Erste Group: Gold – Demand in China and India Continues to Increase

advertisement

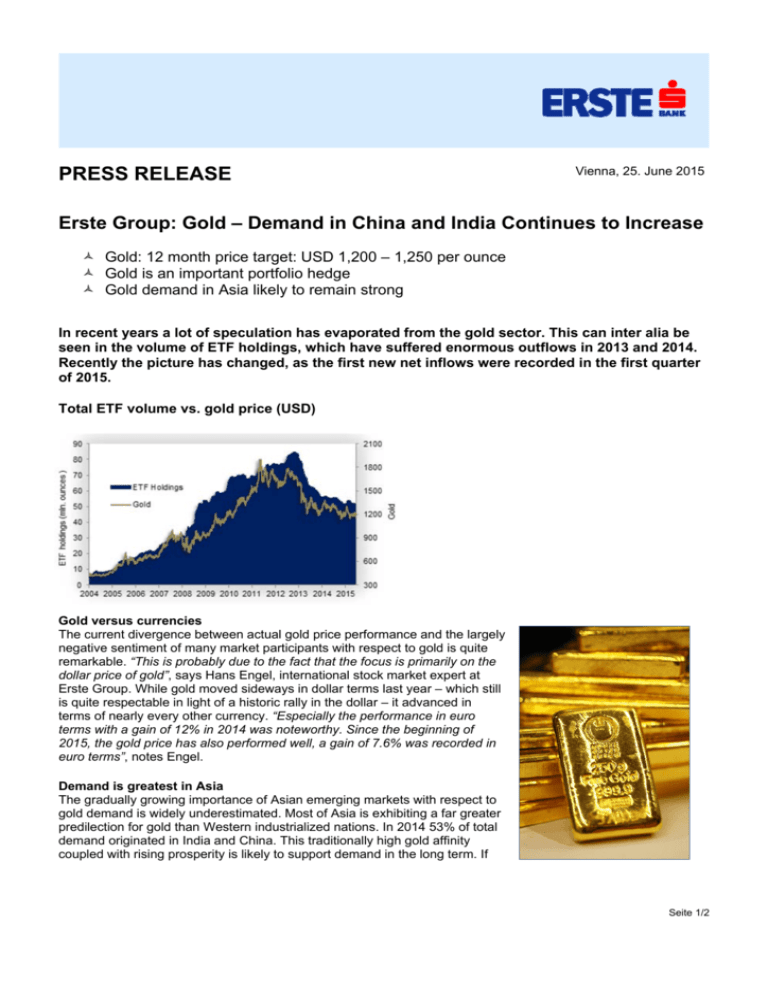

PRESS RELEASE Vienna, 25. June 2015 Erste Group: Gold – Demand in China and India Continues to Increase Gold: 12 month price target: USD 1,200 – 1,250 per ounce Gold is an important portfolio hedge Gold demand in Asia likely to remain strong In recent years a lot of speculation has evaporated from the gold sector. This can inter alia be seen in the volume of ETF holdings, which have suffered enormous outflows in 2013 and 2014. Recently the picture has changed, as the first new net inflows were recorded in the first quarter of 2015. Total ETF volume vs. gold price (USD) Gold versus currencies The current divergence between actual gold price performance and the largely negative sentiment of many market participants with respect to gold is quite remarkable. “This is probably due to the fact that the focus is primarily on the dollar price of gold”, says Hans Engel, international stock market expert at Erste Group. While gold moved sideways in dollar terms last year – which still is quite respectable in light of a historic rally in the dollar – it advanced in terms of nearly every other currency. “Especially the performance in euro terms with a gain of 12% in 2014 was noteworthy. Since the beginning of 2015, the gold price has also performed well, a gain of 7.6% was recorded in euro terms”, notes Engel. Demand is greatest in Asia The gradually growing importance of Asian emerging markets with respect to gold demand is widely underestimated. Most of Asia is exhibiting a far greater predilection for gold than Western industrialized nations. In 2014 53% of total demand originated in India and China. This traditionally high gold affinity coupled with rising prosperity is likely to support demand in the long term. If Seite 1/2 one looks at last year's per capita demand, one can see that numerous emerging markets are already among the 20 largest gold buyers. This is all the more astonishing considering that their purchasing power is significantly lower by comparison. Why gold is a sensible portfolio addition Numerous studies confirm that the addition of gold lowers a portfolio's volatility. However, it is also a fact that bull markets in US stocks aren't providing a positive environment for gold. Rising stock markets currently represent the greatest opportunity cost for gold. An investment of between 5 up to a maximum of 10 percent of one's total investable wealth continues to be recommended. The outlook is moderately positive After a long, drawn-out bottoming period (in USD terms), our outlook for the gold price is moderately optimistic. A technical assessment of the gold price shows however that the long-lasting bottoming phase isn't over just yet, and a sideways trend remains de facto in force. We are forecasting a price range of USD 1,200 – 1,250 per ounce over the coming 12 months. About the 2015 Gold Report The Gold Report has been authored by Ronald Stoeferle. He is an external consultant to Erste Group Research and has been writing reports on the precious metal for the past eight years. Erste Bank, press department 1010 Wien, Graben 21 Karin Berger, 05 0100 DW 17629, E-Mail: karin.berger@erstegroup.com Christian Hromatka, 05 0100 DW 13711, E-Mail: christian.hromatka@erstegroup.com Michaela Riediger, 05 0100 DW 13723, E-Mail: michaela.riediger@erstegroup.com Download this press release here: http://www.erstebank.at/pressrelease Erste Group is the leading financial services provider in the Eastern part of the EU. Around 45,000 employees serve 16.2 million clients in 2,800 branches in 7 countries (Austria, Czech Republic, Slovakia, Romania, Hungary, Croatia, Serbia). As of Q1 2015 Erste Group posts a net profit of EUR 225.8 million and total assets of EUR 202.6 billion. The core tier-1 ratio (Basel III phased-in) stood at 10.5%. Erste Bank und Sparkassen are the largest provider of financial services in Austria. Around 14,000 staff attend to more than 3,4 million customers at over 1,100 branches and OMV banking service points. In 2014 Erste Bank und Sparkassen have helped 14,000 people to fulfill their dream of owning their own home, paid out 540 m. euro in interest to domestic savers and helped 6,000young entrepreneurs to implement their business ideas. Seite 2/2