Audience Measurement for Transit Advertising

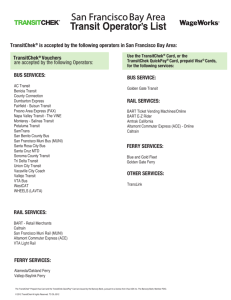

advertisement