Chapter 05 : Job Costing System. Introduction:

advertisement

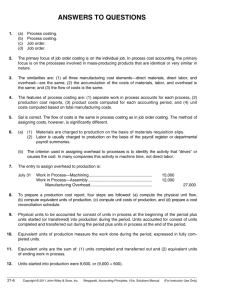

Chapter 05 : Job Costing System. Introduction: - Product costing Systems are used to compute the product cost per unit. - Product cost per unit is needed for a variety of purpose: o In financial accounting; Used to value inventory and to compute cost of goods sold. o In Managerial Accounting: Used for planning, control, directing and management decision making. Q1: How Companies Assign Costs to Cost Object? Q2: When Companies Can Assign Costs to Cost Object? Companies Can Assign Costs to Cost Object at: At end of year At beginning of year Actual Costing Normal Costing Actual Direct Material Actual Direct Material Actual Direct Labor Actual Direct Labor Actual overhead Allocated overhead Cost & Managerial Accounting Page 1 of 8 Ehab Abdou (7672930) Chapter 05 : Job Costing System. Important Note: The Computation of Allocated overhead depending on the type of production system as a result we will use two different types of product costing systems for computing allocated overhead. Q3: What are the types of Product Costing Systems? There are two main types of product costing systems 1- Job order costing system نظام تكاليف األوامر االنتاجية is best used when products can be distinguished from one another. 2- Process Costing System نظام تكاليف العمليات is best used when similar products are mass produced. Note 1: In many companies, hybrid costing systems are used that include characteristics of both job and process costing. Note 2: The following table illustrate the difference between the two main types of product costing systems: Job Costing Process Costing Operations Discrete فريد Continuous متواصل Product Fewer units Many units Units Readily identifiable يعرف بسهولة Fungible يمكن استبدالها Cost object Job or batch Processing department # of WIP accounts One Same as the # of processing departments Examples Film Production , Building House Aircraft Manufacture Chemicals, Microchips, Gasoline , Textiles When a company using a Job costing system, it must maintain a subsidiary ledger account for each Batch or Job order, this ledger Account is called a Job Cost Record, this account is used to accumulate all costs incurred for each Job or (Batch). Cost & Managerial Accounting Page 2 of 8 Ehab Abdou (7672930) Chapter 05 : Job Costing System. Job order Costing System: Job Batch A27 B39 Direct Materials Direct Labor Applied MOH (=) Manufacturing cost ÷ Number of units Cost per unit 100 3,600 250 4,000 150 2,400 500 10,000 1 10 $ 500 $ 1000 Process Costing System: Total Cost Direct Materials Direct Labor Applied MOH $ 1000 2000 3000 $ 6000 40,000 $ 0.15 Total Manufacturing cost Number of units Cost per unit Q4: How We Can Compute allocated overhead? Illustration: Assume the Budget electricity cost of XYZ manufacturing company is $10,000, and the following data are extracted from its operation budget for 2013 (Next year). Department A Department B Department C Number of employers 200 400 100 Area in square meter 1,000 600 400 Total 700 2,000 Instructions: Allocate the electricity cost over the three production departments? Solution Steps: 1- Selecting Allocation Base ( Cost Driver ) The best cost driver is the area in square meter 2- Computing Estimated Allocation rate. EAR = = = $5 per meter 3- Computing Allocated overhead Allocated overhead = EAR × Actual Usage of Allocation Base Department A = $ 5 × 1,000 = $5,000 Department B = $ 5 × 600 = $3,000 Department C = $ 5 × 400 = $2,000 Very Important Note: There are two types of Allocation Base (Cost Drivers) 1- Financial base (DL COST / DM COST) 2- Technique base (DL HOURS / MACHINE HOURS ) Cost & Managerial Accounting Page 3 of 8 : = % of DL Cost : = $ Per DL Hours Ehab Abdou (7672930) Chapter 05 : Job Costing System. Journal Entries in Job Costing Exercise: The following Balances are extracted from Nour Airplanes manufacturing Company at beginning of 2014. Raw Materials Inventory $2,000 Work in Process – Batch 101 $1,500 During 2014 the following transactions occurred in manufacturing of Batch 101 and Job 102. 1-Purchase of raw material (Direct & Indirect) for $10,000 Cash. Date Accounts Dr. Cr. 1 Raw Material Inventory 10,000 Cash 10,000 2-Raw Materials used are as follows : $3,000 for Batch Number 101 $2,000 for Job Number 102 $1,000 for general usage of the factory. Date Accounts 2 Work in Process – Batch 101 Work in Process – Job 102 Overhead Cost Control Raw Materials inventory Dr. Beg. 1 R.M Inventory 2,000 2 10,000 Cr. 6,000 Cost & Managerial Accounting Dr. Beg. 2 DM 3 DL Dr. 3,000 2,000 1,000 Cr. 6,000 WIPBatch 101 1,500 3,000 4,000 Page 4 of 8 Cr. 12,500 3-Labor costs are as follows : $4,000 for Batch Number 101 $3,000 for Job Number 102 $2,000 for general usage of Both jobs Date Accounts 3 Work in Process – Batch 101 Work in Process – Job 102 Overhead Cost Control Wages Payable Dr. 4,000 3,000 2,000 9,000 4-Actual manufactory overhead incurred are as follows $1,000 for Equipment Depreciation $2,000 for Factory Utilities $2,000 for Factory Property Taxes $1,000 for Factory insurance Date Accounts Dr. 4 Overhead Cost Control 6,000 Depreciation Expenses Utility Expenses Property Tax Expenses Insurance Expenses Dr. Beg. 2 DM 3 DL WIP-Job 102 0 2,000 3,000 Cr. Ehab Abdou (7672930) Dr. Beg. 2 DM 3 DL 4 Cr. Overhead Control 0 1,000 2,000 6,000 Cr. 1,000 2,000 2,000 1,000 Cr. Chapter 05 : Job Costing System. 5 - The Company Allocate overhead on the base of Direct labor hours. Total Budget Manufacturing overhead is : $50,000 Total Budget Direct labor hours is : 25,000 hour Actual Direct labor hours for Batch 101 and Job 102 are : 2,000 Hours for Batch 101 1,500 Hours for Job 102 Date Accounts Dr. Cr. 5 Work in Process – Batch 101 4,000 Work in Process – Job 102 6,000 Overhead Cost Control 10,000 6 - Batch Number 101 were completed During 2014 Date Accounts Dr. 6 Finished Goods Inventory 12,500 Work in Process – Batch 101 7- Sale one half of Batch 101 at 150% of its Cost. 7 Cost of Goods Sold 6,250 Finished Goods Inventory Accounts Receivables 9,375 Sales Revenue = $2 Per DLH 9 – Disposition of Misallocated overhead Cost of Goods Sold Overhead Cost Control Misallocated = Applied – Actual = 7,000 – 9,000 = -2,000 U b. Applied MOH = POHR × Actual usage of Cost Driver Applied MOH for Batch 101 = $ 2 × 2,000 DLH = $4,000 Applied MOH for Job 102 = $ 2 × 1,500 DLH = $3,000 Dr. Beg. 1 R.M Inventory 2,000 2 10,000 Cr. 6,000 Dr. Beg. 2 DM 3 DL Cr. 6,250 Dr. 6,000 Dr. Finish Goods 12,500 12,500 6,250 9,375 8 - Incurrence of Selling and Administrative Expenses of $7,000 Selling and Administrative Exp 7,000 Cash 7,000 a. POHR = POHR = Cr. 6,250 Cost & Managerial Accounting WIPBatch 101 1,500 3,000 4,000 4,000 0 Cost of Sale 6,250 2,000 8,250 Page 5 of 8 Cr. 12,500 Cr. Dr. Beg. 2 DM 3 DL Dr. WIP-Job 101 0 2,000 3,000 3,000 8,000 A/R 9,375 2,000 2,000 Cr. Dr. Beg. 2 DM 3 DL 4 Overhead Control 0 1,000 2,000 6,000 0 Cr. Dr. Sales Rev. 9,375 Ehab Abdou (7672930) Cr. 7,000 2,000 Cr. 9,375 9,375 Chapter 05 : Job Costing System. Important Notes: 1- When a company using a Job costing system, it must maintain a subsidiary ledger account for each Batch or Job order, this ledger Account is called a Job Cost Record, (page 52) this account is used to accumulate all costs incurred for each Job or (Batch). 2- There are two methods used to dispose the under or Over applied manufactory overhead. a. Direct Method The over or Under Applied manufactory overhead is closed directly in Cost of Goods Sold Account Over applied Under applied M.O.H X C.O.G.S X C.O.G.S x M.O.H x b. Proportion Method The Over or Under applied manufactory overhead is allocated to three accounts. I. Cost of Goods sold 8,000 [ 2,000 × 8,000/20,500] = 780 II. Work in Process 6,250 [ 2,000 × 6,250/20,500] = 610 III. Finished Goods 6,250 [ 2,000 × 6,250/20,500] = 610 M.O.H C.O.G.S W.I.P F.G Over applied X x x x C.O.G.S W.I.P F.G M.O.H Under applied 780 610 610 2,000 3- The debit side of Overhead Cost Control represent actual manufacturing overhead whereas the credit side represent the applied manufactory overhead. 4- There are three types of overhead Estimated Applied Actual Under or Over Cost & Managerial Accounting Page 6 of 8 Ehab Abdou (7672930) Chapter 05 : Job Costing System. Exercises 1. The Franklin Manufacturing Company uses a job costing system with machine hours as the allocation base for overhead. The company uses normal costing to develop the overhead allocation rate. The following data are available for the latest accounting period: Estimated fixed factory overhead cost Estimated machine-hours $160,000 100,000 Actual fixed factory overhead cost incurred Actual machine-hours used $170,000 110,000 Jobs worked on: Job No. Machine Hours Used 1020 12,000 1030 18,000 1040 15,000 1050 10,000 Instructions: a. b. c. d. e. Compute the overhead allocation rate. Determine the overhead allocated to job 1040. Determine total over or under applied overhead at the end of the year Should cost of goods sold be increased or decreased at the end of the year? Explain. When Franklin incurs an amount of overapplied or underapplied overhead that is quite large (i.e., above 10% of the total allocated cost), how is it assigned? Solution 1. a. b. c. d. e. Allocation rate = $160,000/100,000 = $1.60 per machine hour For job 1040 allocated overhead = $24,000 (15,000 hours x $1.60) Allocated = 110,000 x $1.60 = $176,000 and actual = $170,000, so overhead was overapplied by $6,000. Cost of goods sold should be decreased by $6,000 If the amount is material, it is pro-rated among WIP, finished goods, and COGS. Cost & Managerial Accounting Page 7 of 8 Ehab Abdou (7672930) Chapter 05 : Job Costing System. 2. Fabulous Surf Boards makes custom boards for professional surfers. The boards vary according to the types of materials requested by customers and the amount of direct labor required for the finishing process. The following costs are estimated for 20x5: Number of surf boards 3,000 Direct labor hours 45,000 Direct material cost $175,000 Direct labor cost $900,000 Overhead cost $675,000 During 20x5 actual costs were: Number of surfboards 3,300 Direct labor hours 46,300 Direct materials $185,000 Direct labor $850,000 Overhead $664,000 a. Explain why job costing, and not process costing, should be used for this organization. b. Fabulous uses a normal costing system. Overheard is allocated on the basis of direct labor hours. Calculate the manufacturing cost of a surfboard that takes $150 of direct materials and 36 hours of direct labor. c. At the end of 20x5, how much overhead had been allocated to production? d. Is the overhead over or underapplied, and by how much? e. Assume that any over or underapplied overhead is closed to cost of goods sold. Prepare the journal entry for the adjustment. Solution 2. a. b. c. d. e. Each surfboard is built to a customer’s specifications and the direct materials and direct labor can be traced to the board. For these types of products, job costing is appropriate. Process costing is more appropriate for mass-produced products. Total cost = $1,410 ($150 + 36 x $20 + 36 x $15) $15 x 46,300 = $694,500 It is overapplied by $30,500 Overhead cost control $30,500 Cost of goods sold $30,500 Cost & Managerial Accounting Page 8 of 8 Ehab Abdou (7672930)