Cases in Engineering Economy 2 nd by Peterson & Eschenbach

advertisement

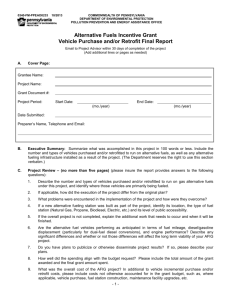

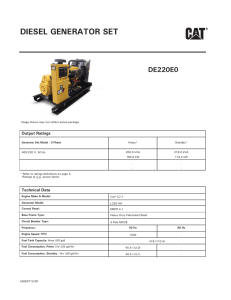

Cases in Engineering Economy 2 nd by Peterson & Eschenbach 1 Case 11 Harbor Delivery Teaching Notes: 1. Cell B46 is set up to use Goal Seek to find the breakeven point (Option) by guessing Nautical miles/day. 2. Problem best solved with EAW since lives different. If PW is used a common horizon (12 years) must be chosen. 3. The $500 insurance cost is treated as a cost for gas powered, but it could be a savings for diesel. 4. The timing of oil changes is based on number of operating hours/day – in practice more occur if done at night when 100 hours will be exceeded during the coming day. 18% 200 18 365 Gasoline $76,586 3 $500 21.1 $50 26 0 $3.15 $15 300 $25 100 $6,000 $38,000 Calculated cells 18.0 0.0 468 57 $20,696 $5,475 $1,643 6,000 $33,813 $18,250 $76,586 $38,000 $23,740.67 MARR Nautical miles/day Hours/day of operation Days/year Diesel $97,995 Purchase price 4 Life Insurance ($/yr) 17.4 Average speed (Knots) 0 Value of higher speed ($/day) 17 Fuel consumption (gal/hr) 1 Fuel consumption when idling $2.95 Fuel cost ($/gal) $15 Cost/refueling 300 Fuel capacity (gal) $57 Oil change cost/change 100 Hours between oil changes $9,000 Annual maintenance cost $48,000 Salvage value 18.0 1.0 306 53 $19,382 $5,475 $3,745 9,000 $37,601 - Hours of power unit operation/day Hours of idling/day Fuel (gal/day) Fueling cost/day Fuel cost/year Fueling cost/year Oil change cost/year Annual maintenance cost Annual operating costs Annual value of higher speed $97,995 EAC (Purchase) $48,000 EAC (Salvage) $26,153.25 EAC -$2,413 Diesel EAC advantage $23,740.67 equivalent annual cost