Commercial Banking - Olin Business School

advertisement

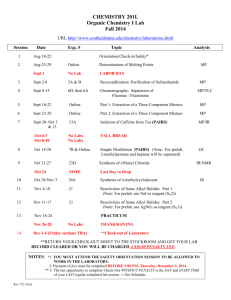

Finance 549D SPECIAL TOPICS: FINANCIAL INSTITUTIONS 2004 Fall A Mini-Course William R. Emmons, Adjunct Professor Economist, Federal Reserve Bank of St. Louis Tel: 314-444-8844; Fax: 444-8740 E-mail (Olin address is preferred): emmons@olin.wustl.edu or emmons@stls.frb.org. Class meetings: Olin office: Hours: 109 Simon Hall MW 4:00-5:30 p.m. 278 Simon Tel: 935-6337 By appointment Course description As part of a small management team, you will control all aspects of a commercial bank in a realistic competitive simulation. You will learn the fundamentals of bank profitability and how to manage your bank effectively. Your performance in the course will be measured both individually and as a member of your management team. Individual grades (70%) will be assigned for presentations you make to the class of your bank’s strategies and results, and on the basis of an in-class midterm exam. Group grades (30%) will be assigned according to the performance of your bank in the banking simulation and on the basis of an “Annual Report” prepared by your management team for your bank’s “shareholders.” Class meetings (12), classroom presentations (2), exam (1), and group paper (1) • Class meetings introduce you to important banking concepts and terms, give you time to formulate and implement strategies for your bank, and allow you to make presentations to the class on some aspect of your bank’s strategy and performance. • Each student will make two brief presentations to the entire class. You will make a presentation (worth 20 percent of your grade) of some aspect of your bank’s strategy on Monday, September 27. You will make another 20-point presentation analyzing some aspect of your bank’s performance on Wednesday, October 20, during your bank’s “Annual Shareholder Meeting.” • There will be one open-book, open-note mid-term exam worth 30 percent of your course grade. This 60-minute exam will be Monday, October 4. • Each management team will prepare a group term paper in the form of an “Annual Report” that describes the bank’s performance, due by Friday, October 22, 2003, at 5;00 p.m. 1 John M. Olin School of Business SPECIAL TOPICS: FINANCIAL INSTITUTIONS Fall 2004 Grading Grades will be assigned on the following basis (individual or group as indicated): Banking concepts Mid-term exam on banking concepts (individual)..……………….......30% Bank simulation Mid-term presentation of your bank’s strategy (individual)……...........20 Final exam: Analysis of your bank’s performance (individual)............20 Term paper: “Annual Report” (group)………………..………..……..20 Your bank’s final standing (group)……………………………….……10 100% Outstanding team member(s) (individual)…....………….2 (Each team will receive two points of extra credit that it may award to any team member or members in any way they choose at the end of the term.) Honor code The honor code applies to all aspects of this course, inside and outside the classroom. Prompt self-report of any possible violations will mitigate the impact of reported violations on your grade. Course Readings (in course packet at bookstore) The Stanford Bank Game, Version 11, “Players’ Manual,” Executive Edition, 2000. Additional Readings (passed out in class or available on Blackboard) Carlson, Mark and Roberto Perli, “Profits and Balance-Sheet Developments at U.S. Commercial Banks in 2003,” Federal Reserve Bulletin 90 (2004), Second Quarter, No. 2, pp. 162-191. 2 John M. Olin School of Business SPECIAL TOPICS: FINANCIAL INSTITUTIONS Fall 2004 Session Date Topics and activities Readings to prepare for class Week 1 0 Sept 6 Labor Day (no class) 1 Sept 8 ¥ ¥ ¥ ¥ Course overview. Introduction to the Stanford Bank Game. Fundamentals of bank profitability. Team organizational meeting. ¥ Syllabus. ¥ Players’ Manual, pp. 3-18. Managing your bank. Period 1.4 and 2.1 positions. Financial statements. Team meeting: Period 2.2 inputs due at end of class (trial period). ¥ Players’ Manual, pp. 19-46. The decision form. Team meeting: Period 2.3 inputs due at end of class (trial period). ¥ Players’ Manual, pp. 49-71. ¥ Players’ Manual, pp. 75-92. ¥ Optional reading: Players’ Manual, pp. 95-112. Week 2 2 Sept 13 ¥ ¥ ¥ ¥ 3 Sept 15 ¥ ¥ Week 3 4 Sept 20 ¥ ¥ ¥ 5 Sept 22 ¥ ¥ Year 2, Quarter 1 position. Sources and uses of funds. Team meeting: Period 2.2 inputs due at end of class (official game begins). Sources and uses of funds. Team meeting: Period 2.3 inputs due at end of class. Week 4 6 Sept 27 ¥ Bank strategy presentations. 3 7 Sept 29 ¥ Team meeting: Period 2.4 inputs due at end of class. ¥ Sources and uses of funds. Review for midterm exam. Team meeting: Period 3.1 inputs due at end of class. ¥ ¥ Week 5 8 9 Oct 4 Oct 6 ¥ Midterm Exam. ¥ Team meeting: Period 3.2 inputs due by Oct. 9. No class. Week 6 10 Oct 11 ¥ ¥ ¥ 11 Oct 13 ¥ ¥ Review midterm exam. Profitability and balance-sheet trends at US banks in 2003. Team meeting: Period 3.3 inputs due at end of class. Recent developments at US banks in 2003. Team meeting: Period 3.4 inputs due at end of class. ¥ Week 7 12 Oct 18 ¥ ¥ ¥ 13 Oct 20 ¥ Oct 22 ¥ Recent developments at US banks in 2003. Team meeting: Period 4.1 inputs due at end of class. Prepare for Annual Shareholder Meetings. Final Exam: Annual Shareholder Meetings. Annual Report due by 5:00 p.m. 4 ¥ Carlson and Perli, pp. 162177. ¥ Carlson and Perli, pp. 178180.