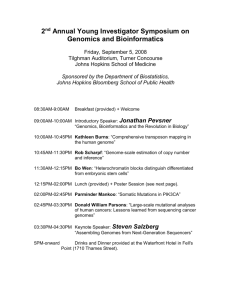

the johns hopkins health system corporation and affiliates

advertisement