011 2020 Emerging Markets +11% p.a. Mature Markets +7% p.a. Mainland China +15% p.a. Global CAGR 2011‒2020: PRESS CONFERENCE | APRIL 2, 2014 +8% Logistics companies venturing into eCommerce to support logistics eCommerce companies venturing into logistics to support eCommerce New competitors entering the market PAGE 29 MAIL DIVISION BECOMES “Post - eCommerce - Parcel” Two main businesses, leveraging their existing strong brands Sub-division Post Sub-divisiion eCommerce & Parcel The Post for Germany The global eCommerce enabler includes • Mail Communication • E-Post • Dialogue Marketing • Presse Services • Export/Import Germany includes • Germany • Europe • International • Cross-Border/Intercontinental Brand power, expertise and resources necessary to meet our ambitious growth targets PRESS CONFERENCE | APRIL 2, 2014 PAGE 30 DHL PAKET SUCCESSFUL MODEL IN GERMANY Consumer centric innovation leader on the first and last mile in Germany EXAMPLES DHL Paketshops Packstation Shopping platforms PRESS CONFERENCE | APRIL 2, 2014 Private parcelbox Grocery delivery Evening delivery/ Flexible delivery PAGE 31 eCOMMERCE & PARCEL: SERVICE PORTFOLIO eFACILITATION eFULFILLMENT DELIVERY 50 40 • • • Marketplaces Marketing services Payment solutions • Domestic eFulfillment (incl. value added services) • In collaboration with DHL Supply Chain 0 30 CROSS-BORDER eCOMMERCE 10 20 • Multichannel domestic delivery and return1) • International B2C shipping • Combined with int‘l eFulfillment and eFacilitation services 1) Incl. intra-EU delivery and return PRESS CONFERENCE | APRIL 2, 2014 PAGE 32 SUBDIVISION DHL “eCommerce & Parcel” The key element of future profit growth DHL Parcel Parcel Germany • Continue success story • Expand and innovate production capacity • Invest in new service features, e.g. private parcelbox, allyouneed.com PRESS CONFERENCE | APRIL 2, 2014 Parcel Europe • Leverage & invest in businesses transferred from DHL(BeNeLux, PL, CZ) • Re-orient and broaden service offering towards B2C • Gradually expand European coverage DHL eCommerce Americas Asia • Build on existing businesses – Global Mail US – Blue Dart India • International B2C shipping services/ Domestic and destination based eFulfillment as a start in emerging markets • Aspiration: Integrated offer of all eCommercerelated logistics and eFacilitation services PAGE 33 OUR ASPIRATION: LEADER IN eCOMMERCE-RELATED LOGISTICS Our Aspiration for 2020 Our assets to get there Further grow and maintain No. 1 position in Germany • Passion to win No. 1 for x-border eCommerce services on most attractive international trade lanes • Great entrepreneurs Top 3 of domestic B2C delivery and eCommerce logistics in selected markets PRESS CONFERENCE | APRIL 2, 2014 • Love for our customers • Strong brands • World-class processes • Support by ”family of divisions” PAGE 34 Financial outlook & aspiration PRESS CONFERENCE | APRIL 2, 2014 PAGE 35 FINANCIAL PERFORMANCE 2009-2013 2.7 2.4 1.8 Strong increase in Group EBIT 2.861 0.2 ‒ in EUR bn‒ 2009 2010 2011 2012 2013 Supported by strong EBIT performance in all Divisions 1,391 2009 1,226 2013 MAIL/PeP 1,133 483 174 -790 2009 2013 -216 2009 EXPRESS 2013 2009 FORWARDING,FREIGHT 2.500 441 ‒ in EUR mn‒ 2013 SUPPLY CHAIN 1.6 1.500 Driving turnaround in Free Cash Flow 0.5 0.7 0.7 500 ‒ in EUR bn‒ -500 -0.2 -1.500 2009 2010 2011 2009 2010 2011 1) Adjusted for non-recurring items PRESS CONFERENCE | APRIL 2, 2014 1) 20121) 2013 2012 2013 PAGE 36 FINANCIAL OUTLOOK AND ASPIRATIONS Further revenue and earnings growth expected Investments to remain at current levels to take full advantage of attractive growth opportunities Free Cash Flow generation to continue positive and increasing Financial policy unchanged PRESS CONFERENCE | APRIL 2, 2014 PAGE 37 2020 TARGETS 2015 EBIT targets confirmed, new 2020 targets introduced EBIT 2013 base1) FY 2015 FY 2020 PeP2) EUR 1.286bn Min. EUR 1.1bn ~3% CAGR 2013-2020 DHL EUR 1.997bn EUR 2.6-2.8bn ~10% CAGR 2013-2020 CC/ Other EUR -422m ~ EUR 350m < 0.5% of Group revenue Group EUR 2.861bn EUR 3.35-3.55bn >8% CAGR 2013-2020 Free Cash Flow generation to remain priority No ambition for major M&A Finance policy including payout ratio range to remain unchanged 1) Adjusted for 2013 EBIT of ~ EUR 60m from transfer of assets from DHL to PeP effective on Jan. 1, 2014 2) POST - eCOMMERCE - PARCEL PRESS CONFERENCE | APRIL 2, 2014 PAGE 38 MAJOR INVESTMENTS PLANNED FOR 2014 2014 Gross Capex guidance (EUR 1.9bn) Major projects: PeP Investments into new international Parcel businesses Continuation of Parcel 2012 investment program EXPRESS Network investment, mainly aviation/ aircraft Extention Leipzig Hub FORWARDING, FREIGHT New Forwarding Environment SUPPLY CHAIN Significant new business wins PRESS CONFERENCE | APRIL 2, 2014 PAGE 39 NO CHANGE IN M&A STRATEGY Goal Continued focus on organic growth Recent M&A history (in EUR m) 2009 M&A Objectives Bolt-on acquisitions to support strategies and new growth initiatives of divisions Further small disposals where necessary to optimize divisional business portfolios 2010 2011 2012 2013 0 -100 -200 -300 -400 Conclusion No significant increase in M&A spend expected Net cash from M&A Cash-out related to disposal of domestic Express activities PRESS CONFERENCE | APRIL 2, 2014 PAGE 40 FREE CASH FLOW DEVELOPMENT 2009-2013 Turnaround in FCF generation lays base for further improvement Major drivers: OCF Net Capex Net Cash from M&A FCF (in EUR m) 2.500 2,500 1,500 1.500 500 -500 -1.500 -1,500 1) 2009 2010 2011 2012 2013 2009 2010 2011 2012 2013 2009 2010 2011 2012 2013 1) 2009 2010 2011 2012 2013 1) Adjusted for non-recurring items PRESS CONFERENCE | APRIL 2, 2014 PAGE 41 CONFIRMATION OF FINANCE POLICY Target/ maintain rating BBB+ Deployment of Free Cash Flow Dividend payout ratio to remain between 40-60% of net profit (continuity and Cash Flow performance considered) Excess liquidity will be used for Stepwise pension funding and/ or Share buybacks and/or extraordinary dividends PRESS CONFERENCE | APRIL 2, 2014 PAGE 42 Recap Strategy 2020 PRESS CONFERENCE | APRIL 2, 2014 OUR STRATEGY 2020. Focus. We focus on what has made us successful… 1 Logistics as our core Committed to the needs 2 of our stakeholders & our planet A family of divisions 3 … to further expand margins. PRESS CONFERENCE | APRIL 2, 2014 Connect. We connect across the organization… 1 A global team Certified specialists 2 for everything we do Connected approach in operations, commercial, 3 green solutions and shared services … to achieve quality leader… to achieve quality leadership and service excellence. Grow. We expand in new segments… Leader in eCommerce 1 related logistics Accelerate footprint shift towards 2 emerging markets Tap new market opportunities for 3 organic expansion … to achieve sustainable above-market growth. PAGE 44 OUR ASPIRATION FOR 2020: DEFINING OUR INDUSTRY When people think of logistics, we want them to think DPDHL WE are the most global WE are the quality leader WE are most customer-centric PRESS CONFERENCE | APRIL 2, 2014 PAGE 45 PRESS CONFERENCE FRANKFURT AM MAIN, APRIL 2, 2014