Regulatory Guide RG 146 Licensing: Training of financial product

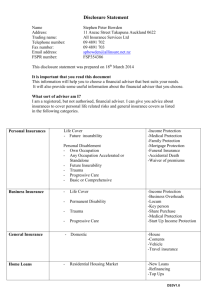

advertisement