in.wbn.outs.020 Converting LIFO to FIFO, recording related entries

advertisement

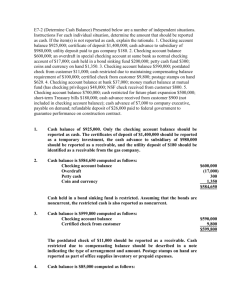

Cost of Sales and Inventories » What’s Behind the numbers » Outs » Exercises www.navigatingaccounting.com S O L U T I O N S in.wbn.outs.020 Converting LIFO to FIFO, recording related entries, and identifying their financial-statement effects (ADM) This exercise asks you to use Archer Daniels Midland Company’s disclosures to convert LIFO numbers reported by the company to FIFO, record related entries, and determine their financial-statement effects. The entries should be recorded using the accounts on page 4. Pages 5-9 report ADM’s financial statements and an excerpt from ADM’s fiscal 2012 10K. Part I: Convert reported LIFO numbers to FIFO Required Write your answers in the appropriate boxes: FIFO "Earnings Before Income Taxes" for the year ended June 30, 2012 $1,755 FIFO "Reinvested earnings" at June 30, 2012 $13,124 LIFO reserve at year end Reported LIFO Earnings Before Income Taxes for year ended June 30, 2012 Increase (decrease) in LIFO reserve FIFO Earnings Before Income Taxes for year ended June 30, 2013 Assumed tax rate (LIFO reserve at June 30, 2012) * (1-tax rate) Reported LIFO Reinvested earnings at June 30, 2112 FIFO Reinvested earnings at June 30, 2113 This exercise helps you learn how to do record keeping and reporting. Search (a) Assuming a tax rate of 40% for all relevant years, estimate what ADM would have reported under FIFO for “Earnings Before Income Taxes” on the Consolidated Statement of Earnings for the year ended June 30, 2012 and “Reinvested earnings” on the Consolidated Balance Sheet at June 30, 2012. Record Keeping 2012 $583 $1,765 ($10) $1,755 This exercise helps you learn how to search for information. Usage 2011 $593 40% $350 12,774 13,124 Part II: Record Entries Simplifying Assumptions ■ Although ADM uses LIFO for financial and tax reporting, we will assume ADM (like most companies): (1) uses FIFO to record day-to-day operating entries that affect inventories such as purchasing materials and recognizing FIFO cost of products sold and (2) records an entry at the end of the reporting period to adjust FIFO inventories to LIFO (using a LIFO reserve contra asset) and FIFO cost of products sold to LIFO cost of products sold. (This approach allows ADM to use FIFO numbers for operating decisions and still get the tax breaks provided by LIFO). ■ Two costs are recorded to LIFO cost of products sold: (1)FIFO cost of products sold and (2) the adjustment needed to convert FIFO cost of products sold to LIFO cost of product sold. ■ Assume all costs recorded to LIFO cost of products sold were previously recorded in inventory and thus there were no delivery costs or other costs recorded directly to cost of products sold. You may customize this work, as long as you credit G. Peter & Carolyn R. Wilson and respect the Creative Commons Attribution-Noncommercial-Share Alike United States license. © 1991–2013 NavAcc LLC. www.navigatingaccounting.com This exercise helps you learn how to use accounting information. 2 NAVIGATING ACCOUNTING® Required (b) Record a journal entry that summarizes the entries ADM recorded during the year ended June 30, 2012 (fiscal 2012) to recognize FIFO cost of products sold. Write your entry in the space below using the accounts on page 4. ADM's fiscal 2012 entry to recognize FIFO cost of products sold Debit LIFO cost of products sold Finished goods inventories -- FIFO Credit $85,380 $85,380 Reported LIFO cost of sales for fiscal 2012 $85,370 Increase (decrease) in LIFO reserve for fiscal 2012 FIFO cost of products sold for fiscal 2012 ($10) $85,380 (c) Record a journal entry that summarizes the entries ADM recorded during the year ended June 30, 2012 (fiscal 2012) to adjust FIFO cost of products sold to LIFO cost of products sold. Write your entry in the space below using the accounts on page 4. ADM's fiscal 2012 entry to adjust FIFO cost of products sold to LIFO Debit LIFO reserve LIFO cost of products sold Credit $10 $10 Reported LIFO cost of sales for fiscal 2012 $85,370 Increase (decrease) in LIFO reserve for fiscal 2012 FIFO cost of products sold for fiscal 2012 ($10) $85,380 Part III: Financial-Statement Effects of Entries Required For the entry you recorded in Part I, complete the related table identifying the ADM financial statement line items that would have been directly affected (and the direction of the effects) during the year ended June 30, 2012. Guidance: (1) Determine the appropriate line item(s) affected using ADM’s financial statements on pages 5-8. For example, write “cash and cash equivalents” rather than “cash” because this is on ADM’s balance sheet. (2) Include line item(s) directly affected, including the effect(s) of closing entries for events affecting income. Ignore taxes. (3) Don’t include totals or sub-totals indirectly affected by the entry. For example, don’t report “net earnings” on the income statement. However, net earnings is NOT a total on the statement of shareholders’ equity. (4) Three or four lines were included below for each statement, but you may need none or more than one line. Write “NONE” if no line item is effected on the statement. (5) Indicate if the effect(s) of the entries associated with the event increased or decreased the line item. Put an X in the appropriate column if the above event increases or decreases that line item. Be sure to mark only one box in each statement’s row. NOTE: If a reported negative number changes from -2 to -3, it decreases; if it changes from - 2 to - 1, it increases. © 1991-2013 NavAcc LLC, G. Peter & Carolyn R. Wilson 3 EXERCISE (d) Fiscal 2012 FIFO cost of products sold: ADM's fiscal 2012 entry to recognize FIFO cost of products sold CONSOLIDATED BALANCE SHEETS Line Items CONSOLIDATED STATEMENTS OF EARNINGS Increases Decreases Inventories X Reinvested earnings X CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY Line Items Increases Decreases X Net earnings Line Items Cost of products sold Increases Decreases X CONSOLIDATED STATEMENT OF CASH FLOWS Line Items Increases X Net earnings including noncontrolling interests Inventories Decreases X (Negatively reported number increases.) (e) Adjusting fiscal 2012 FIFO cost of products sold to LIFO: ADM's fiscal 2012 entry to adjust FIFO cost of products sold to LIFO CONSOLIDATED BALANCE SHEETS Line Items CONSOLIDATED STATEMENTS OF EARNINGS Increases Inventories X Reinvested earnings X Decreases CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY Line Items Increases Decreases Net earnings X Line Items CONSOLIDATED STATEMENT OF CASH FLOWS Line Items Increases Net earnings including noncontrolling interests Inventories Decreases X Cost of products sold (Negatively reported number decreases.) © 1991-2013 NavAcc LLC, G. Peter & Carolyn R. Wilson Increases Decreases X X 4 NAVIGATING ACCOUNTING® Chart of Accounts ASSETS Current Cash C Inventories (this is a title, not an account) Materials inventories -- FIFO Minv Work in process -- FIFO WIP Finished goods inventories -- FIFO FGI LIFO reserve LR Segregated inventories: deferred revenue SIdr Prepaid expenses PrEx Short-term investments Stin Trade receivables, net (this is a title, not an account) Trade receivables: gross Trgr Trade receivables: allowance for doubtful accounts Trall Noncurrent Property, plant, and equipment (this is a title, not an account) HcPPE PP&E historical cost AcDep PP&E accumulated depreciation Eqinv Equity and other investments Goodwill Gdw LIABILITIES Current Accounts payable AP Accrued liabilities (this is a title, not an account) Accrued liabilities: warranty and recalls Alwr Alcom Accrued liabilities: compensation and wages Aloth Accrued liabilities: other Dividends payable DP Short-term debt STD Noncurrent Long-term debt LTD OLTL Other long-term liabilities OWNERS' EQUITY Permanent AOCI APIC CS RE Accumulated other comprehensive income Additional paid-in capital Common stock par value Retained earnings Net income Bdexp Cops DepEx Ginvs Gimp IncS Intinc PPEg PPEl ResEx Rev SG&A Bad debt expense LIFO cost of products sold Depreciation expense Gain on sale of investments Goodwill impairment Income summary Interest income Gain on sale of PP&E Loss on sale of PP&E Restructuring charge Net revenues Selling, general, and administrative expense © 1991-2013 NavAcc LLC, G. Peter & Carolyn R. Wilson 5 EXERCISE Archer- Daniels - Midland Company Consolidated Balance Sheet June 30 2012 Assets Current Assets Cash and cash equivalents Short-term marketable securities Segregated cash and investments Trade receivables Inventories Other current assets Total Current Assets Investments and Other Assets Investments in and advances to affiliates Long-term marketable securities Goodwill Other assets Total Investments and Other Assets Property, Plant, and Equipment Land Buildings Machinery and equipment Construction in progress Accumulated depreciation Net Property, Plant, and Equipment Total Assets Liabilities and Shareholders Equity Current Liabilities Short-term debt Trade payables Accrued expenses and other payables Current maturities of long-term debt Total Current Liabilities Long-Term Liabilities Long-term debt Deferred income taxes Other Total Long-Term Liabilities Shareholders Equity Common stock Reinvested earnings Accumulated other comprehensive income (loss) Noncontrolling interests Total Shareholders Equity Total Liabilities and Shareholders Equity (In millions) 2011 $1,291 176 3,263 3,439 12,192 6,593 26,954 $615 739 3,396 4,808 12,055 5,891 27,504 3,388 262 603 534 4,787 3,240 666 602 681 5,189 325 4,609 16,729 1,027 22,690 (12,878) 9,812 $41,553 305 4,413 16,245 765 21,728 (12,228) 9,500 $42,193 2,108 2,474 8,367 1,677 14,626 1,875 2,581 8,584 178 13,218 6,535 783 1,440 8,758 8,266 859 1,012 10,137 6,102 12,774 (907) 200 18,169 $41,553 6,636 11,996 176 30 18,838 $42,193 Archer - Daniels - Midland 2012 10K, page 49 © 1991-2013 NavAcc LLC, G. Peter & Carolyn R. Wilson 6 NAVIGATING ACCOUNTING® Archer- Daniels - Midland Company Consolidated Statement of Earnings Year Ended June 30 2012 2011 2010 (In millions, except per share amounts) Net sales and other operating income Cost of products sold Gross Profit $89,038 85,370 3,668 $80,676 76,376 4,300 $61,682 57,839 3,843 Selling, general and administrative expenses Asset impairment, exit, and restructuring costs Interest expense Equity in earnings of unconsolidated affiliates Interest income Other (income) expense - net Earnings Before Income Taxes 1,626 437 441 (472) (112) (17) 1,765 1,611 1,398 482 (542) (136) (130) 3,015 422 (561) (126) 125 2,585 Income taxes Net Earnings Including Noncontrolling Interests 523 1,242 997 2,018 666 1,919 Less: Net earnings (losses) attributable to noncontrolling Net Earnings Attributable to Controlling Interests 19 1,223 (18) 2,036 (11) 1,930 Average number of shares outstanding basic 665 642 643 Average number of shares outstanding diluted 666 654 644 Basic earnings per common share $1.84 $3.17 $3.00 Diluted earnings per common share $1.84 $3.13 $3.00 Archer - Daniels - Midland 2012 10K, page 48 © 1991-2013 NavAcc LLC, G. Peter & Carolyn R. Wilson 7 EXERCISE Archer- Daniels - Midland Company Consolidated Statements of Shareholders' Equity Other Common Stock Common Stock Shares Amount Balance June 30, 2009 Comprehensive income Net earnings Other comprehensive income (loss) Total comprehensive income Cash dividends paid-$.58 per share Treasury stock purchases Stock compensation expense Other Balance June 30, 2010 Comprehensive income Net earnings Other comprehensive income (loss) Total comprehensive income Cash dividends paid-$.62 per share Shares issued related to equity unit conversion Treasury stock purchases Stock compensation expense Acquisition of noncontrolling interests Other Balance June 30, 2011 Comprehensive income Net earnings Other comprehensive income (loss) Total comprehensive income Cash dividends paid-$.685 per share Treasury stock purchases Stock compensation expense Noncontrolling interests previously associated with mandatorily redeemable instruments Acquisition of noncontrolling interests Other Balance June 30, 2012 $642 $5,204 Reinvested Comprehensive Earnings $8,778 Income (Loss) (In millions) ($355) 1,930 Total Noncontrolling Interests $26 1 639 (100) 45 2 5,151 (372) 21 10,357 2,036 (899) 1,075 7 22 2 676 1,750 (301) 47 (2) 11,996 1,223 (18) (527) 48 176 (1,083) (40) (15) $6,102 25 1 30 19 (6) (455) $12,774 (1) 14 18,838 153 (455) (527) 48 10 1 $659 1,375 (372) (100) 45 30 14,631 3,093 (395) 1,750 (301) 47 (26) 15 6,636 $13,653 (18) (395) 44 (9) Equity (11) (544) (4) Shareholders 174 ($907) (14) (3) $200 184 (54) (18) $18,169 Archer - Daniels - Midland 2012 10K, page 51 © 1991-2013 NavAcc LLC, G. Peter & Carolyn R. Wilson 8 NAVIGATING ACCOUNTING® Archer- Daniels - Midland Company Consolidated Statements of Cash Flows Year Ended June 30 2012 2011 Operating Activities Net earnings including noncontrolling interests Adjustments to reconcile net earnings to net cash provided (used in) operating activities) Depreciation and amortization Asset impairment charges Deferred income taxes Gain on Golden Peanut revaluation Equity in earnings of affiliates, net of dividends Stock compensation expense Pension and postretirement accruals (contributions), net Charges from early extinguishment of debt Deferred cash flow hedges Other net Changes in operating assets and liabilities Segregated cash and investments Trade receivables Inventories Other current assets Trade payables Accrued expenses and other payables Total Operating Activities Investing Activities Purchases of property, plant, and equipment Proceeds from sales of property, plant, and equipment Cash divested from deconsolidation Net assets of businesses acquired Investments in and advances to affiliates Purchases of marketable securities Proceeds from sales of marketable securities Other net Total Investing Activities Financing Activities Long-term debt borrowings Long-term debt payments Debt repurchase premium and costs Net borrowings under lines of credit agreements Shares issued related to equity unit conversion Purchases of treasury stock Cash dividends Other net Total Financing Activities Increase (decrease) in cash and cash equivalents Cash and cash equivalents beginning of year Cash and cash equivalents Cash paid for interest and income taxes as follows: Interest Income taxes (In millions) $1,242 848 367 45 $2,018 2010 $1,919 (243) 48 37 12 43 156 877 2 521 (71) (397) 47 4 15 (1) (123) (326) 45 (110) 75 49 75 128 974 (272) (954) (117) 581 2,895 (1,035) (687) (3,412) (2,452) 339 2,015 (2,340) 74 (540) (404) 1,069 (75) (118) 2,684 (1,477) 48 (130) (241) (31) (1,297) 1,945 61 (1,122) (1,247) 72 (1,607) 35 (218) (31) (2,379) 2,094 34 (1,675) (62) (146) (1,387) 1,454 48 (1,665) 27 (552) (71) 29 (527) (455) (7) (1,097) 676 615 $1,291 1,564 (417) (21) 1,381 1,750 (301) (395) 23 3,584 (431) 1,046 $615 (100) (372) 11 (1,028) (9) 1,055 $1,046 $411 479 $418 513 $453 604 97 (358) (44) 197 912 9 30 Archer - Daniels - Midland 2012 10K, page 50 © 1991-2013 NavAcc LLC, G. Peter & Carolyn R. Wilson 9 EXERCISE Excerpt from ADM’s Fiscal 2012 10K ■ Note 4: Inventories, Derivative Instruments, and Hedging Activities (excerpt) The Company values certain inventories using the lower of cost, determined by either the LIFO or FIFO method, or market. Inventories of certain merchandisable agricultural commodities, which include inventories acquired under deferred pricing contracts, are stated at market value. 2012 (In millions) LIFO inventories FIFO value LIFO valuation reserve LIFO inventories carrying value FIFO inventories Market inventories $1,070 (583) 487 4,946 6,759 $12,192 2011 $1,143 (593) 550 5,590 5,915 $12,055 During fiscal year 2012, LIFO inventory quantities declined resulting in a liquidation effect on LIFO reserves that increased after-tax earnings by $59 million ($0.09 per share). © 1991-2013 NavAcc LLC, G. Peter & Carolyn R. Wilson ADM 2012 10K, Note 4, page 64