Cross-Tested/ Age-Weighted Plan What is it?

advertisement

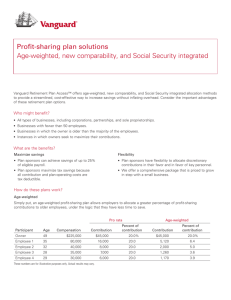

Cross-Tested/ Age-Weighted Plan Chapter 21 Employee Benefit & Retirement Planning What is it? • a defined contribution plan allocation that allows higher plan contributions for older plan entrants • the formula for annual employer contributions or allocations to participant accounts is based on AGE as well as compensation level - older plan entrant’s accounts build up quickly - tends to favor owners and key-employees Copyright 2009, The National Underwriter Company 1 Cross-Tested/ Age-Weighted Plan Chapter 21 Employee Benefit & Retirement Planning Plan Types cross tested (new comparability plan) – maximizes benefits to highly compensated employees (HCEs) – benefits to non-HCEs are whatever is necessary to meet nondiscrimination regulations Copyright 2009, The National Underwriter Company 2 Cross-Tested/ Age-Weighted Plan Chapter 21 Employee Benefit & Retirement Planning Plan Types age-weighted profit sharing plan allocation formula contains actuarial age-weighting factor that gives a higher allocation for older plan entrants target plan pension plan with an age-weighted formula but requires annual contributions Copyright 2009, The National Underwriter Company 3 Cross-Tested/ Age-Weighted Plan Chapter 21 Employee Benefit & Retirement Planning When is it indicated? 1. relatively older business owners and key employees want to – maximize own plan benefits – minimize plan costs 2. employer wants to bring older employees into a defined contribution plan Copyright 2009, The National Underwriter Company 4 Cross-Tested/ Age-Weighted Plan Chapter 21 Employee Benefit & Retirement Planning When is it indicated? 3. want plan that provides adequate retirement benefits to older employees with lower cost and simplicity of a defined contribution plan 4. when employer terminates existing defined benefit plan and wants to provide approximately the same benefits to most employees 5. closely held business or professional corporation has older key employees Copyright 2009, The National Underwriter Company 5 Cross-Tested/ Age-Weighted Plan Chapter 21 Employee Benefit & Retirement Planning Advantages 1. can maximize retirement benefits for employees entering plan at older ages 2. older business owners and key employees may receive a larger portion of plan allocations as compared with other defined contribution plans 3. provides tax-deferred savings for employees 4. simple and inexpensive to design, administer, and explain to employees Copyright 2009, The National Underwriter Company 6 Cross-Tested/ Age-Weighted Plan Chapter 21 Employee Benefit & Retirement Planning Advantages 5. plan benefits may be eligible for special 10 year averaging for income tax purposes 6. individual accounts allow plan participants to benefit from good investment results Copyright 2009, The National Underwriter Company 7 Cross-Tested/ Age-Weighted Plan Chapter 21 Employee Benefit & Retirement Planning Disadvantages 1. annual additions to employee account limited to lesser of 100% compensation or $49,000 (2009); these limits may disadvantage highly compensated or older employees 2. employees bear investment risk 3. contributions to age-weighted or cross-tested profit sharing plan must be “substantial and recurring”; target benefit plan contributions must meet minimum funding standards each year Copyright 2009, The National Underwriter Company 8 Cross-Tested/ Age-Weighted Plan Chapter 21 Employee Benefit & Retirement Planning Disadvantages 4. age-weighted profit sharing plans have uncertain benefits; annual contributions not required 5. target pension plan or cross-tested plan may require annual actuarial services Copyright 2009, The National Underwriter Company 9 Cross-Tested/ Age-Weighted Plan Chapter 21 Employee Benefit & Retirement Planning Cross-Tested Plan Design • designed to meet nondiscrimination requirements of IRS Code Section 401(a)(4) on the basis of benefits provided (i.e. is tested as if were defined benefit plan, hence ‘cross-tested’) • cross-testing rules are complex - basically – highly compensated can receive maximum contribution allowed under Section 415 limits – remaining employees given allocation that meets requirements of cross-testing regulations Copyright 2009, The National Underwriter Company 10 Cross-Tested/ Age-Weighted Plan Chapter 21 Employee Benefit & Retirement Planning Cross-Tested Plan Design • in general, cross-testing regulations focus on plan’s ultimate benefits to evaluate nondiscrimination • plan must satisfy “gateway” requirement; small businesses usually face minimum allocation of 5% of compensation for nonhighly compensated employees to meet this requirement • when more than one highly compensated employee is in group, plan must be broken into “rate groups” to test for nondiscrimination Copyright 2009, The National Underwriter Company 11 Cross-Tested/ Age-Weighted Plan Chapter 21 Employee Benefit & Retirement Planning Disadvantages of Cross-Tested Plans • unstable plan design; age of new hires can necessitate new plan • plan becomes costly or impractical if have – relatively large number of older rank and file employees – relatively young highly compensated employees • must analyze plan design when have new hires, increasing plan costs Copyright 2009, The National Underwriter Company 12 Cross-Tested/ Age-Weighted Plan Chapter 21 Employee Benefit & Retirement Planning Disadvantages of Cross-Tested Plans • plan design inhibits hire of older employees – can put employer in danger of violating age discrimination legislation – can deprive company of valuable and experienced employees who have critical skills Copyright 2009, The National Underwriter Company 13 Cross-Tested/ Age-Weighted Plan Chapter 21 Employee Benefit & Retirement Planning Fixed-Formula Age-Weighted Plans Age-Weighted Profit Sharing Plan • actuarial formula for allocating employer contributions – allows plan to automatically pass cross-testing requirements – reduces plan complexity and cost • plan is difficult to communicate to employees; younger employees may deem larger contributions to older employees as unfair Copyright 2009, The National Underwriter Company 14 Cross-Tested/ Age-Weighted Plan Chapter 21 Employee Benefit & Retirement Planning Fixed-Formula Age-Weighted Plans Age-Weighted Pension (Target Benefit) Plan • similar to profit share plan with fixed formula, but as pension plan must meet annual minimum funding requirements • disadvantages – no guarantee of fund balance at retirement – difficult to communicate to employees – employers must fund annually Copyright 2009, The National Underwriter Company 15 Cross-Tested/ Age-Weighted Plan Chapter 21 Employee Benefit & Retirement Planning Tax Implications 1. employer plan contributions tax deductible 2. employee contribution tax deferred 3. annual additions limited to 100% compensation or $49,000 (2009) 4. must follow rules for qualified plan distributions; premature distributions subject to penalty 5. special 10 year averaging may be available for some lump-sum distributions Copyright 2009, The National Underwriter Company 16 Cross-Tested/ Age-Weighted Plan Chapter 21 Employee Benefit & Retirement Planning Tax Implications 6. target pension plan is subject to minimum funding rules of IRC Section 412 7. some employers may qualify for $500 business tax credit for ‘qualified start up costs’ 8. plan may allow employees to contribute to ‘deemed IRA’ under plan; such contributions will limit other IRA contributions 9. plan subject to ERISA reporting and disclosure rules Copyright 2009, The National Underwriter Company 17 Cross-Tested/ Age-Weighted Plan Chapter 21 Employee Benefit & Retirement Planning Alternatives defined benefit plans – more benefit security – greater tax deductible employer contributions for older, highly compensated employees – more complex and costly to design and administer money purchase plan – similar to target benefit plan – without age-related contribution feature Copyright 2009, The National Underwriter Company 18 Cross-Tested/ Age-Weighted Plan Chapter 21 Employee Benefit & Retirement Planning Alternatives nonqualified deferred compensation plans – can be provided exclusively for executives – employer tax deduction deferred until benefit payments are made individual retirement savings plans – can be alternative or supplement to employer plan – amount of contribution limited Copyright 2009, The National Underwriter Company 19 Cross-Tested/ Age-Weighted Plan Chapter 21 Employee Benefit & Retirement Planning True or False? 1. An age-weighted plan allows for higher contribution levels as percent of compensation for older plan entrants. 2. A cross-tested plan maximizes benefits to highly compensated employees. 3. An age-weighted plan can provide approximately the same benefits to employees when their employer switches from a defined benefit plan. Copyright 2009, The National Underwriter Company 20 Cross-Tested/ Age-Weighted Plan Chapter 21 Employee Benefit & Retirement Planning True or False? 4. An age-weighted plan and a target benefit plan must have annual employer contributions. 5. Cross-tested plans do not need to meet nondiscrimination rules since their structure precludes discrimination. 6. A cross-tested plan is typically not advantageous when many highly compensated employees are relatively young. Copyright 2009, The National Underwriter Company 21 Cross-Tested/ Age-Weighted Plan Chapter 21 Employee Benefit & Retirement Planning Discussion Question Discuss how an age-weighted or cross-tested plan would work for 1. self-employed 2. shareholder employees of S corporation Copyright 2009, The National Underwriter Company 22