THE UNIVERSITY OF GEORGIA FOUNDATION AND SUBSIDIARY

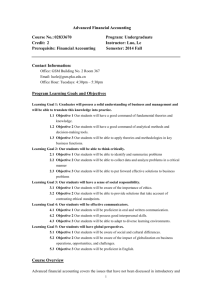

advertisement