Mr & Mrs Asia

advertisement

Mr & Mrs Asia

Moving up the J-curves

Special report

Spring 2010

Mr & Mrs Asia

Anirudha Dutta

Contents

anirudha.dutta@clsa.com

(91) 2266505056

Executive summary ............................................................................ 3

Amar Gill, CFA

Global growth engine ......................................................................... 4

(65) 65122337

Aaron Fischer, CFA

(852) 26008256

Bhavtosh Vajpayee, CFA

Rise of Asia’s middle class................................................................ 19

Sector profiles

(852) 26008388

Autos.........................................30

Property .....................................93

Daniel Tabbush

Banks ........................................40

Technology ...............................104

(66) 22574631

Consumer ..................................58

Telecoms..................................114

Elinor Leung, CFA

Education ...................................85

Transport .................................123

(852) 26008632

Geoff Boyd

Appendices

(65) 64167853

1: Penetration versus disposable income ............................................... 136

Nicole Wong

2: Consumer expenditure .................................................................... 138

(852) 26008207

Nimish Joshi

(91) 2266505054

Robert Bruce

(852) 26008522

3: Disposable income-penetration correlation ........................................ 140

4: Penetration of consumer goods ........................................................ 143

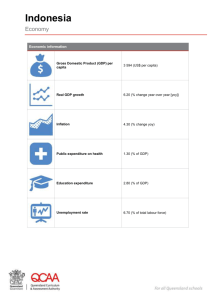

5: Chindonesia by numbers ................................................................. 144

All prices quoted herein are as at close of business 12 April 2010, unless otherwise stated.

The dragon, the elephant and the komodo

2

anirudha.dutta@clsa.com

19 April 2010

Mr & Mrs Asia

Executive summary

Moving up the J-curves

J-curve hypergrowth over

the next five to 10 years

China, India and Indonesia’s (Chindonesia) consumer sectors should exhibit Jcurve hypergrowth over the next five to 10 years on rising incomes and a

propensity to consume and take risks. Easier access to finance, increasing

urbanisation and an optimistic outlook will also drive consumption. This report

examines the macro underpinnings of our thesis, particularly the burgeoning

middle class, and highlights our top picks in eight sectors on a five-year horizon.

Chindonesia contributed a

quarter of global GDP

growth in past five years

Chindonesia contributed more than 25% of global GDP growth over the past

five years and significantly outperformed developed economies in terms of

stockmarket returns. Even more noteworthy is that in the face of the 2008

global financial crisis, the emerging-market trio exhibited relative resilience

and maintained healthy growth trends.

Major consumer

sectors are on the cusp

of strong expansion

The emergence of Asia, particularly China, as a major consumer of industrial

metals, minerals and manufactured products has been evident over the past

decade. While India has been lagging China, its expansion rates remain

among the highest in the world. Major consumer sectors in the region are on

the cusp of five to 10 years of J-curve hypergrowth as the middle class enjoys

rising incomes and exhibits its propensity to consume and take risks.

Availability of finance, growing urbanisation and widely optimistic sentiment

will also be key drivers of this growth.

Middle class to make up

30% of Asia ex-Japan’s

population in five years

We estimate that the middle class makes up 19% of Asia ex-Japan’s

population, and that should rise to 30% in five years, or an 11% Cagr. The

aggregate number of those in the region’s middle class will increase from

570m currently to 945m by 2015. China will account for two-thirds of the new

members, while Chindonesia will represent 90% of the 375m increment. We

expect the social cluster’s consumption spending to increase from US$2.9tn

to US$5.1tn over this period.

Many sectors will witness

exponential growth

Our analysis also suggests demand growth in most sectors is likely to be

exponential, as average per-capita disposable income approaches the critical

US$3,000 level, beyond which discretionary spending kicks in. The best

example is car sales. While 2009 sales of 10.3m have made China the largest

autos market in the world, its total vehicle population is just 62m and

penetration remains low at 5%.

Our top picks

Our top picks in China (including Hong Kong), India and Indonesia include Air

China, Baidu, Bank of China, Cathay Pacific, China Resources Land, Dongfeng

Motor, HDFC Bank, Maruti Suzuki, SAIC and Unitech.

J-curve trajectory

Mobile subscribers

800

(m)

China

India

700

600

500

400

300

200

100

0

1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009

Source: Economist Intelligence Unit, CLSA Asia-Pacific Markets

19 April 2010

anirudha.dutta@clsa.com

3

Mr & Mrs Asia

Section 1: Global growth engine

Global growth engine

In our summer 2005 Chindia: The shape of things to come report, we wrote:

‘A sustained surge in consumption will primarily drive Chindia’s future growth

acceleration . . . Lifestyle change is visible with demand for better housing,

educational and healthcare services, financial services and infrastructure. No

other economy in the world has such a compelling demographic profile.’

Add Indonesia into the mix and we believe this emerging-market trio will

represent 90% of the region’s new middle-class entrants over the next five

years. Demographics and an increasing proportion of middle-income families

will drive consumption and consumerism in these three countries over the

next decade. In many cases, it will be a J-curve hypergrowth trajectory, akin

to what we have seen in the telecoms sector over the past 15 years.

Figure 1

Figure 2

Mobile subscribers

Asia ex-Japan private consumption¹

800

Telecoms sector enjoyed

J-curve hypergrowth

over the past 15 years

(m)

China

45

India

700

(%)

41.3

40

600

500

35

400

30

300

25.2

200

25

100

0

1995

20

1997

1999

2001

2003

2005

2007

Source: CLSA Asia-Pacific Markets

2009

1999

2001

2003

2005

2007

2009

¹ As a share of US private consumption. Source:

CEIC, CLSA Asia-Pacific Markets

Global economic data show China, India and Indonesia enjoyed real-GDP

Cagrs of 11.3%, 8.4% and 5.6% over 2004-09. Together they represented

over 25% of the world’s incremental growth. During the same period, the

three stockmarkets delivered 145-170% returns, versus the Dow Jones

Industrial Average’s (DJIA) 4%.

Figure 3

Chindonesia contributed

to a quarter of global GDP

growth in past five years

Real-GDP growth

16

(%)

Chindonesia¹

World

14

12.4

11.3

12

10

10.4

8.9

9.5

8.7

8.0

8

6

4.9

4.5

5.1

5.2

3.9

4

3.0

2

0

(0.8)

(2)

2004

2005

2006

2007

2008

09CL

10CL

¹ Weighted using nominal US$-denominated GDP. Source: CEIC, Datastream, IMF, CLSA Asia-Pacific Markets

4

anirudha.dutta@clsa.com

19 April 2010

Mr & Mrs Asia

Section 1: Global growth engine

Figure 4

Major outperformance

over the past five years

Stockmarket returns versus gold and DJIA

500

MSCI China

MSCI India

Golds comdty

DJIA

MSCI Indo

400

300

200

100

0

Jan 05

Jan 06

Jan 07

Jan 08

Jan 09

Jan 10

Source: Bloomberg, CLSA Asia-Pacific Markets

Resilience to financial crises

China, India and

Indonesia withstood the

global slowdown well

Impressively, these economies have shown relative resilience to the recent

global financial crisis. Over 2007-09, China, India and Indonesia delivered

real-GDP Cagrs of 9.1%, 6.8% and 5.3%, against the global growth rate of

1.1%. Government intervention and stimulus packages aided the expansion,

like elsewhere in the world.

Figure 5

High growth in

2008 and 2009

Real-GDP Cagr, 2007-09

10

(%)

9.1

8.4

8

6.8

6

5.3

4

2

1.1

0

World

China

India

Indonesia

Chindonesia¹

¹ Weighted using nominal US$-denominated GDP. Source: CEIC, Datastream, IMF, CLSA Asia-Pacific Markets

Domestic demand and

infra spend made up for

China’s decline in exports

19 April 2010

The market expected the global turmoil to hurt China given its high

dependence on exports. However, even as exports declined 18.1% and 5.5%

in 2009 for China and India, the two economies still reported healthy growth.

The size of China’s stimulus package (15% of GDP) meant that it was one of

the few global economies to weather the storm well. In comparison, India’s

stimulus measures were modest and mostly focused on direct and indirect tax

reduction and increased salaries for government employees, due as per the

recommendations of sixth Pay Commission. We should also see India’s 6.2%

GDP growth in 2009 in the context of a 23% below-normal rainfall last year, a

multi-decade low. In the past, similar severe shortages in rainfall had led the

economy into recession.

anirudha.dutta@clsa.com

5

Mr & Mrs Asia

Section 1: Global growth engine

Figure 6

High growth rates

despite poor monsoons

India’s GDP growth in relation to monsoons

(%)

25

(%)

Deviation of monsoon from normal

20

12

GDP growth YoY (RHS)

10

15

10

8

5

0

6

(5)

(10)

4

(15)

(20)

2

(25)

0

(30)

FY88

FY90

FY92

FY94

FY96

FY98

FY00

FY02

FY04

FY06

FY08

Source: IMD, CSO, CLSA Asia-Pacific Markets

Figure 7

Fiscal stimuli

Brazil

Fiscal stimuli

(% of GDP)

0.2

Britain

China

1.1

15.0

Investments and

other spending

Additional long-term measures

US$152bn, including investment

in housing over 15 years and an

extension of "Bolsa Familia" antipoverty programme

Infrastructure, schools and

housing - US$4bn

Tax cuts

Non-financial

bailouts

Credit line for exporters and

strategic industries

Key financial support

VAT reduction US$18bn

Loan for the auto industry US$3bn; working capital for

small businesses - US$14bn

1.1

VAT reforms for

companies; lower tax

on home sales;

increased tax rebates

on exports

Rebates and credits

on investments US$15bn

Income and payroll

tax - US$21bn

Indirect subsidies for auto and

consumer durable industries;

lower export tariff on steel

Funding guarantees US$358bn; capital

injections - US$53bn;

asset purchases US$72bn;

nationalisations US$215bn; liquidity

support - US$286bn

None

Public housing - US$60bn; rural

areas - US$15bn; infrastructure US$300bn; areas hit by

earthquake - US$130bn

Loan guarantees US$423bn; capital

injection - US$53bn

Loan guarantees US$520bn; capital

injection - US$185bn

Lending to non-bank

finance companies

0.4

None

1.6

Loan guarantees; fund

for bank recapitalisation

- US$222bn

2.0

Unsecured,

subordinated loans to

largest banks

Funding guarantees - US$1.5tn;

asset purchases - US$700bn (of

which bank capital - US$290bn);

AIG - US$150bn; conservatorship

- US$200bn; term programmes US$900bn; commercial paper and

money-market funds - US$2.3tn

1.1

US$4bn, mainly for

middle-income

earners

France

1.5

Infrastructure, research and

support for local authorities

Germany

3.1

Infrastructure - US$23bn; social

benefits

India

1.3

Infrastructure and social services

(education, health, housing) US$4bn; capital spending by

state governments - US$6bn;

refinancing of infrastructure

lending - US$8bn

Cuts in central excise

and custom duties;

removal of

surcharges from

personal income tax

Indonesia

1.6

Infrastructure - US$1.3bn;

business subsidies - US$0.5bn

Japan

2.0

Social benefits, reduction in

highway tolls and incentives to

hire workers

Reduction in personal

income tax US$4.7bn; cut in

import duties US$1.4bn

US$12bn, mainly

housing

Russia

1.1

Raised unemployment benefits

Cut in corporate tax US$15bn

USA

5.8

Energy - US$58bn; science US$17bn; infrastructure US$92bn; benefits - US$71bn;

education - US$159bn; health US$154bn; housing - US$13bn

US$275bn, of which

US$140bn to

individuals

Auto industry - US$8bn

Auto aid - US$2bn; loan

guarantees to non-financial

companies

Flow of credit at reasonable rates

to exporters, small businesses,

commercial-vehicle makers.

Small Industries Development

Bank of India made an

aggregate disbursement of

US$750m

None

Indirect support to

construction industry; pledge

to support other struggling

industries

Auto industry, loans or loan

guarantees to companies in

strategic industries

Loans for auto industry US$21bn

Authority to buy loan

portfolio from struggling

banks

Impact

(% of GDP)

0.2

6.0

2.4

1.3

5.8

Source: www.economist.com, CLSA Asia-Pacific Markets

6

anirudha.dutta@clsa.com

19 April 2010

Mr & Mrs Asia

Section 1: Global growth engine

Domestic

economies held up

Figure 8

Figure 9

China’s real GDP

India’s real GDP

China real GDP growth

GDP growth ex-exports

(% YoY)

20

India real GDP growth

GDP growth ex-exports

(% YoY)

14

12

15

10

8

10

6

4

5

2

0

0

80

84

88

92

96

00

04

08

FY80

FY84

FY88

FY92

FY96

FY00

FY04

FY08

Source: CEIC, CLSA Asia-Pacific Markets

Narrowing the gap with global majors

Companies in China and

India are catching up

with global majors

It is interesting to see some other changes sweeping through the markets. In

2001, global outsourcing giant Accenture’s market cap and sales were 5x and

20x that of Infosys. Today, the two companies have the same market cap and

Accenture’s revenue is 5.2x that of the Indian player. In terms of profitability,

Infosys is within touching distance of Accenture. In an entirely different sector,

multinational ABB’s market cap was 25x that of Bharat Heavy Electricals (BHEL)

in 2001, so was its revenue. Now, its market cap is 1.8x that of BHEL and its

revenue in 2009 was 5.5x. Over the past decade, companies in China and India

have scaled up rapidly as they exploited the business opportunities thrown up

not only by the domestic market (BHEL) but also globally (Infosys).

Figure 10

In a decade, market

caps have converged

Accenture and Infosys market-cap differential

6

(x)

Market cap of Accenture

was 5x that of Infosys at

the start of the decade

5

4

3

2

1

0

Aug 01

Jan 05

Oct 06

Jun 08

Mar 10

Figure 11

Figure 12

Accenture and Infosys sales convergence

Accenture and Infosys’ net income

(x)

3,000

118.2

2,500

Revenue of Accenture

was 118x that of Infosys

in 1998; 5.2x in 2009

Infosys

(US$m)

Accenture

2,000

1,500

1,000

5.2

500

FY09

FY08

FY07

FY06

FY05

FY04

FY03

FY02

FY01

FY00

FY99

FY98

FY09

FY08

FY07

FY06

FY05

FY04

FY03

FY02

FY01

FY00

0

FY99

160

140

120

100

80

60

40

20

0

FY98

Infosys plays catchup

with Accenture

May 03

Source: Bloomberg, CLSA Asia-Pacific Markets

19 April 2010

anirudha.dutta@clsa.com

7

Mr & Mrs Asia

Section 1: Global growth engine

Figure 13

BHEL narrows the

market-cap gap with ABB

ABB and BHEL market-cap differential

30

(x)

Market cap of ABB was

25x that of BHEL at the

start of the decade

25

20

15

10

5

0

Apr 01

Nov 03

Feb 05

May 06

Aug 07

Nov 08

Figure 14

Figure 15

ABB and BHEL sales convergence

ABB and BHEL’s net income

Revenue of ABB was

25x that of BHEL in

1996; 5.5x in 2009

25.2

20

BHEL

(US$m)

Mar 10

ABB

3,000

2,000

15

1,000

10

5.5

0

5

FY09

FY08

FY07

FY06

FY05

FY04

FY03

FY02

FY01

FY96

FY09

FY08

FY07

FY06

FY05

FY04

FY03

FY02

FY01

FY00

FY99

FY98

FY97

(1,000)

FY96

0

FY00

25

4,000

(x)

FY99

30

FY98

35

FY97

BHEL has been able to

capitalise on the India

growth opportunity

Jul 02

Source: Bloomberg, CLSA Asia-Pacific Markets

Focus shifting from commodities to consumer

Dominance in industrial

commodities and

products is now a given

Over the past five years, the dominance of China and India, particularly the

former, both as a producer and consumer of minerals, metals, materials and

oil & gas has dramatically increased. As these commodities continued to grab

headlines, the focus on the consumer sector has been less significant.

The same is likely to

happen to consumer

sectors in five to 10 years

We expect consumers in China, India and Indonesia to drive consumption in

Asia over the next five to 10 years. During the next five years, these countries

will see a net addition of 103m people to the 20-60 years age group. We

believe consumption in these countries will grow strongly over the next five to

10 years, led by higher incomes, higher propensity to consume, better risktaking ability, easier availability and access to finance, rising urbanisation and

an optimistic outlook.

Figure 16

Figure 17

China apparent steel consumption¹

China crude-steel production¹

13CL

12CL

11CL

10CL

09CL

08A

10

07A

20

10

06A

20

05A

30

04A

40

30

03A

40

(%)

02A

50

01A

50

00A

60

99A

(%)

98A

60

93A

94A

95A

96A

97A

98A

99A

00A

01A

02A

03A

04A

05A

06A

07A

08A

09CL

10CL

11CL

12CL

13CL

China now accounts for

about 50% of the world’s

steel consumption

¹ As a percentage of world consumption and production. Source: AIIS, CLSA Asia-Pacific Markets

8

anirudha.dutta@clsa.com

19 April 2010

Mr & Mrs Asia

Section 1: Global growth engine

Figure 18

Chindia’s contribution to world mineral production, 2008

Chindia has also added

major capacity in the

past 10-15 years

Mineral

Unit

World

production

China

production

India

production

Chindia as

% of world

Alumina

Copper

k tonnes

60,496

22,748

1,815

40.6

k tonnes

18,619

3,700

1,195

Crude steel

26.3

m tonnes

1,299

498

55.1

42.6

Iron ore

m tonnes

2,145

785

207

46.2

Gold

tonnes

2,385

282

3.75

12.0

Lead

k tonnes

8,558

3,030

124

36.9

Magnesium

k tonnes

11,600

2,188

2,512

40.5

Zinc

k tonnes

11,688

3,913

1,017

42.2

Source: CLSA Asia-Pacific Markets

As Figures 19-22 below show, China, India and Indonesia are at different

stages of the hypergrowth phase, with China already in the midst of it.

China’s growth is likely to remain strong over the next five years. India and

Indonesia, in most cases, are at the cusp of starting that stage. They will

commence their hypergrowth phase as a larger proportion of the population

enters the middle-income group over the next five years. Figures 23-24 show

the shift in consumption to the east is well underway.

Figure 19

Figure 20

Refrigerator penetration versus disposable income

Camera penetration versus disposable income

Ownership of refridgerator (% of household)

120

100

Thailand

Singapore

Malaysia

Ownership of camera (% of household)

120

Taiwan

Korea

HK

Japan

100

80

Malaysia

Taiwan

Korea

Thailand

80

HK

Japan

Singapore

Philippines

60

60

China

y = 21.546Ln(x) - 109.42

Philippines

2

R = 0.7631

40

Indonesia

India

20

y = 20.925Ln(x) - 110.78

40

2

R = 0.5642

China

Indonesia

20

Disposable income per capita (US$)

0

0

5,000

10,000

15,000

20,000

25,000

30,000

Disposable income per capita (US$)

India

0

0

5,000

10,000

15,000

20,000

25,000

30,000

Figure 21

Figure 22

PC penetration versus disposable income

Air-conditioner penetration versus disposable income

Ownership of PC (% of household)

100

80

Korea

70

Taiwan

60

50

China

30

y = 23.818Ln(x) - 153.98

Indonesia

India

10

0

China

Korea

40

R2 = 0.9472

Thailand

Philippines

20

Singapore

70

50

Malaysia

Disposable income per capita (US$)

30

Malaysia

20

Thailand

Philippines

Indonesia

India

10

0

0

5,000

10,000

15,000

20,000

Japan

HK

Taiwan

80

HK

Singapore

90

60

40

Ownership of air-conditioner (% of household)

100

Japan

90

25,000

30,000

0

5,000

y = 24.167Ln(x) - 161.44

2

R = 0.8195

Disposable income per capita (US$)

10,000

15,000

20,000

25,000

30,000

Source: Euromonitor

19 April 2010

anirudha.dutta@clsa.com

9

Mr & Mrs Asia

Section 1: Global growth engine

Chindonesia leads

in incremental

private consumption

Figure 23

Figure 24

Private-consumption growth

Consumption delta is moving east

600

Chindonesia

(US$bn increase)

USA

1,500

500

(US$bn increase)

1,000

400

500

300

200

0

100

China, India and Indonesia

(500)

0

(100)

USA and Eurozone

(1,000)

99 00 01 02 03 04 05 06 07 08 09

99 00 01 02 03 04 05 06 07 08 09

Source: CEIC, CLSA Asia-Pacific Markets

Supportive demographics

India should be the

biggest beneficiary of the

demographic dividend

Among developed

nations, the USA

is well placed

While India is likely to be the biggest beneficiary of the demographic

dividend, for China the challenge will be to become richer before it starts

growing old. Indonesia is another potential beneficiary in Asia. ‘Over the next

decade, the workforce of Indonesia will rise by another 21m people, whereas

Japan, Europe and Russia will see further demographic decline,’ says our

Indonesia country and research head Nick Cashmore.

Figure 25

Figure 26

US demographics, 2009

US demographics, 2015

100+

95-99

90-94

85-89

80-84

75-79

70-74

65-69

60-64

55-59

50-54

45-49

40-44

35-39

30-34

25-29

20-24

15-19

10-14

5-9

0-4

Male

15

India is best

placed to reap

demographic dividend

10

100+

95-99

90-94

85-89

80-84

75-79

70-74

65-69

60-64

55-59

50-54

45-49

40-44

35-39

30-34

25-29

20-24

15-19

10-14

5-9

0-4

Female

5

0

5

10

15

Male

15

10

5

Female

0

5

Figure 27

Figure 28

India demographics, 2009

India demographics, 2015

100+

95-99

90-94

85-89

80-84

75-79

70-74

65-69

60-64

55-59

50-54

45-49

40-44

35-39

30-34

25-29

20-24

15-19

10-14

5-9

0-4

Male

80

60

40

20

100+

95-99

90-94

85-89

80-84

75-79

70-74

65-69

60-64

55-59

50-54

45-49

40-44

35-39

30-34

25-29

20-24

15-19

10-14

5-9

0-4

Female

0

20

40

60

80

Male

80

60

40

20

10

15

Female

0

20

40

60

80

Source: US Census, CLSA Asia-Pacific Markets

10

anirudha.dutta@clsa.com

19 April 2010

Mr & Mrs Asia

Section 1: Global growth engine

In China, demographics

is a concern

Figure 29

Figure 30

China demographics, 2009

China demographics, 2015

100+

95-99

90-94

85-89

80-84

75-79

70-74

65-69

60-64

55-59

50-54

45-49

40-44

35-39

30-34

25-29

20-24

15-19

10-14

5-9

0-4

Male

80

Indonesia is well placed

60

40

20

100+

95-99

90-94

85-89

80-84

75-79

70-74

65-69

60-64

55-59

50-54

45-49

40-44

35-39

30-34

25-29

20-24

15-19

10-14

5-9

0-4

Female

0

20

40

60

Male

80

80

60

40

20

Female

0

20

40

Figure 31

Figure 32

Indonesia demographics, 2009

Indonesia demographics, 2015

100+

95-99

90-94

85-89

80-84

75-79

70-74

65-69

60-64

55-59

50-54

45-49

40-44

35-39

30-34

25-29

20-24

15-19

10-14

5-9

0-4

Male

12

8

4

100+

95-99

90-94

85-89

80-84

75-79

70-74

65-69

60-64

55-59

50-54

45-49

40-44

35-39

30-34

25-29

20-24

15-19

10-14

5-9

0-4

Female

0

4

8

12

Male

12

8

4

60

80

Female

0

4

8

12

Source: US Census, CLSA Asia-Pacific Markets

A burgeoning consumer group

Youth and inexperience

drive consumption,

as does urbanisation

Our strategist Russell Napier wrote in his recent Solid Ground report ‘Buy

chaos, sell order’: ‘When it comes to economics, youth and inexperience, key

drivers of consumption, are often more rewarding than the age and guile that

brings conservatism and savings.’ For the purpose of this study, we focus on

the middle class because we believe the group will be the biggest driver of

Asia’s consumption story. The younger population entering the middle class

will not be tied down by the baggage of a socialist past and their propensity

to consume will be very different from the middle-aged generation.

The middle class will

make up 30% of the

population in five years

We estimate the middle class makes up 19% of Asia ex-Japan’s population

and this will rise to 30% in five years, or an 11% Cagr. During the same

period, the aggregate number of Asians in this social group will increase from

570m presently to 945m. To put it in perspective, this will be nearly three

times the population of the USA and nearly as much as India’s total. China

will account for two-thirds of those entering the Asia ex-Japan middle class,

growing its middle-class members to 600m. Altogether, China, India and

Indonesia will represent 90% of the 375m increment, with India’s total

reaching 140m. The new entrants, along with the rising incomes of the

existing members, will drive consumerism in the three economies.

19 April 2010

anirudha.dutta@clsa.com

11

Mr & Mrs Asia

Section 1: Global growth engine

Figure 33

Growth will be fastest

in India, but China

will remain dominant

Rise of the Asian middle class

1,000

(m)

900

800

700

Other Asia ex-Japan

Indonesia

India

China

10.7% Cagr

600

500

400

300

200

100

0

2009

2010

2011

2012

2013

2014

Source: Euromonitor, World Bank, CLSA Asia-Pacific Markets

Income and consumer-product penetration

The car and the

mobile stories are

likely to be repeated

It is clear that China and India are emerging as major centres for

consumption. In 2009, the mainland became the world’s largest market for

cars with sales of 10.3m units. Meanwhile, India also reached annual auto

sales of 1.6m cars. The two countries are also the largest mobile markets

globally by subscriber numbers. However, in most cases India is about eight

to 10 years behind China in terms of penetration, affordability and income

gap. As Figures 37-40 show, the correlation between various consumer

products and disposable income is very high.

Figure 34

China became

the world’s largest

car market in 2009

Total passenger-vehicle sales

(No.)

Europe

Japan

USA

Total

Australia

China

India

Indonesia

Korea

Malaysia

Singapore

Taiwan

Thailand

Total

1999

16,855,000

5,761,643

16,880,711

39,497,354

774,191

1,496,210

615,527

85,131

1,246,801

286,391

52,378

413,449

246,388

5,216,466

Figure 35

2009

17,525,000

4,808,000

10,430,936

32,763,936

929,366

10,300,182

1,631,777

608,000

1,449,000

529,298

73,005

294,423

520,000

16,335,051

Change

670,000

(953,643)

(6,449,775)

(6,733,418)

155,175

8,803,972

1,016,250

522,869

202,199

242,907

20,627

(119,026)

273,612

11,118,585

Figure 36

In notebook affordability, India lags China by 8-10 years

16

China notebook afforability

14

India notebook affordability

In air travel, China is already in a hypergrowth phase

Per-capita round-trip air travel

10.00

HK

12

Malaysia

Thailand

8

6

Brunei

y = 7E-05x

0.9716

2

R = 0.8855

Australia

USA

Japan

Korea

Indo, Phil, Cambodia

0.10

4

Singapore

New Zealand

1.00

10

China

2

2000

2002

2004

2006

2008

2010

2012

2014

Per-capita GDP (US$)

India, other Asian countries

0.01

0

1998

Change (%)

4

(17)

(38)

(17)

20

588

165

614

16

85

39

(29)

111

213

0

10,000

20,000

30,000

40,000

50,000

Source: CLSA Asia-Pacific Markets

12

anirudha.dutta@clsa.com

19 April 2010

Mr & Mrs Asia

Section 1: Global growth engine

Figure 37

Figure 38

Asia: Correlation - disposable income and penetration

China: Correlation - disposable income and penetration

Microwave

PC

Cable TV

Dishwasher

Cassette/radio

Fridge

Telephone

Video camera

Cooker

Internet-enabled PC

Hi-Fi

Mobile phone

Satellite TV

Motorcycle

Vacumm cleaner

Air-conditioner

Black/white TV

Camera

Passenger car

DVD player

Colour TV

Tumble drier

Shower

Bicycle

CD player

Videotape recorder

Washing machine

Video game console

(%)

0

20

40

60

80

Broadband-enabled PC

Passenger car

Internet Enabled Computer

Videotape recorder

Shower

Dishwasher

Tumble drier

Vacumm cleaner

PC

Cooker

Microwave

Cable TV

Fridge

Cassette/radio

Washing machine

Air-conditioner

Hi-Fi

Camera

Video camera

Black/white TV

Motorcycle

DVD player

Mobile phone

Freezer

Video game console

Telephone

Colour TV

Bicycle

CD player

100

(%)

0

20

40

60

80

100

Figure 39

Figure 40

India: Correlation - disposable income and penetration

Indo: Correlation - disposable income and penetration

PC

Internet-enabled PC

Air-conditioner

DVD player

Broadband-enabled PC

Mobile phone

Dishwasher

Hi-Fi

Freezer

Passenger car

Camera

Telephone

Shower

Microwave

Colour TV

Motorcycle

Cassette/radio

Washing machine

Cooker

Video game console

Vacumm cleaner

Fridge

Satellite TV

Tumble drier

Cable TV

Video camera

Bicycle

Videotape recorder

Black/white TV

CD player

(%)

0

20

40

60

80

DVD player

Cable TV

Dishwasher

PC

Passenger car

Vacumm cleaner

Camera

Air-conditioner

Shower

Tumble drier

Mobile phone

Telephone

Microwave

Internet-enabled PC

Freezer

Fridge

Cooker

Hi-Fi

Broadband-enabled PC

Washing machine

Bicycle

Black/white TV

Video camera

Cassette/radio

Motorcycle

Colour TV

CD player

Video game console

Satellite TV

Videotape recorder

100

(%)

0

20

40

60

80

100

Source: Euromonitor

Access to finance

will be a key enabler

19 April 2010

A key driver of consumerism will be access and availability of finance.

Consumer-credit penetration in these countries is very low, but it will grow

steadily as a larger part of the population comes into the bankable category,

banks and other financial intermediaries spread their network and become able

to assess and price risk properly and the younger population’s propensity to

take credit increases. China will face a challenge as its banking system changes

from a command and control-driven regime to a more market-driven one.

anirudha.dutta@clsa.com

13

Mr & Mrs Asia

Section 1: Global growth engine

Figure 41

Figure 42

Credit-card penetration

Population catered by each bank branch

USA

Japan

HK

Korea

Taiwan

Sing

UK

Aus

Brazil

Malay

Thai

China

Phil

Indo

India

Indo

238

237

15.9

India

172

153

15.2

Thai

131

13.3

Malay

108

12.4

Phil

71

52

11.3

Japan

39

9.4

Korea

18

6.8

HK

12

6

5.3

Sing

3

(%)

3

0

24.4

China

194

50

100

150

200

4.3

Taiwan

250

('000)

3.8

0

5

10

15

20

25

30

Source: CLSA Asia-Pacific Markets

An upbeat middle class

The three countries’

middle class remained

optimistic amid slowdown

Optimism of China, India and Indonesia’s middle-income population was

evident in our two Mr & Mrs Asia studies (2007 and 2009). Their positive

attitude was unsurprising in 2007, as the survey took place amid a protracted

economic boom and soaring stockmarkets when unemployment was low and

incomes were rising. What took us by surprise was that in 2009, when seven

of the 11 countries where we conducted our survey reported negative GDP

growth, a significant number of our respondents were upbeat about their

future and employment prospects and wanted to buy property and cars. As

our head of thematic research Amar Gill then wrote, ‘On balance, Mr & Mrs

Asia are positive about the future.’

Figure 43

Desire to buy property

not dented by the

economic slowdown

Mr & Mrs Asia, 2009: Share of respondents planning to buy property in next 12M

Indonesia

34

HK

31

Malaysia

28

India

27

Philippines

22

Thailand

19

Singapore

18

Taiwan

16

Korea

14

China

14

Japan

(% of respondents)

6

0

5

10

15

20

25

30

35

Source: CLSA Asia-Pacific Markets

Discretionary spending

kicks in at US$3,000 percapita disposable income

14

We believe discretionary spending kicks in at per-capita disposable income of

about US$3,000. Our analysis also shows demand growth in most sectors is

likely to be exponential, the classic hockey-stick model, as a rising proportion

of the population reaches middle-income levels. The best example is car

sales. While China has become the largest car market in the world in 2009,

its total vehicle population is just 62m and penetration level remains low at

5% (1% in India and 3% in Indonesia). This compares to 80% in the USA.

Thus, it is easy to see why growth in car sales and most other sectors can be

high for many years to come. The sector that has probably surpassed the

hypergrowth phase is telecoms, which we believe is seeing stable growth.

anirudha.dutta@clsa.com

19 April 2010

Mr & Mrs Asia

Section 1: Global growth engine

Figure 44

Optimism evident in

employment prospects

Mr & Mrs Asia, 2009: Expectations for employment prospects over next 12M

(%)

Improve

Remain same

Indonesia

Worsen

1

1

98

India

65

Philippines

30

51

Singapore

24

47

China

43

11

HK

5

22

43

59

8

Thailand

19

54

14

Korea

18

41

24

Japan

24

39

40

Taiwan

25

29

43

Malaysia

30

26

66

14

0

5

81

20

40

60

80

100

Figure 45

Even in China, ownership

levels continued to

see strong growth

GDP per capita versus vehicle density

Light-vehicle ownership (units/'000 population)

800

y = 0.0154x + 30.001

2

R = 0.9235

700

New Zealand

Australia

600

Japan

500

400

Malaysia

300

Taiwan

India

Pakistan

Vietnam

200

Korea

Singapore

Thailand

Hong Kong

Philippines

Indonesia

100

Nominal GDP per capita (US$)

China

0

0

10,000

20,000

30,000

40,000

50,000

Source: CLSA Asia-Pacific Markets

The auto story will get

repeated in other sectors

Many consumer sectors, from property to consumer electronics to fastmoving consumer goods (FMCG), will repeat the success of the car and the

telecoms story. Whenever a paradigm shift in technology takes place,

developing countries in Asia are likely to catch up faster as they leapfrog one

generation of technology and go straight into adapting the latest, as has

happened in the case of mobile telephony, at an early stage. With 726m

subscribers, China is the largest mobile-phone subscriber market in the world

today and India, with 519m subscribers, is the second-largest.

Who will be the winners?

While Asia’s consumption growth story is not in doubt, the winners are not

always clear. Certainly, not every company will be a winner, even though most

sectors are likely to witness robust growth. As we highlighted in our previous

19 April 2010

anirudha.dutta@clsa.com

15

Mr & Mrs Asia

Section 1: Global growth engine

Chindia reports, The shape of things to come in 2005 and A new economic

world order by 2020 in 2006, many winners will come from other countries. A

case in point is the consumer-durable market in India. In this intensely

competitive industry, where margins are very narrow, Korean players LG and

Samsung have been able to carve out a niche with attractive price points,

strong brand building and constant product innovation. LG, which expects a

turnover of Rs170bn in 2010, targets to have 12% of its global sales from

India by 2015. Meanwhile, Nokia’s sales from India are about Rs225bn and it

has emerged as the largest FMCG company in the country.

Figure 46

Mobile penetration

Technology and

low costs drive growth

Mobile penetration (%)

100

China

India

Indonesia

USA

80

60

40

20

GDP per capita (US$)

0

0

10,000

20,000

30,000

40,000

50,000

Source: Euromonitor, CLSA Asia-Pacific Markets

Figure 47

Figure 48

Cable-TV penetration versus disposable income

Washing-machine penetration versus disposable income

Ownership of cable TV (% of household)

100

HK

100

80

70

Korea

60

Taiwan

50

China

40

Philippines

30

20

10

Ownership of washing machine (% of household)

120

90

Japan

Malaysia

80

40

2

Malaysia

Indonesia

0

5,000

y = 21.656Ln(x) - 113.66

R2 = 0.7998

Philippines

R = 0.5138

0

Singapore

China

Thailand

India

Japan

HK

60

Singapore

y = 0.002x + 23.74

Thailand

Korea

Taiwan

Indonesia

20

India

Disposable income per capita (US$)

Disposable income per capita (US$)

0

10,000

15,000

20,000

25,000

30,000

0

5,000

10,000

15,000

20,000

25,000

30,000

Source: Euromonitor

Middle class’ consumption

spending will rise to

US$5.1tn in five years

16

This report uses Euromonitor’s disposable-income data, adjusted for grey

income. Our sector research heads have looked at their respective areas to

assess the potential, risks and challenges to the growth story and identify the

stocks they believe will be winners. We estimate Asian middle class’

consumption spending will rise from US$2.9tn to US$5.1tn over the next five

years. We assume modest currency appreciation of 20-22% for the renminbi,

the rupee and the rupiah over this period. Of the US$2.15tn increase, China

is likely to account for 69%, India 16% and Indonesia 4%. While China will

see the largest increase in absolute terms, India’s middle-class spending will

rise faster at an 18% Cagr (versus 15% for China).

anirudha.dutta@clsa.com

19 April 2010

Mr & Mrs Asia

Section 1: Global growth engine

Figure 49

Increase in disposable

income will drive

consumption

Per-capita disposable-income Cagr with and without currency impact

14

(%)

12

10

8

6

4

2

0

China

India

Indonesia

Source: Euromonitor, World Bank, CLSA Asia-Pacific Markets

Growth rates in India

will rise, but China will

lead in aggregate spend

In general, we expect higher growth rates in consumer spend in India than

China. However, the latter will dominate in sheer absolute numbers. Looking

at the different penetration versus disposable income charts, it is evident that

China and Indonesia are ahead of India in the J-curve. While China is likely to

have a few more years of robust growth, India is at the cusp of the

hypergrowth phase and should enjoy an extended period of stronger growth

over the next five to 10 years vis-a-vis China. Autos, financial services,

consumers and telecoms are sectors where India is likely to experience higher

growth rates. In consumer, technology, air travel and real estate, China will

continue to outgrow India.

Top picks

Below we summarise the views of our sector heads and their top picks.

Notwithstanding cyclical ups and downs, we attempt to identify the best

players in each sector that are likely to capitalise from the emerging

opportunities. As the top picks we recommend here are based on a five-year

horizon, there may be instances where they are inconsistent with our nearterm recommendations, especially given the market run-ups over the past 12

months. Hence, in some cases present valuations may appear high. These

may not be QARP (quality at reasonable price) stocks, but QAAP (quality at

any price) stocks.

Autos: Hyundai,

Maruti, SAIC, Dongfeng

In autos, Geoff Boyd believes by 2020, China will have a vehicle population of

322m, up at a 16.6% Cagr, and about 35-44m in India (versus 14.8m now).

Over the next five to seven years, China should remain the more attractive

market. His top picks in the region are Hyundai Mobis, Maruti, SAIC A shares

and Dongfeng H shares.

Banks: Bank Central Asia,

HDFC Bank, Bank of China

One sector that has shown strong performance over the past decade is

banking and financial services, particularly in India and Indonesia. Faster

economic growth will drive credit penetration, so will favourable

demographics, easier access to credit, improved ability of banks to assess and

price risk and increasing choices of products and services for the consumer.

Daniel Tabbush estimates consumer credit can grow 15-23% in China, India

and Indonesia over the next five to 10 years, with Indian banks leading in the

profitability stakes. Bank Central Asia, HDFC Bank and Bank of China are his

top picks in the region.

19 April 2010

anirudha.dutta@clsa.com

17

Section 1: Global growth engine

Mr & Mrs Asia

Consumers: Sands China,

United Spirits, Baidu

Aaron Fischer expects discretionary spending to increase at a Cagr of 18% in

India, 15% in China and 13% in Indonesia. While he likes all three markets,

he believes India is the most compelling given that there is a greater appetite

to spend as income increases. Sands China, United Spirits and Baidu are his

top picks in the region.

Education: Megastudy

Nimish Joshi expects the education sector to be a big opportunity in both

China and India. Our Mr & Mrs Asia studies in 2007 and 2009 highlighted how

education remains one of the most important items in family budget, in good

and bad times. Korea’s Megastudy is our top pick given attractive valuations

and that the company has a China strategy. Other interesting companies in

the space are Educomp and New Oriental.

Property: China

Resources Land, Unitech

Nicole Wong finds striking similarities between the property sector in Hong

Kong in late 1960s/early 1970s and what is happening in China, India and

Indonesia now. Like Amar, she believes average incomes hide a lot and do not

reflect the true purchasing capacity of the middle-income families in these

countries. Low ownership and easier access to mortgages will drive strong

growth in the property markets in India. China Resources Land and Unitech

are her top picks in the region.

Telecoms/internet: China

Mobile, Bharti, Baidu

Elinor Leung believes China, India and Indonesia remain the three countries

with growth prospects in mobile telephony, although they are also

approaching middle age and therefore, the hypergrowth phase is likely over.

With increased competition and large investments in next generation of

technology, business is certainly challenging in the near term. In the longer

run, she is bullish on Bharti and China Mobile. Meanwhile, Elinor is very

excited about the next big thing in these countries - the internet. She

believes China has just entered the hypergrowth phase in this area and Baidu

is her top pick.

Technology: Acer,

Canon, Lenovo, Samsung

Electronics, MediaTek

In technology, Bhavtosh Vajpayee believes rising affordability and increasing

penetration will result in secular growth, and consumer demand will gain

share over enterprise spending. He also expects China to see hypergrowth in

the next five years, while India will enter that phase only from 2015, when its

affordability levels should reach where China was in 2008. Acer, Lenovo,

Canon, Samsung Electronics and MediaTek are Bhavtosh’s top picks to play

this opportunity.

Transport: Air China,

Cathay Pacific

Robert Bruce forecasts the number of air passengers in 17 countries in Asia to

reach 737m by 2014, or a Cagr of 8.5%. China will lead the boom and

become the world’s largest source of outbound passengers at 95m,

representing a tripling over the next 10 years. Robert’s growth expectations

for India over the next five years is a modest 8.9%, which will take the

number of passengers to 67m, nearly twice the present number. Air China is

his top sector pick. Cathay Pacific is Aaron’s next best pick to play the growth

in outbound air-passenger traffic.

18

anirudha.dutta@clsa.com

19 April 2010

Mr & Mrs Asia

Section 2: Rise of Asia’s middle class

Amar Gill, CFA

amar.gill@clsa.com

(65) 65122337

Rise of Asia’s middle class

Beginning with Christopher Wood’s Asia’s Billion Boomers report in 2002, we

have been highlighting the power of the region’s long-term domestic-demand

story for nearly a decade. Our groundbreaking works, including the two Mr &

Mrs Asia surveys (2007 and 2009) on the middle class, support our view that

Asian countries will increasingly dominate global consumption. We estimate

that the middle class, defined as those with discretionary spending power,

makes up 19% of Asia ex-Japan’s population. This is set to rise to 30% in the

next five years, growing nearly 11% per annum. A large segment in China

getting past the threshold income - with per-capita incomes in China, India

and Indonesia in US-dollar terms rising 8-12% - helped by likely currency

appreciation, will drive the increase.

GDP per capita a

misleading indicator

for spending power

GDP per capita, often used as an indicator of spending power, is misleading,

as barely two-thirds of national income goes to households. The skew in

distribution also results in the average household getting much less than percapita estimates. However, official data exclude grey income from the parallel

economy. This could be 30% or more of GDP in developing Asia. The buying

power of the middle class is also underestimated if purely on nominal

exchange rates without adjusting for local currencies’ buying power.

Including grey economy,

middle class in Asia exJapan estimated at 570m

We take these factors into account and focus on median disposable income

adjusted for the grey economy. Discretionary spending appears to kick in at

around US$3,000 per capita, equivalent to US$10,000 per household with three

or more persons. Currently Asia ex-Japan has some 570m people, 19% of the

overall population, earning this level of income or higher. Forces in place that will

push up the middle-class numbers include: economic growth; a rising share of

GDP going to households as labour growth slows, a factor that will pull up wages;

the hordes just below who will cross into the threshold of middle-class income;

and appreciating currencies to lift the buying power of Asian consumers.

Figure 50

China at US$1,900

median income will have

large increase in segment

with discretionary

spending power

Median-income levels and % of population with discretionary spending power

(% of population)

Thailand

Malaysia

China

Indonesia

India and Indonesia at

lower income level but

percentage growth in the

middle class will be larger

Philippines

Korea

India

0

2,000

4,000

6,000

8,000

Taiwan

10,000

Singapore

12,000

Hong Kong

14,000 16,000

Median income (US$)

Source: CLSA Asia-Pacific Markets

An 11% Cagr set to take

the region’s middle class

to 945m in five years

19 April 2010

These numbers are necessarily all approximations but our analysis implies

compounded growth of near 11% pushing some 375m Asians into this income

segment over the coming five years, taking to 945m those with discretionary

spending power. China is likely to contribute to two-thirds and China, India

and Indonesia together represent more than 90% of those entering the Asia

ex-Japan middle class in this period.

amar.gill@clsa.com

19

Mr & Mrs Asia

Section 2: Rise of Asia’s middle class

Figure 51

Estimated to rise by

US$2.15tn over the next

five years, of which over

half will come from

existing middle-class

families, nearly 20%

from new entrants into

middle-class bracket and

about 1/4 from currency

appreciation

Growth in Asia ex-Japan discretionary spending, 2009-14

6,000

(US$bn)

5,000

557

387

4,000

1,206

3,000

5,092

2,000

2,941

1,000

0

Est 2009

discretionary

spending

Spending growth Spending by new

by current middle

entrants to

class

middle class

Currency impact

on buying power

Projected 2014

discretionary

spending

Source: CLSA Asia-Pacific Markets

Discretionary spending

set to grow faster than

middle-class size

Discretionary spending power will rise with higher incomes for the existing

middle class, new entrants into this income threshold and the effect of

appreciating currencies on buying power. We estimate discretionary spending

in the region to rise nearly 12% per annum. It should almost double over five

years in China while India’s discretionary spend is set to rise 126% on a

smaller base.

China is at 8%; Indonesia

at 5%; India at 2% of

US GDP per capita

These estimates, implicitly assuming an upswing in Asia with currency

appreciation, are subject to cyclical hiccups. Quite certainly, the growth will

not be in a straight line. However, the fast-developing Asian economies have

the building blocks in place for structural growth, namely education

investment, infrastructure, property rights, liberalisation of the economies,

high savings and investment, urbanisation, the shift from agriculture to

manufacturing, etc. China, Indonesia and India’s GDP per capita are just 8%,

5% and 2% of US income levels. As average incomes rise, the expanding

middle class will be an overarching theme for investing in Asia.

Estimating disposable incomes

Household disposable

income is just under twothirds of GDP for Asia

Disposable income is defined as household income less taxes. To the extent

that corporations are sizable and retain a large amount of profits, average

household income could be significantly lower than GDP per capita. A further

adjustment for available income to households is tax rates.

We use Euromonitor’s estimates of disposable income for this report. On

average, disposable income is about 64% of GDP per capita for the Asian

countries that we cover, excluding Japan. Disposable income is only around

60% of GDP per capita for China, Singapore, Korea and Thailand. In absolute

terms, the difference is striking in Singapore where GDP per capita for 2009

is US$36,902 but disposable income per capita is just US$22,290. While

Singapore’s GDP per capita is higher than that of Hong Kong, its average

disposable income is lower.

China’s disposable income

58% of its GDP per capita

20

China’s 2009 disposable income of US$2,136 is 58% of its US$3,697 GDP per

capita, as big companies retain a large share of the economic pie. For India,

disposable income at US$836 is 19% lower than GDP per capita, while

Indonesia’s disposable income of US$1,553 is two-thirds of its GDP per head.

amar.gill@clsa.com

19 April 2010

Mr & Mrs Asia

Section 2: Rise of Asia’s middle class

Figure 52

Singapore, Korea, China:

per-capita disposable

income lower than GDP

GDP and disposable income per capita, 2009

Singapore

Hong Kong

Korea

Taiwan

Malaysia

Thailand

GDP per capita

China

Disposable income per capita

Indonesia

Philippines

(US$)

India

0

5,000

10,000

15,000

20,000

25,000

30,000

35,000

40,000

Source: Euromonitor, CLSA Asia-Pacific Markets

Grey income

Including grey economy,

emerging economies in

Asia at least 30% larger

Official figures, however, do not capture the grey economy. Black can be

viewed as a shade of grey. That is, crime and bribery are only part of

undeclared income. Other aspects of the grey economy not captured in

national accounts include income of street peddlers, unofficial contract staff,

prostitutes and the like, who do not fill tax returns, as well as doctors who

underdeclare their income, policemen on the take and politicians with bank

accounts in Switzerland. The grey economy in developing Asia is huge. Recent

reports estimate that in Afghanistan, bribery alone makes up 23% of GDP

while reports indicate that in 2006 Indians have US$1.5tn (1.5x its GDP then)

in Swiss bank accounts.

No official estimates

on the size of the

grey economy

Clearly, there are no official estimates on how large the grey economy is.

There is no tax adjustment for this additional portion of incomes, thus relative

to disposable incomes (after tax) it is likely to be a significant addition to

actual incomes and spending power in these countries. If the grey economy is

around 20% of GDP in China, then it would push up disposable incomes to

30% above the official data. We estimate the grey economy to be around

30% of GDP for India and Indonesia, implying around 35% higher disposable

incomes. We put it at around 20% of disposable income in the Philippines,

Malaysia and Thailand. Conservatively, we take it as immaterial in Singapore,

Hong Kong, Korea and Taiwan - although even in corruption-free Singapore,

the oldest profession is clearly thriving and is one sector importing talent

from around the region.

Who’s got spending power?

Income skew results

in median being

lower than mean

19 April 2010

The happy mean can hide an unhappy median. Mean income, based on total

income divided by total population, does not take into account the skew in

incomes. This can be severe in developing countries. While sounding

paradoxical, the average person’s income is usually not the average income.

Most often the average family income, ie, the median income, is quite a bit

lower than the mean. However, with the top quintile of households taking in

about half of total income in most countries, there is a large group with

spending power well above the average.

amar.gill@clsa.com

21

Mr & Mrs Asia

Section 2: Rise of Asia’s middle class

We use statistics from the World Bank on the dispersion of incomes. In China,

the top 20% get 52% of total household income. In India and Indonesia,

around 45% of total household income goes to the top 20%. The lowest

quintile for family income accounts for just 4% of total household income in

China and 8% in India and Indonesia.

Figure 53

Top 20% of households

take about 50% of

income in most places

Distribution of income in Asian economies

(%)

China

Hong Kong

India

Gini

coefficient

46.9

43.4

36.8

Lowest

20%

4.3

5.3

8.1

Fourth

20%

8.5

9.4

11.3

Third

20%

13.7

13.9

14.9

Second

20%

21.7

20.7

20.4

Highest

20%

51.9

50.7

45.3

Indonesia

Korea

Malaysia

Philippines

Singapore

Thailand

34.3

31.6

49.2

44.5

42.5

42.0

8.4

7.9

4.4

5.4

5.0

6.3

11.9

13.6

8.1

9.1

9.4

9.9

15.4

18.0

12.9

13.6

14.6

14.0

21.0

23.1

20.3

21.3

22.0

20.8

43.3

37.5

54.3

50.6

49.0

49.0

Source: CLSA Asia-Pacific Markets, World Bank

The table below makes various adjustments to income. It gives the official

GDP per capita for 2009, shows the corresponding disposable income and

adjusts up for our ballpark estimates of the grey economy. From this, we

estimate median income using the World Bank data on income distribution.

What a dollar buys

in different markets

varies quite significantly

The last column adjusts income levels for purchasing-power parity. Generally,

national accounts of each country are converted into dollars at market

exchange rates for comparison. But what a dollar buys obviously varies quite

significantly. An annual income of US$10,000 is not only very different in

terms of buying power in the USA and Asia. Converted into local currency it

would also provide quite different standard of living in say Hong Kong,

Singapore or Korea compared to China, India or Indonesia.

Figure 54

GDP per capita

overestimates

median income

Per-capita GDP, disposable income adjusted for grey economy and PPP (2009)

(US$)

GDP per

capita

China

HK

India

Indonesia

3,697

29,912

1,035

2,333

Disposable

income

per capita

2,136

25,551

836

1,554

Korea

Malaysia

Philippines

Singapore

Taiwan

Thailand

16,937

6,595

1,721

36,902

16,059

3,983

10,711

4,287

1,328

22,290

10,861

2,384

Disposable Median disposable Median disposable

income adjusted

income adjusted

income adjusted

for grey economy

for grey

for PPP

2,777

1,883

2,730

25,551

17,403

18,712

1,128

832

1,364

2,098

1,599

2,579

10,711

5,145

1,593

22,290

10,861

2,861

9,447

3,252

1,072

15,946

9,579

1,983

10,050

4,394

1,730

13,747

13,122

2,478

Source: CLSA Asia-Pacific Markets, Euromonitor, World Bank

For current spending

power of middle class, we

ignore PPP adjustments

22

Our interest is in the spending of the middle-class on discretionary items. In

most countries, these items are not very differently priced across countries,

ie, fridge, LCD television, notebook computer, iPod, and a car will have a fairly

similar price in various markets based on current exchange rates. There

might be some differences locally. For example, if a television is made in

Malaysia and exported to the region, it is likely to cost less at home.

Internationally traded products that might be cheaper in given markets where

they are manufactured will differ from country to country. The bulk of the

difference in PPP, however, comes from locally produced items rather than

amar.gill@clsa.com

19 April 2010

Mr & Mrs Asia

Section 2: Rise of Asia’s middle class

internationally tradable middle-class goods. We, thus, focus on median

disposable income without PPP adjustments. (If we adjusted for PPP, the US$stated incomes and size of the middle class would be much larger as most of

the markets we cover have undervalued currencies.)

Need to multiply percapita income by 3-5x to

get household income

Regionally, we find that car ownership takes off in Thailand when GDP per

capita is US$4,000 and mean disposable income is just below US$3,000

(while median income is only about US$2,000). Mean incomes of about

US$3,000 appears to be about the level where the ability to spend on

discretionary items kicks in, as car ownership reflects. This is not a very high

figure for annual income, but bear in mind the distinction between per-capita

income and household income: per-capita estimates divide by the whole

population including children and elderly dependents. Average household

income is higher than per-capita income by a factor representing the average

household size, which is between three and five in most of Asia.

For Thailand, at the income level where car ownership starts to shoot up, the

grey-adjusted mean income is about US$3,000, which translates to family or

household income of close to US$12,000 per annum. That is certainly a level

of income where households can afford to spend on discretionary items.

Figure 55

Car ownership takes off in

Thailand at disposable

income near US$3,000

which translates to

around US$10,000

household income

Car ownership and disposable income per capita

800

y = 0.0249x + 35.063

Light-vehicle ownership (units/'000 population)

2

R = 0.8803

700

New Zealand

600

Australia

Japan

500

400

Korea

Malaysia

India

300

Taiwan

200

Thailand

Hong Kong

Philippines

Indonesia

100

Disposable income per capita (US$)

China

0

0

5,000

Singapore

10,000

15,000

20,000

25,000

30,000

Source: Ashwin Chotai, Euromonitor, CLSA Asia-Pacific Markets

Figure 56

Just over 60% of the

region’s middle class is in

China, and 10% is in India

Composition of the middle class in Asia ex-Japan

Singapore

1%

Thailand

3%

Taiwan

4%

Philippines

1%

Malaysia

3%

Korea

9%

Indonesia

5%

India

10%

China

63%

Hong Kong

1%

Source: Euromonitor, World Bank, CLSA Asia-Pacific Markets

19 April 2010

amar.gill@clsa.com

23

Mr & Mrs Asia

Section 2: Rise of Asia’s middle class

Households in the bracket

is about one-fourth of the

figure for population with

spending power

We use US$3,000 as the level of individual income where discretionary

spending of Asia ex-Japan’s middle class kicks in. An estimated 570m in the

region are at this level of income or higher in 2009, or almost one-fifth of the

population. Of these, just over 60% or about 360m live in China. Close to

60m, or approximately 5% of India’s population, make up the next largest

segment of the middle class by this definition. India has more people with

some element of discretionary spending power than the entire 48m Korean

population. We estimate some 27m or 12% of Indonesians also have

discretionary spending power. (Note the number of households in the middle

class is around a quarter of the population estimate, given average

households of around four persons.)

The big shift

Drivers of middleclass growth

Economic growth is obviously a key factor determining how fast the middle

class grows. Other determinants include changes in the share of total GDP

going to households; how many people are just below the level of income

where discretionary spending kicks in; and changes in buying power of

consumers resulting from currency movements.

Figure 57

Currency appreciation will

help lift disposable

income in dollar terms

Projected five-year Cagr in median disposable income

China

India

Indonesia

Philippines

Thailand

Taiwan

Malaysia

Korea

Singapore

(%)

Hong Kong

0

2

4

6

8

10

12

14

Source: Euromonitor, World Bank, CLSA Asia-Pacific Markets

China will see the biggest

absolute increase in the

middle class in 2010-15

These factors are all working in favour of China, which will continue to have

the largest number of people joining the middle class over the coming years.

China’s GDP is likely to keep growing at around 9% per annum over the

medium term, as it continues to industrialise at a fairly rapid rate while some

55% of the population still lives in rural areas and works on the farms. As

growth in China’s total labour force slows, however (the result of its one-child

policy since the 1970s), factories in the coastal regions will have to offer

higher salaries to attract rural workers from further inland. Thus, households’

share of GDP, at around 60%, will rise. Conservatively, we expect the share of

GDP to households to rise by 1.25ppts over the next five years, adding

around 0.3ppts per annum to disposable-income growth.

The renminbi is also set to appreciate, which will strengthen the buying power

of the Chinese consumer. In our calculations, we assume Beijing would allow

the currency to appreciate to reduce its PPP undervaluation by half over the

next five years. This would lead to a 22% rise in the renminbi to

Rmb5.55/US$ by 2014, adding about 4% per annum to the buying power of

the Chinese. Our number is conservative against most street estimates.

24

amar.gill@clsa.com

19 April 2010

Mr & Mrs Asia

Section 2: Rise of Asia’s middle class

Figure 58

Median income for

China to rise from

US$1,900 to US$2,700,

pushing 17% of its

population into the middle

class in just five years

China: Large expansion of the middle class as median income rises

(% of population)

60

Increase in median income (2009-14)

50

Population above US$3,000 income

(area bottom right below line)

40

30

20

Per-capita income

(US$)

10

0

0

1,000

2,000

3,000

4,000

5,000

6,000

Source: CLSA Asia-Pacific Markets

Each year 3.5% of Chinese

cross the discretionaryspending threshold

China has a huge population and a large segment just under the level of

income where discretionary spending kicks in. For 2009, median income

adjusted for the grey economy is almost US$1,900. We estimate some 27% of

the population are at the US$3,000 level of income or higher. With renminbi

appreciation, per-capita disposable income in dollar terms should rise by 12%

per annum (allowing for some reduction in the relative size of the grey

economy). Median income should rise to US$2,700 by 2014 when about 44%

of the population earns US$3,000 income or more. China’s middle class,

growing at 11% per annum, is equivalent to 3.5% of the population crossing

the discretionary-spending threshold each year. This would add almost 250m

people, allowing its middle class to expand to just over 600m by 2014.

Discretionary-spending

power for additional 80m

in India in next five years

India will have the next largest increase in middle-class numbers of around

80m, taking it to almost 140m by 2014. In percentage terms, its growth is

set to be the highest. Some 5% of its population currently have middle-class

spending power, earning more than US$3,000. This should more than double

to 11% in five years: disposable income rising approximately 10% per annum

should take 1.2% of its population across the income threshold each year.

Figure 59

Middle class to rise from

19% of Asian population

in 2009 to 30% by 2014

Percentage of population in the middle class

Malaysia

China

Thailand

Asia ex-Japan

2014

Indonesia

2009

Philippines

India

(%)

0

10

20

30

40

50

60

70

Source: Euromonitor, World Bank, CLSA Asia-Pacific Markets

19 April 2010

amar.gill@clsa.com

25

Mr & Mrs Asia

Section 2: Rise of Asia’s middle class

Currently, India’s middle class is around one-sixth the size of China’s. On this

small base, we estimate by 2014, the Indian middle class will rise by 135%

(an approximately 19% Cagr). India should, thus, represent around one-fifth

of those entering the middle class in the region.