ACCA and CIMA courses

advertisement

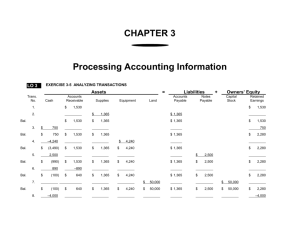

CIMA Certificate Level Paper C2 Fundamentals of Financial Accounting Name Telephone Email Fire Safety Procedures • Fire alarm = continuous bell • Fire Exits • Assembly Point Slide 2 Course Administration • Start and finish times • Breaks • Daily attendance register • The attendance register will shortly be passed round the class; please ensure that the information you give is correct. Please note if you are a company sponsored student, then your attendance / nonattendance will be reported to your employer. Slide 3 Facilities •Toilets •Canteen/common room •Drinks machines •No smoking •Switch off mobile phones Slide 4 Classroom Tuition and Home Study • Classroom tuition – Key areas of the syllabus • Home study – NEW Course Companion – Homestudy is vital for: • Reinforcing your knowledge • Practising your skills • CIMA forum – www.bpp.com/cimaforum • Helpline for queries Slide 5 Pass Assurance • Attend all days of the course • Book and take the CBA at a BPP centre • If you fail the CBA you can attend another certificate course for that paper free of charge at any BPP centre Slide 6 Deadline for CBAs • If you wish to sit managerial papers in May 2010 you must have passed all CBAs by 1st March 2010. • If you wish to sit managerial papers in November 2010 you must have passed all CBAs by 1st September 2010. Slide 7 CIMA syllabus progression Paper C2 FFA Paper F1 Financial Operations Paper F2 Financial Management Slide 8 Syllabus • • • • Conceptual & regulatory framework Accounting systems Control of accounting systems Preparation of accounts Slide 9 (20%) (20%) (15%) (45%) Computer Based Assessment 50 objective test questions – 100 marks Time allowed – 2 hours Pass mark – 50% Slide 10 Chapter 1 The nature and objective of accounting Introduction What is accounting? Recording, analysing & summarising information …… Who requires this information? Slide 12 notes reference - page 13 Lecture example 1 • • • • • • • Managers Owners/shareholders Providers of finance Inland Revenue/C&E Suppliers Financial Analysts Government Slide 13 notes reference - page 13 Financial Records Maintained for all commercial transactions Must be complete, accurate and valid BOOKKEEPING Slide 14 notes reference - page 14 Types of Business – profit making • Sole trader • Partnership • Companies Slide 15 notes reference - page 14 Separate identity concept A business is considered separate from owner Limited liability company has separate legal identity Slide 16 notes reference - page 15 Chapter 2 An introduction to final accounts Lecture example 1 OWN House Car Cash OWE Mortgage Car loan Credit card Slide 18 200,000 10,000 5,000 215,000 (180,000) (5,000) (5,000) (190,000) notes reference - page 19 ASSETS LIABILITIES The Balance Sheet (SOFP) $ ASSETS Non-current assets Land and buildings Office equipment Motor vehicles Furniture and fixtures $ $ 100,000 50,000 30,000 20,000 200,000 Current assets Inventories Trade receivables Less: allowance for doubtful debts 50,000 30,000 (2,000) Prepayments Cash in hand and at bank 90,000 290,000 Total assets Slide 19 28,000 5,000 7,000 notes reference - page 20 The Balance Sheet (SOFP) $ CAPITAL AND LIABILITIES Capital Capital Profit Less: drawings $ $ 170,000 45,000 (25,000) 190,000 Non-current liabilities Bank loans 40,000 Current liabilities Bank overdraft Trade payables Accruals 16,000 40,000 4,000 Total capital and liabilities Slide 20 notes reference - page 20 60,000 290,000 Key Features • Always date a balance sheet • Non-current assets – long-term • Current assets – not non-current assets! • Capital – what the business owes the owner • Don’t include nil value items • Balance sheet = snapshot of the business Slide 21 notes reference - page 20 The Income Statement Income statement for the year ended 31 December 20X1: $ $ Sales Less: Cost of sales Opening inventories Purchases Carriage inwards Closing inventories 200,000 40,000 110,000 20,000 170,000 (50,000) (120,000) 80,000 Gross profit ….continued on next slide Slide 22 Trading account notes reference - page 22 The Income Statement (cont’d) $ Gross profit (from previous slide) Sundry income Discounts receivable Less: Expenses Rent Carriage outwards Telephone Electricity Wages and salaries Depreciation Bad and doubtful debts Motor expenses Discounts allowable 11,000 4,000 1,000 2,000 9,000 7,000 3,000 5,000 1,000 (43,000) 45,000 Profit for the period Slide 23 $ 80,000 5,000 3,000 88,000 notes reference - page 22 Key features • Headed up with accounting period • Top part (down to gross profit) is trading account • Sundry income includes items like bank interest • Do not include nil value items • Income statement = video of the period Slide 24 notes reference - page 22 Balance Sheet & Income Statement Balance sheet – worth of business at a point in time Income statement – trading activities over period Slide 25 notes reference - page 23 Chapter 3 Sources, records and the books of prime entry Maintaining Records There are a number and variety of transactions Slide 27 CASH CREDIT Sales Purchases Wages Stationery Acquisition of non-current Sales Purchases notes reference - page 27 Flow of information Assorted Transactions A business has lots of detailed data on a day to day basis Categorised Grouping together of similar transactions e.g. wages payments Summarised Financial Statements Slide 28 Produce useful information e.g. monthly sales total The formal and accepted format for a company to report notes reference - page 27 Main books of prime entry • Cash book • Sales (Receivables) Day Book • Purchases (Payables) Day Book • Petty Cash Book • Journal Slide 29 notes reference - page 28 Cash Book • Records receipts and payments into and out of the bank. • Often assumed to be two books • Very important record of company’s cash flow position Slide 30 notes reference - page 28 Cash Book Receipts Date Narrative Total $ Capital $ 2.1.X6 5.1.X6 6.1.X6 F. Bloggs J. Spalding J.Smith 4,000 200 500 4,000 4,700 4,000 Slide 31 Sales $ Receivables $ 200 500 notes reference - page 28 500 200 Cash Book Payments Date Narrative Total $ 6.1.X6 6.1.X6 8.1.X6 Slide 32 Manley & Co. Petty Cash Digby Co Purchases $ Van $ 350 50 1,000 1,000 1,400 1,000 Rent $ Payables $ Petty Cash $ 350 50 notes reference - page 28 350 50 Drawings $ Sales Day Book Lists all sales made on CREDIT Date Customer 3.1.X6 5.1.X6 J.Spalding G.McGregor $ 200 400 TOTAL Slide 33 notes reference - page 29 600 Purchases Day Book Lists all purchases made on CREDIT Date Supplier 1.1.X6 4.1.X6 Tewson Co Manley and Co TOTAL Slide 34 $ notes reference - page 29 400 350 750 Petty Cash Book Receipts Payments Date Narrative 6.1.X6 Cheque cashed Total $ 50 Date Narrative Total $ Stationery $ 7.1.X6 City Stationers 10 10 8.1.X6 F.Bloggs Metro Fare 2 12 Slide 35 notes reference - page 29 Travel $ 2 10 2 Imprest System •Pre-set limit say $50 •Voucher is filled in when money is taken •At any time, vouchers + cash = $50 •The petty cash book is filled in from the vouchers •The amount used to restore the pre-set limit = money spent Slide 36 notes reference - page 29 Journal Certain transactions do not fit in the main books: Correction of errors Period end adjustments Slide 37 notes reference - page 30 Memorandum Ledgers Can you identify how much Mr Spalding owes you from the following invoices? Or how much you owe to Tewson & Co.? Slide 38 notes reference - page 30 Memorandum Ledgers A business has to keep separate ledgers so that it can keep track of individual credit customers and suppliers Sales (Receivables) ledger • Shows the total outstanding from each credit customer (receivable) • Useful for credit control Slide 39 Purchases (Payables) ledger • Shows total due to each credit supplier (payable) • Useful for cash flow notes reference - page 30 Chapter 4 Ledger accounting and double entry Introduction Categorise transactions in BOPE then Summarise information in nominal ledger Slide 41 notes reference - page 35 Dual Effect Any transaction that takes place always affects 2 items in the accounts. E.g. A sole trader pays $6,000 into the business bank account The items in the accounts affected are? Capital Cash Slide 42 notes reference - page 35 Ledger accounts Which side of T- account should entry go? DEBIT Slide 43 CREDIT notes reference - page 35 General rules Debits Credits Expenses L iabilities A ssets Income Drawings Capital Slide 44 notes reference - page 36 Ledger accounts The amounts are recorded in T- accounts Each item in the I/S and B/S has an account Dr CAPITAL Cr 6,000 Slide 45 Dr 6,000 notes reference - page 36 CASH Cr Ledger accounting A sole trader purchases goods on credit for $400 Which 2 accounts are affected? Dr Slide 46 PURCHASES 400 Cr Dr notes reference - page 36 PAYABLES Cr 400 Lecture example 1 Transaction Debit Credit Sales for cash Cash Sales Sales on credit Receivables Sales Purchases for cash Purchases Cash Purchases on credit Purchases Payables Pay electricity bill Heat & light Cash Receive cash from a receivable Cash Receivables Pay cash to a payable Payables Cash Borrow money from the bank Cash Loan Slide 47 notes reference - page 36 Lecture example 2 - Douglas part (a) Cash Capital Sales $ 5,000 Rent 2,100 Electricity Car Drawings Capital $ Cash Slide 48 notes reference - page 38 $ 500 200 1,000 300 $ 5,000 Lecture example 2(a) continued Payables $ $ Purchases 2,000 Purchases $ Payables 2,000 $ Electricity $ 200 $ Rent Cash Slide 49 $ 500 $ Cash notes reference - page 38 Lecture example 2(a) continued Car Cash $ 1,000 Sales Receivables $ 1,750 Slide 50 $ Cash Drawings $ 300 $ Sales $ $ Rec. Cash notes reference - page 38 $ 1,750 2,100 Lecture e.g. 3: Balancing off the accounts Sales Sales Cash 500 Purchases 300 500 Telephone 50 c/d b/d 1000 650 650 1000 Let’s see this in T-account terms Step 1: Fill in highest total on both sides Step Balance How2:much cashoffdothe welower haveside left? Step 3: Complete the double entry $650 Slide 51 notes reference - page 42 Lecture example 2 - Douglas part (b) Cash Capital Sales $ 5,000 2,100 Rent Electricity Car Drawings bal c/d 7,100 bal b/d $ 500 200 1,000 300 5,100 7,100 5,100 Capital bal c/d Slide 52 $ 5,000 5,000 Cash $ 5,000 5,000 bal b/d 5,000 notes reference - page 38 Lecture example 2(b) continued Payables bal c/d $ $ 2,000 Purchases 2,000 2,000 2,000 bal b/d Cash bal b/d Slide 53 2,000 Rent $ 500 bal c/d $ 500 500 500 500 Purchases $ Payables 2,000 bal c/d 2,000 bal b/d Cash bal b/d notes reference - page 38 $ 2,000 2,000 2,000 Electricity $ 200 bal c/d $ 200 200 200 200 Lecture example 2(b) continued Car Cash $ 1,000 bal c/d $ 1,000 1,000 1,000 bal b/d 1,000 Sales Receivables $ 1,750 bal c/d $ 1,750 1,750 1,750 bal b/d Cash bal b/d bal c/d 1,750 Drawings $ 300 bal c/d $ 300 300 300 300 Sales $ 3,850 Rec. Cash $ 1,750 2,100 3,850 3,850 bal b/d Slide 54 notes reference - page 38 3,850 Chapter 5 From trial balance to financial statements Example – Miss Smith Account Debit $ Cash 720 Capital 500 Sales 2,200 Purchases 1,100 Furniture 500 Electricity 120 Telephone 60 Drawings 200 Total Slide 56 Credit $ notes reference - page 47 2,700 2,700 Errors in the trial balance • Error of Commission Omission Principle Compensating Original Entry Reversing Slide 57 C O P C O R notes reference - page 47 Ch4 - Lecture example 2 - Douglas part (c) Trial Balance Account Cash Capital Payables Purchases Rent Electricity Car Drawings Receivables Sales Debit 5,100 5,000 2,000 2,000 500 200 1,000 300 1,750 3,850 10,850 Slide 58 Credit notes reference - page 38 10,850 The closing inventory/stock adjustment Stock Asset of the business COS must match sales Remove unsold inventory from COS Dr Inventory (B/S) Slide 59 Cr Inventory (IS) notes reference - page 49 Lecture example 1 – closing inventory adj. Sales (20 x $30) 600 Cost of sales: Purchases (50 x $20) Less: Closing inventories (30 left @ $20) Gross profit Slide 60 1,000 (600) (400) 200 notes reference - page 49 The income statement ….. …..is part of the double entry system Sales I/S 4,500 4,500 Rec Rec Rec I/S 1,000 2,000 1,500 4,500 Sales 4,500 …..all income and expense accounts are transferred to the I/S T-account. Slide 61 notes reference - page 50 Ch4 - Lecture example 2 - Douglas part (d) Income Statement Slide 62 notes reference - page 38 Ch4 - Lecture example 2(d) continued bal c/d Sales $ 3,850 Rec. Cash $ 1,750 2,100 3,850 3,850 I/Statement 3,850 Cash bal b/d Slide 63 bal b/d 2,000 bal b/d $ 2,000 2,000 2,000 3,850 Rent $ 500 bal c/d $ 500 500 500 500 Purchases $ Payables 2,000 bal c/d Cash bal b/d notes reference - page 38 Electricity $ 200 bal c/d $ 200 200 200 200 Ch4 - Lecture example 2(d) continued Income statement Sales Slide 64 notes reference - page 38 3,850 Ch4 - Lecture example 2(d) continued bal c/d Sales $ 3,850 Rec Cash $ 1,750 2,100 3,850 3,850 I/statement 3,850 Cash bal b/d Slide 65 bal b/d 2,000 bal b/d $ 2,000 2,000 2,000 I/Statement 2,000 3,850 Rent $ 500 bal c/d $ 500 500 500 500 Purchases $ Payables 2,000 bal c/d Cash bal b/d notes reference - page 38 Electricity $ 200 bal c/d $ 200 200 200 200 Ch4 - Lecture example 2(d) continued Income Statement Purchases Slide 66 2,000 Sales notes reference - page 38 3,850 Ch4 - Lecture example 2(d) continued bal c/d Sales $ 3,850 Rec Cash $ 1,750 2,100 3,850 3,850 I/Statement 3,850 Cash bal b/d Slide 67 bal b/d Purchases $ Payables 2,000 bal c/d 2,000 bal b/d $ 2,000 2,000 2,000 I/Statement 2,000 3,850 Rent $ 500 bal c/d $ 500 500 500 500 I/St’ment 500 Cash bal b/d notes reference - page 38 Electricity $ 200 bal c/d $ 200 200 200 200 I/St’ment 200 Ch4 - Lecture example 2(d) continued Income Statement Purchases 2,000 Gross profit c/d 2,100 Rent Electricity Net profit c/d Sales Closing inv. 4,100 4,100 500 200 1,400 Gross profit b/d 2,100 2,100 2,100 Net profit b/d Slide 68 3,850 250 notes reference - page 38 1,400 Balance Sheet….. …..is not part of double entry system Receivables Sales 1,000 Sales 2,000 Sales 1,500 4,500 b/d c/d 4,500 4,500 4,500 …all assets and liabilities are not transferred They are only listed in the balance sheet Slide 69 notes reference - page 50 Ch4 - Lecture example 2 - Douglas part (e) Douglas: Income Statement for the month of January $ $ Sales 3,850 Less Cost of Sales Purchases 2,000 Less Closing Invent. (250) (1,750) Gross Profit Less Expenses: Rent Electricity 2,100 500 200 (700) 1,400 Net Profit Slide 70 notes reference - page 38 Ch4 - Lecture example 2(e) continued Douglas: Balance Sheet as at 31 January Non-Current asset Motor Vehicle Current Assets Inventory Receivables Cash Total Assets Proprietor’s Interest Capital Profit Drawings $ $ 1,000 250 1,750 5,100 7,100 8,100 5,000 1,400 (300) 6,100 Current Liabilities Payables 2,000 8,100 Slide 71 notes reference - page 38 Income statement and Drawings….. …are cleared to the capital account at the end of the period Drawings I/S Purchases 500 Sales Rent 100 Phone 100 Capital 300 1,000 1,000 Cash 200 Capital 200 200 200 Capital 1,000 Drawings 200 Cash 4,000 c/d 4,100 I/S 300 4,300 b/d Slide 72 notes reference - page 50 4,300 4,100 Ch4 - Lecture example 2 - Douglas part (f) Profit and drawings are cleared to the capital account at the end of the period Capital bal c/d $ 5,000 Cash 5,000 5,000 bal b/d Slide 73 $ 5,000 notes reference - page 38 5,000 Ch4 - Lecture example 2(f) continued Purchases Gross profit c/d Rent Electricity Net profit c/d Capital a/c Income statement $ 2,000 Sales 2,100 Closing Inv 4,100 500 Gross profit b/d 200 1,400 2,100 1,400 Net profit b/d $ 3,850 250 4,100 2,100 2,100 1,400 Drawings Cash bal b/d Slide 74 $ 300 300 300 bal c/d notes reference - page 38 $ 300 300 Ch4 - Lecture example 2(f) continued Capital bal c/d $ 5,000 Cash 5,000 Slide 75 $ 5,000 5,000 bal b/d 5,000 Net profit 1,400 notes reference - page 38 Ch4 - Lecture example 2(f) continued Purchases Gross profit c/d Rent Electricity Net profit c/d Capital a/c Income Statement $ 2,000 Sales 2,100 Closing inv. 4,100 500 Gross profit b/d 200 1,400 2,100 1,400 Net profit b/d $ 3,850 250 4,100 2,100 2,100 1,400 Drawings Cash bal b/d Slide 76 $ 300 300 300 bal c/d Capital a/c notes reference - page 38 $ 300 300 300 Ch4 - Lecture example 2(f) continued Capital bal c/d $ 5,000 Cash 5,000 Drawings 300 bal c/d 6,100 5,000 bal b/d 5,000 Net profit 1,400 6,400 6,400 bal b/d Slide 77 $ 5,000 notes reference - page 38 6,100 Chapter 6 The accounting equation The accounting equation ASSETS ASSETS = LIABILITIES ASSETS = PROPRIETOR’S + PAYABLES INTEREST - PAYABLES = PROPRIETOR’S INTEREST Capital Slide 79 + Profit notes reference - page 57 Drawings The accounting equation Assets Slide 80 = Capital + Profit - notes reference - page 58 Drawings + Payables Using Douglas Example ASSETS = $1,000 $250 $1,750 $5,100 $8,100 Slide 81 = Capital $5,000 + Profit - Drawings + $1,400 - $300 notes reference - page 58 + Payables + $2,000 Practical definitions • Assets – Something valuable an entity owns • Liabilities – Owed to someone else • Capital as liability – Money owed to the proprietor • Drawings – Taken out of business by its owner Slide 82 notes reference - page 60 Rearranging the accounting equation Assets = (Capital + Profit – Drawings) + Payables or Assets - Payables Net Assets Slide 83 = Capital + Profit – Drawings = Proprietor’s interest notes reference - page 58 The business equation Change in net assets = Change in Capital + Profit – Drawings 1 March Net Assets = 6,000 31 March Net Assets = 11,700 Increase = 5,700 Additional capital introduced = 4,000. Profit = ? Slide 84 notes reference - page 58 The business equation Increase in capital Profit 4,000 2,000 Less: Drawings (300) 5,700 Rearranging the business equation: Profit = increase in net assets – increase in capital + drawings Slide 85 notes reference - page 58 End of day 1 - what to do now… • Reinforce today’s learning • Develop question skills Course Companion 1.Course notes review Slide 86 2. Question practice 3. Study text review