Southwest Airlines

advertisement

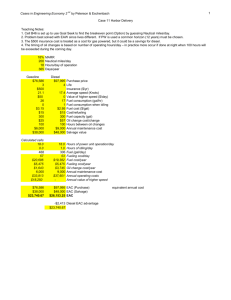

Bryan Brown John Bynum Southwest is experiencing financial difficulties following the expiration of their oil hedging contracts Make a recommendation for the companies strategy for the next 5 years Volatile fuel prices Inconsistent culture High cost of labor Heavily unionized No longer the low cost provider Point to Point strategy 2 free bags No seating chart/ class 737 sole airframe Put the employee first, everything else will follow 12.00% 10.00% 8.00% 6.00% 4.00% Southwest Operating Profit Margin 2.00% Delta Operating Profit Margin 0.00% 2010 -2.00% -4.00% 2011 2012 2013 through Q2 2014 American Operating Profit Margin United Operating Profit Margin -6.00% -8.00% -10.00% *see Fig. 1 1000 900 800 700 600 Raleigh - San Antonio 500 Raleigh - New York 400 Raleigh - Jacksonville 300 200 100 0 Southwest American US Airways • • • • Abandoned humorous advertising campaign Emphasizing that they care Messages on carts and napkins Positioning themselves as more professional A warrior spirit A servant’s heart A “fun-luving” attitude Employee recognition program Shift in culture Employees first, the rest will follow Kelleher to Kelley 2007 Strategy, Structure, Rivalry Factor conditions National Comparative Advantage Related and Supporting Industry Demand Conditions Be a best cost provider Reduce Fuel Consumption Expand to Alaska/ Hawaii Hedge fuel Labor Relations Fuel saving policy- top down Practice maintaining a higher cruise altitude 40,000 ft. Glide down to airport 6,875 gal. * .01 = 68.75 gal. 68.75 * 3,400 Daily flights = 233,750 gal. 233,750 * 365 = 85,318,750 gallons 85,318,750 gal. * $3 = $255,956,250 Alaska/ Hawaii only serviced by one major carrier- Alaska Airlines Fleet consists of exclusively Boeing 737’s Higher profit margins on longer flights, more time in air, less time in terminals/ fewer terminal fees *See Fig. 2 Push for increased presence in Western US Seattle- Alaska headquarters Spokane Los Angeles Chip away at Alaska’s market share *See figure 3 Shares: 132,631,936 Current Price: $55.42 Premium: $57.00 Total Cost: $7,560,020,352.00 Have more transparency within the ranks Satisfy the internal customer Go back to employee first, everything else will follow See Fig. 4 Implement fuel saving practices Today Dec 29 Airtran dissolves Hedge fuel 2015 Expand national operations in western US Buy Alaska Airlines 2016 2017 2018 2019 Alaska Airline fully integrated Southwest Airlines- Fuel Hedging Case Analysis by Vishal Prabhakar NASDAQ finance- Income Statements Southwest 2013 Annual Report Delta 2013 Annual Report COB Case packet Frank Miner- personal interview Boeing.com Ogj.com