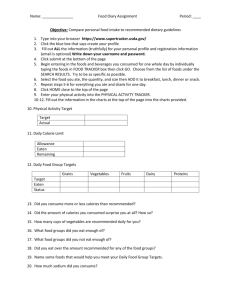

AgBenefit Final Report

advertisement