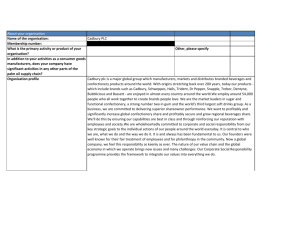

Cadbury current Annual Report final pdf

advertisement