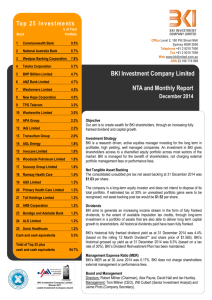

Dividends - BKI Investment Company Limited

advertisement

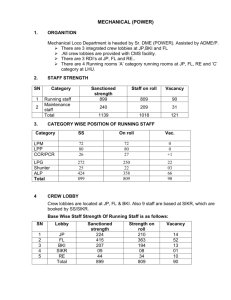

Half Year Presentation January - February 2013 1 Disclaimer This material has been prepared by BKI Investment Company Limited. The information within this document is not intended to provide advice to investors or take into account an individual’s financial circumstances or investment objectives. This is general investment advice only and does not constitute advice to any person. The opinions within this document are not intended to represent recommendations to investors, they are the view of BKI Investment Company Limited as of this date and are accordingly subject to change. Information related to any company or security is for information purposes only and should not be interpreted as a solicitation of offer to buy or sell any security. The information on which this presentation is based has been obtained from sources we believe to be reliable, but we do not guarantee its accuracy or completeness. Investors should consult their financial adviser in relation to any material within this document. 2 BKI Result Highlights 1H 2013 1H 2012 Growth Ordinary Dividend Income $15.6m $14.3m 8.6% Net Operating Result* $15.4m $14.2m 8.8% Earnings Per Share* 3.56cps 3.33cps 6.9% Ordinary Dividend Per Share 3.25cps 3.20cps 1.2% Special Dividend Per Share 0.50cps - n/a Total Interim Dividends 3.75cps 3.20cps 17.2% Management Expense Ratio (MER) maintained at 0.18% 12 month Total Shareholder Returns - outperformance of 5.8%** * Excluding Special Dividends. **BKI’s Total Shareholder Returns (including the reinvestment of dividends) for the year to 31 December 2012 was 25.5% compared to the S&P/ASX 300 Accumulation Index which returned 19.7% over the same period. Past performance is not indicative of future performance. 3 Net Operating Result 16 14 12 $ Millions 10 8 6 4 2 0 1H 04 1H 05 1H 06 1H 07 1H 08 1H 09 1H 10 1H 11 1H 12 1H 13 4 Dividends Paid 4.0 3.5 1 3.0 1 0.5 0.5 Cents per Share 0.5 2.5 2.0 1.5 1.0 2 2.1 2.2 2.5 2.5 2.6 2.7 3 3 3 3 2.5 2.75 3 3 3.2 3.2 3.25 0.5 0.0 Ordinary Dividends Special Dividends 5 Dividends and Franking Credits received from a $10,000 Investment in 2004 BKI Historical Dividend V’s Bank Quarterly Interest Highlights the opportunity of a fully franked dividend in a falling interest rate environment 1,000 $ Australian Dollars 800 600 400 200 0 FY2005 FY2006 FY2007 FY2008 BKI Dividend Source: BKI Investment Company Limited; IRESS. FY2009 FY2010 BKI Franking FY2011 FY2012 FY2013 Interest 6 BKI Grossed Up Dividend Yield Assumes a tax rate of 30% 10.0% 9.0% 8.0% 7.0% 6.0% 5.0% 4.0% 3.0% 2.0% BKI Grossed Up Dividend Yield 90 Day Bank Bill 7 Management Expense Ratio 0.80% 0.70% 0.69% 0.71% 0.56% 0.60% 0.46% 0.50% 0.46% BKI Internally Managed 0.40% 0.31% 0.30% 0.19% 0.18% 0.18% 0.18% 2010 2011 2012 1H 13 0.20% 0.10% 2004 2005 2006 2007 2008 2009 8 BKI Performance as at 31 December 2012 BKI Performance 1 Year 3 Years 5 Years 7 Years 9 Years as at 31 December 2012 BKI Portfolio Returns are measured after all operating expenses, provision and payment of income and capital gains tax. (pa) (pa) (pa) (pa) S&P/ASX 300 ACC INDEX (XKOAI) 19.7% 2.8% -1.8% 4.1% 8.4% BKI Total Shareholder Returns 25.5% 7.8% 4.9% 6.7% 8.9% 5.8% 5.0% 6.7% 2.6% 0.5% BKI Portfolio Performance 15.3% 4.8% 2.3% 5.4% 8.5% BKI Portfolio Outperformance V's XKOAI -4.4% 2.0% 4.1% 1.3% 0.1% BKI Share Price Outperformance V's XKOAI Source: BKI Investment Company Limited, IRESS. Portfolio Returns are measured by change in pre tax NTA and are after all operating expenses, provision and payment of both income and capital gains tax and the reinvestment of dividends. Total Shareholder Returns include reinvestment of dividends. Past performance is not indicative of future performance. 9 Total Shareholder Returns as at 31 December 2012 30.0% 25.5% 25.0% 20.0% 19.7% 15.0% 8.9% 7.8% 10.0% 6.7% 4.9% 5.0% 8.4% 4.1% 2.8% 0.0% -5.0% -1.8% 1 Year 3 Years (pa) 5 Years (pa) BKI Total Shareholder Returns 7 Years (pa) 9 Years (pa) S&P/ASX 300 ACC INDEX (XKOAI) Source: BKI Investment Company Limited, IRESS. Total Shareholder Returns include reinvestment of dividends. Past performance is not indicative of future performance. 10 Discount to NTA as at 31 December 2012 $1.70 30.0% $1.60 $1.50 20.0% $1.40 $1.30 $1.20 10.0% $1.10 $1.00 0.0% $0.90 $0.80 -10.0% $0.70 $0.60 $0.50 -20.0% Prem/Disc % Pre Tax NTA BKI Share Price 11 Share Purchase Plan Completed October 2012 $19.1m raised through the Share Purchase Plan (SPP). SPP shares were issued at $1.29. Now trading at $1.45 (as at 29 January 2012). SPP shares entitled to Fully Franked Interim Dividend of 3.25cps and Fully Franked Special Dividend of 0.50cps. New shares issued in SPP have seen a capital appreciation of 15.3%* since October 2012. * Includes the Interim Ordinary and Special Dividends, excludes franking credits. Source - BKI Investment Company Limited; IRESS. 12 Portfolio Valuation 700 600 $ Millions 500 400 300 200 100 0 2004 2005 2006 2007 2008 2009 Investment Portfolio 2010 2011 2012 1H 2013 Cash 13 BKI Investment Company Limited Top 20 Shareholdings Diversification BKI’s portfolio comprises of dividend paying, well managed companies. Exposure to most sectors of the market. High Conviction Benchmark Unaware – BKI’s long term strategy of investing in dividend paying stocks means the portfolio is not aligned with an index. 14 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 NHC CBA NAB BHP WBC TLS WES ANZ WOW ALQ AGK WPL CCL TPM MTS ARP APA IVC QBE MLT Total New Hope Corporation Commonwealth Bank National Australia Bank BHP Billiton Limited Westpac Banking Corp. Telstra Corporation Wesfarmers Limited ANZ Banking Corporation Woolworths Limited ALS Limited AGL Energy Limited Woodside Corporation Coca-Cola Amatil TPG Telecom Limited Metcash Corporation ARB Corporation APA Group Invocare Limited QBE Insurance Group Milton Corporation Cash & Cash Equivalents 9.5% 9.1% 8.4% 7.9% 7.0% 4.9% 4.4% 3.5% 3.4% 3.2% 2.7% 2.1% 1.8% 1.7% 1.6% 1.4% 1.3% 1.3% 1.2% 1.1% 6.4% 79.6% Index 0.0% 7.9% 4.9% 9.3% 6.5% 4.4% 3.0% 5.5% 3.0% 0.3% 0.7% 2.3% 0.8% 0.2% 0.3% 0.1% 0.4% 0.1% 1.1% 0.0% 0.0% 14 50.8% Sector Weightings Sector Portfolio Weight 31 Dec 2012 Index Weight 31 Dec 2012 Financials 36.6% 32.6% Energy 12.2% 7.3% Consumer Staples 11.3% 7.7% Materials 9.3% 20.9% Industrial 7.5% 7.3% Telecommunications 6.7% 5.1% Cash 6.4% Consumer Discretionary 4.8% 5.6% Utilities 3.6% 1.9% Health Care 1.2% 4.6% Property Trusts 0.4% 6.9% 15 Sector Performance 12 Months to 31 December 2012 (BKI Top 20 V’s S&P/ASX300 Accumulation Indexes) 100% 90% 80% 70% 60% 50% BKI Investment Company (BKI.ASX) 40% 30% 20% 10% S&P/ASX 300 0% -10% -20% Telco Services Financials Consumer Staples Consumer Disc. Utilities XKOAI Industrials Materials Energy 16 Sector Performance 12 Months to 31 December 2012 (BKI Top 20 V’s S&P/ASX300 Accumulation Indexes) 100% TPM 90% 80% 70% 60% 50% ARP 40% TLS 30% APA CBA WBC ANZ MLT NAB 20% 10% WES WOW IVC CCL BKI Investment Company (BKI.ASX) AGK ALQ BHP S&P/ASX 300 WPL 0% QBE -10% MTS NHC -20% Telco Services Financials Consumer Staples Consumer Disc. Utilities XKOAI Industrials Materials Energy 17 Benefits of investing in BKI.ASX Performance - Delivering sound long term returns to shareholders. Low Cost - Management Expense Ratio of 18bps. No Performance Fees. Dividends - Predictable fully franked income stream. Franking Credits - 30% tax rate already paid on dividend income, tax credits passed on directly to shareholders. Diversification – Exposure to most sectors of the market through well managed, dividend paying companies. Simplicity – An investment in BKI.ASX provides administration simplicity. Structure – BKI is a Company with a closed end investment structure. Listed on the ASX - High levels of Transparency and Compliance, ASX Listing Rules, Continuous Disclosure requirements. 18 19 BKI Fact Sheet www.bkilimited.com.au ASX Code Listing Date Mandate Investment Sectors Benchmark Total Assets Debt Management Expense Ratio Performance Fee BKI.ASX Research Coverage December 2003 Morningstar IRR Morgan Stanley Smith Barney Bell Potter Aust Listed Equities Diversified S&P/ASX 300 Acc Index $644m Evans and Partners Baillieu Holst Nil 0.18% Nil Board Members Rob Millner Historical Dividend Yield 4.8% David Hall Percentage Franked 100% Alex Payne Grossed Up Yield 6.8% Ian Huntley Dividend Distribution Frequency Dividend Payout Policy Dividend Reinvestment Plan Share Purchase Plan Half Yearly 90%-95% Chief Executive Officer Tom Millner Company Secretary Jaime Pinto Active Inactive