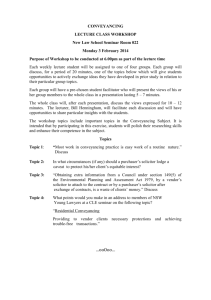

Land and Business (Sale and Conveyancing)Act 1994

advertisement