Question 16: Using the Percentage of Sales method, multiply $60000

advertisement

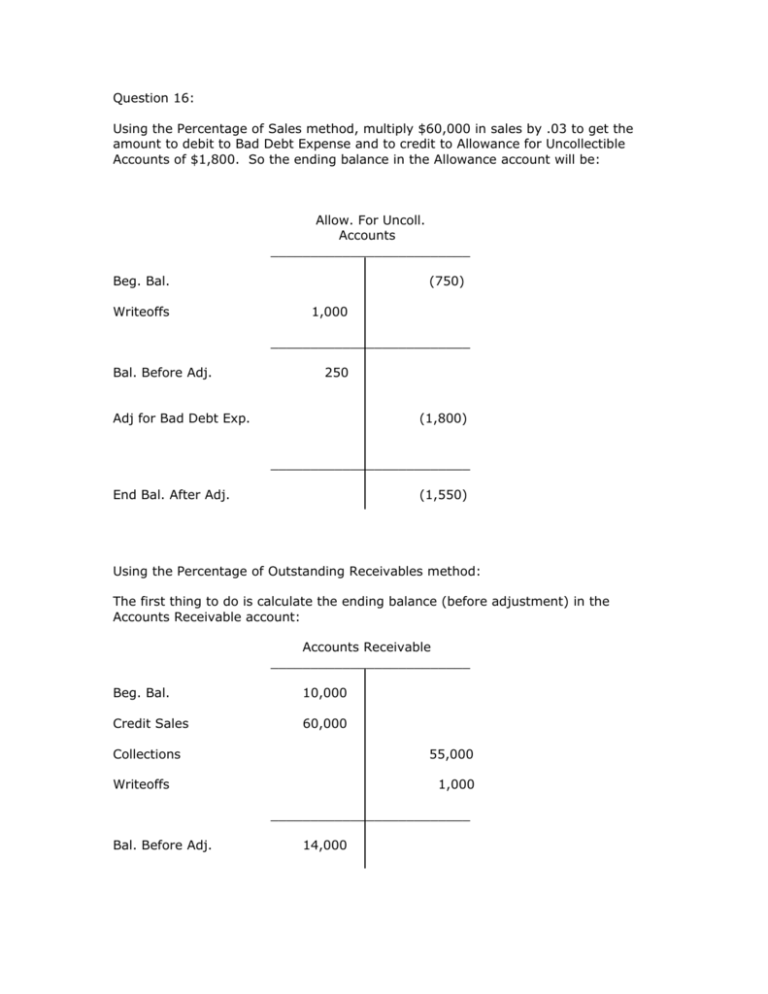

Question 16: Using the Percentage of Sales method, multiply $60,000 in sales by .03 to get the amount to debit to Bad Debt Expense and to credit to Allowance for Uncollectible Accounts of $1,800. So the ending balance in the Allowance account will be: Allow. For Uncoll. Accounts _________________________ Beg. Bal. Writeoffs (750) 1,000 _________________________ Bal. Before Adj. 250 Adj for Bad Debt Exp. (1,800) _________________________ End Bal. After Adj. (1,550) Using the Percentage of Outstanding Receivables method: The first thing to do is calculate the ending balance (before adjustment) in the Accounts Receivable account: Accounts Receivable _________________________ Beg. Bal. 10,000 Credit Sales 60,000 Collections 55,000 Writeoffs 1,000 _________________________ Bal. Before Adj. 14,000 Since the ending A/R balance (before adjustment) is $14,000, the ending balance in the Allowance for Uncollectible Accounts after adjustment needs to be $840 ($14,000 * .06). The ending balance in the Allowance for Uncollectible Accounts account before adjustment is: Allow. For Uncoll. Accounts _________________________ Beg. Bal. Writeoffs 750 1,000 _________________________ Bal. Before Adj. 250 Since the account has a debit balance of $250 and it needs to have a credit balance of $840, the credit to the Allowance account needs to be $250 + $840, or $1,090. Therefore, the debit to Bad Debt Expense will be $1,090. Here is the ending balance, after adjustment for Bad Debt Expense, in the Allowance for Uncollectible Accounts: Allow. For Uncoll. Accounts _________________________ Beg. Bal. Writeoffs 750 1,000 _________________________ Bal. Before Adj. Adj for Bad Debt Exp. End. Bal After Adj. 250 1,090 _________________________ 840