Branch_Account

advertisement

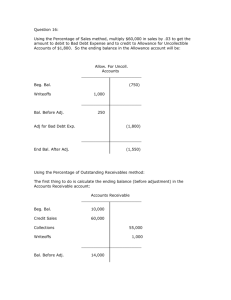

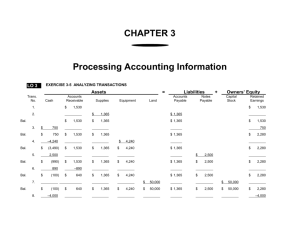

Branch Account 1 Branch A trading company may try to expand its business by opening BRANCHES as another establishment of the company in different locations 2 Branch Accounts ~ Branches keep their own records ~ Head office keeps records for branches Procedures: Procedures: Separate trial balances for the head Branch adjustment account (= Branch office and the branches trading account) Separate trading and profit and loss Branch profit and loss account accounts for the head office and the branches Trading and profit and loss account for the whole business Separate balance sheets for the head office and the branches Balance sheet for the whole business 3 Account kept by Branch 4 Account Kept by Branch Head office and Branch will open a full set of books to record their won transactions instead of branch books are kept by the Head office 5 In Head Office books: Branch Current Account is opened to record transactions between the Head Office and the Branch In Branch books: Head Office Current Account is opened to record transactions between them 6 HO’s Book: Branch Current $ X X Bal b/f Branch net profit Goods in Transit Remittance from branch Cash in Transit Bal c/f X Branch’s Book: Remittance to HO Bal c/f HO Current $ X Bal b/f X Net profit X $ X X X X X $ X X X 7 Goods in Transit (GIT) Goods were sent by the Head Office before the end of the financial period, but received by the branch after the end of the financial period GIT =Goods Sent to Branch – Goods received from HO 8 Remittances/Cash in Transit (CIT) The remittance or cash was remitted by the branch before the end of the financial period, but was received by the Head office after the end of the financial period CIT= Remittance to Head Office – Remittance from Branch 9 Preparation of the Final Accounts Separate trading and profit and loss accounts and balance sheets would be prepared for the head office and the branch(es) 10 Transactions Head office (HO) Branch books books 1 Opening Stock Dr HO Trading Cr Stock (opening stock)[at cost] 2 Goods purchased directly from HO suppliers[at cost] Dr Purchase(Trading) No entry Cr Creditors 3 Goods purchased NO entry directly from Branch suppliers [at cost] Dr Branch Trading Cr Stock (Opening stock)[at Cost or Cost+profit] Dr Purchase(trading) Cr Creditors 11 Transactions Head office (HO) Branch books books 4 Goods sent from HO to Branch [cost+profit] Dr Branch Current Cr Goods sent to Branch Dr Good received from HO Cr HO Current 5 Goods returned from Branch to HO Dr Goods sent to branch Cr Branch Current Dr HO Current Cr Good received from HO 6 Cash sales/Credit sales Dr HO Cash/Debtors Cr HO Sales Dr Branch cash/ debtors Cr Branch sales 12 Transactions Head office (HO) Branch books books 7 Closing stock Dr Stock(Closing) Cr HO Trading Dr Stock (Closing) Cr Branch Trading good purchased directly from Branch suppliers [at cost] & goods received from HO [cost+profit] 8 Gross profit on trading Dr HO Trading Cr HO profit and loss Dr Branch Trading Cr Branch profit and loss 9 HO expenses paid Dr Expenses (P&L) No entry by HO Cr Cash/Bank 13 Transactions Head office (HO) Branch books books 10 Branch expenses Dr Branch Current paid by Head Office Cr Cash/Bank Dr Expenses (P&L) Cr HO Current 11 Branch expenses No entry paid by Branch Dr Expenses (P&L) Cr Cash/Bank 12 Administrative charges for services rendered by HO to Branch Dr Branch P&L Cr HO Current Dr Branch Current Cr HO P&L (Income) 14 Transactions Head office (HO) Branch books books 13 Provision for Unrealized Profit (Branch & Goods in Transit)[cost+profit] Increase in provision Dr HO P&L Cr Prov. For Unrealized profit Decrease in provision Reverse No entry 14 Goods in Transit(GIT) Dr Goods in Transit Cr Branch Current NO entry 15 Cash in Transit (CIT) Dr Cash in Transit Cr Branch Current No entry 15 Transactions Head office (HO) Branch books books 16 Profit made by the branch Dr Branch Current Dr Branch P&L Cr Retained profit Cr HO Current 17 Profit made by HO Dr P&L Cr Retained profit No entry 18 Cash remittances from the branch Dr Bank Cr Branch Current Or Dr Bank Cr remittance from branch Dr Remittance from branch Cr Branch Current Dr HO Current Cr Bank Or Dr Remittance to HO Cr Bank Dr HO Current Cr Remittances to HO 16 Inter-company transactions It would not be transferred to the total column of the trading and profit and loss account and the balance sheet For example, goods sent to the branch, goods from the head office, service overheads charged by the head office to the branch, head office current account, branch current account provision for unrealized profit 17 Example 2 18 Colour Toys Ltd. has its head office in Central and a branch in Shatin and separate final accounts are prepared for HO and Branch. Trial Balance as at 31 December as at 31 Dec 1997 HO Branch $ $ $ $ Cash and Bank 114300 80800 Debtors 360000 40000 HO Current 146000 Branch Current 194000 Fixed assets 1532000 152000 Stock,1Jan 1997 60000 36000 Creditors 96000 10000 Prov. For dep 38300 3800 Remittances to HO 11000 Remittances from Branch 10000 Capital 1200000 19 HO $ $ 112000 900000 1400000 664000 Retained Profits Purchases and Sales Good sent to branch Good from HO Selling Expenses 120000 Service Charged Received 5000 Administrative Expenses 245000 3525300 3525300 Branch $ $ 860000 616000 48000 36000 1019800 1019800 Additional information: 1. Goods purchased by the HO are sent to the branch at cost 2. Stock at 31 Dec 1997: HO $80000; Branch $10600 3. Depreciation is to be provided at 10% on cost per annum 4. Administrative expenses include an annual charge of $5000 for services rendered by the head office Required: Prepare final accounts of HO and Branch for the year ended 31Dec 1997 20 Trading and profit and loss a/c for the year ended 31 Dec 1997 HO Branch Total $000 $000 $000 $000 $000 $000 Sales Good Sent to Branch Less COGS Opening Stock Purchases Goods from HO 1400 664 2064 60 900 960 Less Closing stock(WK1)80 860 860 36 616 652 880 Gross profit 1184 Add: Service charges received 5 Less: Depreciation 153.2 Selling expense 120 Admin. Exp.(WK2)245 518 Net profit 670.8 10.6 80+10.6+48 641.4 218.6 - 15.2 48 36 99.2 119.4 2260 2260 96 900 996 138.6 857.4 1402.6 168.4 168 276 612.4 790.2 245+36-5 21 WK1: The total closing stock should be included Goods in transit as GIT are still unsold goods at year end but those goods are transported on the way => 80+10.6+48 = 138.6 Wk2: The total administrative expenses should deduct the interCompany service charges of $5000 => 24.5+36-5=276 Back 22 HO’s Book: Branch Current $ $ Bal b/f 194000 Goods in Transit Branch net profit 119400 (664000-61600) 48000 Remittance from branch 10000 Cash in Transit (11000-10000) 1000 Bal c/f 254400 313400 313400 Branch’s Book: HO Current $ Remittance to HO 11000 Bal b/f Bal c/f 254400 Net profit 265400 $ 146000 119400 265400 23 Balance Sheet as at 31 Dec 1997 HO Branch $000 $000 $000 $000 Fixed Assets Less provision for Dep Current Assets Stock Goods in Transit Branch Current Debtors Cash and Bank Cash in Transit Less Current Liabilities Creditors Working Capital Capital Retained profit Head Office Current 1532 191.5 1340.5 80 48 254.4 360 114.3 1 857.7 96 Total $000 $000 152 19 133 1684 210.5 1437.5 10.6 80+10.6+48 40 80.8 131.4 138.6 400 196.1 734.7 10 106 114.3+80.8+1 761.7 121.4 2102.2 254.4 1200 112+670.8+119.4 902.2 254.4 212.2 254.4 628.7 2102.2 1200 902.2 2102.2 24 Goods Sent to Branch at Mark-up 25 Goods Sent to Branch at a Mark Up The head office supplies goods to its branch with an invoice price at cost plus profit Goods Sent to Branch a/c and Goods Received from HO a/c are valued at invoice price. If there is unsold stock at the end of the accounting period, the unrealized profit-instock must be eliminated from the consolidated final accounts A Provision for Unrealized Profit a/c will be opened to measure unearned profit included in the closing stock of the branch and reflect in the HO’s book 26 Provision for Unrealized Profit =Stock at mark up* Mark up 100%+Mark up Stock mark up= Closing stock at branch sent from HO + Goods in transit Closing stock of branch include goods directly purchased from suppliers will not be concerned in the calculation of the provision of unrealized profit 27 Account entries Increase in Provision Dr P/L Cr Provision for unrealized profit Decrease in Provision Dr Provision for unrealized profit Cr P/L •The increase or decrease in the provision should be entered in the profit and loss a/c •The balance should be appear in the balance sheet under Current Liabilities •The total stock= stock in HO+stock in branch+stock in transit - provision for unrealized profit 28 Example 3 29 Goods sent form the head office are charged to the branch At cost plus 10% the closing stock was valued as follows: Date HO 31 Dec 1991 80000 (1st year of business) 31 Dec 1992 96000 31 Dec 1993 84000 31 Dec 1994 108000 Branch 66000 86900 71500 75900 Goods in transit 22000 5500 4950 550 Required Prepare Provision for unrealized profit account for 1992-1994 30 Provision for unrealized profit 91 $ Dec 31 Bal c/d 8000 (66000+22000*10/110 91 Dec 31 92 Dec 31 Bal c/d 8400 (869000+5500)*10/110 8400 93 Dec 31 P/L 1450 Dec 31 Bal c/d 6950 (71500+4950)*10/110 8400 94 Dec 31 Bal c/d 6950 (75900+550)*10/110 92 Jan 1 Bal b/d Dec 31 P/L P/L $ 8000 8000 400 8400 93 Jan 1 Bal b/d 8400 8400 94 Jan 1 Bal b/d 6950 31 Stock Loss Normal stock loss Abnormal stock loss Related to the ordinary activities of the business e.g. Obsolete stock, damaged stock No entry needed Caused by an exceptional events e.g. fire loss, burglary loss Accounting recorded needed 32 Accounting entries – abnormal Loss Events HO’s book Branch’s book Total column Stock loss in the HO Dr P/L Cr Trading (cost) No entry Dr P/L Cr Trading (Cost) Stock loss in transit Dr Goods sent to Branch Cr Branch Current (Mark up) Dr P/L Cr Trading (Cost) No entry Dr P/L Cr Trading (cost) Stock loss in Branch NO entry Dr P/L Cr Trading (cost) Dr P/L Cr Trading (cost) 33 Example 4 34 Colour Toys Ltd. has its head office in Central and a branch in Shatin and separate final accounts are prepared for HO and Branch. All goods sold by branch are supplied by the HO at cost plus 10% Trial Balance as at 31 December as at 31 Dec 1997 HO Branch $ $ $ $ Share Capital 260000 Profit and loss account 125000 HO Current 79500 Branch Current 85000 Fixed assets 345000 70000 Stock,1Jan 1997 48500 15400 Debtors/Creditors 60400 35000 14700 37200 Prov. For dep 13700 16400 Remittances to HO 26000 Remittances from Branch 22000 35 HO $ 15900 255000 Bank and cash Purchases and Sales Good sent to branch Good from HO Provision for unrealized profit Administrative Expenses 31000 840800 Branch $ $ $ 3100 229700 44600 199700 154000 148500 1400 10500 840800 332800 332800 Additional information: 1. Stock as at 31 Dec 1997 excluding goods in transit was valued at followings: Head office, at cost $32600 Branch, at cost to branch - received from HO $16500 - own purchases $8000 The branch stock at 31 Dec 1996 consisted wholly of goods received from the head office 36 2. On 20 Nov 1997 some goods received by the branch from the head office were destroyed by fire. No entry has been made for this loss. The cost of these goods to the branch was $11000 3. Depreciation is to be provided on fixed asset at 2% per annum on cost Required Prepare final accounts for HO and Branch separately as at 31 Dec 1997 37 Trading and profit and loss a/c for the year ended 31 Dec 1997 HO Branch Total $000 $000 $000 $000 $000 $000 Sales Good Sent to Branch Less COGS Opening Stock (WK1) 48.5 Purchases 255 Goods from HO 303.5 Less:Fire loss (WK2) Less Closing stock(WK3)32.6 Gross profit Less: Depreciation 6.9 Fire loss Administrative 31 Prov for Unrealized profit 0.6 (1.5+5)-1.4 229.7 154 383.7 16.5+8 270.9 199.7 199.7 15.4 44.6 148.5 208.5 11 24.5 112.8 62.5 299.6 362.1 10 173 74.3 60.6 291.5 26.7 1.4 11 10.5 38.5 429.4 429.4 - 137.9 8.3 10 41.5 22.9 3.8 - 59.8 38 78.1 WK1: HO and Branch value stock on different bases in this case. HO’s Stock is valued at cost; while Branch’s stock is valued at mark-up. Total opening stock should be recorded at cost price HO+Branch(at mark up) – Opening prov. for unrealized profit = 48.5+15.4+1.4 = 62.5 WK2: Fire loss in total column should be recorded at cost price rather than mark-up price Invoice price = Cost + Profit Cost = Invoice Price – Profit = 1.1 – 1.1*10/110 = 10 Back 39 WK3: Total closing stock should be included HO’s stock, Branch’s Stock and Goods in transit HO’s stock and Branch (own purchases)’s stock are valued at cost;while Branch (received from HO)’s stock and Goods in transit are valued at mark-up. Those goods should be adjusted at cost price Total closing stock should be included: 32.6+8+(16.5-16.5*10/110)+(1.1-1.1*10/110) = 60.6 Back 40 WK4 : Provision for unrealized profit Bal c/f 2000 (16500+5500)*10/110 2000 Bal b/f P/L 1400 600 2000 Back 41 Balance Sheet as at 31 Dec 1997 HO Branch $000 $000 $000 $000 Fixed Assets Less provision for Dep Current Assets Stock Goods in Transit Branch Current(WK1) Debtors Cash and Bank Cash in Transit 345 20.6 324.4 32.6 5.5 57.3 60.4 15.9 1 175.7 Less Current Liabilities Creditors 35 Prov for unrealized 2 profit Working Capital Capital Retained profit Head Office Current WK2) Total $000 $000 70 17.8 52.2 24.5 14.7 3.1 42.3 37.2 - 138.7 463.1 260 12.5+74.3+3.8 203.1 463.1 15.9+31+4 5.1 57.3 57.3 57.3 415 38.4 376.6 60.6 75.1 23 158.7 72.2 - 86.5 463.1 260 203.1 42 463.1 WK1: HO’s book: Branch Current Bal b/f 85000 Goods in transit 5500 Branch net profit 3800 Remittance from branch22000 Cash in transit (26000-22000) 4000 Bal c/f 57300 88800 88800 Wk2: Branch’s book: Remittance to HO Bal c/f Back HO Current 26000 Bal b/f 57300 Branch net profit 833000 79500 3800 833000 43 Account kept by Head Office 44 Account kept by HO The branch do not keep their won records, the HO will keep all accounting records for the branch transactions 45 Goods are invoiced to the Branch at cost plus profit Cost Goods Sent to Branch a/c + Profit Branch Stock Adjustment a/c = Invoiced price Branch Stock a/c The gross profit will be calculated in Branch Stock Adjustment account 46 Transactions Accounting entries Opening stock balance Branch stock a/c-opening “debit” balance recorded as “cost plus profit” Branch Stock Adjustment a/cOpening “Credit” balance recorded as “Profit” portion only Goods sent to branch Dr Branch Stock [cost+profit] Cr Goods sent to Branch [cost] Cr Branch stock adjustment [profit] Goods returned by Branch to HO Dr Goods sent to Branch [cost] Dr Branch stock adjustment [profit] Cr Branch Stock [cost+profit] 47 Transactions Accounting entries Credit Sales at the Branch Dr Branch Debtors (selling price) Cr Branch Stock Cash Sales at the Branch Dr Branch Cash (selling price) Cr Branch Stock Goods returned by customer to Branch Dr Branch Stock (selling price) Cr Branch Debtors Bad debts, Discount Allowed to customer Dr Branch Profit and loss Cr Branch Debtors Branch expenses Dr Branch Profit and loss Cr Cash/Bank Branch income Dr Cash/Bank Cr Branch Profit and loss 48 Transactions Accounting entries Treatment of closing stock Branch Stock a/c- actual stock+ GIT recorded as “cost plus profit” will be entered on the credit side as closing debit balance Branch stock adjustment a/c- actual stock + GIT recorded as “Profit” portion will be entered on debit side as closing credit balance Net amount of Goods sent to Branch deducted from HO Purchases a/c and transfer to trading a/c Dr Goods sent to Branch [cost] Cr Head Office Purchases/Trading Branch transferred Stock adjustment to branch P/L Dr Branch Stock Adjustment Cr Branch Profit and loss Treatment of Branch net profit Dr Branch Profit and loss Cr Head Office profit and loss 49 Example 5 50 Sino Ltd. Sends goods at the selling price to the branch. The selling price is cost plus 10 per cent. The branch accounts are maintained by the head office. Transactions between the head office and the branch for the year ended 31 December 1997 were as follows: Opening stock at branch at selling price $ 110,000 Goods sent to branch at cost Goods returned to the head office at cost Credit sales by branch Cash sales by branch Goods returned to branch at selling price Closing stock at branch at selling price Closing goods in transit at selling price 750,000 50,000 354,000 350,000 33,000 171,500 37,500 51 Branch Stock(SP) $ Bal b/f 110000 Return to HO (50000*1.1) Gd sent to branch Branch debtors (750000*1.1) 825000 Branch cash Branch debtors-return 33000 Bal c/f (171500+37500) 968000 $ 55000 354000 350000 209000 968000 Branch Adjustment(Profit) $ Return to HO Bal b/f (110000*10/110) (55000*10/110) 5000 Branch stock (75000*0.1) Branch P/L 61000 Bal c/f(209000*10/110) 19000 85000 $ 10000 75000 85000 Goods Sent to Branch(cost) Branch stock HO Purchase $ 50000 Branch stock 700000 750000 $ 750000 750000 52 Transactions Stock Loss in Branch Accounting entries Dr Branch Stock Adjustment [cost+profit] -Normal Loss event related to ordinary Cr Branch Stock activities of the business e.g. pilferage, stock wastage, unaccounted stock -Abnormal Loss caused by exceptional event e.g. fire, burglary etc -Goods lost in transit Dr Branch Profit & Loss [cost] Dr Branch Stock Adjustment [profit] Cr Branch Stock [cost+profit] Dr Branch adjustment [profit] Dr Profit & Loss [cost] Cr Branch Stock [cost+profit] 53 Transactions Accounting entries Stock transfer from branch A to branch B Dr Goods sent branch A [cost] Dr Branch A Adjustment [profit] Cr Branch A Stock [cost+profit] Dr Branch B Stock [cost+profit] Cr Good sent to branch B [cost] Cr Branch B stock [cost+profit] Branch Stock Valuation -reduction in selling price Dr Branch Adjustment Cr Branch Stock [with the total reduction off the selling price] Addition mark up -Goods are sent to the branch Dr Branch Stock [cost+profit] at mark up lower than selling Cr Branch adjustment [profit] price Cr Goods sent to branch [cost] -Goods are sold to customers with an additional mark up Dr Branch Stock Cr Branch adjustment [profit] 54 Transactions Cash Misappropriation -loss from the theft of the cash takings Accounting entries Dr Cash Misappropriated Cr Cash Dr Branch profit and loss Cr Cash Misappropriated 55 Example 6 56 Joyce Ltd. Has a head office in Central and two branches, one in Shatin and the other in Tsuen Wan. Branch accounts are maintained by the head office. Goods are invoiced to Shatin at cost plus 20 per cent. This is the selling price. Joyce Ltd. Sent goods at cost plus 25 per cent to Tsuen Wan. The selling price in this branch was cost plus 30 per cent. The head office books showed the following balances related to transactions between the head office and its two branches for the year ended 31 December 1997: Shatin Tsuen Wan Opening stock at cost Credit sales by branches $ 100,000 800,000 $ 56,000 57 476,840 Shatin Tsuen Wan $ Goods sent to branches at cost $ 806,000 400,000 Goods returned by branches at cost 80,000 -- Stock lost in first at cost 64,000 -- Reduction in selling price 13,500 -- Cash received from debtors Discount allowed Bad debts written off Returns by debtors 340,200 345,320 2,000 3,000 500 800 2,400 -- Branch transfer at selling price from Shatin To Tsuen Wan 960 58 Shatin Tsuen Wan $ Closing stock at selling price 91,680 $ 117,000 Goods in transit from head office to Shatin At selling price Expenses 4,800 26,800 34,500 Any stock unaccounted for may be regarded as pilferage and normal wastage. 59 Shatin Branch Bal b/f (100000*1.2) Gd sent to branch (806000*1.2) Branch Stock(SP) $ 120000 Branch debtors Return to HO (80000*1.2) 967200 Fire loss (64000*1.2) Branch adj.-reduction in selling price $ 800000 96000 76800 13500 Branch Adjustment (Profit) $ $ Return to HO(80000*0.2) 16000 Bal b/f (100000*0.2) 20000 Fire loss (64000*0.2) 12800 Branch stock (806000*0.2) 161200 Branch adj.-reduction in selling price 13500 Goods Sent to Branch(cost) $ $ Gd return to HO 80000 Branch stock 806000 Branch Debtors(SP) $ $ Branch stock 800000 Branch profit and loss account for the year ended 31 Dec 1997 $ $ 60 Fire loss 64000 Branch Stock $ Bal b/f (100000*1.2) 120000 Branch debtors Gd sent to branch Return to HO (80000*1.2) (806000*1.2) 967200 Fire loss (64000*1.2) Branch debtors-return 2400 Branch adj.-reduction in selling price Shatin Branch $ 800000 96000 76800 13500 Branch Debtors $ $ 340200 Branch stock 800000 Branch cash Discount allowed 2000 Bad debts 500 Branch stock-return 2400 Branch profit and loss account for the year ended 31 Dec 1997 $ $ Fire loss 64000 Discount allowed 2000 Bad debts 500 61 Branch Stock $ Bal b/f (100000*1.2) 120000 Branch debtors Gd sent to branch Return to HO (80000*1.2) (806000*1.2) 967200 Fire loss (64000*1.2) Branch debtors-return 2400 Branch adj.-reduction in selling price Branch transfer Shatin Branch Branch Adjustment $ Return to HO(80000*0.2) 16000 Bal b/f (100000*0.2) Fire loss (64000*0.2) 12800 Branch stock (806000*0.2) Branch adj.-reduction in selling price 13500 Branch transfer 160 (960*20/120) Goods Sent to Branch $ Gd return to HO 80000 Branch stock Branch transfer (960*100/120) 800 $ 800000 96000 76800 13500 960 $ 20000 161200 $ 806000 62 Branch Stock $ $ 800000 Bal b/f (100000*1.2) 120000 Branch debtors Gd sent to branch Return to HO (80000*1.2) 96000 (806000*1.2) 967200 Fire loss (64000*1.2) 76800 Branch debtors-return 2400 Branch adj.-reduction in selling price 13500 Branch transfer 960 Pilferage & wastage(Bal fig) 5860 Bal c/f (91680+4800) 96480 1089600 1089600 Branch Adjustment $ $ Return to HO(80000*0.2) 16000 Bal b/f (100000*0.2) 20000 Fire loss (64000*0.2) 12800 Branch stock (806000*0.2) 161200 Branch adj.-reduction in selling price 13500 Branch transfer 160 (960*20/120) Pilferage & wastage 5860 Branch P/L(Bal fig) 116800 Bal c/f(96480*20/120) 16080 63 181200 181200 Shatin Branch Gd return to HO Branch transfer (960*100/120) HO Purchase(bal.fig.) Branch stock Goods Sent to Branch $ 80000 Branch stock 800 725200 806000 Branch Debtors $ 800000 Branch cash Discount allowed Bad debts Branch stock-return Bal c/f 800000 $ 806000 806000 $ 340200 2000 500 2400 454900 800000 Branch profit and loss account for the year ended 31 Dec 1997 $ $ 116800 Fire loss 64000 Branch Adj.- gross profit Discount allowed 2000 Bad debts 500 Expense 26800 Net profit 23500 64 116800 116800 Tsuen Wan Branch 65 Tsuen Wan Branch Bal b/f (56000*1.3) Gd sent to branch (400000*1.25) Branch adj (400000*0.05) Branch Stock $ 72800 Branch debtors $ 476840 500000 20000 Branch Adjustment $ $ Bal b/f (56000*0.3) 16800 Branch stock (400000*0.25) 100000 Branch stock (400000*0.05) 20000 Goods Sent to Branch $ $ Branch stock 400000 Branch stock Branch Debtors $ 476840 Branch cash $ 345320 66 Branch stock Branch Debtors $ 476840 Branch cash Discount allowed Bad debts $ 345320 3000 800 Branch profit and loss account for the year ended 31 Dec 1997 $ $ Discount allowed 3000 Bad debts 800 67 Tsuen Wan Branch Branch Stock $ 72800 Branch debtors $ 476840 Bal b/f (56000*1.3) Gd sent to branch (400000*1.25) 500000 Branch adj (400000*0.05) 20000 Gd sent to branch (800*1.25) 1000 Branch adj.(800*0.05) 40 Branch Adjustment $ $ Bal b/f (56000*0.3) 16800 Branch stock (400000*025) 100000 Branch stock (400000*0.05) 20000 Branch stock-branch transfer (800*0.25) 200 Branch stock (800*0.05) 40 Goods Sent to Branch $ Branch stock Branch stock-branch transfer $ 400000 68 800 Tsuen Wan Branch Branch Stock $ 72800 Branch debtors Bal c/f 500000 $ 476840 117000 Bal b/f (56000*1.3) Gd sent to branch (400000*1.25) Branch adj (400000*0.05) 20000 Gd sent to branch (800*1.25) 1000 Branch adj.(800*0.05) 40 593840 593840 Branch Adjustment $ $ 16800 Branch P/L(Bal fig) 110040 Bal b/f (56000*0.3) Bal c/f(117000*30/130) 27000 Branch stock (400000*025) 100000 Branch stock (400000*0.05) 20000 Branch stock-branch transfer (800*0.25) 200 Branch stock (800*0.05) 40 137040 137040 69 Goods Sent to Branch $ HO Purchase(bal.fig.) 400800 Branch stock Branch stock-branch transfer Branch stock 400800 Branch Debtors $ 476840 Branch cash Discount allowed Bad debts Bal c/f 476840 $ 400000 800 400800 $ 345320 3000 800 127720 476840 Branch profit and loss account for the year ended 31 Dec 1997 $ $ 110040 Discount allowed 3000 Branch Adj.- gross profit Bad debts 800 Expense 34500 Net profit 71740 110040 70 110040 Preparation of the Final Accounts for the Head Office After calculating the branch profits or losses, the overall profit and loss for the head office can be computed 71 Account entries Transactions Accounting Entries Balance transferred from goods sent to branch account to the head office purchases account Dr Goods sent to branch Cr HO purchases/trading Dr Branch Profit and loss Cr HO P/L Branch net profit transferred to head office profit and loss account 72 Example 7 73 The following trial balalnce was extracted from the books of Joyce Ltd Trial Balance as at 31 December as at 31 Dec 1997 Share Capital Profit and loss account Fixed assets Stock at Head Office,1Jan 1997 Debtors/Creditors Prov. for dep Purchases Sales Administrative expenses Selling expenses Bank and cash $ 800000 250000 774600 200000 3800000 225000 108000 456500 $ 1656000 300900 950000 3463200 74 $ Branch stock 1 Jan 1997-Shatin $ 250000 - Tsuen Wan 120000 Branch adjustment- Shatin 20000 - Tsuen Wan 16800 6606900 6606900 Additional information: 1. On 31 Dec 1997, stock in the HO was valued at $180000 2. The branches paid local expenses and remitted all the remianing cash received from debtors to the HO. NO entry had been made about the remittances from the branches. 3. Depreciation is to be charged on the fixed asset at 10% per annum on cost. Prepare final account for Joyce Ltd for the year ended 31 Dec1997 75 Joyce Ltd. Trading and Profit and Loss Account for the year ended 31 December 1997 $ Opening Stock 250,000 Sales Purchases 3,800,000 Less Goods sent to Branch 1,126,000 ($725,200 + $400,800) Less Closing Stock Cost of Goods Sold Gross Profit $ $ 3,463,200 2,674,000 2,924,000 180,000 2,744,000 719,200 3,463,200 3,463,200 Provision for Depreciation 80,000 Gross Profit Administrative Expenses 225,000 Branch Profit Selling Expenses 108,000 - Shatin 23,500 Net Profit 401,440 -Tsuen Wan 71,740 814,440 719,200 814,440 76 Joyce Ltd. Balance Sheet as at 31 December 1997 $ $ Fixed Assets 800,000 Share Capital Less Provision for Depreciation 280,000 Profit & Loss Account ($300,900 + $401,440) 1,656,000 702,340 520,000 Current Assets Stock Current Liabilities 350,400 Creditors Debtors ($774,600 + $454,900 + $127,720) 1,357,220 Bank and Cash (W1) 1,080,720 3,308,340 950,000 3,308,340 77 Workings: W1. Branch Cash Shatin $ Branch Debtors 340,200 Tsuen Wan Shatin $ 345,320 Expenses Remittances to HO 340,200 345,320 Tsuen Wan $ $ 26,800 34,500 313,400 310,820 340,200 345,320 Note Total Stock: HO Shatin Tsuen Wan Goods in transit Provision for Unrealized Profit $ 180,000 91,680 117,000 4,800 (43,080) 350,400 78