Profit-sharing plan solutions

Age-weighted, new comparability, and Social Security integrated

Vanguard Retirement Plan Access™ offers age-weighted, new comparability, and Social Security integrated allocation methods

to provide a streamlined, cost-effective way to increase savings without inflating overhead. Consider the important advantages

of these retirement plan options.

Who might benefit?

• All types of businesses, including corporations, partnerships, and sole proprietorships.

• Businesses with fewer than 50 employees.

• Businesses in which the owner is older than the majority of the employees.

• Instances in which owners seek to maximize their contributions.

What are the benefits?

Maximize savings

Flexibility

•Plan sponsors can achieve savings of up to 25%

•Plan sponsors have flexibility to allocate discretionary

of eligible payroll.

contributions in their favor and in favor of key personnel.

•Plan sponsors maximize tax savings because

•We offer a comprehensive package that is priced to grow

all contribution and plan-operating costs are

tax deductible.

in step with a small business.

How do these plans work?

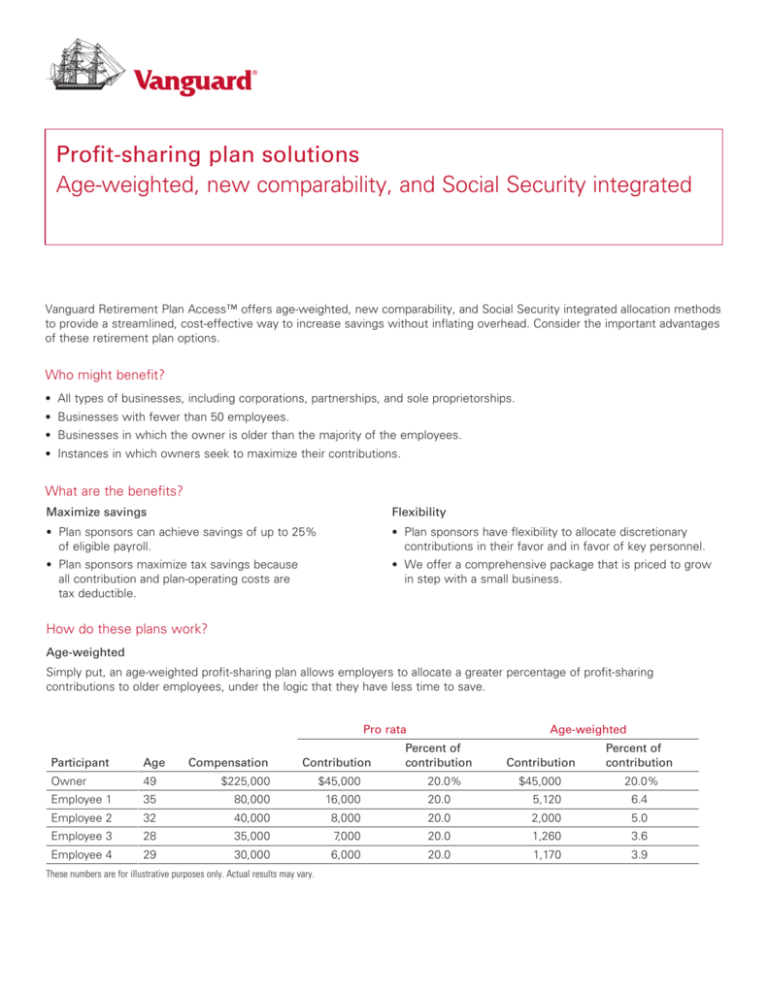

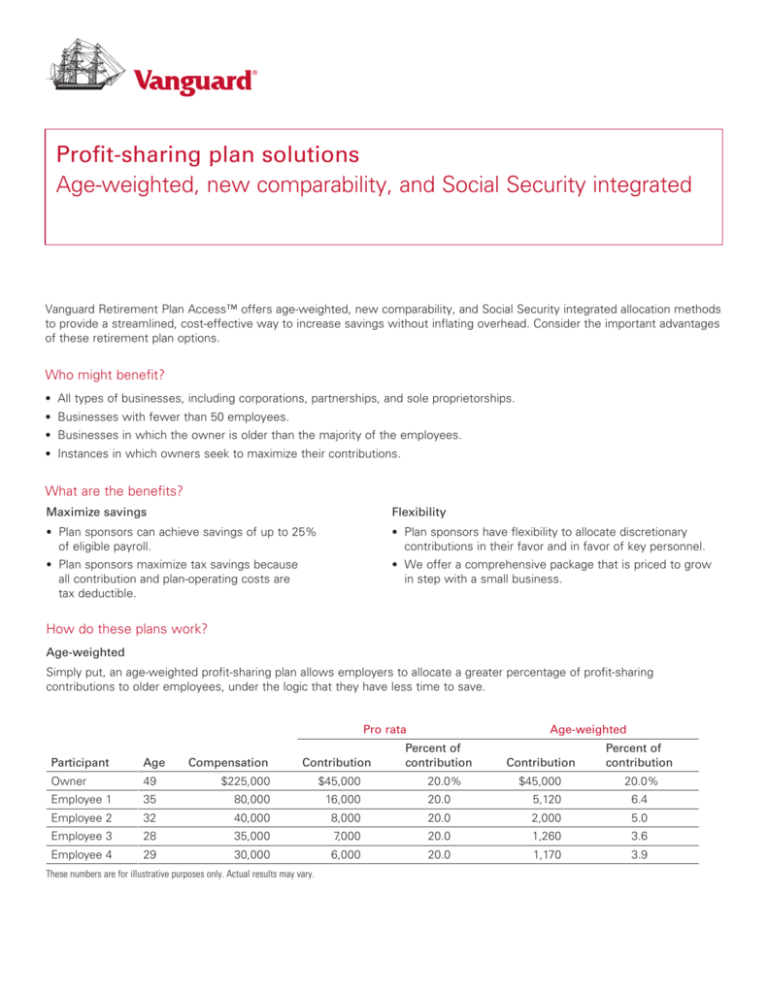

Age-weighted

Simply put, an age-weighted profit-sharing plan allows employers to allocate a greater percentage of profit-sharing

contributions to older employees, under the logic that they have less time to save.

Pro rata

Compensation

Contribution

Age-weighted

Percent of

contribution

Contribution

Percent of

contribution

$45,000

20.0%

Participant

Age

Owner

49

$225,000

$45,000

Employee 1

35

80,000

16,000

20.0

5,120

6.4

Employee 2

32

40,000

8,000

20.0

2,000

5.0

Employee 3

28

35,000

7,000

20.0

1,260

3.6

Employee 4

29

30,000

6,000

20.0

1,170

3.9

These numbers are for illustrative purposes only. Actual results may vary.

20.0%

New comparability

A new comparability profit-sharing plan divides employees into two or more groups on the basis of objective standards. An IRSapproved formula allows a greater percentage of profit-sharing contributions to be allocated to one group (e.g., “the owner”)

versus the other group(s). Because of the allocation flexibility of this type of plan, it is subject to stringent discrimination tests.

Additionally, changing employee demographics throughout the year may impact the groups and their contribution rates.

Pro rata

Compensation

Contribution

New comparability

Percent of

contribution

Contribution

Percent of

contribution

$45,000

20.0%

Participant

Age

Owner

49

$225,000

$45,000

Employee 1

35

80,000

16,000

20.0

4,000

5.0

Employee 2

32

40,000

8,000

20.0

2,000

5.0

Employee 3

28

35,000

7,000

20.0

1,750

5.0

Employee 4

29

30,000

6,000

20.0

1,500

5.0

20.0%

These numbers are for illustrative purposes only. Actual results may vary.

Social Security integrated

The Social Security taxable wage can be integrated into a plan’s allocation formula as a feature of a 401(k) plan. With this

feature, employees earning more than the taxable wage base are eligible to receive an additional allocation and employees

earning less than this integration receive a base pro rata allocation. The additional contribution is allowed for those employees

who do not have the benefit of the employer’s Social Security contribution on their excess compensation.

Pro rata

Social Security integrated

Contribution

Percent of

contribution

Contribution

Percent of

contribution

$225,000

$45,000

20.00%

$35,010

15.56%

35

80,000

16,000

20.00

Employee 2

32

40,000

8,000

20.00

4,972

12.43

Employee 3

28

35,000

7,000

20.00

4,351

12.43

Employee 4

29

30,000

6,000

20.00

3,729

12.43

Participant

Age

Owner

49

Employee 1

Compensation

9,944

12.43

These numbers are for illustrative purposes only. Actual results may vary.

To learn more about these plan design features, contact Vanguard at 888-684-401K.

Retirement plan recordkeeping and administrative services are provided by The Vanguard Group, Inc. (VGI). VGI has entered into an agreement with Ascensus,

Inc., to provide certain plan recordkeeping and administrative services on its behalf. Ascensus is not affiliated with The Vanguard Group, Inc., or any of its

affiliates. Ascensus® is a registered trademark of Ascensus, Inc.

© 2015 The Vanguard Group, Inc. All rights reserved. VRPAAWNC 112015